The United States House of Representatives has passed a bill that aims to limit Chinese involvement in electric vehicles (EVs) by tightening the criteria for EV tax credits. This legislation is designed to reduce the reliance on Chinese-manufactured components and materials in electric vehicle batteries and supply chains, which are critical to the growth of the US EV market. Passed narrowly with a 217 to 192 vote, the bill now awaits deliberation in the US Senate. If enacted, it could significantly impact the automotive industry, particularly the eligibility of vehicles for tax incentives that were introduced to encourage the adoption of electric vehicles.

Background and Purpose of the Bill

The proposed legislation seeks to further strengthen the provisions of the Inflation Reduction Act (IRA), passed in August 2022, which includes rules to diminish US dependence on China for EV battery supply chains. Under the IRA, EV tax credits are contingent on strict sourcing guidelines that require a percentage of key battery materials, such as lithium, cobalt, and nickel, to be sourced from the United States or its free-trade partners. However, these rules have met resistance from automakers, who argue that the transition away from Chinese supply chains is challenging and cannot be achieved overnight.

The bill, spearheaded by Representative Carol Miller, a Republican from West Virginia, proposes tightening the definition of a “Foreign Entity of Concern,” which applies to China and other nations. The bill’s purpose is to ensure that US tax credits for electric vehicles benefit American manufacturers and supply chains, and not those of foreign adversaries, primarily China. According to Miller, “Chinese companies can no longer benefit from electric vehicle tax credits meant for US manufacturers.”

Impact on Automakers and EV Market

The Alliance for Automotive Innovation (AAI), a trade group that represents major automakers including General Motors, Toyota, Hyundai, and Volkswagen, expressed concerns about the potential ramifications of the bill. The AAI warned that if the legislation becomes law, it would reduce the number of vehicles eligible for EV tax credits, which could have far-reaching consequences for automakers and the broader EV market.

Currently, out of the 113 EV and plug-in hybrid models available in the US market, only 22 models qualify for the EV tax credit, with just 13 models being eligible for the full $7,500 credit. These numbers reflect the stringent criteria already in place for battery sourcing and manufacturing under the IRA.

AAI’s CEO, John Bozzella, voiced concerns that automakers’ ambitious targets for reducing emissions and increasing EV adoption are closely linked to the availability of these tax credits. He emphasized that if the tax credits are severely restricted, automakers will have to revisit their emissions and EV goals, stating, “The automotive industrial base faces a serious economic and national security risk from China, the US becomes less competitive, and the rug is pulled out from consumers.”

EV Tax Credit: A Crucial Incentive

The federal EV tax credit is a critical component of the US government’s strategy to promote electric vehicles as part of its broader efforts to reduce carbon emissions and combat climate change. EVs are seen as essential to achieving the Biden administration’s ambitious goal of cutting US greenhouse gas emissions by 50% by 2030 and reaching net-zero emissions by 2050. To incentivize consumers to make the switch from gasoline-powered vehicles to electric ones, the government offers tax credits of up to $7,500 per vehicle.

However, to qualify for the full tax credit, electric vehicles must meet certain criteria related to battery production, vehicle assembly, and the sourcing of key materials. The IRA already restricts tax credits for vehicles with batteries containing materials from foreign entities of concern, a category that includes China. The new bill would further tighten these restrictions, making it even more difficult for automakers to source materials for their batteries while remaining eligible for the credits.

US-China Tensions Over EV Supply Chain

China dominates the global supply chain for EV batteries, producing 75% of all lithium-ion batteries and controlling large portions of the raw materials market, such as lithium, cobalt, and nickel, which are essential for EV battery production. This has created a significant dependency on Chinese suppliers for automakers worldwide, including those in the United States.

As the US government pushes to bring more of the EV supply chain within its borders or those of friendly nations, it faces several challenges. The mining and processing of critical minerals like lithium and cobalt are resource-intensive, and building a domestic supply chain could take years. Moreover, the US currently lacks the infrastructure to meet the surging demand for EV batteries.

