President Donald Trump has enacted one of the most dramatic overhauls of American immigration policy in decades, signing two executive orders on Friday that fundamentally transform how the United States approaches both skilled worker visas and high-net-worth immigration. The sweeping changes impose a $100,000 application fee on H-1B visas while simultaneously launching the “Trump Gold Card” program, creating a premium immigration pathway for individuals willing to pay $1 million or corporations willing to invest $2 million per sponsored worker.

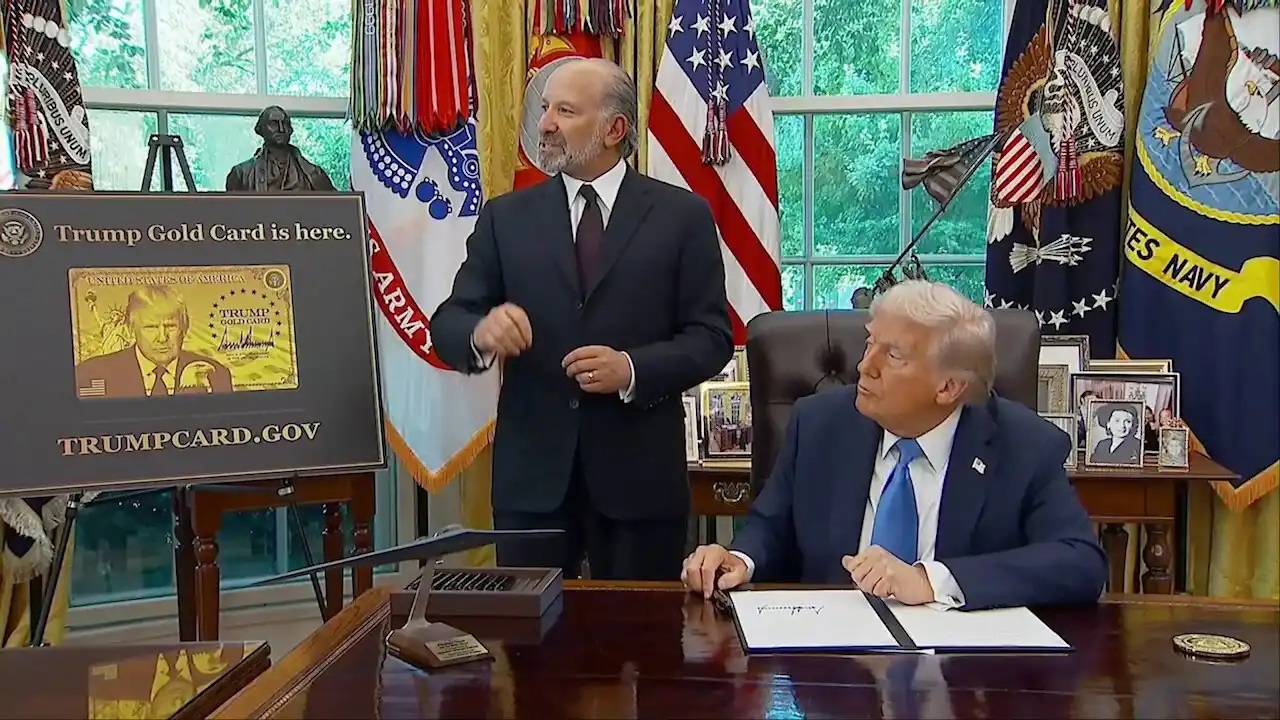

The dual measures, announced from the Oval Office with Commerce Secretary Howard Lutnick present, represent the administration’s most significant immigration policy shift since taking office and are expected to generate billions in revenue while fundamentally altering America’s approach to legal immigration.

One decision can change your entire career. Take that step with our Online courses in ACCA, HESI A2, ATI TEAS 7, HESI EXIT, NCLEX-RN, NCLEX-PN, and Financial Literacy. Join Serrari Ed and start building your brighter future today.

