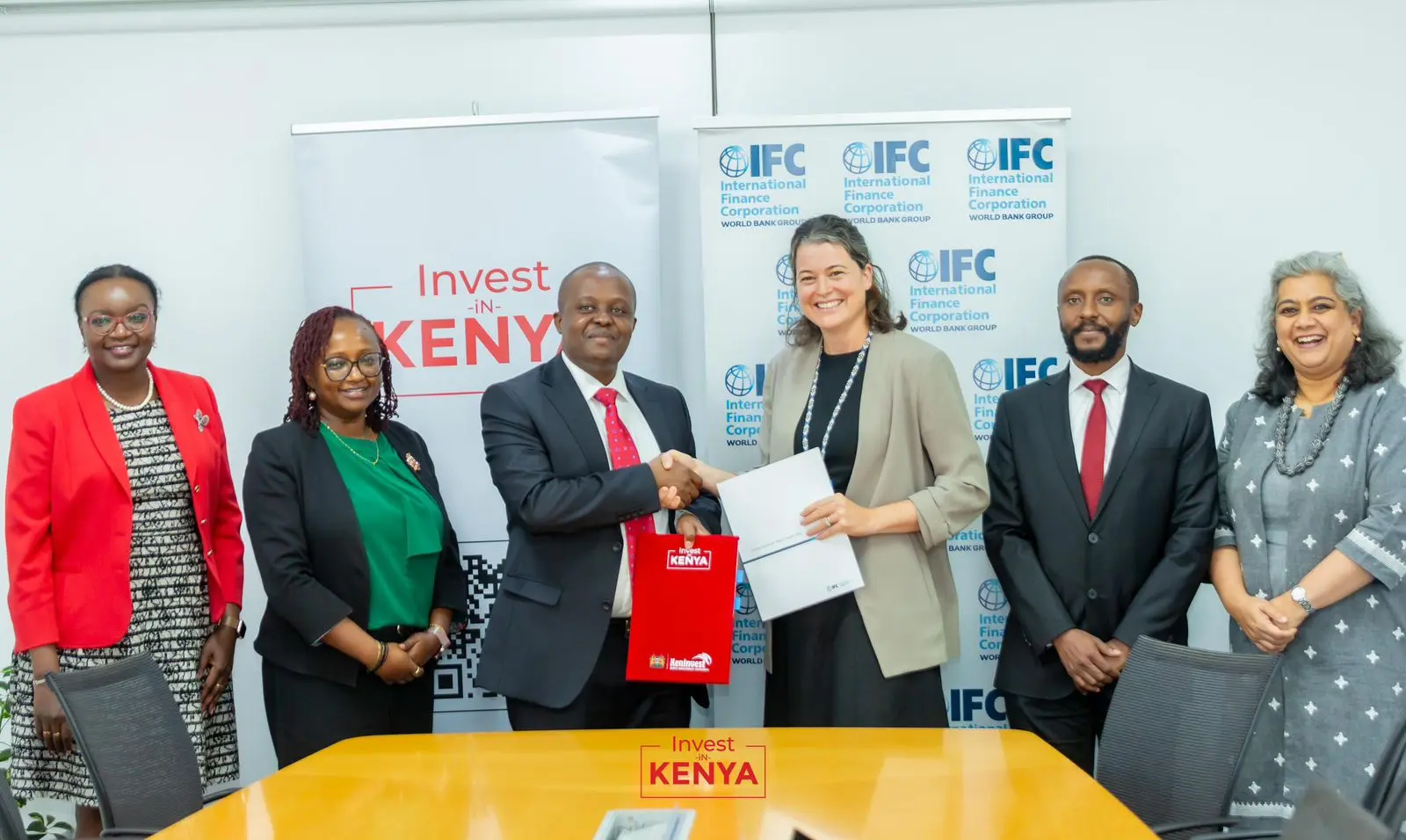

The International Finance Corporation and the Kenya Investment Authority have entered into a strategic collaboration that establishes a comprehensive framework for enhanced cooperation aimed at transforming Kenya’s investment promotion landscape. This partnership, announced on December 2, 2025, represents a significant milestone in Kenya’s efforts to systematically attract foreign direct investment while positioning the country as East Africa’s premier investment destination.

