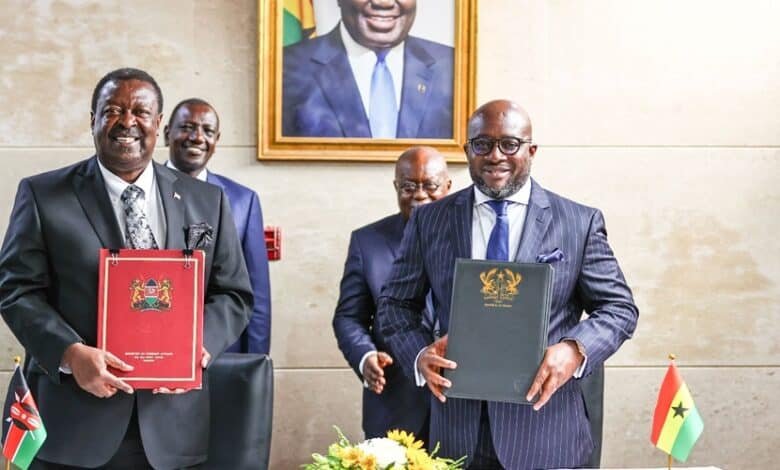

Kenya, Ghana Commit to Improve Trade Relations

Kenya and Ghana are committed to strengthening bilateral trade ties as the volume of goods exchanged between the two countries continues to grow. This development comes as both nations seek to deepen economic cooperation and foster stronger intra-African trade relations. Kenya’s primary exports to Ghana include vegetable fibers, tea, and aluminum, while Ghana exports coconut […]