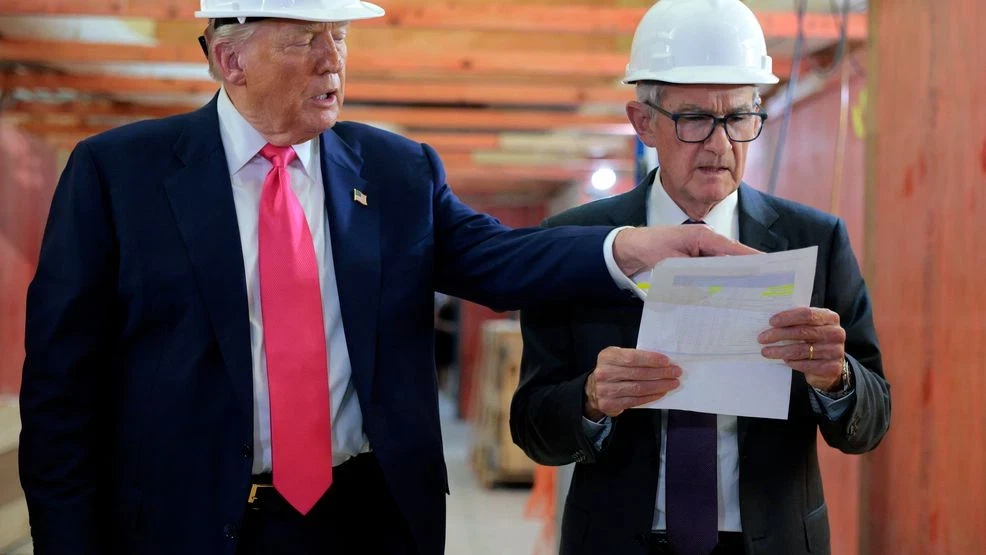

In an extraordinary display of presidential pressure on the nation’s independent central bank, U.S. President Donald Trump made a rare visit to the Federal Reserve headquarters on Thursday, engaging in a visibly tense exchange with Chair Jerome Powell. The encounter, unfolding amidst the backdrop of a multi-billion dollar renovation project at the Fed’s Washington D.C. complex, saw the President reiterate his insistent demands for significant interest rate cuts, while simultaneously criticizing the soaring costs of the building overhaul. This direct confrontation, just days before a crucial Federal Open Market Committee (FOMC) meeting, reignited concerns about the sanctity of the Fed’s independence, a cornerstone of global financial stability.

President Trump, who had earlier in the week publicly lambasted Powell as a “numbskull” for the central bank’s perceived inaction on borrowing costs, concluded his tour by stating he had no intention of firing the Fed chief, a threat he has frequently brandished. “To do so is a big move and I just don’t think it’s necessary,” Trump told reporters, attempting to dial back the intensity of his long-running feud with the institution. However, the underlying tension remained palpable, underscoring a deep ideological chasm between the White House’s desire for aggressive monetary easing and the Federal Reserve’s commitment to its dual mandate of maximum employment and stable prices.

The Battle Over Interest Rates: A Clash of Mandates

At the heart of the ongoing friction between President Trump and Federal Reserve Chair Powell lies a fundamental disagreement over monetary policy, specifically the appropriate level of interest rates. The Federal Reserve, established by Congress in 1913, operates under a dual mandate to promote effectively the goals of maximum employment and stable prices. This mandate requires the Fed to balance the need for economic growth with the imperative to control inflation. In practice, the FOMC translates these broad goals into specific longer-run objectives, aiming for 2% inflation as measured by the Personal Consumption Expenditures (PCE) price index, while monitoring a wide range of labor market indicators to assess maximum sustainable employment.

President Trump has consistently and vociferously advocated for dramatically lower interest rates, often suggesting cuts of “3 percentage points or more,” and at times even calling for a 1% rate. His rationale often centers on the belief that lower rates would reduce federal borrowing costs, boost economic growth, and make the U.S. more competitive globally. He frequently asserts that there is “No Inflation,” despite economic data.

