In a climate of economic uncertainty and fiscal strain, Zimbabwe finds itself wrestling with a staggering US$1.2 billion debt owed to infrastructure contractors. This mounting arrears issue has sent ripples through the nation’s development agenda as stalled public projects—from major roadways to vital dam constructions—face delays due to liquidity challenges. Amid heightened public scrutiny and political debate, Finance Minister Mthuli Ncube addressed Parliament, citing “cash constraints” as the primary cause of payment delays. While the government remains committed to settling these debts, concerns continue to mount over whether the current payment program is sufficient to restore confidence and spur economic growth.

A History of Infrastructure Investment and Fiscal Challenges

Zimbabwe’s infrastructure has long been recognized as a critical component of its economic revival strategy. Since the advent of the “Second Republic” seven years ago, government-led infrastructure programmes have played a fundamental role in developing local construction companies and driving socio-economic progress. Many contractors, born out of these initiatives, have emerged as key players in building roads, dams, and other vital projects. However, the significant US$1.2 billion debt has now cast a long shadow over these accomplishments.

Finance Minister Mthuli Ncube explained in Parliament that while the government has been making concerted efforts to meet its contractual obligations, ongoing liquidity issues have forced delays in payments to infrastructure contractors. “We have been settling these arrears bit by bit, and we keep encouraging them to take on new work while we settle these arrears,” Ncube stated. He highlighted recent disbursements of approximately US$30 million for projects such as the Harare-Masvingo-Beitbridge Road and Greater Harare roads, and around US$35.2 million towards dam construction projects. Additionally, US$17 million was recently paid in arrears in other sectors. Yet these measures, while positive signals of progress, still represent only a fraction of the total outstanding debt.

The government’s acknowledgment of payment delays has raised serious concerns among industry stakeholders. Opposition Members of Parliament, including Citizens for Coalition Change MP Corban Madzivanyika, have questioned whether the current pace of payments is sustainable. The Zimbabwe Building Contractors Association has also highlighted a mismatch between the sums being paid and the monumental scale of the debt, warning that the sluggish payment process could stymie much-needed infrastructure development and push the economy toward contraction.

The Human Impact and Economic Consequences

Projects on the Back Burner

The practical implications of these payment delays are tangible and far-reaching. Critical public infrastructure projects—including road construction essential for commerce, dam projects that support both water supply and energy generation, and other civic facilities—are on hold. Masimba Holdings, a major government contractor, has recently underscored the “liquidity challenges” hampering project execution despite possessing a robust order book. Such delays are not just operational hiccups; they have real-world consequences for Zimbabwe’s citizens and business communities.

For instance, stalled road construction projects are affecting the timely transport of goods and people, thereby undermining trade and investment. In a country where rural connectivity is pivotal for agricultural supply chains, these delays can result in increased costs, reduced market access, and a decline in overall economic activity. Moreover, delays in dam construction projects disrupt water management and energy generation plans, potentially leading to water scarcity and unreliable electricity supply—factors that further hinder economic growth.

Uncertainty and Confidence Crisis

Beyond physical infrastructure, there is an acute crisis of confidence. Contractors, both large and small, are increasingly wary of entering new agreements given the unpredictable flow of funds from the government. “If these financial constraints persist, Zimbabwe’s economic growth could very well shift toward contraction in the short term,” cautioned representatives of the construction industry. For many of these companies, the debt is not just a financial statement item—it directly affects their operations, staffing levels, and ability to secure future work.

The human element is central to this story. Local construction companies, which were built almost from scratch under the government’s development programmes, are now under severe stress. These businesses not only provide employment for thousands of Zimbabweans but also contribute to skills development and technological advancement within the country. The possibility of further delays or defaults in payments could lead to layoffs, closures, and a cascading effect on the national economy.

