Amid mounting economic uncertainty and the lingering spectre of U.S. tariff threats, UK companies are increasingly shifting their focus to cashflow improvement, cost-cutting, and reduced borrowing, according to Deloitte’s latest quarterly survey of chief financial officers (CFOs) at major British firms. In a climate of cautious optimism about long-term prospects tempered by short-term defensive maneuvers, CFOs across Britain have revealed that, ahead of U.S. President Donald Trump’s tariff announcements on April 2, businesses are bracing for turbulence not seen since the early days of the COVID-19 pandemic and the height of geopolitical shockwaves following Russia’s full-scale invasion of Ukraine.

This strategic pivot marks the most defensive stance adopted by Britain’s largest companies since early 2020. In a survey conducted between March 18 and March 31, 2025, CFOs indicated that the intensity of cost-cutting measures had sharply increased. Approximately 63% of the respondents ranked cost-cutting as a top priority—a significant jump from 52% just three months earlier and now one of the highest levels on record. With hiring expected to decline by the largest margin since the third quarter of 2020 and wage growth projected to slow to 3% over the coming 12 months, the mood in boardrooms is one of cautious retrenchment.

A Cautious Outlook Amid Lingering Tariff Uncertainty

The current defensive measures come as UK companies confront renewed fears over U.S. tariff policies. Even though Trump’s tariff announcements originally date back to earlier trade disputes, there is widespread speculation about their potential scale and scope affecting global markets once again. “Given widespread speculation over the scale and scope of U.S. tariff rises during the survey period, it is unsurprising that CFOs reported elevated levels of uncertainty,” noted Amanda Tickel, head of tax and trade policy at Deloitte UK.

The tariff concerns have resonated with companies that are still recovering from the impacts of both the Russia-Ukraine conflict and the economic dislocations induced by the COVID-19 crisis. These past events not only reshaped global trade patterns but also taught companies harsh lessons about the need for financial resiliency in an increasingly volatile environment. For many British firms, the possibility of having to absorb additional costs imposed by U.S. tariffs has triggered a rapid reappraisal of existing capital expenditures, operational expenses, and debt management practices.

Defensive Strategies: A Shift from Growth to Stability

Deloitte’s survey of 67 CFOs from major British businesses—including 42 UK-listed companies that together account for 18% of Britain’s stock market capitalisation—revealed a profound shift from growth-oriented strategies toward defensive measures. While just 25% of CFOs had prioritized launching new products or entering fresh markets in the previous quarter, that figure has dropped to 20% during the current period of uncertainty. With profit margins expected to decline, largely due to rising operational costs, many firms are doubling down on strategies designed to improve cashflow and cut unnecessary spending.

Key defensive measures include:

- Cost-Cutting Initiatives: Companies are actively seeking to reduce expenses across the board. This includes renegotiating supplier contracts, delaying non-essential capital projects, and streamlining administrative overheads.

- Controlled Hiring Practices: In anticipation of a potential downturn, businesses are scaling back on recruitment. This slowdown in hiring is expected to impact overall wage growth, with projections suggesting that wage increases could be constrained to about 3% over the next year.

- Focused Debt Management: With borrowing costs under strain from recent increases in interest rates, UK businesses are prioritising the reduction of outstanding debt and improving liquidity. Enhanced focus on cashflow management is seen as essential to navigating the upcoming economic headwinds.

- Preservation of Capital: In a landscape where uncertainties abound, maintaining a strong balance sheet is paramount. Companies are redirecting resources to safeguard against unexpected shocks, ensuring that adequate capital reserves are available if market conditions deteriorate further.

The Broader Economic Context and Its Implications

The defensive stances adopted by UK companies come at a time when the nation’s economic outlook appears increasingly muted. Last month, government budget forecasters cut their economic growth projection for 2025 to just 1%, a stark revision from earlier expectations that had hoped for a boost from increased public spending following a lacklustre 2024. The anticipated economic slowdown, compounded by the rising cost of payroll taxes and a near 7% hike in the minimum wage, suggests that UK profit margins could face further erosion in the coming year.