Dramatic H-1B Fee Increase Targets Tech Industry Usage

The most immediate impact comes from the presidential proclamation requiring a $100,000 payment to accompany H-1B visa petitions, effective September 21, 2025, at 12:01 AM EDT. This represents a staggering increase from the current base filing fee of approximately $1,500, making it potentially the most expensive work visa program globally.

“We need great workers, and this pretty much ensures that that’s what’s going to happen,” Trump stated from the Oval Office, emphasizing that the measure would incentivize companies to prioritize American workers while maintaining pathways for hiring highly skilled foreign talent in specialized fields.

The H-1B program, which has been controversial since its inception, allows U.S. companies to temporarily hire foreign workers in specialty occupations requiring specialized knowledge and typically a bachelor’s degree or higher. According to Pew Research, nearly 400,000 H-1B applications were approved in fiscal year 2024, with the majority being renewal applications for workers already in the United States.

The technology sector, which has historically been the largest user of H-1B visas, will face the most significant impact. Computer-related jobs have represented approximately 65% of H-1B workers in recent years, with these workers reporting a median annual salary of $123,600 in 2023. Major technology companies have been among the program’s heaviest users, with Amazon receiving more than 10,000 H-1B approvals in 2025, followed by other tech giants like Microsoft, Google, and Meta.

Administrative Justification Centers on Wage Protection

The administration’s justification for the fee increase draws heavily on concerns about wage depression and job displacement for American workers. According to the White House fact sheet, recent data shows troubling employment trends among recent college graduates, with computer science and computer engineering majors facing unemployment rates of 6.1% and 7.5% respectively – more than double the rates for biology and art history graduates.

The proclamation cites specific examples of companies simultaneously laying off American workers while hiring H-1B employees: “One software company was approved for over 5,000 H-1B workers in FY 2025; around the same time, it announced a series of layoffs totaling more than 15,000 employees.” Another company reportedly “eliminated 1,000 jobs in February” while being “approved for over 1,100 H-1B workers for FY 2025.”

Commerce Secretary Howard Lutnick explained that the administration arrived at the $100,000 figure after consulting with companies, noting that the payment structure remains under discussion with the Department of Homeland Security regarding “whether we’re going to charge the $300,000 up front or $100,000 a year for the three years.” However, Press Secretary Karoline Leavitt later clarified that the fee is one-time, not annual, and applies only to new H-1B visas, not renewals.

Industry Response and Economic Implications

The dramatic fee increase has created immediate uncertainty across industries that rely heavily on H-1B workers. According to the Economic Policy Institute, the top 30 H-1B employers hired more than 34,000 new H-1B workers in 2022, accounting for 40% of the total annual cap of 85,000 visas.

The policy particularly targets outsourcing firms, which have been criticized for years by lawmakers from both parties. Thirteen of the top 30 H-1B employers in 2022 were outsourcing firms, receiving 21% of the total annual cap. These companies have been associated with paying H-1B workers the lowest wages permitted by law, often significantly below what comparable American workers earn.

The timing of the fee increase coincides with widespread layoffs in the technology sector. According to EPI analysis, the same top 30 companies that hired 34,000 new H-1B workers in 2022 also laid off at least 85,000 workers in 2022 and early 2023, highlighting what critics see as the program’s disconnect from genuine labor shortages.

Revolutionary “Gold Card” Program Creates Premium Immigration Pathway

Simultaneously, Trump launched the “Trump Gold Card” program, described by the administration as a revolutionary approach to attracting high-value immigrants. The program offers expedited immigrant visas for individuals making unrestricted gifts of $1 million to the Department of Commerce, or $2 million if sponsored by a corporation.

“This program will raise more than $100 billion, which we’ll use for cutting taxes and paying down debt,” Trump announced, adding that wealthy immigrants “are going to spend a lot of money to come in.” The president expressed ambitious revenue projections, suggesting the program could potentially generate trillions in revenue if widely adopted.