Government Measures and the Road Ahead

Improving Payment Programs

In response to mounting criticism, Finance Minister Ncube has reiterated the government’s commitment to resolving the arrears issue. During his appearance in Parliament, Ncube assured lawmakers and the public that the Treasury is actively “working out payment plans for contractors.” The government is now focused on improving the consistency and reliability of its payment program. “We already owe the contractors, and they are doing some good work. We have a constructive relationship with them, and we will continue paying until we clear these arrears,” said Ncube, emphasizing that while the current payment schedule was taking small, incremental steps, improvements were both planned and necessary.

To restore trust, the government has pledged to increase transparency around its debt management practices. This includes regular updates on payment disbursements and clearer timelines for settling outstanding balances. The intention is to provide a roadmap for contractors that not only communicates commitment but also sets expectations that new orders and additional projects will only be undertaken when sufficient funds are guaranteed.

Funding Challenges and Fiscal Reforms

However, the crux of the issue remains the government’s own cash constraints. Zimbabwe’s fiscal challenges are well known—years of economic mismanagement, hyperinflation, and a complex legacy of external debts have left the country in a precarious position. In recent years, fiscal reforms have been implemented to stabilize the economy, but progress has been uneven. The current debt to infrastructure contractors represents both a symptom and a cause of deeper financial woes.

In various public statements, government officials have pointed to broader fiscal reforms aimed at improving revenue collection and curbing unnecessary expenditures. Measures such as streamlining the payment mechanisms within government agencies, reducing bureaucratic delays, and pursuing negotiations with international creditors are all part of a broader strategy to stabilize the country’s finances. Experts suggest that if these measures succeed, Zimbabwe might gradually restore liquidity, which in turn could lead to more timely payments to contractors.

The finance ministry is also exploring partnerships with international development banks and seeking donor assistance to help bridge the immediate liquidity gaps. Such collaborative efforts would not only help clear the existing arrears but also lay the groundwork for more sustainable fiscal policies in the future. However, many stakeholders remain skeptical about the pace of these reforms, noting that without swift action, the debt burden may continue to hamper infrastructure development and, by extension, economic recovery.

Regional and Global Context

A Tale of Infrastructure Investment in Africa

Zimbabwe is not alone in facing challenges with infrastructure funding and contractor payments. Across the African continent, several nations are grappling with similar issues—balancing ambitious development programmes with limited fiscal space and competing priorities. In many African countries, delays in government payments have stalled projects that are critical not only to economic growth but also to social development. For instance, nations like Kenya and Nigeria have also encountered significant challenges with contractor arrears, resulting in delayed road, bridge, and power projects that are vital for supporting rapidly growing populations and industrial sectors.

Infrastructure investments have always been a cornerstone of Africa’s development agenda. When implemented efficiently, such investments lead to job creation, technological transfer, and improved connectivity—all of which are essential for economic diversification. In Zimbabwe’s case, the infrastructure programmes initiated under the “Second Republic” have been lauded for having created a robust local construction sector. Many of today’s leading contractors were founded or significantly expanded as a direct result of government projects. This legacy makes it all the more urgent for the government to address payment delays, as failure to do so could unravel years of progress.

The International Ripple Effect

On the global stage, Zimbabwe’s debt situation is a microcosm of the challenges faced by emerging economies in managing public infrastructure investments. In recent years, global financial institutions have increasingly emphasized the importance of transparency in public spending and efficient debt management. International investors and aid organizations look unfavorably on countries with chronic arrears and inconsistent financial practices, as these factors increase the risk of default and diminish investor confidence.

Moreover, Zimbabwe’s situation has broader implications for its relationships with international partners. Countries that provide technical assistance and development aid are likely to scrutinize the country’s fiscal health. Persistent delays in clearing debts might lead to reductions in future aid or increased conditions tied to economic reforms. In this way, the current debt issue is not just a domestic challenge but also a signal to the international community regarding the country’s governance and economic stability.