However, the Fed’s current stance reflects a different assessment of the economic landscape. As of the latest figures, the benchmark federal funds rate remains in the 4.25%-4.50% range, a level maintained since December 2024. This range was set after a series of aggressive rate hikes initiated to combat persistently high inflation that surged in the post-pandemic period. Recent data indicates that the annual inflation rate in the US accelerated to 2.7% in June 2025, up from 2.4% in May, with core inflation (excluding volatile food and energy prices) at 2.9%. While lower than peak levels, these figures suggest that inflationary pressures, though moderating, are still present and above the Fed’s 2% target.

Simultaneously, the U.S. labor market has shown remarkable stability. The unemployment rate edged down to 4.1% in June 2025, holding within a narrow range of 4.0%–4.2% since May 2024. This signals a robust job market, which, from the Fed’s perspective, does not necessitate aggressive rate cuts to stimulate employment. In fact, an overly loose monetary policy in a tight labor market could risk reigniting inflationary pressures, forcing the Fed into another cycle of rate hikes, which could be detrimental to long-term economic stability.

The economic impact of high interest rates is multifaceted. While they serve to cool an overheating economy and curb inflation by making borrowing more expensive, they can also affect various sectors. Higher rates increase the cost of mortgages, dampening housing demand. They raise borrowing costs for businesses, potentially slowing investment and expansion. For the government, higher rates mean increased debt servicing costs, adding to the national debt. Conversely, lower rates stimulate borrowing and spending, boost stock prices, and can encourage business expansion, but also carry the risk of fueling inflation and asset bubbles if not managed carefully. The Fed’s challenge is to find the “neutral rate” that supports maximum employment without triggering excessive inflation.

The Renovation Controversy: A Billion-Dollar Blame Game

Beyond the monetary policy debate, President Trump’s visit also spotlighted a contentious issue: the ongoing, multi-billion dollar renovation of the Federal Reserve’s historic headquarters in Washington D.C. The project, encompassing the Eccles Building and the 1951 Constitution Avenue building, has been a target of criticism from Trump and his allies, who view it as a symbol of an institution “run amok” and indicative of poor oversight.

Initially estimated at $2.5 billion, President Trump claimed during his visit that the project’s cost had ballooned to “$3.1 billion,” a figure that visibly surprised Chair Powell. “I am not aware of that,” Powell responded, before being handed a piece of paper by Trump. Upon examining it, Powell clarified, “You just added in a third building,” noting that the Martin Building had been completed five years prior and was not part of the current renovation scope. This public fact-check underscored the tension and the differing narratives surrounding the project’s finances.

White House budget director Russell Vought and Trump’s deputy chief of staff, James Blair, who have spearheaded criticism of the renovation as “overly costly and ostentatious,” accompanied the President and continued to voice their concerns about poor oversight and potential fraud. Republican Senator Tim Scott, Chair of the Senate Banking Committee, had also sent a letter to Powell demanding answers about the renovation, further highlighting congressional scrutiny.

The Federal Reserve, in letters to Vought and lawmakers, backed by documents on its website, has provided detailed explanations for the rising costs. They attribute much of the increase to unexpected challenges encountered during the renovation of nearly century-old buildings, including:

- Toxic Materials Abatement: The discovery and safe removal of hazardous materials, common in older structures, added significant unforeseen expenses.

- Higher-than-Estimated Costs for Materials and Labor: Inflationary pressures and supply chain disruptions have driven up the cost of construction materials (e.g., steel prices up 60% since 2017) and labor.

- Tariffs: Trump’s own administration’s imposition of tariffs, such as a 25% duty on steel and 10% on aluminum in 2018, ironically contributed to the increased material costs for the project.

- Underground Construction: Initial plans for more above-ground construction were constrained by Washington D.C.’s height restrictions, necessitating more expensive underground excavation for three levels of parking.

Fed staff also pointed out security features, such as blast-resistant windows, as significant cost drivers, given the sensitive nature of the institution. They further clarified that the project, which started in mid-2022, is not operating under a fixed-price contract but rather a fee and overhead rate model with competitive bids for different packages, making “cost overrun” a debatable term in their view.