The collaboration builds upon the IFC Africa Investment Promotion Agency Network, which was launched earlier in 2025 at the 12th edition of the Africa CEO Forum in Abidjan. This continental initiative seeks to encourage greater investment and private sector development across Africa by strengthening the institutional capacity of investment promotion agencies to identify, structure, and promote high-value investment opportunities.

Build the future you deserve. Get started with our top-tier Online courses: ACCA, HESI A2, ATI TEAS 7, HESI EXIT, NCLEX-RN, NCLEX-PN, and Financial Literacy. Let Serrari Ed guide your path to success. Enroll today.

Strategic Objectives and Implementation Framework

The partnership’s core objective centers on strengthening Invest Kenya’s institutional capacity to systematically identify, structure, and promote investable opportunities that appeal to private investors and financiers. Through targeted technical support from IFC, the collaboration aims to develop a robust pipeline of investment-ready projects across Kenya’s prioritized growth sectors, accelerating investment generation while stimulating job creation and economic transformation.

John Mwendwa, CEO of the Kenya Investment Authority, emphasized the practical significance of this collaboration, stating that investors are eager to deploy capital in markets with clear, credible pipelines. He noted that IFC’s technical expertise enables Invest Kenya to respond to that demand by bringing forward high-quality, investment-ready projects in Kenya’s most promising sectors, representing a major step in ensuring Kenya remains the destination of choice for global investors seeking both impact and opportunity.

A key deliverable from this partnership involves the preparation of investable projects across priority sectors, subject to review and approval by Invest Kenya upon completion. The initiative is expected to generate concrete investment leads, signaling increased investor appetite and confidence in Kenya’s market potential. This collaborative effort will ensure that Kenya can attract and secure higher-value foreign direct investment aligned with national development priorities, driving new capital inflows, business growth, and employment creation.

Kenya’s Current FDI Landscape and Challenges

Understanding the context in which this partnership operates requires examining Kenya’s recent foreign direct investment performance. According to the 2024 Foreign Investment Survey Report published by the Kenya National Bureau of Statistics, the stock of foreign liabilities increased by 3.4% from KSh 2,263.6 billion at the end of 2022 to KSh 2,341.6 billion at the end of 2023.

This increase was primarily driven by Foreign Direct Investment, which rose by 8.5% from KSh 1,343.1 billion at the end of 2022 to KSh 1,457.5 billion at the end of 2023. Foreign Direct Investment accounted for 62.2% of total foreign liabilities in 2023, largely comprising equity and investment fund shares. However, FDI flows to Kenya decreased by 5.8% year-on-year in 2023, totaling USD 1.5 billion according to UNCTAD’s World Investment Report 2024.

Despite being one of the largest recipients of FDI in Africa, Kenya faces persistent challenges that constrain foreign investment inflows. These obstacles include infrastructure quality issues, skills shortages, security concerns related to terrorism and political instability, ineffective rule of law, and corruption. Kenya ranks 121st out of 180 economies on Transparency International’s 2024 Corruption Perception Index, indicating significant governance challenges that deter foreign investors.

Additionally, regulatory hurdles and the complexity of entry and licensing procedures, alongside variations in processes across counties, further inhibit FDI. Local participation requirements remain mandatory in various sectors, including insurance (at least one-third), telecommunications, and ICT services (minimum 30%), while continued restrictions on FDI persist in critical sectors like business services and financial services.

IFC’s Expanded Role in Kenya’s Development

The partnership with Invest Kenya represents part of IFC’s broader strategic engagement in Kenya, where the institution maintains a substantial and growing presence. As of August 31, 2025, IFC’s investment portfolio in Kenya totaled $1.3 billion, supporting job creation, energy access expansion, infrastructure strengthening, manufacturing growth, agribusiness development, financial services deepening, and digital connectivity advancement.

Beyond its investment portfolio, IFC delivers $65 million in advisory programs designed to attract private investment in agribusiness, affordable housing, manufacturing, and small businesses. These advisory services complement IFC’s financing activities by helping to create enabling environments for private sector development and addressing market failures that constrain investment flows.