The Human Side: Stories from the Ground

Impact on Contractors and Workers

For the contractors, the delayed payments have a direct human toll. Local companies like Masimba Holdings have voiced concerns that continued financial constraints may force them to postpone projects, reduce workforce levels, or even halt operations altogether. In a country where construction companies not only build infrastructure but also serve as major employers, such outcomes could lead to widespread job losses and decreased economic activity in affected communities.

Workers employed by these contractors, many of whom rely on stable wages to support their families, face uncertainty as project timelines stretch indefinitely. Delays in projects like road construction affect local trade and mobility, meaning that not only are the workers affected, but so are the small businesses that depend on efficient transportation networks for supplies and distribution. When projects stall, the ripple effects extend into everyday life—disrupting schedules, increasing the cost of commuting, and causing longer delays in access to essential services like healthcare and education.

Voices from the Community

Interviews with local business owners and residents paint a picture of a community caught between hope and frustration. “We saw great promise when these new roads were announced,” said a shop owner in a town along the Harare-Masvingo-Beitbridge Road corridor. “But with these delays, we are starting to feel the pinch. Delivery times are longer, and it costs more to get our goods from one place to another.” Another construction worker shared, “We’ve been promised payments and new projects, but when the money does not come on time, it affects not just our work but our families as well. It’s hard to stay hopeful when you’re not sure if you’ll be paid on schedule.”

Such personal accounts illustrate that behind the balance sheets and political debates lie real people whose livelihoods and futures are intimately tied to the government’s ability to manage its debts effectively. The human face of this crisis is a stark reminder that efficient public financial management directly influences everyday life for millions.

Policy Options and the Way Forward

Short-Term Measures: Restoring Confidence

In the immediate future, policy experts recommend that the government intensify its efforts to regularize payments to contractors. Establishing a clear, transparent schedule for clearing arrears could help restore trust among the contractor community and signal to international investors that the government is serious about its commitments. Some proposals include setting up an escrow account backed by donor funds or international loans, which could be used specifically for paying off infrastructure-related debts. This approach has been adopted successfully in other emerging markets facing similar liquidity issues.

Long-Term Reforms: Structural Adjustments

Beyond short-term fixes, Zimbabwe’s infrastructure debt problem calls for deeper structural reforms. This includes the modernization of public financial management systems, improvement in revenue collection, and a comprehensive review of fiscal policies to ensure that large-scale infrastructure projects are financed sustainably. The government is also exploring public-private partnerships (PPPs) as a viable model to involve private investment in public projects. PPPs could help mitigate some of the cash flow challenges while leveraging the efficiency and innovation of the private sector.

Such reforms, while challenging to implement, are essential to avoiding a repeat of past mistakes. Effective debt management would not only clear the current arrears but also build a more resilient fiscal framework for future investments. The key to success lies in balancing short-term cash flow needs with long-term developmental goals—a task that requires coordinated efforts between government entities, international partners, and local stakeholders.

Strengthening Institutional Capacity

Rebuilding institutional capacity is another critical area. The government’s engagement with local contractors over the past seven years has laid the foundation for a robust domestic construction industry. However, to sustain this progress, investments in improving administrative and managerial capabilities within government agencies are essential. Training programs, improved regulatory frameworks, and the adoption of modern financial management software are some of the measures that could help streamline the payment process and reduce future delays.

Conclusion: Bridging the Gap Toward Sustainable Growth

Zimbabwe’s current challenge with a US$1.2 billion debt to infrastructure contractors is emblematic of broader economic and fiscal struggles that the country has faced over the past decades. The arrears have not only stalled vital public projects but also undermined confidence among contractors and the general populace. The government, led by Finance Minister Mthuli Ncube, insists on its commitment to a structured payment program while emphasizing ongoing reforms aimed at clearing these arrears. Yet the road ahead is steep, requiring both short-term interventions and long-term structural reforms.