Rising Costs and Shrinking Margins

Several factors are contributing to the challenging economic environment:

- Payroll and Minimum Wage Increases: With a significant rise in payroll taxes and the near-7% increase in the minimum wage, companies are faced with higher ongoing costs. This, in turn, squeezes profit margins—especially in industries where labor represents a significant portion of total expenses.

- Inflationary Pressures: While some inflationary pressures have begun to subside after the post-pandemic recovery, they continue to present challenges in cost management. The effect of lingering inflation is forcing businesses to re-evaluate pricing strategies, procurement processes, and overall operational efficiency.

- Global Economic Uncertainty: The ripple effects of geopolitical conflicts, trade disputes, and fluctuating commodity prices continue to impact business confidence. In this climate, even companies with strong fundamentals are forced to adopt conservative financial practices to protect against unforeseen market downturns.

- Regulatory and Fiscal Policies: Government policies, such as changes in tax regulations and public spending measures, further complicate the economic landscape. The recent revisions in economic forecasts have prompted businesses to adopt a wait-and-see approach, halting expansion plans until a clearer picture of fiscal policy emerges.

Historical Echoes: Lessons from 2020 and Beyond

The defensive measures observed in the current survey echo the behavior of UK firms during previous periods of economic distress. In 2020, amid the initial wave of COVID-19 disruptions, businesses across various sectors drastically reduced hiring, scaled back on capital expenditures, and focused intensely on improving cashflow. These measures were critical in helping many companies weather the worst of the pandemic-induced economic storm.

Today, while the nature of the threat has shifted—from public health crises and geopolitical conflicts to trade-related challenges and regulatory uncertainties—the underlying principle remains unchanged: preserving financial flexibility in times of crisis is paramount. By learning from past experiences, many UK companies are now preemptively implementing cost-cutting measures to buffer against potential shocks related to tariff escalations and an unpredictable global economic environment.

Sector-Specific Impacts: Not All Industries Are Equal

While the survey reflects a broad defensive trend across major UK firms, the impact of these measures is likely to vary considerably across different sectors. Industries that are heavily dependent on international trade, such as manufacturing and export-oriented services, are expected to feel the brunt of any additional tariff burdens. These sectors, which rely on the smooth flow of goods and services across borders, may need to contend with increased input costs and disrupted supply chains.

Conversely, sectors less reliant on global trade—such as domestic retail and certain financial services—may be able to absorb the shocks more comfortably. However, even these industries are not immune to the broader cost pressures and the potential slowdown in consumer spending that can accompany economic uncertainty.

For example, UK manufacturers have already begun to adjust their production schedules and procurement strategies in anticipation of possible tariff-related cost increases. Some are exploring alternative sourcing options from non-U.S. markets, while others are investing in automation and lean manufacturing techniques to reduce labor costs and boost operational efficiency. In contrast, the financial services sector is focusing on enhancing digital capabilities and streamlining operations to maintain profitability in a high-interest-rate environment.

Managing Cashflow in a Turbulent Economy

In a business environment where external shocks can quickly upset even the most carefully balanced financial plans, maintaining healthy cashflow has never been more critical. Companies are increasingly turning their attention to short-term liquidity management as a primary objective, even if it means delaying some long-term growth initiatives.

The rationale is straightforward: in times of uncertainty, having ready cash reserves allows businesses to navigate unforeseen disruptions, meet debt obligations, and seize opportunities that may arise even in a downturn. CFOs are thus placing an emphasis on strategies that improve working capital, such as optimizing inventory levels, accelerating receivables collection, and renegotiating payment terms with suppliers.

Moreover, enhanced cashflow management is not solely about survival; it is also about positioning companies to act quickly when the economic outlook eventually improves. Many UK companies are confident that once the external pressures subside, those with strong cash positions will be well-placed to invest in new growth opportunities, whether through organic expansion, mergers, or strategic acquisitions.

The Role of Government and Policy Response

Amid these defensive strategies, the UK government is also under pressure to provide a supportive policy framework that can help stabilize the business environment. Recent budgetary announcements and economic forecasts indicate that policymakers are aware of the challenges facing UK companies. Yet, the reduction in the economic growth projection to 1% for 2025 sends a clear signal that the road ahead will be challenging.

