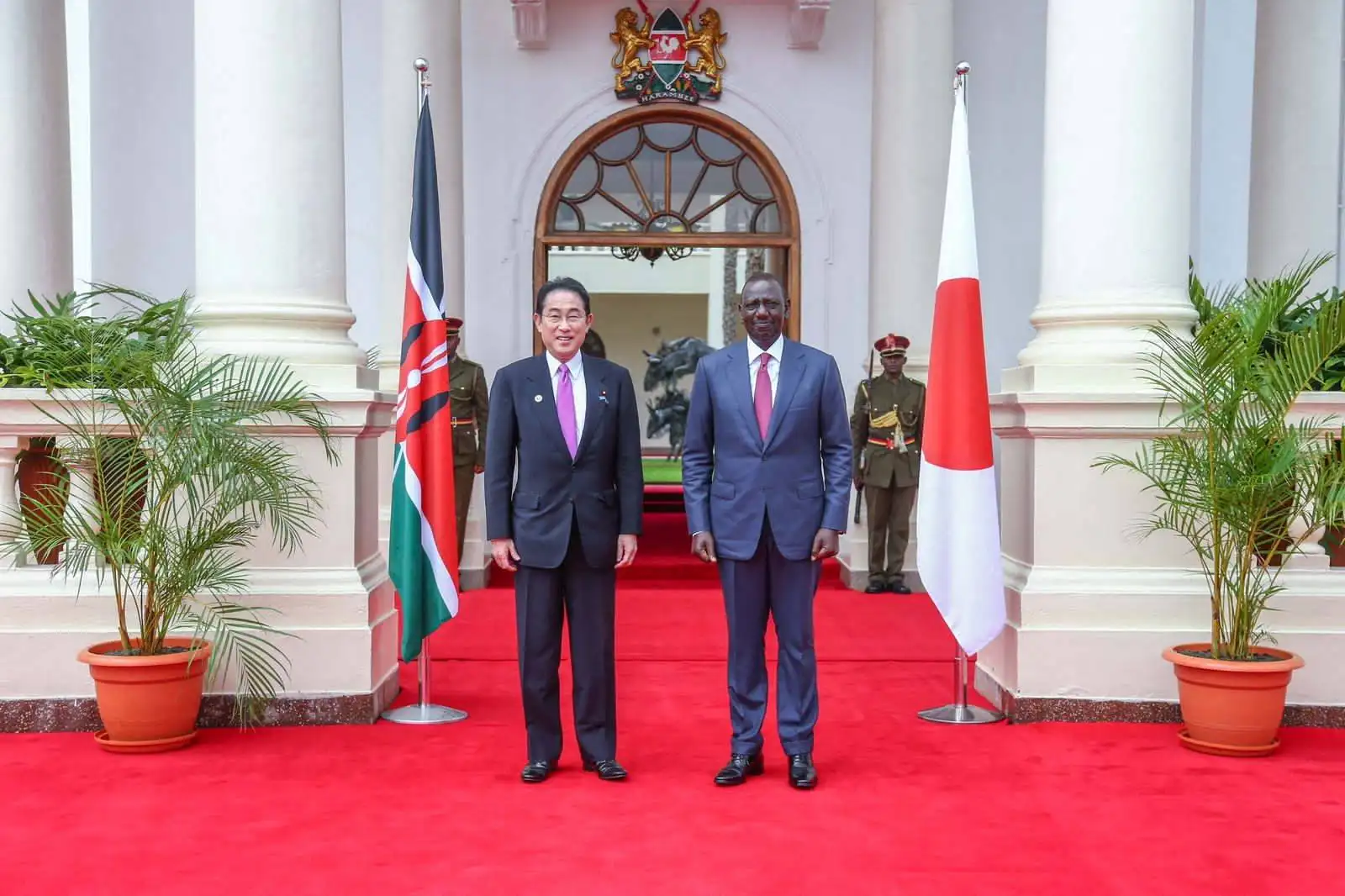

Historic Win for Kenya as Japan Eyes Groundbreaking Free Trade Deal with Africa

Japan is looking to Africa for its next big trade move, and Kenya is right at the center of an ambitious plan that could reshape economic relations between Asia and Africa. In what represents a potential game-changer for continental trade dynamics, Tokyo is preparing to launch negotiations for a comprehensive Free Trade Agreement (FTA) with […]