Britain requires an additional one trillion pounds ($1.3 trillion) in investment over the next decade to revitalize its economy, according to a report released on Friday. The ambitious investment goal is seen as essential for achieving the annual economic growth of 2.5% promised by Prime Minister Keir Starmer during his campaign leading up to the July 4 election—a growth rate that Britain has not consistently reached since before the 2008 financial crisis.

The Economic Context: Post-Crisis Challenges

The United Kingdom has faced significant economic challenges since the 2008 financial crisis, with growth rates struggling to reach pre-crisis levels. The crisis itself triggered a prolonged period of austerity, reducing public spending and investment in key sectors. While the UK economy has seen periods of recovery, sustained and robust growth has remained elusive. The COVID-19 pandemic further exacerbated these challenges, leading to increased government borrowing, disruptions in global trade, and heightened economic uncertainty.

The report, authored by the UK financial services lobby group Capital Markets Industry Taskforce and led by Nigel Wilson, former CEO of Legal & General, underscores the critical need for targeted investment in specific sectors to drive growth. According to the report, an annual growth rate of 3% would require an additional 100 billion pounds of investment per year over the next decade. This investment is particularly needed in energy, housing, and venture capital—sectors that are vital for the UK’s long-term economic stability and competitiveness.

Sector-Specific Investment Needs

Energy Sector: Meeting Net Zero Targets

The report highlights the energy sector as a top priority, requiring an extra 50 billion pounds annually. This investment is crucial for the UK to meet its net zero emissions targets by 2050. The transition to renewable energy sources, coupled with the need to upgrade existing infrastructure, demands substantial financial resources. Investments in wind, solar, and nuclear energy, as well as in energy storage technologies, are essential to reduce the UK’s carbon footprint and ensure energy security.

The UK government has already made significant strides in promoting renewable energy, with offshore wind farms playing a pivotal role in the country’s energy mix. However, the scale of investment needed to achieve net zero is vast, and the private sector will need to play a critical role. The report suggests that leveraging the six trillion pounds in long-term capital available in Britain’s pensions and insurance sector could be a solution. Reallocating this capital towards sustainable energy projects could provide the necessary funding while offering stable returns for investors.

Housing Sector: Addressing the Crisis

The UK has long faced a housing crisis, with demand consistently outstripping supply, leading to skyrocketing property prices and rents. The report calls for an additional 30 billion pounds in annual investment in the housing sector. This investment is essential not only to increase the supply of affordable housing but also to improve the quality and sustainability of the housing stock.

The government has introduced various schemes over the years to stimulate housing construction, including Help to Buy and shared ownership initiatives. However, these measures have often been criticized for driving up prices rather than addressing the root causes of the housing shortage. The report advocates for a more comprehensive approach, including investment in social housing and infrastructure projects that support new developments. Moreover, the integration of green technologies in new housing projects is emphasized as a way to align with the UK’s broader environmental goals.

Venture Capital: Supporting Innovation and Startups

Venture capital is another critical area highlighted in the report, with a recommended investment of 20-30 billion pounds annually. The UK’s startup ecosystem, particularly in technology and fintech, has been a significant driver of innovation and economic growth. However, access to capital remains a challenge for many startups, especially in their early stages.

The report suggests that increasing the allocation of UK pensions to domestic startups could provide a much-needed boost. Currently, UK pensions have a “significantly lower” allocation to domestic and unlisted equities compared to other developed markets. By doubling these allocations, the UK could better support its burgeoning startup scene and maintain its position as a global leader in innovation.

Policy Recommendations: Incentivizing Investment

To mobilize the required investment, the report recommends several policy measures, including incentives for retail investors. Reducing taxes on shares for retail investors is one such suggestion, aimed at encouraging broader participation in the stock market and increasing the flow of capital into high-growth sectors.

Additionally, the report calls for a review of the UK’s pension system, particularly in how pension funds allocate their capital. The government has already recognized the need for reform, with calls to increase pension investment in domestic startups. By aligning pension investments with the needs of the economy, the UK could unlock significant capital for growth while ensuring long-term returns for retirees.

Comparative Analysis: The G7 Context

The report also draws attention to the UK’s investment gap compared to other G7 countries. Historically, the UK has underinvested in critical sectors, leading to a “massive gap” between its infrastructure and that of its peers. This underinvestment has had long-term consequences, including lower productivity and competitiveness on the global stage.

The taskforce’s findings suggest that to bridge this gap, the UK must not only increase its investment levels but also ensure that these investments are strategically targeted. Learning from the experiences of other G7 nations, the UK can adopt best practices in areas such as public-private partnerships, infrastructure financing, and innovation funding.

The Role of Capital Markets

Capital markets play a crucial role in channeling investment into the economy. The report emphasizes the need to strengthen the UK’s capital markets to attract both domestic and international investors. Initiatives such as the London Stock Exchange’s Green Economy Mark, which highlights companies that derive 50% or more of their revenues from green activities, are examples of how capital markets can support sustainable investment.

Furthermore, the report advocates for regulatory reforms that make it easier for companies to raise capital and for investors to access a broader range of investment opportunities. By creating a more investor-friendly environment, the UK can enhance its attractiveness as a destination for capital.

Challenges and Opportunities

While the report outlines an ambitious investment agenda, it also acknowledges the challenges that lie ahead. Economic uncertainty, geopolitical tensions, and the ongoing effects of Brexit all pose risks to the UK’s growth prospects. However, these challenges also present opportunities for the UK to redefine its economic model and strengthen its position on the global stage.