The Gold Card represents a fundamental shift in American immigration philosophy, creating an explicit pay-to-immigrate pathway that bypasses traditional qualification criteria. Unlike the existing EB-5 investor visa program, which requires investments of $800,000 to $1.05 million in job-creating enterprises, the Gold Card requires only an unrestricted gift to the federal government.

Commerce Secretary Lutnick criticized the current immigration system for accepting what he characterized as the “bottom quartile” of workers, stating: “We’re going to only take extraordinary people at the very top.” The Gold Card program positions payment capacity as evidence of “exceptional business ability and national benefit.”

Legal and Constitutional Questions

The Gold Card program raises significant legal and constitutional questions about executive authority over immigration and tax policy. According to Wikipedia, there are “constitutional questions about the executive authority for this kind of change to immigration and tax law without express approval from the US Congress.”

Immigration attorneys have noted that while the executive branch has broad authority over immigration enforcement, creating entirely new visa categories with novel fee structures may require congressional approval. The administration maintains the program is “totally legal” since it offers permanent residency rather than direct citizenship pathways.

The program also faces scrutiny regarding its interaction with existing immigration law. The executive order directs that Gold Card gifts serve as evidence of eligibility under existing statutory categories (8 U.S.C. 1153), attempting to work within current immigration frameworks rather than creating entirely new legal structures.

Implementation Timeline and Practical Challenges

The H-1B fee increase took effect immediately on September 21, 2025, creating urgent situations for visa holders currently outside the United States. Immigration attorneys are advising existing H-1B holders to “proceed with caution and avoid travel if possible until the government releases further official guidance.”

The USCIS implementation guidance clarifies that the proclamation does not apply to petitions filed before September 21, 2025, currently approved petitions, or individuals holding valid H-1B visas. However, uncertainty remains about how the fee applies to extensions, renewals, and travel for current visa holders.

For the Gold Card program, implementation details remain sparse. The executive order directs the Secretaries of Commerce, State, and Homeland Security to establish application processes within 90 days, but critical questions about processing times, background checks, and integration with existing immigration quotas remain unresolved.

Build the future you deserve. Get started with our top-tier Online courses: ACCA, HESI A2, ATI TEAS 7, HESI EXIT, NCLEX-RN, NCLEX-PN, and Financial Literacy. Let Serrari Ed guide your path to success. Enroll today.

Global Context and International Programs

The Trump Gold Card joins a controversial category of “golden visa” or citizenship-by-investment programs that have faced increasing scrutiny globally. According to NPR, similar programs in Malta, Greece, Portugal, and New Zealand have encountered significant challenges, with many recently terminated due to concerns about national security, money laundering, and housing market distortions.

Malta’s “Golden Visa” program was deemed in violation of EU law and ordered shut down in April 2025, while Spain terminated its program after being blamed for driving up housing prices. The UK ended its investor visa program in 2022 amid national security concerns, and similar issues led to program closures in Cyprus, Ireland, and Bulgaria.

Immigration policy expert Kate Hooper of the Migration Policy Institute warns: “We’ve seen that these programs attract unsavory characters,” highlighting the persistent challenges of vetting wealthy applicants and preventing money laundering through investment migration programs.

Economic Projections and Revenue Generation

The Trump administration has made ambitious claims about the revenue potential of both programs. With 85,000 new H-1B visas issued annually, the $100,000 fee could theoretically generate $8.5 billion per year, though actual collections will likely be lower due to reduced applications and increased use of cap-exempt employers.

The Gold Card program’s revenue potential depends heavily on uptake rates. Trump suggested the possibility of selling “a million of these cards,” which would generate $1 trillion, though immigration experts consider such figures wildly unrealistic. According to NPR, most attorneys expect sales in the low thousands rather than hundreds of thousands or millions.

Immigration lawyer Darren Silver reports that initial client interest in Gold Cards “wanes as soon as he explains this program is not like the existing EB-5 visa program,” which offers potential investment returns. The Gold Card’s structure as an unrestricted gift rather than a job-creating investment fundamentally changes its appeal to wealthy individuals.

