The Central Bank of Kenya (CBK) has announced its intention to raise KSh 30 billion through a bond auction in September 2024. The auction, which is aimed at providing budgetary support, will involve the issuance of two reopened bonds with remaining tenors of 9.5 years and 12 years, respectively. This move is part of the Kenyan government’s broader strategy to manage its debt portfolio by favoring longer-dated securities over short-term instruments.

A Closer Look at the Bonds

The bonds in question include a 10-year paper, first issued in March 2024, and a 20-year paper originally issued in September 2016. The 10-year bond has seen multiple reopenings, including a tap sale in May 2024, but has faced challenges in achieving full subscription. Despite offering yields that attracted investors, the bond underperformed in its initial and subsequent offerings, reflecting a cautious investor sentiment in the face of economic uncertainties.

In contrast, the 20-year bond, issued almost a decade ago, is being reopened to meet the government’s ongoing budgetary needs. This bond has historically been a part of Kenya’s strategy to extend the average maturity of its debt, reducing the pressure of near-term repayments and aligning with the government’s long-term fiscal objectives.

Investor Sentiment and Market Dynamics

Investor behavior in Kenya’s bond market has shown a clear preference for shorter-term securities, primarily due to concerns about duration risk. Duration risk refers to the sensitivity of a bond’s price to changes in interest rates—the longer the bond’s maturity, the higher the duration risk. Investors tend to shy away from longer-term bonds in uncertain economic climates, opting instead for shorter-term papers that offer quicker returns and lower risk.

However, the Kenyan government’s shift towards issuing longer-dated bonds reflects a deliberate policy to manage the nation’s debt more sustainably. By extending the maturity profile of its debt, Kenya aims to reduce the frequency of refinancing needs, which can be a source of fiscal stress. This strategy is particularly important given the high levels of public debt that have accumulated over recent years.

Economic Context: Inflation, Interest Rates, and Fiscal Policy

The backdrop to this bond issuance is Kenya’s current economic environment, characterized by moderated inflation and a relatively strong shilling. Earlier this month, the CBK made a significant policy move by lowering the benchmark interest rate by 25 basis points to 12.75 percent. This decision came after the inflation rate eased below the midpoint of the CBK’s target range, providing some breathing room for both consumers and businesses.

The reduction in interest rates is a crucial factor for the bond market. Lower rates typically reduce the yield on government securities, making them less attractive to investors who seek higher returns. However, in the context of Kenya’s current economic situation, the rate cut was seen as necessary to support economic growth by making borrowing cheaper for businesses and individuals. The stronger shilling, on the other hand, has provided some relief for the economy by reducing the cost of imports and helping to keep inflation in check.

The Role of the Bond Market in Kenya’s Economic Development

Kenya’s bond market plays a vital role in financing the government’s budgetary needs, particularly in funding infrastructure projects and other public investments. The government’s reliance on domestic borrowing has increased in recent years, partly due to the rising costs and risks associated with external debt. The CBK’s strategy of issuing longer-term bonds is designed to create a more stable and predictable debt repayment schedule, which is crucial for maintaining investor confidence and ensuring the sustainability of public finances.

The funds raised from the September bond auction will likely be directed towards critical areas of the budget, including infrastructure development, health, education, and social welfare programs. These investments are essential for driving economic growth and improving the living standards of Kenyans. However, the success of this bond issuance will depend on the willingness of investors to commit to longer-term securities in the current economic climate.

Challenges and Risks Ahead

Despite the CBK’s efforts to encourage investment in longer-dated bonds, several challenges remain. The global economic environment is uncertain, with potential risks stemming from geopolitical tensions, fluctuations in global commodity prices, and changes in international interest rates. These factors could impact investor sentiment and make it more difficult for the CBK to achieve its fundraising targets.

Moreover, Kenya’s domestic economic challenges, including high levels of public debt and the need for fiscal consolidation, could also affect the outcome of the bond auction. The government’s commitment to reducing the fiscal deficit and managing debt levels is critical for maintaining investor confidence. However, achieving these goals will require careful management of both revenue collection and expenditure.

The bond market’s response to the September auction will be closely watched as an indicator of investor confidence in Kenya’s economic management and fiscal policy. A successful auction could provide the government with the necessary funds to support its budget while also sending a positive signal to the market about the stability of Kenya’s debt management strategy.

Looking Ahead: The Future of Kenya’s Bond Market

As Kenya continues to navigate its economic challenges, the role of the bond market in financing the government’s needs will remain crucial. The CBK’s focus on longer-dated bonds is likely to continue as part of a broader strategy to manage the country’s debt more sustainably. However, attracting investors to these instruments will require a careful balancing act, ensuring that the yields offered are attractive enough to compensate for the risks while also aligning with the government’s fiscal objectives.

In the longer term, the development of Kenya’s bond market will be critical for the country’s economic growth. A deep and liquid bond market can provide the government with a reliable source of funding, reduce the reliance on external borrowing, and support the development of other sectors of the economy. For this to happen, the CBK and the government will need to continue building investor confidence through sound economic policies, transparent governance, and effective communication with the market.

Conclusion

The CBK’s September bond auction is a significant event in Kenya’s financial calendar, with the potential to raise KSh 30 billion for budgetary support. The government’s preference for longer-dated bonds reflects a strategic shift towards managing the country’s debt more sustainably, but the success of this initiative will depend on investor sentiment and broader economic conditions. As Kenya looks to the future, the development of its bond market will be a key factor in supporting economic growth and achieving the government’s fiscal objectives.