Adding to the controversy were aesthetic choices. Senator Scott had specifically complained about “rooftop garden terraces.” While a tour of the Eccles Building roof revealed impressive views, Fed staff explained that rooftop seating, though inexpensive, had been removed due to its “appearance of being an amenity.” This was one of only two deviations from the original plan, the other being the scrapping of a couple of planned fountains, highlighting the sensitivity to public perception amidst the scrutiny.

Fed Independence: A Cornerstone Under Threat

The spectacle of a sitting President publicly berating the central bank chief at the Fed’s own headquarters is highly unusual and carries significant implications for the principle of central bank independence. This independence is widely considered a critical underpinning of the global financial system. It ensures that monetary policy decisions are made based on economic data and long-term stability goals, rather than short-term political expediency or electoral cycles.

Historically, the Federal Reserve’s journey to independence has been a gradual one. While established in 1913, the Fed was not always free from political influence, particularly during World War I and II when it largely served to finance government war efforts. True operational independence, especially from the Treasury, was largely solidified with the Treasury-Fed Accord of 1951. Since 1977, Congress formally mandated the Fed to pursue maximum employment and stable prices, granting it the autonomy to deploy its tools (primarily interest rates) to achieve this mandate without direct interference from the White House or Congress.

President Trump’s approach has consistently challenged this long-standing norm. His frequent public criticisms of Powell, including suggestions of firing him, have previously sent ripples through financial markets, as investors value the predictability and non-political nature of monetary policy. While a President can nominate Fed governors, removing them “for cause” is a high legal bar, as established by Supreme Court precedent in cases like Humphrey’s Executor v. United States (1935), which limited presidential power to remove officers for policy disagreements.

This latest visit starkly contrasts with previous documented presidential visits to the Fed. For instance, President Franklin Delano Roosevelt visited in 1937 to dedicate the newly built headquarters (one of the buildings now undergoing renovation), and more recently, President George W. Bush attended Ben Bernanke’s swearing-in as Fed chief in 2006. These visits were ceremonial or supportive, not confrontational. The current administration’s direct engagement, particularly with the media present, signals a deliberate strategy to exert public pressure.

Political Undercurrents and Market Reaction

The timing of President Trump’s visit is also noteworthy. It occurred less than a week before the central bank’s 19 policymakers were due to gather for a two-day rate-setting meeting, where they are widely expected to leave their benchmark interest rate in the 4.25%-4.50% range. The President’s public demands for rate cuts right before such a meeting can be seen as an attempt to influence the decision or, failing that, to lay the groundwork for blaming the Fed if economic conditions do not align with his political narrative.

Furthermore, the visit took place as President Trump was battling to deflect attention from a brewing political crisis surrounding his administration’s refusal to release additional files related to convicted sex offender Jeffrey Epstein. This reversal of a campaign promise has drawn significant scrutiny. While the Justice Department has stated that a so-called Epstein “client list” does not exist and that no further documents will be released, the controversy continues to generate headlines. The timing of the Fed visit could be interpreted as a strategic maneuver to shift the media’s focus.

Despite the high-profile nature of the confrontation, market reaction to Trump’s visit was relatively subdued. The yield on benchmark 10-year Treasury bonds ticked higher, primarily after data showed new jobless claims dropped in the most recent week, signaling a stable labor market not in need of immediate support from a Fed rate cut. The S&P 500 equities index closed largely flat on the day. This muted response suggests that while the political rhetoric is noted, markets are largely focused on underlying economic fundamentals and the Fed’s consistent communication regarding its data-dependent approach.

The Fed’s internal preparations for the upcoming meeting, typically involving Chair Powell’s back-to-back calls with Fed bank presidents, continued as scheduled, underscoring the institution’s commitment to its established processes despite external pressures.

The Path Ahead for Monetary Policy

The upcoming FOMC meeting (July 29-30, 2025) will be closely watched. Given the latest inflation data (2.7% annual CPI in June) and the robust labor market (4.1% unemployment), the consensus among economists and analysts is that the Fed will likely maintain the current federal funds rate target. While the Fed’s own economic projections from the June FOMC meeting suggested the possibility of two 25-basis-point rate cuts later in 2025, these projections are always conditional on evolving economic data. The persistent inflation above target and the strong employment figures provide little immediate impetus for a rate reduction.