For Zimbabwe, the stakes could not be higher. Efficiently addressing these challenges is critical—not merely for the sake of balancing the books, but for revitalizing public infrastructure, creating jobs, and restoring the nation’s economic momentum. As policymakers engage in dialogue with stakeholders from all sectors, the hope is that a renewed commitment to transparency, fiscal discipline, and reform will pave the way toward sustainable growth.

The transformation from a troubled past to a hopeful future is rooted in the understanding that economic policies affect the lives of ordinary Zimbabweans. Restoring prompt payments to contractors is about ensuring that road construction projects, dam projects, and other critical infrastructure can resume without disruption. It is about enabling small business owners to thrive, allowing for stable wages among construction workers, and ultimately, contributing to an environment where long-term development is not sacrificed at the altar of short-term cash constraints.

In these challenging times, Zimbabwe stands at a crossroads. With international partnerships, improved internal controls, and a renewed focus on efficient public financial management, there is a pathway out of the current crisis. The government’s resolve to continue payments until all arrears are cleared, coupled with its stated intentions to reform and modernize its financial systems, offers a glimmer of hope that the infrastructure investments that have driven development over the past seven years can indeed yield long-term dividends for the nation.

As the debate continues in Parliament and the eyes of investors, contractors, and citizens remain fixed on the future, one thing is clear: bridging the gap between payment promises and actual disbursements is essential for Zimbabwe to continue its journey toward economic revival and sustainable development. The coming months will be critical in determining whether the policies enacted today can restore confidence and build a more resilient future for all Zimbabweans.

In summary, Zimbabwe’s struggle with US$1.2 billion in infrastructure debt is a multifaceted challenge that touches on fiscal management, public policy, and the everyday lives of its citizens. It is a story of ambition, setbacks, and the unyielding desire for progress—a story that, with the right reforms and unwavering commitment, may yet evolve into one of national renewal and renewed hope for a sustainable future.

Ready to take your career to the next level? Join our dynamic courses: ACCA, HESI A2, ATI TEAS 7 , HESI EXIT , NCLEX – RN and NCLEX – PN, Financial Literacy!🌟 Dive into a world of opportunities and empower yourself for success. Explore more at Serrari Ed and start your exciting journey today! ✨

