In a volatile trading session on Monday, the Adani Group witnessed a dramatic drop in market capitalization, shedding up to $13.4 billion in value, only to claw back much of the losses by the end of the day. The turbulence was triggered by fresh allegations from Hindenburg Research, accusing the head of India’s market regulator, the Securities and Exchange Board of India (SEBI), of having ties to offshore funds linked to the Adani conglomerate. The latest accusations have reignited a battle that began 18 months ago, when the U.S.-based shortseller first claimed that the Adani Group had improperly used tax havens—a charge the Indian conglomerate has consistently denied.

The renewed allegations come at a critical time for the Adani Group, with the company preparing for a $1 billion share sale by mid-September and recent successful capital raising efforts, including a $1 billion investment from U.S. investors and sovereign wealth funds. The timing of Hindenburg’s accusations has raised eyebrows, especially given that SEBI, under the leadership of Chair Madhabi Puri Buch, has been actively investigating the Adani Group for the past year and a half.

Market Reaction and Investor Sentiment

At the start of trading on Monday, Adani Group’s flagship firm, Adani Enterprises, saw its shares decline by 1.5%, while other group companies such as Adani Ports, Adani Total Gas, Adani Power, Adani Wilmar, and Adani Energy Solutions experienced drops ranging from 0.5% to 3.8%. The only outlier was Adani Green, which managed to post a modest gain of 0.3%. By mid-morning, the total losses across the group had reached approximately $2 billion, although the stocks began to recover as the trading session progressed.

Adani Enterprises and Adani Ports were among the biggest losers on the blue-chip Nifty 50 index, which initially mirrored the broader market’s early losses but eventually reversed course, trading up 0.3% by the afternoon. Analysts and market observers noted that the drop in Adani’s share prices was largely driven by panic selling among retail investors, spurred by fears of regulatory crackdowns and potential legal ramifications.

Sunny Agrawal, head of fundamental equity research at SBICAPS Securities, downplayed the impact of the latest allegations, describing the market’s reaction as a “knee-jerk” response. “The allegations are coming for the second time. A lot of investigations have happened over the last year and a half. This is a temporary, knee-jerk reaction. Things will get back to normalcy,” Agrawal remarked, expressing confidence in the resilience of the Adani Group’s stock.

Hindenburg’s Accusations and SEBI’s Response

The conflict between Hindenburg Research and the Adani Group dates back to January 2023, when the shortseller published a scathing report accusing the conglomerate of engaging in financial misconduct, including the use of offshore tax havens to inflate stock prices and evade taxes. The report wiped out more than $150 billion in market value from Adani’s listed companies, though the stocks have since recovered a significant portion of those losses.

In its latest salvo, Hindenburg cited whistleblower documents alleging that SEBI Chair Madhabi Puri Buch has a conflict of interest in the Adani investigation due to her previous investments in offshore funds associated with the conglomerate. Hindenburg argued that these ties call into question SEBI’s ability to act as an impartial regulator in the ongoing probe against Adani.

“We do not think SEBI can be trusted as an objective arbiter in the Adani matter,” Hindenburg stated in a report released on Saturday. The shortseller’s allegations have fueled concerns about regulatory capture and the integrity of India’s financial watchdog, particularly in light of the substantial political and economic influence wielded by the Adani Group.

Madhabi Puri Buch, who has served as SEBI Chair since 2022, categorically denied the allegations, labeling them as an attempt at “character assassination” following the regulator’s enforcement actions against Hindenburg. SEBI, in a separate statement, confirmed that it had thoroughly investigated the claims made by the shortseller and found no evidence of wrongdoing by its Chair.

“This is nothing more than a baseless attack designed to undermine the credibility of SEBI and derail the ongoing investigations into the Adani Group,” Buch stated, emphasizing that the regulator remains committed to upholding the principles of transparency and accountability in the Indian financial markets.

Political Fallout and Public Discourse

The controversy surrounding the Adani Group and SEBI has also taken on a political dimension, with opposition leaders seizing the opportunity to criticize the government’s handling of the situation. Rahul Gandhi, a prominent figure in India’s opposition Congress Party, took to social media platform X to voice his concerns, declaring, “The integrity of SEBI, the securities regulator entrusted with safeguarding the wealth of small retail investors, has been gravely compromised by the allegations against its chairperson.”

