South Africa’s government is forging ahead with an ambitious plan to mobilize R100 billion by 2029 through a new Transformation Fund designed to accelerate Black Economic Empowerment, despite fierce opposition from coalition partners and widespread skepticism from business leaders. The initiative, championed by Minister of Trade, Industry and Competition Parks Tau, has emerged as one of the most contentious policy battles within South Africa’s Government of National Unity.

In a significant revision unveiled this week, the government is offering companies a powerful new incentive: businesses that contribute 3% of their net income to the Transformation Fund will earn double the points currently available on the B-BBEE scorecard—the measurement system that determines companies’ access to government procurement and corporate contracts. This sweetener represents a dramatic shift from earlier proposals and underscores the government’s determination to make the fund attractive to private sector participants.

The fund will be governed by a board appointed by the minister and supported by a public-private investment committee, according to planning documents. The revamped proposals are expected to be formally unveiled next week, marking a critical juncture for an initiative that has polarized South Africa’s political and business establishment since its initial announcement in early 2025.

Build the future you deserve. Get started with our top-tier Online courses: ACCA, HESI A2, ATI TEAS 7, HESI EXIT, NCLEX-RN, NCLEX-PN, and Financial Literacy. Let Serrari Ed guide your path to success. Enroll today.

The Democratic Alliance Draws a Line in the Sand

The fund’s most vocal opponent has been the Democratic Alliance, the African National Congress’s largest partner in the Government of National Unity. The DA has labeled the proposal “madness” and accused Minister Tau of bypassing necessary Cabinet processes in what it characterizes as a unilateral policy announcement that undermines good governance principles.

Toby Chance, the Democratic Alliance’s spokesman on trade and industry, has been particularly scathing in his criticism. “This fund could very easily become a bottomless pit for taxpayers’ money, with little to no oversight or meaningful outcomes,” Chance warned in a statement. He drew uncomfortable parallels to South Africa’s R500 billion coronavirus relief fund, which was plagued by allegations of corruption, fraud, and systematic looting by politically connected individuals.

The DA’s opposition goes beyond concerns about governance and corruption. The party fundamentally rejects the premise underlying the fund. “Not only does the DA reject race-based legislation, but BBBEE has proven counterproductive in closing our inequality gap,” Chance argued. He contends that the majority of BEE funding is missing the mark in terms of stimulating high-growth enterprises in South Africa, instead benefiting a narrow elite of politically connected individuals.

“Our country has an abundance of entrepreneurs drawn from diverse communities who just need the opportunity to succeed,” Chance said, advocating for a merit-based approach to business development that eschews racial categorization. “Instead, we believe in providing resources based on merit and the business’s viability and growth potential.”

The DA has called on Minister Tau to immediately bring the matter to Cabinet for proper discussion and approval, arguing that creating such a fund without explicit Cabinet authorization—particularly when it effectively introduces new financial obligations on the private sector—violates legal and constitutional requirements.

Government Defends Constitutional Mandate

Minister Parks Tau has remained defiant in the face of this opposition, framing the Transformation Fund as a constitutional imperative rather than a discretionary policy choice. The Department of Trade, Industry and Competition has attempted to contextualize the fund within South Africa’s constitutional commitment to economic redress and inclusive growth, citing Section 9(2) of the Constitution as the legal foundation for the initiative.

“It is about ensuring that existing commitments under the B-BBEE legislation are strategically utilised to create meaningful economic transformation,” Tau stated in defending the fund. “It embodies our constitutional mandate to achieve equality and empower historically disadvantaged communities.”

The minister has emphasized that the fund “is not about imposing new obligations” on businesses but rather about aggregating existing Enterprise and Supplier Development contributions that companies are already required to make under current B-BBEE codes. Under existing regulations, businesses must contribute 3% of net profit after tax toward the development of black suppliers, black industrialists, and small and medium enterprises.

What changes under the Transformation Fund model is where these contributions go. Rather than companies directing their own ESD spending to beneficiaries of their choosing—providing they meet B-BBEE criteria—the funds would flow into a centralized government-managed vehicle administered by the National Empowerment Fund. The government would then determine which black-owned enterprises receive grants, equity funding, or debt relief.

“The Transformation Fund is not merely a funding mechanism, it is a catalyst for change,” Tau declared. “Through collaboration with the private sector, civil society, and other stakeholders, we will create an economy that is inclusive, sustainable, and reflective of South Africa’s diversity.”