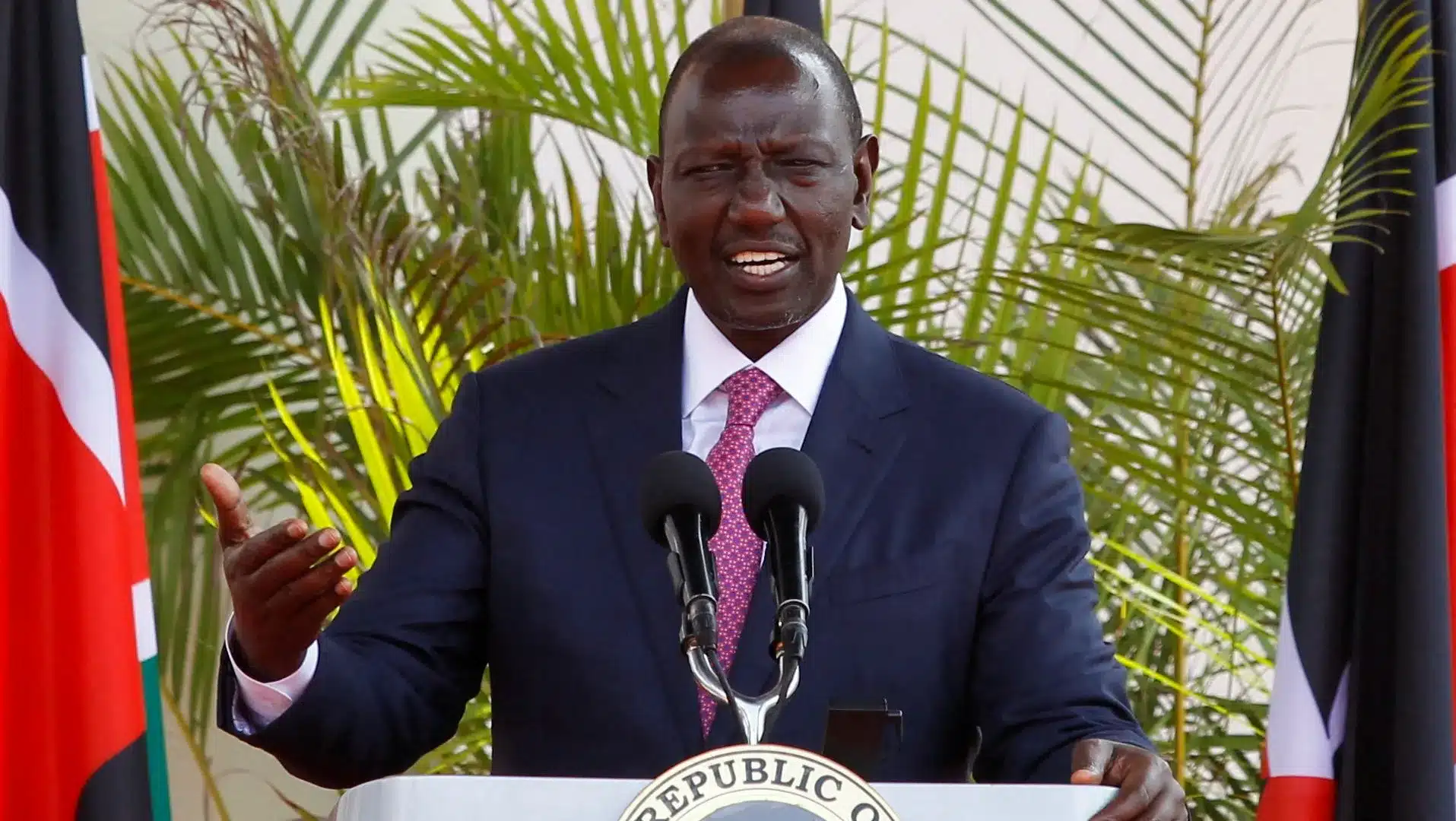

photo source: Google

By: Montel Kamau

Serrari Financial Analyst

5th August, 2024

Article and News Disclaimer

The information provided on www.serrarigroup.com is for general informational purposes only. While we strive to keep the information up to date and accurate, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability with respect to the website or the information, products, services, or related graphics contained on the website for any purpose. Any reliance you place on such information is therefore strictly at your own risk.

www.serrarigroup.com is not responsible for any errors or omissions, or for the results obtained from the use of this information. All information on the website is provided on an "as-is" basis, with no guarantee of completeness, accuracy, timeliness, or of the results obtained from the use of this information, and without warranty of any kind, express or implied, including but not limited to warranties of performance, merchantability, and fitness for a particular purpose.

In no event will www.serrarigroup.com be liable to you or anyone else for any decision made or action taken in reliance on the information provided on the website or for any consequential, special, or similar damages, even if advised of the possibility of such damages.

The articles, news, and information presented on www.serrarigroup.com reflect the opinions of the respective authors and contributors and do not necessarily represent the views of the website or its management. Any views or opinions expressed are solely those of the individual authors and do not represent the website's views or opinions as a whole.

The content on www.serrarigroup.com may include links to external websites, which are provided for convenience and informational purposes only. We have no control over the nature, content, and availability of those sites. The inclusion of any links does not necessarily imply a recommendation or endorsement of the views expressed within them.

Every effort is made to keep the website up and running smoothly. However, www.serrarigroup.com takes no responsibility for, and will not be liable for, the website being temporarily unavailable due to technical issues beyond our control.

Please note that laws, regulations, and information can change rapidly, and we advise you to conduct further research and seek professional advice when necessary.

By using www.serrarigroup.com, you agree to this disclaimer and its terms. If you do not agree with this disclaimer, please do not use the website.

www.serrarigroup.com, reserves the right to update, modify, or remove any part of this disclaimer without prior notice. It is your responsibility to review this disclaimer periodically for changes.

Serrari Group 2023