In a significant policy shift, Kenya has formally announced its withdrawal from the Government to Government (G2G) oil deal with Saudi Arabia, citing concerns over its impact on the forex market and an inability to mitigate the fluctuating shilling-dollar exchange rate. Launched with much anticipation in April 2023 by President William Ruto, the G2G deal aimed to stabilize the shilling against the dollar.

The agreement, established between Kenya and three prominent Gulf oil exporters, introduced a unique credit mechanism for oil imports, backed by letters of credit issued by participating commercial banks. However, a recent IMF report quoting the Treasury unveils the government’s decision to exit the G2G arrangement, acknowledging the distortions it has introduced to the foreign exchange market.

“This move is a response to the distortions in the FX market and the increased rollover risk associated with private sector financing facilities supporting the deal. The government remains committed to exploring private market solutions in the energy sector,” stated the Treasury in the report.

Admitting that the G2G deal was implemented as a short-term measure to address foreign exchange pressures, the government clarified, “As an interim solution to alleviate FX pressures, we introduced a new oil import arrangement in April 2023. This replaced the previous open tendering system, where oil import dues were payable upon five days of delivery, contributing to undue FX market pressures.”

The challenges faced by the G2G deal became evident early on, with a noticeable decline in actual average monthly import volumes during the initial six months. The government attributes this decrease to lower demand both domestically and in regional reexport markets.

President Ruto’s initial optimism in April, where he foresaw a significant drop in the exchange rate, now contrasts with the decision to terminate the G2G arrangement. Meanwhile, opposition leader Raila Odinga, who expressed skepticism from the outset, raised concerns about the deal’s impact on the cost of fuel and accused handpicked distributors of selling oil at nearly twice the price of bulk suppliers.