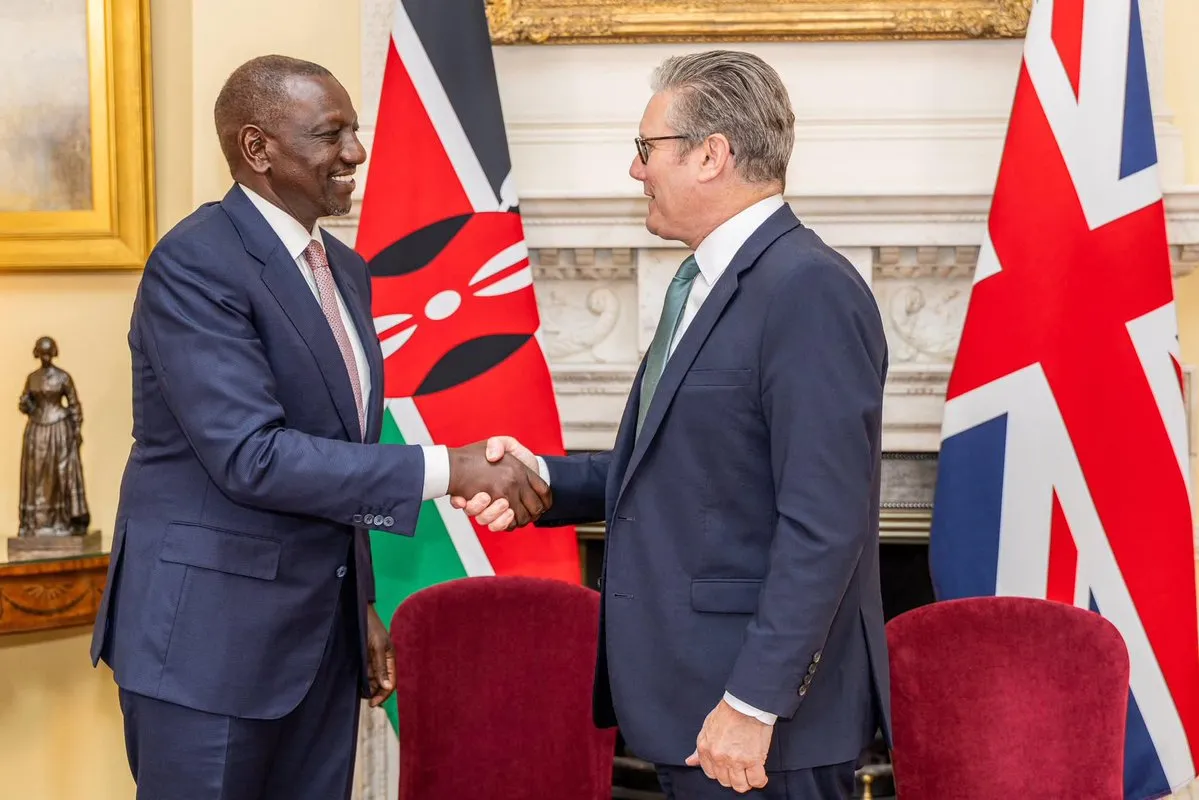

photo source: Google

By: Montel Kamau

Serrari Financial Analyst

8th April, 2025

Article, Financial and News Disclaimer

The Value of a Financial Advisor

While this article offers valuable insights, it is essential to recognize that personal finance can be highly complex and unique to each individual. A financial advisor provides professional expertise and personalized guidance to help you make well-informed decisions tailored to your specific circumstances and goals.

Beyond offering knowledge, a financial advisor serves as a trusted partner to help you stay disciplined, avoid common pitfalls, and remain focused on your long-term objectives. Their perspective and experience can complement your own efforts, enhancing your financial well-being and ensuring a more confident approach to managing your finances.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Readers are encouraged to consult a licensed financial advisor to obtain guidance specific to their financial situation.

Article and News Disclaimer

The information provided on www.serrarigroup.com is for general informational purposes only. While we strive to keep the information up to date and accurate, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability with respect to the website or the information, products, services, or related graphics contained on the website for any purpose. Any reliance you place on such information is therefore strictly at your own risk.

www.serrarigroup.com is not responsible for any errors or omissions, or for the results obtained from the use of this information. All information on the website is provided on an as-is basis, with no guarantee of completeness, accuracy, timeliness, or of the results obtained from the use of this information, and without warranty of any kind, express or implied, including but not limited to warranties of performance, merchantability, and fitness for a particular purpose.

In no event will www.serrarigroup.com be liable to you or anyone else for any decision made or action taken in reliance on the information provided on the website or for any consequential, special, or similar damages, even if advised of the possibility of such damages.

The articles, news, and information presented on www.serrarigroup.com reflect the opinions of the respective authors and contributors and do not necessarily represent the views of the website or its management. Any views or opinions expressed are solely those of the individual authors and do not represent the website's views or opinions as a whole.

The content on www.serrarigroup.com may include links to external websites, which are provided for convenience and informational purposes only. We have no control over the nature, content, and availability of those sites. The inclusion of any links does not necessarily imply a recommendation or endorsement of the views expressed within them.

Every effort is made to keep the website up and running smoothly. However, www.serrarigroup.com takes no responsibility for, and will not be liable for, the website being temporarily unavailable due to technical issues beyond our control.

Please note that laws, regulations, and information can change rapidly, and we advise you to conduct further research and seek professional advice when necessary.

By using www.serrarigroup.com, you agree to this disclaimer and its terms. If you do not agree with this disclaimer, please do not use the website.

www.serrarigroup.com, reserves the right to update, modify, or remove any part of this disclaimer without prior notice. It is your responsibility to review this disclaimer periodically for changes.

Serrari Group 2025