In May 2024, the US Treasury Department provided some relief to automakers by offering them more flexibility on sourcing requirements for certain battery materials, including hard-to-trace minerals such as graphite, which is primarily sourced from China. Automakers were given until 2027 to phase out the use of these minerals. However, this leniency is seen by some lawmakers as undermining the goal of reducing reliance on Chinese materials.

Broader Implications

The debate over the EV tax credit bill reflects broader concerns about US-China economic competition and national security risks. China’s dominance in the EV battery supply chain has been identified by US policymakers as a key vulnerability, not only because of the economic leverage it gives China but also because of the potential for disruptions in the supply chain, which could hamper the US’s transition to clean energy.

For the US, reducing dependence on Chinese components in EVs is not just an economic issue, but a matter of national security. With EVs expected to become a major part of the automotive market in the coming decades, ensuring a stable and secure supply of battery materials is seen as critical to the US’s future economic competitiveness and energy security.

On the other hand, critics of the bill argue that the focus should be on building domestic capabilities and strengthening relationships with friendly nations, rather than punitive measures that could slow down the growth of the EV market. They point out that the EV industry is still in its early stages and needs time to mature before it can fully wean itself off Chinese supply chains.

Future Prospects

While the bill has passed in the House, it still needs to be taken up by the Senate, where it faces uncertain prospects. The US Senate is more divided on trade and environmental issues, and some lawmakers may be hesitant to back legislation that could hurt consumers by making electric vehicles more expensive.

If the bill does pass, it could represent a significant shift in US policy towards China and the electric vehicle industry. It would signal a further hardening of US-China trade relations, particularly in sectors like clean energy, where the two countries are increasingly seen as competitors.

The passage of the bill would also put more pressure on automakers to diversify their supply chains and invest in domestic production of critical battery materials. In the long run, this could lead to more innovation and investment in the US clean energy sector. However, in the short term, it could create challenges for automakers and slow the adoption of electric vehicles, which would be a setback for the Biden administration’s climate goals.

Conclusion

The US House of Representatives’ decision to pass a bill that tightens restrictions on Chinese components in electric vehicles is a significant development in the ongoing trade tensions between the US and China. The bill, if enacted, would have far-reaching implications for automakers, consumers, and the future of the electric vehicle industry in the US. While the aim is to strengthen national security and reduce reliance on Chinese supply chains, the bill could also slow down the transition to electric vehicles and hinder efforts to combat climate change. Automakers and policymakers will need to find a delicate balance between promoting domestic production and ensuring that the US remains a competitive player in the global EV market.