Gillian Rogers, IFC’s Principal Country Officer for Kenya, highlighted the institution’s longstanding partnership with the country, noting that Kenya possesses a dynamic and diverse private sector competitive in industries ranging from agriculture and manufacturing to tourism and financial services. She emphasized that working with the Kenya Investment Authority, IFC aims to strengthen Kenya’s economy further by helping attract investment that creates jobs and builds industries, contributing to long-term growth and opportunity.

IFC’s strategic focus in Kenya emphasizes supporting job creation through targeted investments to grow private enterprises, expand market opportunities, and drive inclusive economic growth, alongside provision of advisory services at firm and sector levels. Key focus areas include agriculture, energy, access to finance, and small and medium-sized enterprises—all sectors critical to Kenya’s economic transformation agenda.

The Africa Investment Promotion Agency Network Context

The IFC-Invest Kenya partnership must be understood within the broader context of IFC’s continental investment promotion strategy. The Africa Investment Promotion Agency Network, launched at the 12th Africa CEO Forum in Abidjan in May 2025, represents a landmark initiative to coordinate and strengthen investment promotion efforts across the continent.

IFC Managing Director Makhtar Diop emphasized at the Forum’s launch that the platform had become key for shaping and scaling solutions that empower Africa’s private sector. He noted that initiatives range from innovative financial tools like local currency financing to major programs that unlock high-potential investment opportunities, with the new network of African investment promotion agencies launched at the 12th edition demonstrating IFC’s commitment to supporting efforts that help African companies realize their full potential.

The network provides a common platform for African Investment Promotion Agencies to discuss and design investment promotion strategies, share best practices, and coordinate approaches to attracting foreign investment. By connecting IPAs across the continent, the network facilitates knowledge exchange and enables smaller or less-resourced agencies to benefit from the experiences of more established counterparts.

Priority Sectors and Investment Opportunities

While the partnership announcement does not specify exact sectors, Kenya’s investment promotion priorities can be inferred from recent policy initiatives and IFC’s sectoral focus areas. The country’s National Development Strategy emphasizes manufacturing, renewable energy, digital infrastructure, agribusiness, and tourism as key growth sectors requiring sustained investment inflows.

Kenya’s manufacturing sector presents particularly compelling opportunities, supported by a stable economic environment, government commitment to industrialization, abundant resources, and sustainability focus. The sector offers strategic entry into a dynamic and growing market, with export opportunities through regional trade agreements and access to the expanding East African Community market of over 300 million consumers.

In renewable energy, Kenya maintains ambitious targets, including achieving 100% renewable energy by 2030. IFC is partnering with Kenya through the M300 initiative to accelerate the country’s energy access goals. The country’s renewable energy sector benefits from substantial geothermal, solar, wind, and hydroelectric resources, creating opportunities for greenfield investments and project finance.

Agriculture and agribusiness represent another priority area where Kenya possesses significant competitive advantages. The country is a priority nation for the World Bank Group’s AgriConnect initiative, which unlocks new markets and opportunities for farmers. IFC partners with companies to help farmers increase incomes, strengthen businesses, and boost food production, addressing both food security concerns and export earnings generation.

The digital economy and ICT sector continue expanding rapidly, driven by Kenya’s position as East Africa’s technology hub. The country’s thriving fintech ecosystem, robust mobile money infrastructure, and growing startup scene create opportunities for investments in digital infrastructure, technology platforms, and innovative business models serving underserved market segments.

One decision can change your entire career. Take that step with our Online courses in ACCA, HESI A2, ATI TEAS 7, HESI EXIT, NCLEX-RN, NCLEX-PN, and Financial Literacy. Join Serrari Ed and start building your brighter future today.

Institutional Capacity Building and Technical Assistance

A central component of the IFC-Invest Kenya partnership involves institutional capacity building to enhance the investment promotion agency’s effectiveness. This technical assistance addresses several critical dimensions of investment promotion capability.

First, project identification and screening methodologies will be strengthened to enable Invest Kenya to systematically identify promising investment opportunities aligned with national development priorities and investor interests. This involves developing sector-specific expertise, understanding global investment trends, and maintaining awareness of investor preferences and requirements.