Gandhi’s remarks reflect growing unease among the public and political commentators about the potential consequences of the ongoing saga for India’s financial markets and the broader economy. Critics argue that the perception of regulatory bias in favor of powerful corporate interests could erode investor confidence and deter foreign investment at a time when India is seeking to position itself as a global economic powerhouse.

In contrast, members of the ruling Bharatiya Janata Party (BJP) have dismissed Hindenburg’s latest report as a politically motivated smear campaign. Ravi Shankar Prasad, a senior BJP lawmaker, defended SEBI’s actions and criticized the shortseller for attempting to deflect attention from the regulator’s show cause notice, which signaled an intention to take disciplinary action against Hindenburg for violating Indian securities laws.

“Instead of giving a response to the SEBI show cause notice, Hindenburg has issued this report, which is a baseless attack,” Prasad told reporters, reaffirming the government’s support for SEBI and its leadership.

Adani’s Strategic Moves Amid Turbulence

Despite the ongoing controversy, the Adani Group has continued to pursue its ambitious growth plans, both domestically and internationally. The conglomerate, which has interests in sectors ranging from energy and infrastructure to logistics and agribusiness, has been at the forefront of India’s economic development, spearheading large-scale projects aimed at modernizing the country’s infrastructure and reducing its dependence on fossil fuels.

Earlier this month, Adani Energy raised $1 billion from U.S. investors and sovereign wealth funds, marking a significant milestone in the group’s efforts to attract foreign capital and expand its global footprint. The funds are expected to be used to finance a range of renewable energy projects, including solar and wind power initiatives, as part of Adani’s broader commitment to achieving carbon neutrality by 2050.

In addition to its energy ventures, the Adani Group has also been actively involved in developing India’s ports and logistics infrastructure, with Adani Ports & SEZ Limited emerging as the country’s largest private port operator. The company’s strategic acquisitions and investments in key maritime hubs have positioned it as a critical player in India’s trade and transportation network, facilitating the movement of goods and resources across the subcontinent and beyond.

However, the latest allegations by Hindenburg have cast a shadow over these achievements, raising questions about the long-term sustainability of Adani’s business model and the potential risks associated with its rapid expansion. Analysts warn that the ongoing legal and regulatory battles could weigh on investor sentiment and hinder the group’s ability to raise capital in the future, particularly if the allegations lead to protracted litigation or regulatory sanctions.

Global Implications and Market Outlook

The Adani Group’s ongoing battle with Hindenburg Research has not only captured the attention of investors in India but has also reverberated across global financial markets. The group’s stocks are widely held by both domestic and international institutional investors, including major asset management firms and pension funds, making the outcome of the dispute a matter of considerable interest for global financial stakeholders.

The volatility in Adani’s share prices has also raised concerns about the broader implications for India’s equity markets, which have been among the top performers globally in recent years. As one of the country’s largest conglomerates, the Adani Group’s fortunes are closely tied to the performance of the Indian stock market, and any sustained weakness in its shares could have a ripple effect on investor sentiment and market dynamics.

In the near term, analysts expect Adani stocks to remain under pressure as the market digests the latest allegations and assesses their potential impact on the group’s financial performance and regulatory standing. However, some experts believe that the long-term outlook for the group remains positive, given its strong fundamentals and strategic positioning in key growth sectors such as renewable energy and infrastructure.

Kranthi Bathini, Director of Equity Strategy at WealthMills Securities, offered a measured perspective on the situation, noting that while the allegations could create short-term headwinds for Adani stocks, the group’s underlying business prospects remain robust. “We will likely see a short to medium term sentiment impact on Adani stocks, especially as retail investors are pressurized by the allegations made against SEBI,” Bathini said. “However, the group’s long-term growth trajectory is supported by strong fundamentals and a diversified portfolio of businesses.”

As the Adani Group navigates the latest chapter in its ongoing battle with Hindenburg Research, the outcome of this high-stakes confrontation could have far-reaching implications for the conglomerate, its investors, and the broader Indian economy. With both sides digging in for what promises to be a protracted legal and regulatory fight, the stakes have never been higher for one of India’s most influential corporate empires.