The Fed’s policymakers will continue to evaluate a wide range of economic indicators, including inflation trends, employment figures, wage growth, consumer spending, business investment, and global economic developments. Their decisions are guided by a commitment to achieving both mandates without triggering instability. The ongoing political pressure, while a distraction, is unlikely to fundamentally alter the Fed’s data-driven approach, given its institutional independence and the long-term credibility it seeks to maintain.

Conclusion: A Test of Institutional Resilience

President Trump’s tense visit to the Federal Reserve underscores the persistent tension between political desires for economic stimulus and the central bank’s mandate for long-term stability. The public exchange over interest rates and the renovation project highlights the unique position of the Fed as an independent institution, often operating in the crosshairs of political debate.

While the immediate market reaction was calm, the broader implications for central bank independence remain a critical concern. The Fed’s ability to make decisions free from political interference is vital for maintaining investor confidence, managing inflation expectations, and ensuring the stability of the U.S. and global financial systems. As the U.S. economy navigates evolving challenges, the resilience of institutions like the Federal Reserve in upholding their mandates will be paramount. The July FOMC meeting will serve as another test of this resolve, with all eyes on Jerome Powell and his colleagues to see how they balance economic realities with persistent political demands.

Ready to take your career to the next level? Join our dynamic courses: ACCA, HESI A2, ATI TEAS 7 , HESI EXIT , NCLEX – RN and NCLEX – PN, Financial Literacy!🌟 Dive into a world of opportunities and empower yourself for success. Explore more at Serrari Ed and start your exciting journey today! ✨

photo source: Google

By: Montel Kamau

Serrari Financial Analyst

25th July, 2025

Article, Financial and News Disclaimer

The Value of a Financial Advisor

While this article offers valuable insights, it is essential to recognize that personal finance can be highly complex and unique to each individual. A financial advisor provides professional expertise and personalized guidance to help you make well-informed decisions tailored to your specific circumstances and goals.

Beyond offering knowledge, a financial advisor serves as a trusted partner to help you stay disciplined, avoid common pitfalls, and remain focused on your long-term objectives. Their perspective and experience can complement your own efforts, enhancing your financial well-being and ensuring a more confident approach to managing your finances.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Readers are encouraged to consult a licensed financial advisor to obtain guidance specific to their financial situation.

Article and News Disclaimer

The information provided on www.serrarigroup.com is for general informational purposes only. While we strive to keep the information up to date and accurate, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability with respect to the website or the information, products, services, or related graphics contained on the website for any purpose. Any reliance you place on such information is therefore strictly at your own risk.

www.serrarigroup.com is not responsible for any errors or omissions, or for the results obtained from the use of this information. All information on the website is provided on an as-is basis, with no guarantee of completeness, accuracy, timeliness, or of the results obtained from the use of this information, and without warranty of any kind, express or implied, including but not limited to warranties of performance, merchantability, and fitness for a particular purpose.

In no event will www.serrarigroup.com be liable to you or anyone else for any decision made or action taken in reliance on the information provided on the website or for any consequential, special, or similar damages, even if advised of the possibility of such damages.

The articles, news, and information presented on www.serrarigroup.com reflect the opinions of the respective authors and contributors and do not necessarily represent the views of the website or its management. Any views or opinions expressed are solely those of the individual authors and do not represent the website's views or opinions as a whole.

The content on www.serrarigroup.com may include links to external websites, which are provided for convenience and informational purposes only. We have no control over the nature, content, and availability of those sites. The inclusion of any links does not necessarily imply a recommendation or endorsement of the views expressed within them.

Every effort is made to keep the website up and running smoothly. However, www.serrarigroup.com takes no responsibility for, and will not be liable for, the website being temporarily unavailable due to technical issues beyond our control.

Please note that laws, regulations, and information can change rapidly, and we advise you to conduct further research and seek professional advice when necessary.

By using www.serrarigroup.com, you agree to this disclaimer and its terms. If you do not agree with this disclaimer, please do not use the website.

www.serrarigroup.com, reserves the right to update, modify, or remove any part of this disclaimer without prior notice. It is your responsibility to review this disclaimer periodically for changes.

Serrari Group 2025