Second, project structuring capabilities will be enhanced to transform identified opportunities into bankable investment proposals. This includes financial modeling, risk assessment, regulatory compliance analysis, and preparation of comprehensive information packages that meet international investor standards. Many potentially attractive investment opportunities fail to materialize due to inadequate project preparation and structuring.

Third, investment promotion and marketing strategies will be refined to effectively communicate Kenya’s value proposition to target investor segments. This encompasses developing compelling investment narratives, creating sector-specific promotional materials, organizing targeted investor outreach activities, and maintaining systematic engagement with investor communities.

Fourth, aftercare and investor servicing capabilities will be strengthened to support existing investors and encourage expansion investments. Research consistently demonstrates that expansion investments from existing investors represent a significant and often underutilized source of FDI. Effective aftercare requires systematic engagement with established investors, proactive problem-solving, and facilitation of expansion plans.

Regional and International Investor Outreach

The partnership explicitly commits to promoting stronger regional and international investor outreach, recognizing that attracting foreign investment requires sustained engagement with investor communities in key source markets. Kenya’s traditional FDI source regions include Europe, North America, and Asia, each requiring tailored outreach strategies reflecting distinct investor characteristics and preferences.

According to the 2023 Foreign Investment Survey, Europe held the largest share of Kenya’s total stock of FDI liabilities at 47.8%, with the United Kingdom and Netherlands accounting for 45.8% and 24.1% respectively of the region’s total. This concentration suggests the importance of maintaining strong relationships with European investor communities while also diversifying source markets.

Asian investors have shown increasing interest in African markets, with China, India, and Japan representing significant actual and potential FDI sources. Kenya’s recent investor outreach activities reflect this reality, with the country preparing for a Kenya-India Investment Roadshow scheduled for December 2-4, 2025, in New Delhi and Bengaluru, focusing on pharmaceutical manufacturing, textiles and apparel, and ICT and business process outsourcing services.

The United States represents another priority investor market, particularly for technology, manufacturing, and services sector investments. Recent initiatives like the California-Africa Climate and Economic Partnership Forum in Nairobi demonstrate ongoing efforts to strengthen U.S.-Kenya investment relationships, particularly in climate-related sectors.

Policy Reform Initiatives and Investment Climate Enhancement

Beyond project pipeline development and investor outreach, the collaboration will support policy reform initiatives aimed at enhancing Kenya’s investment climate. While the partnership announcement does not detail specific reforms, Kenya’s investment climate challenges suggest several priority areas requiring attention.

Regulatory streamlining represents a critical reform area, particularly regarding business licensing and permits. The complexity of entry and licensing procedures, alongside variations in processes across Kenya’s 47 counties, creates unnecessary friction for investors. Digitalization of processes and enhanced coordination between national and county governments could significantly improve the investor experience.

Land acquisition and property rights clarity also require attention, given that foreigners are not permitted to own land in Kenya, though they can lease land for up to 99 years. Clearer procedures and greater transparency in land transactions would reduce uncertainty and transaction costs for investors.

Tax policy consistency and predictability represent another priority area. Recent changes to Kenya’s tax framework, including increases introduced through various Finance Acts, have created uncertainty regarding the stability of fiscal policy. Investors prioritize predictability in tax treatment and benefit from clearly articulated frameworks that provide confidence regarding medium-term fiscal obligations.

Infrastructure investment and maintenance, while partially outside Invest Kenya’s direct mandate, fundamentally affect investment attractiveness. Reliable electricity supply, quality transport infrastructure, and digital connectivity represent baseline requirements for most commercial activities. Policy reforms that accelerate infrastructure development and maintenance directly support investment promotion objectives.

Alignment with National Development Priorities

The IFC-Invest Kenya partnership explicitly aligns with Kenya’s national development priorities, ensuring that attracted investments contribute to the country’s long-term transformation objectives. Kenya’s Vision 2030 provides the overarching framework for the country’s development aspirations, aiming to transform Kenya into a newly industrializing, middle-income country providing high quality of life to all citizens by 2030 in a clean and secure environment.

