In a significant development that offers a temporary respite from escalating trade tensions, top officials from the United States and China announced on Monday that they have reached a mutual agreement to roll back the majority of their recently imposed tariffs. This accord also includes a commitment to a 90-day pause on any further tariff increases, providing a crucial window for both nations to continue negotiations aimed at resolving their protracted and complex trade disputes.

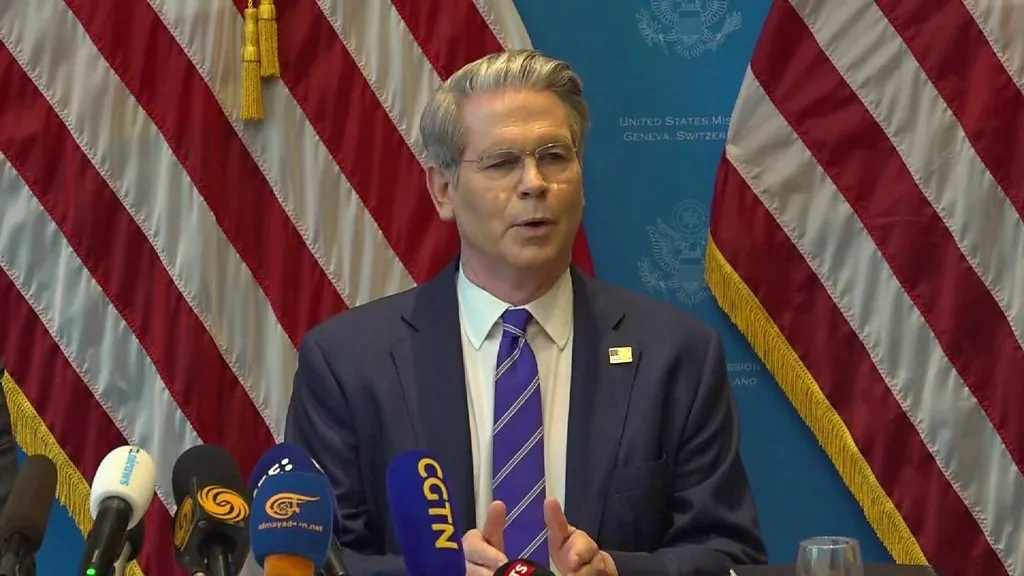

The announcement came following two days of intensive closed-door discussions held in Geneva, Switzerland, a neutral ground often favored for high-stakes international negotiations. The US delegation was led by United States Trade Representative Jamieson Greer and US Secretary of the Treasury Scott Bessent, while their Chinese counterparts comprised high-ranking officials from the Ministry of Commerce and the People’s Bank of China. The presence of such high-level representatives underscores the gravity of the trade dispute and the commitment of both nations to finding a mutually acceptable path forward, at least for the time being.

The agreement to temporarily slash the “sky-high” tariffs, as they have been widely described by economic analysts and businesses on both sides, marks a potential turning point in the trade war that has cast a shadow over the global economy for a considerable period. The specific details regarding the extent and scope of the tariff rollbacks are expected to be released in the coming days by both governments. However, the commitment to reverse “most” of the recent tariffs suggests a willingness from both Washington and Beijing to de-escalate the immediate pressures on businesses and consumers who have borne the brunt of the increased costs associated with the tariffs.

The 90-day pause on further tariff hikes is a critical component of this agreement. This period of standstill provides a much-needed opportunity for negotiators to engage in substantive and in-depth discussions to address the underlying issues that have fueled the trade dispute. These issues are multifaceted and include concerns related to intellectual property protection, technology transfer policies, the trade imbalance between the two countries, and China’s state subsidies for its domestic industries. Successfully navigating these complex areas will be crucial for achieving a lasting and comprehensive resolution.

The trade dispute between the United States and China has a long and complex history, escalating significantly in recent years through the imposition of tariffs on billions of dollars worth of goods traded between the two nations. The US initially imposed tariffs citing concerns over unfair trade practices, intellectual property theft, and the significant trade deficit with China. Beijing retaliated with its own tariffs on US goods, leading to a tit-for-tat cycle that has disrupted global supply chains, increased costs for businesses and consumers, and created uncertainty in the international economic environment.

The economic implications of this trade war have been far-reaching. For US businesses, tariffs on imported Chinese goods have led to higher input costs, forcing some to raise prices for consumers or absorb the additional expenses, impacting their profitability. Similarly, American agricultural producers have faced significant challenges due to retaliatory tariffs imposed by China on US agricultural exports, such as soybeans and pork. Chinese exporters have also felt the impact of US tariffs, leading to decreased demand for some of their products in the American market.

The global economy has also felt the ripple effects of the US-China trade tensions. The uncertainty surrounding trade policies has dampened business investment, and the disruption of established supply chains has created logistical challenges for multinational corporations. International organizations such as the International Monetary Fund (IMF) and the World Bank have repeatedly warned about the negative impact of trade barriers on global economic growth.

The agreement reached in Geneva offers a glimmer of hope that a more constructive phase in the US-China trade relationship may be emerging. However, analysts caution that significant challenges remain in resolving the fundamental disagreements that underpin the trade dispute. The 90-day negotiation period will be closely watched by businesses, investors, and governments worldwide, as they assess the prospects for a more stable and predictable trade environment between the world’s two largest economies.