In response, industry experts and business leaders are calling on the government to implement targeted measures that address both immediate cost pressures and long-term structural weaknesses. Suggestions include:

- Tax Relief and Incentives: Providing temporary tax breaks or deferral schemes to alleviate the burden of rising payroll taxes could help companies preserve cashflow during this period of uncertainty.

- Support for Innovation and Technology: Investing in technology and innovation—such as automation, digital transformation, and advanced manufacturing techniques—can help companies reduce costs in the long term while maintaining competitiveness.

- Trade Negotiations: Proactive diplomatic engagement aimed at clarifying and, where possible, mitigating the impact of U.S. tariffs could also restore some confidence among businesses. Given the historical volatility associated with tariff disputes, a clear and stable trade policy would be welcomed by companies facing supply chain uncertainties.

- Infrastructure Investments: Strategic investments in infrastructure, particularly in areas that support key sectors like manufacturing and exports, could help reduce operational bottlenecks and boost overall productivity.

Voices from the Boardroom: Insights from CFOs

Many CFOs interviewed by Deloitte provided candid insights into their organizations’ decision-making processes in these uncertain times. One CFO, who preferred to remain anonymous, stated, “The environment remains unpredictable, and while our long-term outlook is cautiously optimistic, in the short term, preserving cash and reducing exposure to unforeseen costs is our top priority.” Another executive highlighted the importance of agility: “We are adapting our business models on the fly, reassessing every line of expenditure. While growth is important, right now, maintaining stability is paramount.”

These sentiments underscore a broader trend among UK companies—a collective willingness to trade off immediate expansion for longer-term resilience. In boardrooms across Britain, the message is clear: prudence and preparedness will be the defining traits of successful companies in an era marked by shifting trade policies and economic headwinds.

Looking Ahead: Balancing Resilience with Opportunity

Despite the defensive measures currently being implemented, there remains an undercurrent of optimism among some UK business leaders. The prevailing view is that this period of retrenchment is temporary, and that companies that emerge financially stronger from the current challenges will be well-positioned to capitalize on future growth opportunities.

Many firms are already investing in initiatives designed to build long-term resilience. These include diversifying supply chains to reduce reliance on any single market, investing in automation to offset rising labor costs, and exploring innovative financing mechanisms to bolster liquidity. The strategic focus is not simply on cost-cutting, but on building a more agile, adaptable business model that can thrive in both downturns and recoveries.

Moreover, the current period of caution is seen as a prelude to a broader transformation in corporate strategy. In a post-pandemic global economy—further complicated by geopolitical tensions and unexpected regulatory shifts—the winners will be those companies that can balance defensive cost management with a readiness to invest when the economic outlook improves.

Recent analyses by financial institutions suggest that the companies most affected by rising tariffs and regulatory pressures could, in time, turn these challenges into competitive advantages by driving internal efficiencies and spurring innovation. With robust cash reserves and disciplined cost control, these firms may well find themselves in a strong position to reinvigorate growth once external conditions stabilize.

Strategic Implications for the UK Economy

The defensive stance adopted by large UK companies is not merely a reflection of individual corporate prudence; it has broader implications for the UK economy as a whole. The cumulative effect of cost-cutting, reduced hiring, and restrained wage growth could lead to a moderation in domestic consumer spending—a crucial driver of economic activity. At the same time, lower profit margins across major sectors may impact investor sentiment and dampen overall market confidence.

Yet, there is also reason to believe that these measures, while seemingly contractionary in the short term, may lay the groundwork for a more sustainable economic recovery in the future. If businesses can successfully navigate the current period of uncertainty, the long-term benefits could include a leaner, more competitive corporate sector. Historically, periods of economic retrenchment have often been followed by phases of rapid innovation and growth, as companies emerge with enhanced operational efficiencies and stronger financial foundations.

Conclusion: A Moment of Strategic Reassessment

As the UK navigates a period marked by tariff fears, rising costs, and a cautious economic forecast, the defensive strategies adopted by its leading companies reveal a broader truth about the current global economic environment: resilience has become the watchword of corporate leadership. With cost-cutting, improved cashflow management, and restrained hiring at the forefront of their agendas, UK companies are poised to weather the storm of uncertainty.