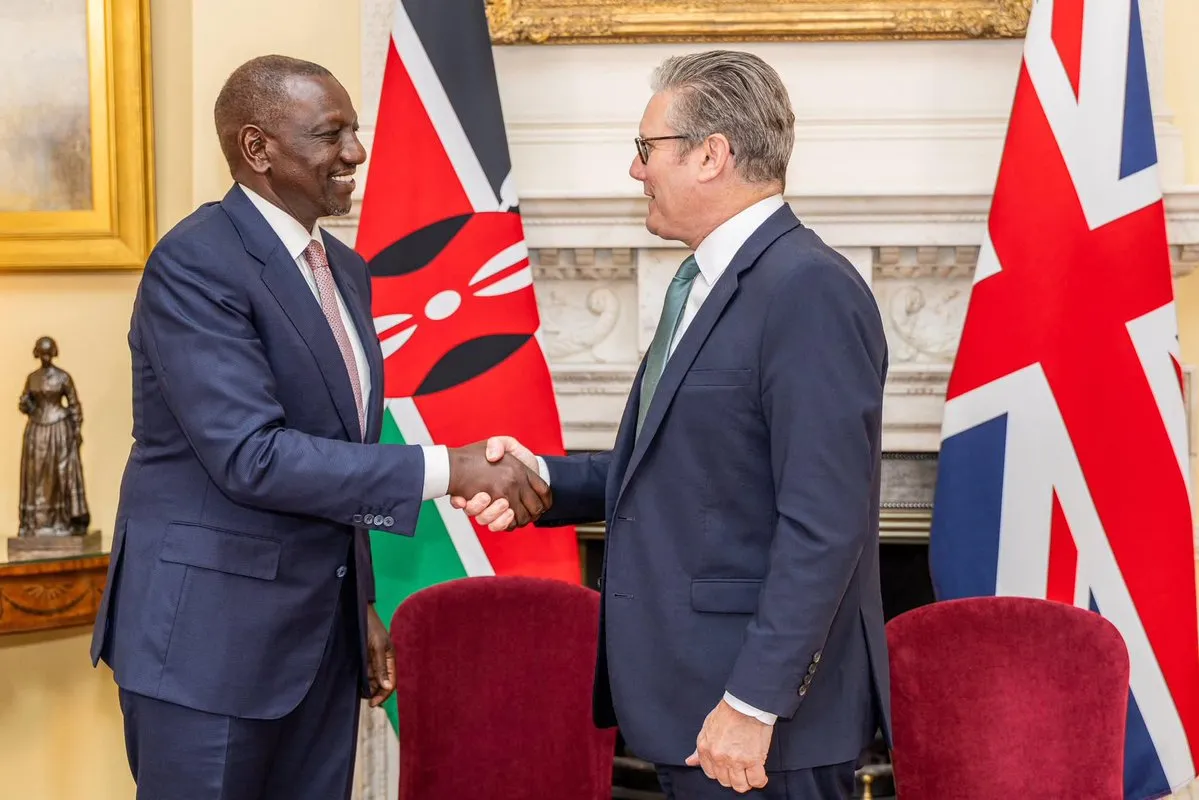

photo source: Google

By: Montel Kamau

Serrari Financial Analyst

13th August, 2024

Article, Financial and News Disclaimer

The Value of a Financial Advisor

While this article offers valuable insights, it is essential to recognize that personal finance can be highly complex and unique to each individual. A financial advisor provides professional expertise and personalized guidance to help you make well-informed decisions tailored to your specific circumstances and goals.

Beyond offering knowledge, a financial advisor serves as a trusted partner to help you stay disciplined, avoid common pitfalls, and remain focused on your long-term objectives. Their perspective and experience can complement your own efforts, enhancing your financial well-being and ensuring a more confident approach to managing your finances.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Readers are encouraged to consult a licensed financial advisor to obtain guidance specific to their financial situation.

Article and News Disclaimer

The information provided on www.serrarigroup.com is for general informational purposes only. While we strive to keep the information up to date and accurate, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability with respect to the website or the information, products, services, or related graphics contained on the website for any purpose. Any reliance you place on such information is therefore strictly at your own risk.

www.serrarigroup.com is not responsible for any errors or omissions, or for the results obtained from the use of this information. All information on the website is provided on an as-is basis, with no guarantee of completeness, accuracy, timeliness, or of the results obtained from the use of this information, and without warranty of any kind, express or implied, including but not limited to warranties of performance, merchantability, and fitness for a particular purpose.

In no event will www.serrarigroup.com be liable to you or anyone else for any decision made or action taken in reliance on the information provided on the website or for any consequential, special, or similar damages, even if advised of the possibility of such damages.

The articles, news, and information presented on www.serrarigroup.com reflect the opinions of the respective authors and contributors and do not necessarily represent the views of the website or its management. Any views or opinions expressed are solely those of the individual authors and do not represent the website's views or opinions as a whole.

The content on www.serrarigroup.com may include links to external websites, which are provided for convenience and informational purposes only. We have no control over the nature, content, and availability of those sites. The inclusion of any links does not necessarily imply a recommendation or endorsement of the views expressed within them.

Every effort is made to keep the website up and running smoothly. However, www.serrarigroup.com takes no responsibility for, and will not be liable for, the website being temporarily unavailable due to technical issues beyond our control.

Please note that laws, regulations, and information can change rapidly, and we advise you to conduct further research and seek professional advice when necessary.

By using www.serrarigroup.com, you agree to this disclaimer and its terms. If you do not agree with this disclaimer, please do not use the website.

www.serrarigroup.com, reserves the right to update, modify, or remove any part of this disclaimer without prior notice. It is your responsibility to review this disclaimer periodically for changes.

Serrari Group 2025