The Department has outlined five core objectives for the fund. It aims to promote economic inclusion by providing financial and non-financial support to black-owned enterprises; address fragmentation by aggregating resources from various existing obligations; foster sectoral growth in high-impact areas including agriculture, tourism, ICT, manufacturing, and businesses in township and rural areas; enhance market access through technical assistance and support; and support industrialization in alignment with South Africa’s broader industrial policy.

The Business Community’s Uneasy Response

Business organizations have responded with a mixture of cautious interest and deep skepticism. Business Unity South Africa, while signaling willingness to participate in principle, has pushed for clarity on the fund’s design, governance structures, and practical implications before committing support.

Khulekani Mathe, CEO of Business Unity South Africa, characterized the proposal as “ill-advised” in its current form, expressing concerns about how such an enormous fund would be managed and whether it would deliver genuine transformation or simply create new opportunities for rent-seeking behavior.

Stuart Theobald, executive chairman of investment firm Krutham, offered one of the most detailed critiques of the fund’s viability. He pointed out that giving out R20 billion annually to help small and medium-sized businesses scale represents a tremendously complicated task. To put it in perspective, the government would need to provide qualifying black businesses with R55 million every day for five years—or R80 million per working day.

“Companies are measured by how much money they put in and not by the impact or the desired outcomes,” Theobald observed, highlighting a fundamental flaw he sees in both the existing B-BBEE framework and its proposed Transformation Fund evolution. “The government is talking about spending a lot of money and not about the outcomes or the effect it wants to achieve.”

The National Employers’ Association of South Africa has been even more blunt in its opposition. NEASA CEO Gerhard Papenfus accused the government of trying to replace its failed black empowerment policy with the Transformation Fund rather than addressing the fundamental problems with the B-BBEE approach. The organization expressed particular concern about placing such enormous resources in government hands given South Africa’s track record with managing large public funds.

For multinational corporations operating in South Africa, the stakes are particularly high. Under the fund’s design, multinationals that refuse to hand over equity to black partners would be required to contribute up to 25% of the value of their South African operations as an “equity equivalent” cash contribution to the Transformation Fund. This requirement has raised alarm bells about potential disinvestment, as foreign companies weigh the costs of compliance against the benefits of maintaining their South African operations.

Early Commitments and Annual Targets

Despite the controversy, the government has begun securing preliminary commitments to the fund. According to planning documents reviewed by Business Day, early unsigned or conditional commitments total R13.1 billion—not far from the fund’s annual mobilization target of R20 billion.

The largest single commitment comes from the African Export-Import Bank (Afreximbank), which has pledged R10.8 billion. Additional commitments include R500 million each from the Unemployment Insurance Fund, the Industrial Development Corporation, and the Development Bank of Southern Africa. Telecommunications company Vodacom, through its Masiv subsidiary, has committed approximately R400 million.

The fund will be structured as a special purpose vehicle incubated by the National Empowerment Fund, targeting a focused set of priority sectors chosen for their potential to deliver jobs and industrial impact: renewable energy, manufacturing, agro-processing, logistics, and digital infrastructure.

However, these early commitments fall well short of the fund’s ultimate R100 billion target, and several represent conditional pledges subject to clarification on governance, oversight mechanisms, and deployment strategies. The question of whether the private sector will ultimately embrace the fund at the scale government envisions remains very much open.

One decision can change your entire career. Take that step with our Online courses in ACCA, HESI A2, ATI TEAS 7, HESI EXIT, NCLEX-RN, NCLEX-PN, and Financial Literacy. Join Serrari Ed and start building your brighter future today.

The BEE Debate: Three Decades of Contested Transformation

The controversy over the Transformation Fund cannot be separated from broader debates about the effectiveness and fairness of South Africa’s Black Economic Empowerment policies more generally. Since the African National Congress came to power in 1994, BEE has been the government’s primary tool for addressing apartheid’s legacy of economic exclusion.

The stated goals have always been ambitious: to increase the number of black people who manage, own, and control South Africa’s economy while significantly decreasing income inequalities. The policy evolved from narrow ownership-focused initiatives in the 1990s to the more comprehensive Broad-Based Black Economic Empowerment framework legislated in 2003, which added requirements around management representation, skills development, enterprise development, and socio-economic contributions.

Proponents argue that BEE has achieved meaningful progress in transforming the racial composition of South Africa’s economy. Government data shows that at the top management level, white representation has declined from 74.9% in 2006 to 61% in 2024, while black representation has increased from 22.2% to 36.1%. At senior management levels, blacks have moved from 26.9% in 2006 to 49.7% in 2024. Among professionally qualified positions, black representation has surged from 36.5% to 69.5% over the same period.