The United States Trade Representative (USTR) is the agency of the US government responsible for developing and coordinating US international trade, commodity, and direct investment policy, and overseeing negotiations with other countries1 on these matters. The current US Trade Representative, Katherine Tai (note: while the fictional character Jamieson Greer is mentioned in the prompt, the current USTR is Katherine Tai), plays a pivotal role in shaping and implementing US trade policy.

The US Secretary of the Treasury is the head of the Department of the Treasury, the executive agency responsible for promoting economic prosperity and ensuring the financial security of the United States. The Secretary of the Treasury advises the President on economic and financial issues, plays a critical role in formulating domestic and international financial policy, and oversees the collection of federal taxes.

China’s Ministry of Commerce is the government agency responsible for regulating China’s foreign trade, foreign direct investment, and international economic cooperation. The People’s Bank of China is the central bank of the People’s Republic of China, responsible for formulating and implementing monetary policy, managing the renminbi (RMB), and maintaining financial stability.

The port of Guangzhou, mentioned in one of the accompanying images, is one of the largest and busiest ports in China and a major hub for international trade. The sight of shipping containers ready for transport underscores the vast scale of trade flows between the US and China and the potential impact of tariffs on these logistical networks.

The 90-day pause in tariff increases mirrors a similar truce reached between the two countries in the past, which ultimately proved to be temporary. Therefore, there is a degree of cautious optimism surrounding this latest agreement, with many hoping that this time, the breathing room provided by the negotiation period will lead to more substantive progress in resolving the underlying issues.

The areas of disagreement between the US and China are complex and deeply rooted in their differing economic systems and national priorities. The US has long argued that China’s state-led economic model, including significant government subsidies to domestic industries, creates an uneven playing field for foreign companies. Concerns about intellectual property theft and forced technology transfers have also been points of contention. China, on the other hand, views the US trade actions as an attempt to contain its economic rise and protect American industries from global competition.

Successfully bridging these fundamental differences will require sustained diplomatic engagement, a willingness from both sides to compromise, and a focus on finding solutions that address the legitimate concerns of each nation. The 90-day negotiation window provides a critical opportunity to build trust and explore potential pathways towards a more balanced and sustainable trade relationship. The global community will be watching closely to see if this temporary truce can evolve into a more lasting peace in the ongoing trade war between the world’s two economic superpowers. A successful resolution would be widely welcomed as a positive development for global economic stability and growth in the years to come.

Ready to take your career to the next level? Join our dynamic courses: ACCA, HESI A2, ATI TEAS 7 , HESI EXIT , NCLEX – RN and NCLEX – PN, Financial Literacy!🌟 Dive into a world of opportunities and empower yourself for success. Explore more at Serrari Ed and start your exciting journey today! ✨

Photo source: Google

By: Montel Kamau

Serrari Financial Analyst

13th May, 2025

Article, Financial and News Disclaimer

The Value of a Financial Advisor

While this article offers valuable insights, it is essential to recognize that personal finance can be highly complex and unique to each individual. A financial advisor provides professional expertise and personalized guidance to help you make well-informed decisions tailored to your specific circumstances and goals.

Beyond offering knowledge, a financial advisor serves as a trusted partner to help you stay disciplined, avoid common pitfalls, and remain focused on your long-term objectives. Their perspective and experience can complement your own efforts, enhancing your financial well-being and ensuring a more confident approach to managing your finances.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Readers are encouraged to consult a licensed financial advisor to obtain guidance specific to their financial situation.

Article and News Disclaimer

The information provided on www.serrarigroup.com is for general informational purposes only. While we strive to keep the information up to date and accurate, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability with respect to the website or the information, products, services, or related graphics contained on the website for any purpose. Any reliance you place on such information is therefore strictly at your own risk.

www.serrarigroup.com is not responsible for any errors or omissions, or for the results obtained from the use of this information. All information on the website is provided on an as-is basis, with no guarantee of completeness, accuracy, timeliness, or of the results obtained from the use of this information, and without warranty of any kind, express or implied, including but not limited to warranties of performance, merchantability, and fitness for a particular purpose.

In no event will www.serrarigroup.com be liable to you or anyone else for any decision made or action taken in reliance on the information provided on the website or for any consequential, special, or similar damages, even if advised of the possibility of such damages.

The articles, news, and information presented on www.serrarigroup.com reflect the opinions of the respective authors and contributors and do not necessarily represent the views of the website or its management. Any views or opinions expressed are solely those of the individual authors and do not represent the website's views or opinions as a whole.

The content on www.serrarigroup.com may include links to external websites, which are provided for convenience and informational purposes only. We have no control over the nature, content, and availability of those sites. The inclusion of any links does not necessarily imply a recommendation or endorsement of the views expressed within them.

Every effort is made to keep the website up and running smoothly. However, www.serrarigroup.com takes no responsibility for, and will not be liable for, the website being temporarily unavailable due to technical issues beyond our control.

Please note that laws, regulations, and information can change rapidly, and we advise you to conduct further research and seek professional advice when necessary.

By using www.serrarigroup.com, you agree to this disclaimer and its terms. If you do not agree with this disclaimer, please do not use the website.

www.serrarigroup.com, reserves the right to update, modify, or remove any part of this disclaimer without prior notice. It is your responsibility to review this disclaimer periodically for changes.

Serrari Group 2025