The Deloitte survey paints a picture of a corporate landscape undergoing rapid transformation—from one driven by aggressive growth ambitions to a more measured, survival-focused approach. While profit margins may contract and expansion plans take a temporary backseat, these steps are seen as essential investments in long-term stability. As CFOs weigh the immediate pressures of rising payroll taxes, increased minimum wages, and unpredictable trade policies, they remain resolute in their belief that a focus on financial discipline today will yield dividends in the future.

In boardrooms across Britain, the collective decision to prioritize resilience over rapid growth reflects both a response to current challenges and a strategic bet on the future. The ability to adapt quickly, manage risks prudently, and preserve capital in an unpredictable environment will be the defining features of successful companies in the years to come.

Despite the pressing challenges, there is cautious optimism that, once uncertainties subside, a new wave of growth and innovation will follow. UK companies that emerge from this period with stronger cash reserves and leaner operations may well be the ones that drive the next phase of economic recovery, turning today’s defensive strategies into tomorrow’s competitive advantages.

In these turbulent times, the message is clear: while the uncertainty brought about by looming tariff threats and economic headwinds is significant, so too is the resolve of UK businesses to navigate these challenges head-on. The coming months will undoubtedly test the mettle of the nation’s corporate leaders, but those who invest wisely in defensive measures today are likely to be the ones who capture the opportunities of a future rebalanced global economy.

Ultimately, the current period of retrenchment and strategic reassessment offers a valuable opportunity for UK companies to build a more resilient and dynamic business model—one that is capable of withstanding external shocks while remaining agile enough to seize emerging opportunities. As businesses across Britain recalibrate their strategies and tighten their belts, the hope is that these efforts will not only safeguard their short-term interests but also pave the way for a more robust economic recovery in the years ahead.

In summary, while UK companies are rightly bracing for potential turbulence amid tariff uncertainties and economic pressures, their focused shift toward cashflow improvement and cost control signals a strategic evolution that could ultimately strengthen the nation’s competitive edge. The journey ahead remains fraught with challenges, but the determined, measured responses in the face of adversity offer a promising glimpse of a resilient future for the UK corporate sector.

Ready to take your career to the next level? Join our dynamic courses: ACCA, HESI A2, ATI TEAS 7 , HESI EXIT , NCLEX – RN and NCLEX – PN, Financial Literacy!🌟 Dive into a world of opportunities and empower yourself for success. Explore more at Serrari Ed and start your exciting journey today! ✨