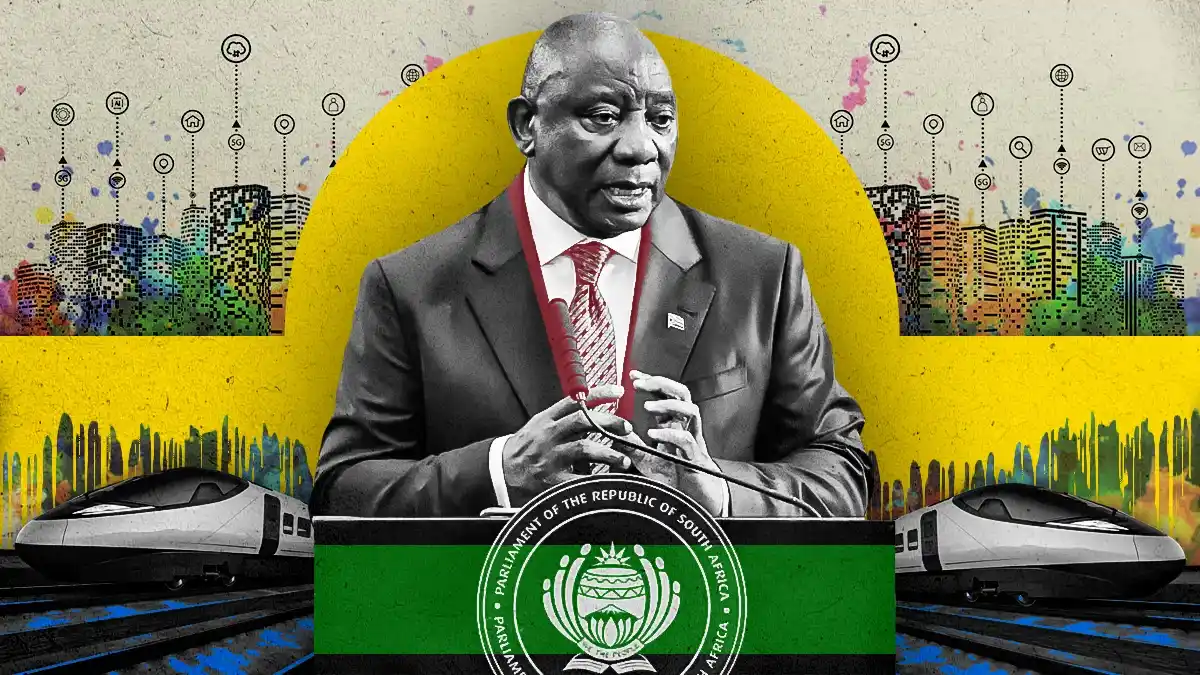

President Cyril Ramaphosa has defended BEE as essential for redressing inequality, dismissing criticism that “it is a cost to the economy” and arguing instead that “it is an investment in the economy.” He promoted the Transformation Fund during his 2025 State of the Nation Address, framing it as a continuation of constitutional obligations to create a more inclusive economy.

Yet critics point to persistent problems that suggest BEE’s impact has been far more limited than its architects intended. Despite three decades of implementation, South Africa remains one of the world’s most unequal societies. The Gini coefficient measuring income inequality has remained largely unchanged over the past thirty years, and wealth inequality is even more extreme.

More troublingly, while inequality between racial groups has declined modestly, inequality within racial groups—particularly among black South Africans—has actually increased. A small black elite has benefited enormously from BEE transactions and opportunities, while the vast majority of black South Africans have seen little material improvement in their economic circumstances.

Archbishop Desmond Tutu famously captured this critique, asking: “What is black empowerment when it seems to benefit not the vast majority but an elite that tends to be recycled?” He warned that, combined with widespread poverty, such a system risked building popular resentment against ruling classes and between different sections of society.

Labour market data underscores these concerns. As of 2021, white unemployment stood at 8.6% compared to 38.2% for black South Africans, 28.5% for coloureds, and 19.5% for Indians and Asians. White South Africans continue to occupy 67.8% of top management positions in the private sector despite constituting less than 8% of the population.

Professor Imraan Valodia’s research shows that despite BEE and Employment Equity legislation, black South Africans and women continue to face significant wage gaps and occupational segregation. He argues that transformation must extend beyond boardrooms and balance sheets to reach the factory floor and training room—something BEE in its current form has struggled to achieve.

The Fronting Problem and Elite Capture

One of the most damaging criticisms of BEE concerns the prevalence of “fronting”—arrangements where companies improve their BEE ratings through tokenistic appointments of black directors, managers, or suppliers who exercise little real power or derive minimal benefit from their positions. Several large companies have been investigated and sanctioned for such practices, which the government defines as deliberately misrepresenting facts about BEE compliance.

