As global stock markets reel from a sharp sell-off, there’s growing pressure on the US Federal Reserve to lower interest rates more aggressively. With some analysts calling for an emergency rate cut before the Fed’s scheduled meeting in September, the situation is rapidly evolving.

Just a week ago, futures markets were anticipating a modest quarter percentage-point cut at the Fed’s next meeting. However, the outlook has since shifted dramatically. According to data from CME Group, there is now a strong expectation of a half-point reduction. “The rate tide has quickly turned,” noted economists from Bank of America in a recent update, suggesting that a September rate cut is nearly certain.

The Economic Landscape

For the past year, the Federal Reserve has maintained its benchmark lending rate at a two-decade high in its effort to curb inflation and bring it back to a long-term target of 2%. Despite a brief uptick earlier this year, inflation is now trending back towards this target. The US economy is still growing, but there are signs of weakening in the labor market, which has raised concerns among investors and analysts alike.

Fed Chair Jerome Powell recently hinted that the first rate cut could come as early as September. However, with last week’s weaker-than-expected US jobs report sparking fears of a possible recession, some analysts are pushing for a more immediate response.

Urgent Calls for Action

Economists and financial experts are increasingly calling for the Fed to act quickly. Jeremy Siegel, professor emeritus of finance at Wharton School, has been vocal about his concerns. “I’m calling for a 75-basis point emergency cut in the Fed funds rate, with another 75-basis point cut indicated for next month at the September meeting,” Siegel said in an interview with CNBC. “And that’s the minimum.”

Paul Krugman, a Nobel laureate and influential economist, also weighed in. Although he initially hesitated to support an inter-meeting cut, he now sees the situation differently. “I wasn’t calling for an inter-meeting cut because that might signal panic,” Krugman admitted on social media. “But since we may be seeing a panic anyway, that argument loses its force. Real case for an emergency cut soon.”

Market Reactions

The stock market’s reaction to recent economic developments has been severe. On Monday, Wall Street’s three major indices extended their losses. The Dow Jones Industrial Average fell by 2.6%, the S&P 500 dropped by 3%, and the Nasdaq, which is heavily weighted with technology stocks, closed down more than 3.4%.

This sell-off is reflected in the CBOE Volatility Index (VIX), also known as Wall Street’s “fear gauge,” which spiked to levels not seen since the early days of the COVID-19 pandemic. Investors are clearly anxious, and the market volatility underscores the growing uncertainty.

Caution from Fed Officials

Despite the turmoil, some Fed officials are urging restraint. Chicago Fed President Austan Goolsbee spoke out before the markets opened on Monday, advising against overreacting to a single jobs report. “As you see jobs numbers come in weaker than expected but not looking yet like recession, I do think you want to be forward-looking about where the economy is headed,” Goolsbee told CNBC. He cautioned against drawing too many conclusions from data that falls within the margin of error, adding that the Fed is prepared to address any economic issues that arise.

Differing Opinions

While some economists are pushing for an immediate rate cut, others believe a more measured approach is appropriate. Goldman Sachs economists David Mericle and Manuel Abecasis caution against reacting too strongly to a single jobs report. “It is usually a mistake to infer too much from one jobs report absent a major shock that abruptly changes the picture,” they wrote in an investor note. They also raised their forecast for a recession to 25%, up from 15%.

Economists at Pantheon Macroeconomics echoed a similar sentiment, suggesting that the Fed would likely downplay the recent drop in stock prices. They noted that major indices are still performing better than at the beginning of the year, and thus, the Fed might focus less on recent market fluctuations.

Political Implications

The Fed’s actions in the run-up to the November presidential election could have significant political implications. The central bank might find itself at the center of the political debate between former President Donald Trump and Democratic Vice President Kamala Harris. Trump has previously accused Fed Chair Jerome Powell, whom he appointed, of political favoritism toward the Democratic Party. Trump has even suggested he might not reappoint Powell if he wins the election.

The Broader Economic Context

The current market turmoil is part of a larger global economic picture characterized by uncertainty and volatility. Geopolitical tensions, trade disputes, and shifting economic policies are all contributing to an environment where market sentiment can change rapidly.

The Fed’s response to these challenges will be closely scrutinized by investors and policymakers around the world. Balancing the need for economic stability with the risks of inflation and recession will require careful and nuanced decision-making.

Looking Ahead

As the situation evolves, the Fed’s decisions in the coming weeks will be crucial. Market participants will be watching closely for any signs of action or changes in the central bank’s stance. Whether through an emergency rate cut or a more measured approach in September, the Fed’s actions will have significant implications for both the US and global economies.

The central bank’s ability to navigate this period of uncertainty will be tested, and its decisions will play a key role in shaping the economic landscape moving forward. Maintaining a balanced perspective and focusing on long-term stability will be essential for managing the current challenges and steering the economy towards a more stable future.