The Third Medium Term Plan (2018-2022) and subsequent planning frameworks emphasize manufacturing, food security, affordable housing, and universal healthcare as key priority areas requiring sustained investment. The “Big Four” agenda, though evolving under new political leadership, established these priorities and continues to influence investment promotion strategies.

Industrial transformation represents a particularly critical priority, given Kenya’s objective to increase manufacturing’s contribution to GDP. This requires substantial investments in manufacturing capacity, technology upgrading, skills development, and industrial infrastructure. The IFC partnership can support this objective by identifying and structuring manufacturing projects that meet both investor return requirements and national industrialization goals.

Job creation remains paramount given Kenya’s demographic dynamics, with a young and growing population requiring productive employment opportunities. The partnership’s emphasis on job-creating investments directly addresses this fundamental development challenge, recognizing that sustainable poverty reduction depends on expanding formal employment opportunities.

Implementation Mechanisms and Monitoring Frameworks

Successful partnership implementation requires clear mechanisms for coordination, resource allocation, and progress monitoring. While the partnership announcement does not specify detailed implementation arrangements, effective collaboration typically involves several key elements.

Joint steering committees comprising representatives from both IFC and Invest Kenya provide strategic oversight and resolve implementation challenges. These governance structures ensure alignment between IFC’s technical assistance and Invest Kenya’s operational priorities while maintaining accountability for deliverables.

Work planning processes establish specific objectives, timelines, and resource requirements for different partnership components. Clear work plans enable progress tracking and ensure that technical assistance activities systematically build Invest Kenya’s institutional capacity rather than creating dependency on external expertise.

Capacity assessment and gap analysis inform technical assistance priorities by identifying specific areas where Invest Kenya requires strengthening. This diagnostic work ensures that IFC’s support addresses genuine capability gaps rather than applying generic solutions that may not fit Kenya’s specific context.

Knowledge transfer mechanisms, including training programs, study tours, peer learning exchanges, and embedded technical advisors, facilitate skills and knowledge transfer from IFC to Invest Kenya staff. Sustainable capacity building requires genuine knowledge transfer rather than simple service provision, enabling Invest Kenya to maintain enhanced capabilities after IFC’s direct support concludes.

The Path Forward: Measuring Success and Impact

The partnership’s ultimate success will be measured not merely by process improvements or enhanced institutional capacity but by tangible outcomes including increased investment flows, job creation, and sectoral transformation. Several key performance indicators can assess partnership effectiveness.

Investment pipeline metrics, including the number and value of projects developed to investment-ready status, provide direct measures of partnership productivity. These metrics should distinguish between projects at different stages of development, recognizing that pipeline development involves progressive refinement from initial concept to bankable proposal.

Investor engagement metrics, including the number of investor site visits facilitated, memoranda of understanding signed, and investment commitments secured, indicate the partnership’s effectiveness in converting project pipelines into actual investments. These leading indicators provide early signals of partnership impact before actual capital inflows materialize.

Investment flow metrics, particularly FDI inflows to priority sectors, represent ultimate outcome measures. While attributing specific investments to partnership interventions poses methodological challenges, sustained increases in sectoral investment flows following partnership launch would suggest positive impact.

Employment creation metrics, disaggregated by sector, skill level, and demographics, assess the partnership’s contribution to Kenya’s job creation objectives. Given that employment generation represents a primary partnership rationale, systematic tracking of jobs created through supported investments provides critical impact data.

Conclusion: A Model for Investment Promotion Collaboration

The IFC-Invest Kenya partnership represents a potentially transformative intervention in Kenya’s investment promotion landscape, addressing fundamental constraints that have limited the country’s ability to attract foreign capital commensurate with its economic potential and strategic positioning. By combining IFC’s global expertise in investment promotion with Invest Kenya’s local market knowledge and institutional mandate, the collaboration creates conditions for systematic improvement in Kenya’s investment attraction capacity.

The partnership’s emphasis on developing investable project pipelines addresses a critical market failure in many developing economies, where potentially attractive investment opportunities remain unrealized due to inadequate project preparation and structuring. By systematically identifying, structuring, and promoting high-quality investment opportunities, the partnership reduces transaction costs for investors while ensuring that incoming investments align with national development priorities.