By focusing on long-term investment in critical sectors, the UK has the potential to build a more resilient and sustainable economy. The transition to a net zero economy, the resolution of the housing crisis, and the support of innovation through venture capital are all areas where strategic investment can yield significant returns.

Conclusion: A Roadmap for Sustainable Growth

The Capital Markets Industry Taskforce’s report provides a comprehensive roadmap for achieving sustainable economic growth in the UK. The call for an additional one trillion pounds in investment over the next decade is a bold but necessary step to ensure the country’s future prosperity. With the right policies, incentives, and strategic focus, the UK can overcome its current challenges and set the stage for a new era of growth.

Prime Minister Keir Starmer’s vision of achieving 2.5% annual growth is within reach, but it will require a concerted effort from both the public and private sectors. By unlocking the potential of the UK’s long-term capital, encouraging investment in key sectors, and aligning pension funds with economic needs, the UK can achieve its growth targets and secure its place as a global economic leader.

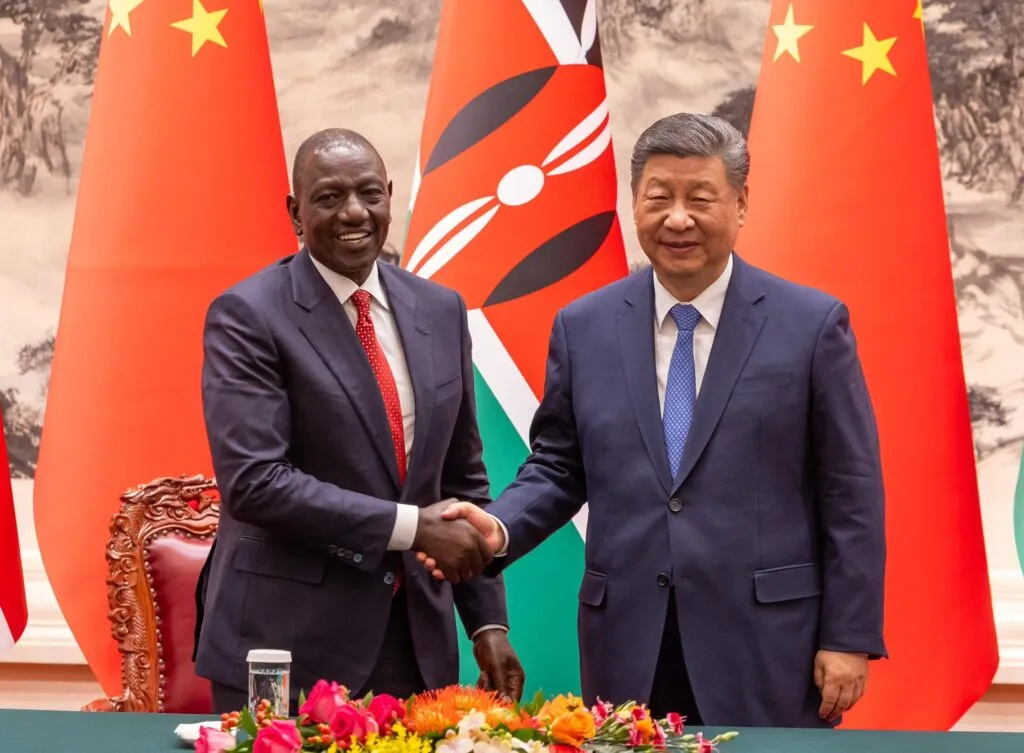

photo source: Google

By: Montel Kamau

Serrari Financial Analyst

6th September, 2024

Article and News Disclaimer

The information provided on www.serrarigroup.com is for general informational purposes only. While we strive to keep the information up to date and accurate, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability with respect to the website or the information, products, services, or related graphics contained on the website for any purpose. Any reliance you place on such information is therefore strictly at your own risk.

www.serrarigroup.com is not responsible for any errors or omissions, or for the results obtained from the use of this information. All information on the website is provided on an "as-is" basis, with no guarantee of completeness, accuracy, timeliness, or of the results obtained from the use of this information, and without warranty of any kind, express or implied, including but not limited to warranties of performance, merchantability, and fitness for a particular purpose.

In no event will www.serrarigroup.com be liable to you or anyone else for any decision made or action taken in reliance on the information provided on the website or for any consequential, special, or similar damages, even if advised of the possibility of such damages.

The articles, news, and information presented on www.serrarigroup.com reflect the opinions of the respective authors and contributors and do not necessarily represent the views of the website or its management. Any views or opinions expressed are solely those of the individual authors and do not represent the website's views or opinions as a whole.

The content on www.serrarigroup.com may include links to external websites, which are provided for convenience and informational purposes only. We have no control over the nature, content, and availability of those sites. The inclusion of any links does not necessarily imply a recommendation or endorsement of the views expressed within them.

Every effort is made to keep the website up and running smoothly. However, www.serrarigroup.com takes no responsibility for, and will not be liable for, the website being temporarily unavailable due to technical issues beyond our control.

Please note that laws, regulations, and information can change rapidly, and we advise you to conduct further research and seek professional advice when necessary.

By using www.serrarigroup.com, you agree to this disclaimer and its terms. If you do not agree with this disclaimer, please do not use the website.

www.serrarigroup.com, reserves the right to update, modify, or remove any part of this disclaimer without prior notice. It is your responsibility to review this disclaimer periodically for changes.

Serrari Group 2025