In this complex and shifting environment, the Fed’s approach will be a critical factor in determining the trajectory of the economy. As the situation unfolds, the central bank’s decisions will be closely monitored, and their impact will be felt across financial markets and beyond.

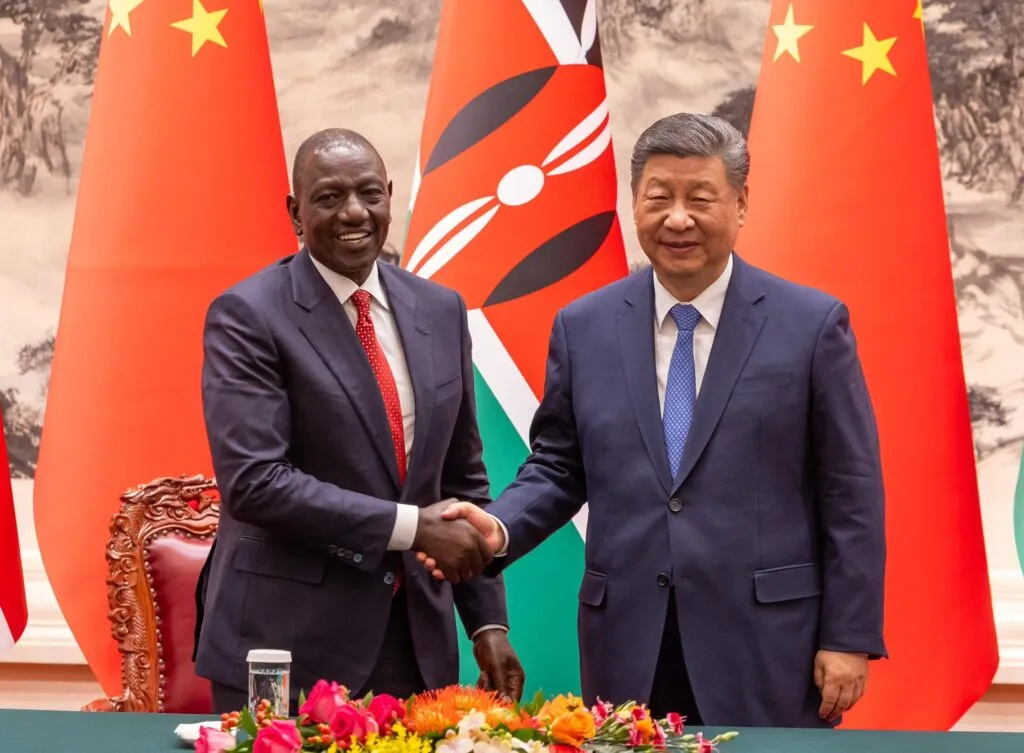

photo source: Google

By: Montel Kamau

Serrari Financial Analyst

6th August, 2024

Article and News Disclaimer

The information provided on www.serrarigroup.com is for general informational purposes only. While we strive to keep the information up to date and accurate, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability with respect to the website or the information, products, services, or related graphics contained on the website for any purpose. Any reliance you place on such information is therefore strictly at your own risk.

www.serrarigroup.com is not responsible for any errors or omissions, or for the results obtained from the use of this information. All information on the website is provided on an "as-is" basis, with no guarantee of completeness, accuracy, timeliness, or of the results obtained from the use of this information, and without warranty of any kind, express or implied, including but not limited to warranties of performance, merchantability, and fitness for a particular purpose.

In no event will www.serrarigroup.com be liable to you or anyone else for any decision made or action taken in reliance on the information provided on the website or for any consequential, special, or similar damages, even if advised of the possibility of such damages.

The articles, news, and information presented on www.serrarigroup.com reflect the opinions of the respective authors and contributors and do not necessarily represent the views of the website or its management. Any views or opinions expressed are solely those of the individual authors and do not represent the website's views or opinions as a whole.

The content on www.serrarigroup.com may include links to external websites, which are provided for convenience and informational purposes only. We have no control over the nature, content, and availability of those sites. The inclusion of any links does not necessarily imply a recommendation or endorsement of the views expressed within them.

Every effort is made to keep the website up and running smoothly. However, www.serrarigroup.com takes no responsibility for, and will not be liable for, the website being temporarily unavailable due to technical issues beyond our control.

Please note that laws, regulations, and information can change rapidly, and we advise you to conduct further research and seek professional advice when necessary.

By using www.serrarigroup.com, you agree to this disclaimer and its terms. If you do not agree with this disclaimer, please do not use the website.

www.serrarigroup.com, reserves the right to update, modify, or remove any part of this disclaimer without prior notice. It is your responsibility to review this disclaimer periodically for changes.

Serrari Group 2025