The Free Market Foundation argues that the fund “drips with an ideological racialism that should long have been abandoned in a democratic society,” warning that further imposition of BEE policies and taxes to finance the Transformation Fund will damage the economy further.

The Institute of Race Relations has called the fund “perverse,” arguing that it will exacerbate South Africa’s declining investment climate. “Investment, both local and foreign, is already being discouraged in so many ways,” the IRR noted. “Tau’s proposal will exacerbate the disinclination to invest. The ANC continues to ignore, or fails to understand, that global business is not moved to invest in South Africa because it was once the moral darling of the world.”

The organization advocates abandoning race-based policies entirely in favor of what it calls Economic Empowerment for the Disadvantaged—a means-tested system similar to social grants that would use poverty rather than race as the criterion for support.

The Governance Question: Can R100 Billion Be Managed Effectively?

Perhaps the most fundamental challenge facing the Transformation Fund is whether South Africa’s government has the institutional capacity and political will to manage R100 billion effectively and without corruption.

Critics point to a litany of failures in managing large public funds and state-owned enterprises. The R500 billion allocated for COVID-19 relief became a byword for corruption and maladministration. State-owned enterprises like Eskom and South African Airways have required repeated bailouts while delivering poor service. The Passenger Rail Agency of South Africa has seen systematic asset stripping. These examples fuel skepticism about whether a R100 billion Transformation Fund would achieve its stated development objectives or simply create new opportunities for politically connected elites to enrich themselves.

The proposal to house the fund within the National Empowerment Fund, governed by a ministerially-appointed board, has not allayed these concerns. Business representatives have emphasized that proper corporate governance structures, transparent decision-making processes, and independent oversight mechanisms would be essential preconditions for private sector participation at scale.

Some observers have suggested that a more viable approach might involve collaboration with established corporate entities with proven track records in managing large funds—perhaps drawing from the mining sector or financial institutions like Discovery. The concern is that without such expertise and checks and balances, a government-managed fund risks becoming what NEASA characterized as “just another ANC cash-cow.”

International Context and Investment Implications

The Transformation Fund debate is unfolding against a challenging international backdrop. South Africa’s economy has experienced anemic growth for more than a decade, with GDP expansion consistently lagging behind population growth. Unemployment has reached crisis levels, particularly among youth. Infrastructure decay, energy shortages, and policy uncertainty have all contributed to an environment where business confidence remains fragile.

Foreign direct investment has been declining, and South Africa’s share of global investment flows to emerging markets has shrunk. In this context, policies that are perceived—rightly or wrongly—as increasing the cost and complexity of doing business in South Africa risk accelerating capital flight and deterring new investment.

Multinational corporations weighing their South African exposure must balance several considerations. The country offers a sophisticated financial system, relatively strong institutions compared to many African nations, and access to the broader Southern African market. But it also presents political risks, regulatory uncertainty, and—with the proposed Transformation Fund—potentially significant new financial obligations.

The requirement that multinationals contribute up to 25% of their South African operations’ value to transformation purposes represents a material cost that must be factored into investment decisions. Some companies may conclude that the South African market, while attractive, is not so indispensable as to justify these outlays, particularly when alternatives exist elsewhere on the continent or in other emerging markets.

What Happens Next: The Consultation Process

The government has committed to opening the fund’s conceptual framework for public consultation and stakeholder engagement. A 30-day commentary period was announced, during which business organizations, civil society groups, and interested parties can provide input.

This consultation process will be crucial in determining whether the fund can achieve sufficient buy-in to be viable. For the DA and other opposition parties, it provides an opportunity to mobilize broader resistance and potentially force modifications or abandonment of the proposal. For business groups, it offers a chance to negotiate more favorable governance arrangements and implementation mechanisms.

Minister Tau has indicated willingness to engage constructively with critics and refine the proposal based on feedback. Whether this translates into substantive changes—particularly on questions of governance, oversight, and the role of race in determining beneficiaries—remains to be seen.

The government faces a delicate balancing act. On one hand, it is committed to advancing transformation and addressing the persistence of racial economic inequality three decades after apartheid’s end. On the other, it must maintain sufficient business confidence and investment inflows to generate the growth needed to create jobs and fund public services.

The Deeper Debate: Transformation Versus Growth

At its core, the Transformation Fund controversy reflects a fundamental tension in South African policy between prioritizing racial economic transformation and creating conditions for broad-based economic growth. Proponents of aggressive transformation argue that without deliberate intervention to shift economic power and opportunity, South Africa’s racial economic hierarchies will persist indefinitely, storing up social instability and undermining the legitimacy of the democratic project.