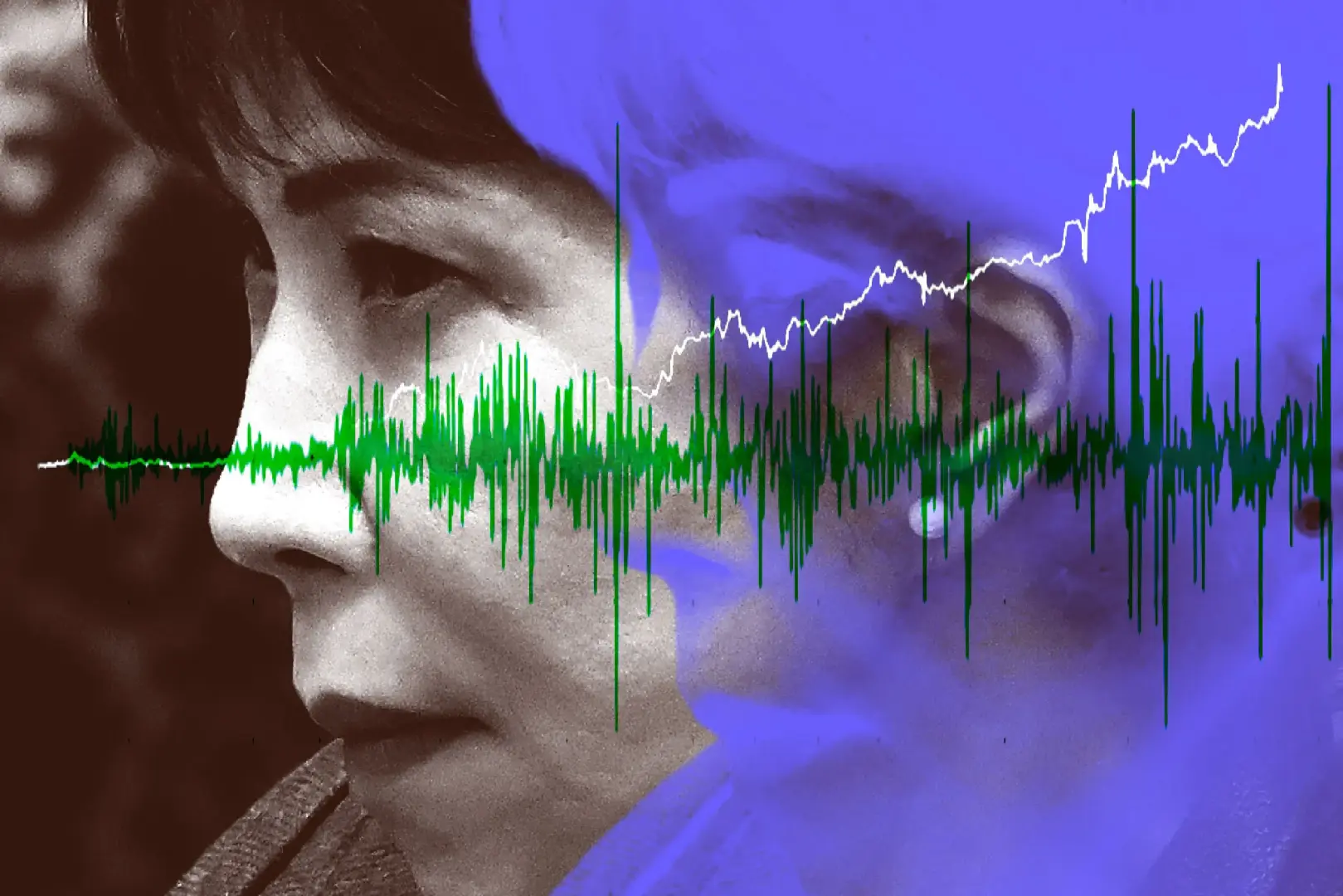

“The US-dollar to Kenya-shilling exchange rate has risen from Ksh.132 to Ksh.159 six months later. The cost of fuel escalated significantly after the deal. Why have things worsened since its inception?” questioned Odinga.

In response, President Ruto defended the transparency of the G2G deal, asserting that it served the dual purpose of ensuring a steady oil supply for six months and fulfilling payment obligations.

The decision to exit the G2G oil deal adds complexity to Kenya’s economic landscape, prompting further scrutiny of the efficacy and transparency of international agreements in the nation’s energy sector.

Photo (By The Star Kenya)

By: Montel Kamau

Serrari Financial Analyst

22nd January, 2024

Article, Financial and News Disclaimer

The Value of a Financial Advisor

While this article offers valuable insights, it is essential to recognize that personal finance can be highly complex and unique to each individual. A financial advisor provides professional expertise and personalized guidance to help you make well-informed decisions tailored to your specific circumstances and goals.

Beyond offering knowledge, a financial advisor serves as a trusted partner to help you stay disciplined, avoid common pitfalls, and remain focused on your long-term objectives. Their perspective and experience can complement your own efforts, enhancing your financial well-being and ensuring a more confident approach to managing your finances.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Readers are encouraged to consult a licensed financial advisor to obtain guidance specific to their financial situation.

Article and News Disclaimer

The information provided on www.serrarigroup.com is for general informational purposes only. While we strive to keep the information up to date and accurate, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability with respect to the website or the information, products, services, or related graphics contained on the website for any purpose. Any reliance you place on such information is therefore strictly at your own risk.

www.serrarigroup.com is not responsible for any errors or omissions, or for the results obtained from the use of this information. All information on the website is provided on an as-is basis, with no guarantee of completeness, accuracy, timeliness, or of the results obtained from the use of this information, and without warranty of any kind, express or implied, including but not limited to warranties of performance, merchantability, and fitness for a particular purpose.

In no event will www.serrarigroup.com be liable to you or anyone else for any decision made or action taken in reliance on the information provided on the website or for any consequential, special, or similar damages, even if advised of the possibility of such damages.

The articles, news, and information presented on www.serrarigroup.com reflect the opinions of the respective authors and contributors and do not necessarily represent the views of the website or its management. Any views or opinions expressed are solely those of the individual authors and do not represent the website's views or opinions as a whole.

The content on www.serrarigroup.com may include links to external websites, which are provided for convenience and informational purposes only. We have no control over the nature, content, and availability of those sites. The inclusion of any links does not necessarily imply a recommendation or endorsement of the views expressed within them.

Every effort is made to keep the website up and running smoothly. However, www.serrarigroup.com takes no responsibility for, and will not be liable for, the website being temporarily unavailable due to technical issues beyond our control.

Please note that laws, regulations, and information can change rapidly, and we advise you to conduct further research and seek professional advice when necessary.

By using www.serrarigroup.com, you agree to this disclaimer and its terms. If you do not agree with this disclaimer, please do not use the website.

www.serrarigroup.com, reserves the right to update, modify, or remove any part of this disclaimer without prior notice. It is your responsibility to review this disclaimer periodically for changes.

Serrari Group 2025