Moreover, the partnership’s focus on institutional capacity building rather than simple service provision creates conditions for sustainable improvement in investment promotion effectiveness. By transferring skills, methodologies, and systems to Invest Kenya, the collaboration enables the agency to maintain enhanced capabilities beyond IFC’s direct involvement, creating lasting improvements in Kenya’s investment promotion infrastructure.

As Kenya navigates the challenges of attracting foreign investment in an increasingly competitive global environment, partnerships like this collaboration with IFC provide essential support for building the institutional capabilities and project pipelines necessary for success. The initiative’s outcomes will be watched closely by other African nations seeking to enhance their own investment promotion effectiveness, potentially establishing a replicable model for development finance institution-investment promotion agency collaboration across the continent.

Catch Up With Our Other Headlines

3rd December, 2025

America Takes Command: U.S. Charts New Economic Path as G20 President Amid Diplomatic Tensions

New MoU Between Kenya and Somalia Exchanges Targets Stronger Regional Market Link

Ready to take your career to the next level? Join our Online courses: ACCA, HESI A2, ATI TEAS 7 , HESI EXIT , NCLEX – RN and NCLEX – PN, Financial Literacy!🌟 Dive into a world of opportunities and empower yourself for success. Explore more at Serrari Ed and start your exciting journey today! ✨

Track GDP, Inflation and Central Bank rates for top African markets with Serrari’s comparator tool.

See today’s Treasury bonds and Money market funds movement across financial service providers in Kenya, using Serrari’s comparator tools.

photo source: Google

By: Montel Kamau

Serrari Financial Analyst

3rd December, 2025’

Article, Financial and News Disclaimer

The Value of a Financial Advisor

While this article offers valuable insights, it is essential to recognize that personal finance can be highly complex and unique to each individual. A financial advisor provides professional expertise and personalized guidance to help you make well-informed decisions tailored to your specific circumstances and goals.

Beyond offering knowledge, a financial advisor serves as a trusted partner to help you stay disciplined, avoid common pitfalls, and remain focused on your long-term objectives. Their perspective and experience can complement your own efforts, enhancing your financial well-being and ensuring a more confident approach to managing your finances.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Readers are encouraged to consult a licensed financial advisor to obtain guidance specific to their financial situation.

Article and News Disclaimer

The information provided on www.serrarigroup.com is for general informational purposes only. While we strive to keep the information up to date and accurate, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability with respect to the website or the information, products, services, or related graphics contained on the website for any purpose. Any reliance you place on such information is therefore strictly at your own risk.

www.serrarigroup.com is not responsible for any errors or omissions, or for the results obtained from the use of this information. All information on the website is provided on an as-is basis, with no guarantee of completeness, accuracy, timeliness, or of the results obtained from the use of this information, and without warranty of any kind, express or implied, including but not limited to warranties of performance, merchantability, and fitness for a particular purpose.

In no event will www.serrarigroup.com be liable to you or anyone else for any decision made or action taken in reliance on the information provided on the website or for any consequential, special, or similar damages, even if advised of the possibility of such damages.

The articles, news, and information presented on www.serrarigroup.com reflect the opinions of the respective authors and contributors and do not necessarily represent the views of the website or its management. Any views or opinions expressed are solely those of the individual authors and do not represent the website's views or opinions as a whole.

The content on www.serrarigroup.com may include links to external websites, which are provided for convenience and informational purposes only. We have no control over the nature, content, and availability of those sites. The inclusion of any links does not necessarily imply a recommendation or endorsement of the views expressed within them.

Every effort is made to keep the website up and running smoothly. However, www.serrarigroup.com takes no responsibility for, and will not be liable for, the website being temporarily unavailable due to technical issues beyond our control.

Please note that laws, regulations, and information can change rapidly, and we advise you to conduct further research and seek professional advice when necessary.

By using www.serrarigroup.com, you agree to this disclaimer and its terms. If you do not agree with this disclaimer, please do not use the website.

www.serrarigroup.com, reserves the right to update, modify, or remove any part of this disclaimer without prior notice. It is your responsibility to review this disclaimer periodically for changes.

Serrari Group 2025