Impact on Tech Industry and Innovation

The H-1B fee increase poses particular challenges for the technology sector, which has long argued that the program is essential for maintaining competitiveness in global markets. Tech companies frequently claim they cannot find sufficient qualified American workers for specialized roles, particularly in emerging technologies like artificial intelligence, cybersecurity, and advanced computing.

However, the Federal Reserve Bank of New York study cited in the administration’s justification shows computer science and engineering graduates facing higher unemployment rates than many other fields, challenging industry claims of worker shortages.

The policy’s impact may vary significantly across different types of employers. Large technology companies with substantial profit margins may absorb the additional costs more easily than smaller firms or startups. This could potentially concentrate H-1B usage among the largest corporations while reducing access for smaller companies that previously relied on the program.

Enforcement and Monitoring Mechanisms

The new policies include enhanced enforcement provisions designed to prevent abuse and ensure compliance. The H-1B proclamation requires employers to retain documentation of fee payment, with the Department of State verifying payments during the petition process. Both State and Homeland Security departments are authorized to deny entry for non-payment.

The Gold Card program includes similar documentation requirements, with the Commerce Department responsible for processing gifts and ensuring they comply with legal restrictions. The program also includes provisions for corporate sponsors to transfer sponsorship between employees, providing some flexibility for business users.

Both programs include national security exemptions, allowing case-by-case exceptions “if in the national interest.” This language provides the administration with discretionary authority to waive requirements for strategically important cases while maintaining the general fee structure.

Opposition and Political Responses

The immigration overhaul has generated significant opposition from various quarters. Democratic lawmakers argue the policies create discriminatory two-tiered immigration system that prioritizes wealth over merit or humanitarian considerations. Some Republicans, particularly those representing technology-heavy districts, have also expressed concerns about the impact on American competitiveness.

The H-1B changes have complicated Trump’s relationship with tech industry leaders like Elon Musk, who previously defended the program during internal Republican debates. Musk and other tech leaders argued that H-1B visas are essential for maintaining American technological leadership, particularly in competition with China and other rivals.

Labor unions and worker advocacy groups have generally supported restrictions on H-1B usage, arguing the program has been systematically abused to undercut American workers’ wages and employment opportunities. The dramatic fee increase aligns with long-standing union positions calling for higher costs and stronger labor protections in temporary worker programs.

Future Prospects and Potential Modifications

The long-term sustainability of both programs remains uncertain, particularly given their reliance on executive authority rather than congressional approval. Future administrations could potentially modify or eliminate both the H-1B fees and Gold Card program through new executive orders, creating uncertainty for both employers and prospective immigrants.

The administration has also hinted at additional premium immigration programs, including a “Platinum Card” costing $5 million that would allow foreigners to spend up to 270 days annually in the United States without being subject to U.S. taxes on non-U.S. income. However, this program would require congressional approval due to its tax implications.

Industry observers expect both programs to face legal challenges, particularly regarding the constitutional authority for implementing such dramatic changes without legislative approval. Immigration law experts note that while the executive branch has broad enforcement discretion, creating new fee structures and visa categories may exceed presidential authority.

International Implications and Diplomatic Considerations

The new policies could significantly impact America’s relationships with key allies and trading partners. Countries like India, which supplies the largest number of H-1B workers (72% of all approvals in 2023), may view the fee increase as discriminatory against their nationals.

The Gold Card program’s explicit wealth-based criteria may also strain diplomatic relationships, as it creates preferential treatment based on financial capacity rather than traditional diplomatic or strategic considerations. Some allies may view this as inconsistent with American values of meritocracy and equal opportunity.

Trade relationships could also be affected, particularly with countries that have significant technology sectors relying on American market access through temporary worker programs. The policy changes occur as the administration pursues broader trade renegotiations and could become part of larger diplomatic discussions.