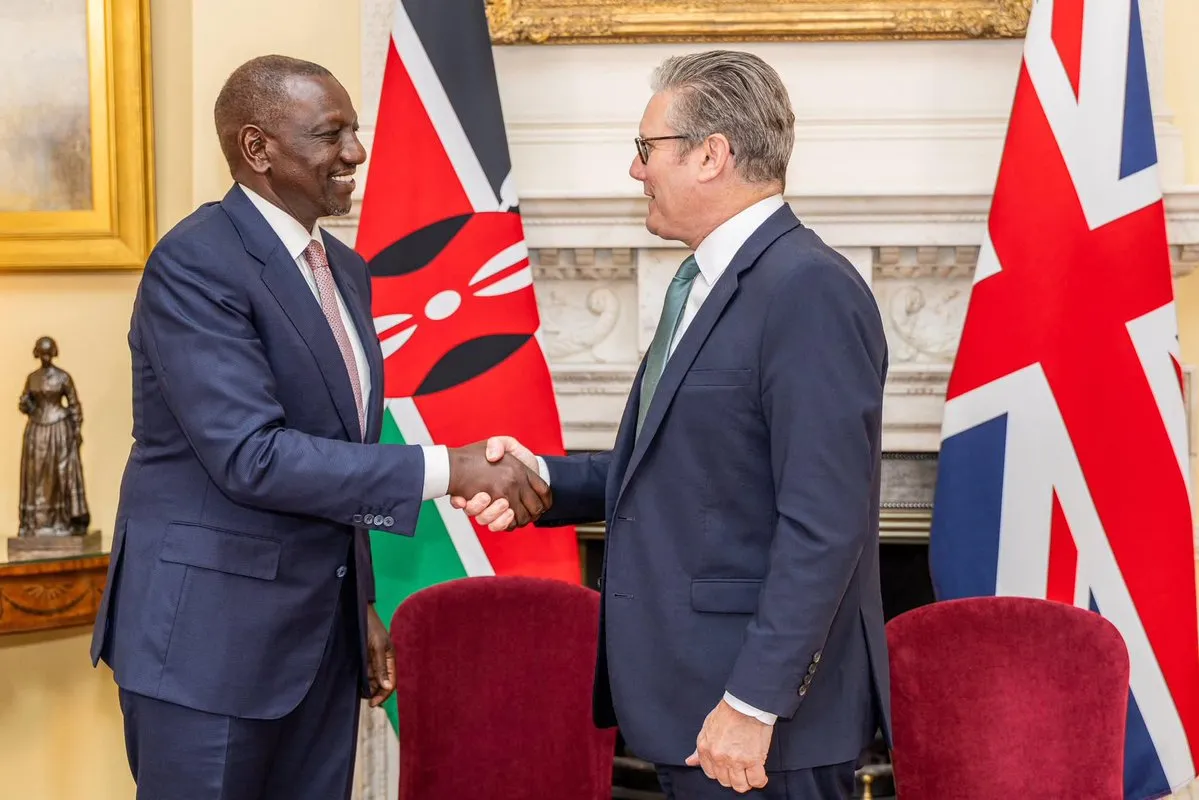

photo source: Google

By: Montel Kamau

Serrari Financial Analyst

14th April, 2025

Article, Financial and News Disclaimer

The Value of a Financial Advisor

While this article offers valuable insights, it is essential to recognize that personal finance can be highly complex and unique to each individual. A financial advisor provides professional expertise and personalized guidance to help you make well-informed decisions tailored to your specific circumstances and goals.

Beyond offering knowledge, a financial advisor serves as a trusted partner to help you stay disciplined, avoid common pitfalls, and remain focused on your long-term objectives. Their perspective and experience can complement your own efforts, enhancing your financial well-being and ensuring a more confident approach to managing your finances.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Readers are encouraged to consult a licensed financial advisor to obtain guidance specific to their financial situation.

Article and News Disclaimer

The information provided on www.serrarigroup.com is for general informational purposes only. While we strive to keep the information up to date and accurate, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability with respect to the website or the information, products, services, or related graphics contained on the website for any purpose. Any reliance you place on such information is therefore strictly at your own risk.

www.serrarigroup.com is not responsible for any errors or omissions, or for the results obtained from the use of this information. All information on the website is provided on an as-is basis, with no guarantee of completeness, accuracy, timeliness, or of the results obtained from the use of this information, and without warranty of any kind, express or implied, including but not limited to warranties of performance, merchantability, and fitness for a particular purpose.

In no event will www.serrarigroup.com be liable to you or anyone else for any decision made or action taken in reliance on the information provided on the website or for any consequential, special, or similar damages, even if advised of the possibility of such damages.

The articles, news, and information presented on www.serrarigroup.com reflect the opinions of the respective authors and contributors and do not necessarily represent the views of the website or its management. Any views or opinions expressed are solely those of the individual authors and do not represent the website's views or opinions as a whole.

The content on www.serrarigroup.com may include links to external websites, which are provided for convenience and informational purposes only. We have no control over the nature, content, and availability of those sites. The inclusion of any links does not necessarily imply a recommendation or endorsement of the views expressed within them.

Every effort is made to keep the website up and running smoothly. However, www.serrarigroup.com takes no responsibility for, and will not be liable for, the website being temporarily unavailable due to technical issues beyond our control.

Please note that laws, regulations, and information can change rapidly, and we advise you to conduct further research and seek professional advice when necessary.

By using www.serrarigroup.com, you agree to this disclaimer and its terms. If you do not agree with this disclaimer, please do not use the website.

www.serrarigroup.com, reserves the right to update, modify, or remove any part of this disclaimer without prior notice. It is your responsibility to review this disclaimer periodically for changes.

Serrari Group 2025