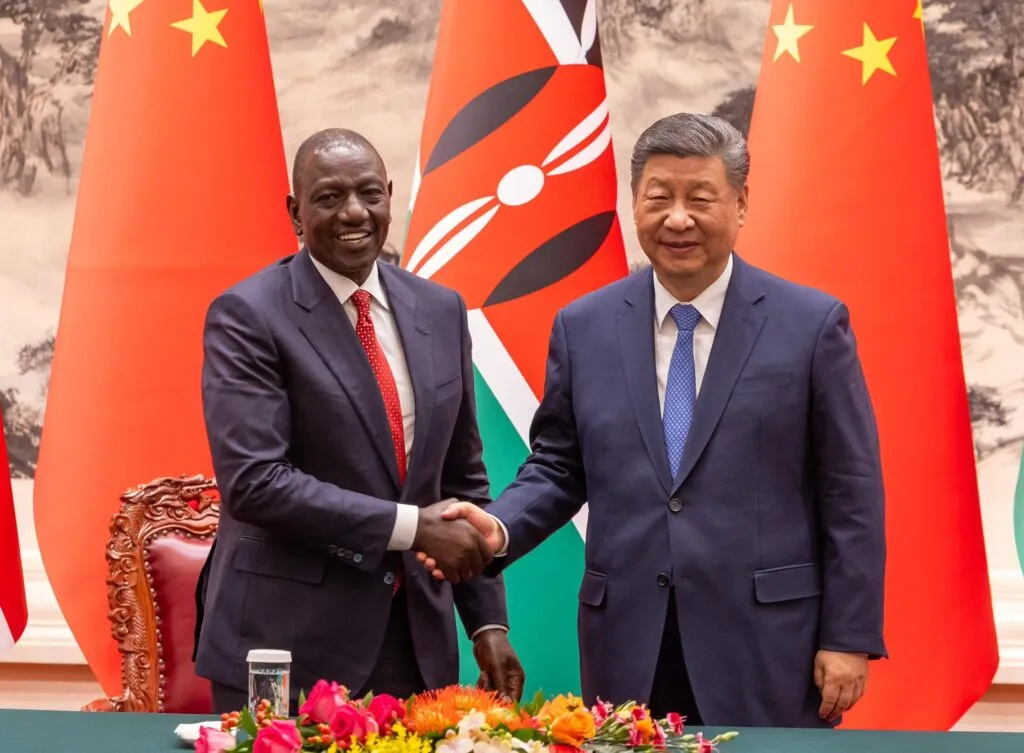

photo source: Google

By: Montel Kamau

Serrari Financial Analyst

13th August, 2024

Article and News Disclaimer

The information provided on www.serrarigroup.com is for general informational purposes only. While we strive to keep the information up to date and accurate, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability with respect to the website or the information, products, services, or related graphics contained on the website for any purpose. Any reliance you place on such information is therefore strictly at your own risk.

www.serrarigroup.com is not responsible for any errors or omissions, or for the results obtained from the use of this information. All information on the website is provided on an "as-is" basis, with no guarantee of completeness, accuracy, timeliness, or of the results obtained from the use of this information, and without warranty of any kind, express or implied, including but not limited to warranties of performance, merchantability, and fitness for a particular purpose.

In no event will www.serrarigroup.com be liable to you or anyone else for any decision made or action taken in reliance on the information provided on the website or for any consequential, special, or similar damages, even if advised of the possibility of such damages.

The articles, news, and information presented on www.serrarigroup.com reflect the opinions of the respective authors and contributors and do not necessarily represent the views of the website or its management. Any views or opinions expressed are solely those of the individual authors and do not represent the website's views or opinions as a whole.

The content on www.serrarigroup.com may include links to external websites, which are provided for convenience and informational purposes only. We have no control over the nature, content, and availability of those sites. The inclusion of any links does not necessarily imply a recommendation or endorsement of the views expressed within them.

Every effort is made to keep the website up and running smoothly. However, www.serrarigroup.com takes no responsibility for, and will not be liable for, the website being temporarily unavailable due to technical issues beyond our control.

Please note that laws, regulations, and information can change rapidly, and we advise you to conduct further research and seek professional advice when necessary.

By using www.serrarigroup.com, you agree to this disclaimer and its terms. If you do not agree with this disclaimer, please do not use the website.

www.serrarigroup.com, reserves the right to update, modify, or remove any part of this disclaimer without prior notice. It is your responsibility to review this disclaimer periodically for changes.

Serrari Group 2025