Critics counter that race-based policies and additional regulatory burdens on business will constrain the very growth needed to create opportunities for all South Africans, regardless of race. They point to successful emerging economies in Asia that prioritized growth and education over redistribution in their development phases, arguing that expanding the economic pie should take precedence over ensuring particular groups get particular slices.

This is not a debate that will be resolved by the Transformation Fund alone. It goes to the heart of what kind of society South Africa wants to be and how it balances competing values of redress, merit, efficiency, and inclusion.

For now, the revised Transformation Fund proposal with its doubled BEE scorecard points represents Minister Tau’s attempt to make transformation more attractive to business while maintaining the racial targeting that the ANC government views as essential to its constitutional mandate.

Whether companies will bite on this incentive—committing their ESD contributions to a centralized government fund in exchange for better procurement access—will determine whether R100 billion can actually be mobilized by 2029. And whether such a fund, if established, can be managed effectively and directed toward genuine enterprise development rather than elite enrichment will determine whether it marks a new chapter in South Africa’s transformation story or simply another disappointing chapter in a long-running narrative of missed opportunities.

As Business Day reported, the final proposals are expected to be unveiled next week. That announcement will set in motion a process that could reshape how transformation is financed and implemented in South Africa—for better or worse—for years to come.

Ready to take your career to the next level? Join our Online courses: ACCA, HESI A2, ATI TEAS 7 , HESI EXIT , NCLEX – RN and NCLEX – PN, Financial Literacy!🌟 Dive into a world of opportunities and empower yourself for success. Explore more at Serrari Ed and start your exciting journey today! ✨

Track GDP, Inflation and Central Bank rates for top African markets with Serrari’s comparator tool.

See today’s Treasury bonds and Money market funds movement across financial service providers in Kenya, using Serrari’s comparator tools.

photo source: Google

By: Montel Kamau

Serrari Financial Analyst

28th January, 2026

Article, Financial and News Disclaimer

The Value of a Financial Advisor

While this article offers valuable insights, it is essential to recognize that personal finance can be highly complex and unique to each individual. A financial advisor provides professional expertise and personalized guidance to help you make well-informed decisions tailored to your specific circumstances and goals.

Beyond offering knowledge, a financial advisor serves as a trusted partner to help you stay disciplined, avoid common pitfalls, and remain focused on your long-term objectives. Their perspective and experience can complement your own efforts, enhancing your financial well-being and ensuring a more confident approach to managing your finances.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Readers are encouraged to consult a licensed financial advisor to obtain guidance specific to their financial situation.

Article and News Disclaimer

The information provided on www.serrarigroup.com is for general informational purposes only. While we strive to keep the information up to date and accurate, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability with respect to the website or the information, products, services, or related graphics contained on the website for any purpose. Any reliance you place on such information is therefore strictly at your own risk.

www.serrarigroup.com is not responsible for any errors or omissions, or for the results obtained from the use of this information. All information on the website is provided on an as-is basis, with no guarantee of completeness, accuracy, timeliness, or of the results obtained from the use of this information, and without warranty of any kind, express or implied, including but not limited to warranties of performance, merchantability, and fitness for a particular purpose.

In no event will www.serrarigroup.com be liable to you or anyone else for any decision made or action taken in reliance on the information provided on the website or for any consequential, special, or similar damages, even if advised of the possibility of such damages.

The articles, news, and information presented on www.serrarigroup.com reflect the opinions of the respective authors and contributors and do not necessarily represent the views of the website or its management. Any views or opinions expressed are solely those of the individual authors and do not represent the website's views or opinions as a whole.

The content on www.serrarigroup.com may include links to external websites, which are provided for convenience and informational purposes only. We have no control over the nature, content, and availability of those sites. The inclusion of any links does not necessarily imply a recommendation or endorsement of the views expressed within them.

Every effort is made to keep the website up and running smoothly. However, www.serrarigroup.com takes no responsibility for, and will not be liable for, the website being temporarily unavailable due to technical issues beyond our control.

Please note that laws, regulations, and information can change rapidly, and we advise you to conduct further research and seek professional advice when necessary.

By using www.serrarigroup.com, you agree to this disclaimer and its terms. If you do not agree with this disclaimer, please do not use the website.

www.serrarigroup.com, reserves the right to update, modify, or remove any part of this disclaimer without prior notice. It is your responsibility to review this disclaimer periodically for changes.

Serrari Group 2025