Looking Forward: Immigration Policy Transformation

The September 2025 immigration overhaul represents perhaps the most significant transformation of American immigration policy since the 1965 Immigration Act. By simultaneously restricting traditional skilled worker pathways while creating premium alternatives, the administration is fundamentally redefining how America approaches legal immigration.

The success or failure of these programs will likely influence American immigration policy for years to come. If the initiatives generate substantial revenue while maintaining economic competitiveness, they could become permanent features of the immigration system. Conversely, if they create significant economic disruption or fail to meet revenue projections, they may serve as cautionary examples for future policy makers.

The ultimate test will be whether this dual approach – restricting access through higher costs while creating premium alternatives – can balance the competing demands of economic competitiveness, worker protection, and fiscal responsibility that have long characterized American immigration debates. As implementation proceeds, the real-world impacts on American workers, employers, and prospective immigrants will determine whether this represents successful policy innovation or a costly experiment in immigration monetization.

Ready to take your career to the next level? Join our Online courses: ACCA, HESI A2, ATI TEAS 7 , HESI EXIT , NCLEX – RN and NCLEX – PN, Financial Literacy!🌟 Dive into a world of opportunities and empower yourself for success. Explore more at Serrari Ed and start your exciting journey today! ✨

Track GDP, Inflation and Central Bank rates for top African markets with Serrari’s comparator tool.

See today’s Treasury bonds and Money market funds movement across financial service providers in Kenya, using Serrari’s comparator tools.

Photo source: Google

By: Montel Kamau

Serrari Financial Analyst

22nd September, 2025

Article, Financial and News Disclaimer

The Value of a Financial Advisor

While this article offers valuable insights, it is essential to recognize that personal finance can be highly complex and unique to each individual. A financial advisor provides professional expertise and personalized guidance to help you make well-informed decisions tailored to your specific circumstances and goals.

Beyond offering knowledge, a financial advisor serves as a trusted partner to help you stay disciplined, avoid common pitfalls, and remain focused on your long-term objectives. Their perspective and experience can complement your own efforts, enhancing your financial well-being and ensuring a more confident approach to managing your finances.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Readers are encouraged to consult a licensed financial advisor to obtain guidance specific to their financial situation.

Article and News Disclaimer

The information provided on www.serrarigroup.com is for general informational purposes only. While we strive to keep the information up to date and accurate, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability with respect to the website or the information, products, services, or related graphics contained on the website for any purpose. Any reliance you place on such information is therefore strictly at your own risk.

www.serrarigroup.com is not responsible for any errors or omissions, or for the results obtained from the use of this information. All information on the website is provided on an as-is basis, with no guarantee of completeness, accuracy, timeliness, or of the results obtained from the use of this information, and without warranty of any kind, express or implied, including but not limited to warranties of performance, merchantability, and fitness for a particular purpose.

In no event will www.serrarigroup.com be liable to you or anyone else for any decision made or action taken in reliance on the information provided on the website or for any consequential, special, or similar damages, even if advised of the possibility of such damages.

The articles, news, and information presented on www.serrarigroup.com reflect the opinions of the respective authors and contributors and do not necessarily represent the views of the website or its management. Any views or opinions expressed are solely those of the individual authors and do not represent the website's views or opinions as a whole.

The content on www.serrarigroup.com may include links to external websites, which are provided for convenience and informational purposes only. We have no control over the nature, content, and availability of those sites. The inclusion of any links does not necessarily imply a recommendation or endorsement of the views expressed within them.

Every effort is made to keep the website up and running smoothly. However, www.serrarigroup.com takes no responsibility for, and will not be liable for, the website being temporarily unavailable due to technical issues beyond our control.

Please note that laws, regulations, and information can change rapidly, and we advise you to conduct further research and seek professional advice when necessary.

By using www.serrarigroup.com, you agree to this disclaimer and its terms. If you do not agree with this disclaimer, please do not use the website.

www.serrarigroup.com, reserves the right to update, modify, or remove any part of this disclaimer without prior notice. It is your responsibility to review this disclaimer periodically for changes.

Serrari Group 2025