Naked, a South African insurtech startup revolutionizing the insurance industry through artificial intelligence (AI), has raised R700 million ($38 million) in its latest Series B2 funding round. The funding, led by global impact investor BlueOrchard, represents the largest single investment in the African insurtech sector to date and underscores the rapid evolution of the insurance landscape in emerging markets.

Other participants in the funding round include prominent names such as the Hollard Insurance Group, Yellowwoods investment holding company, the International Finance Corporation (IFC), and DEG, a German development finance institution. These investors’ continued support highlights Naked’s potential to redefine insurance accessibility and affordability in Africa.

A Game-Changer in African Insurtech

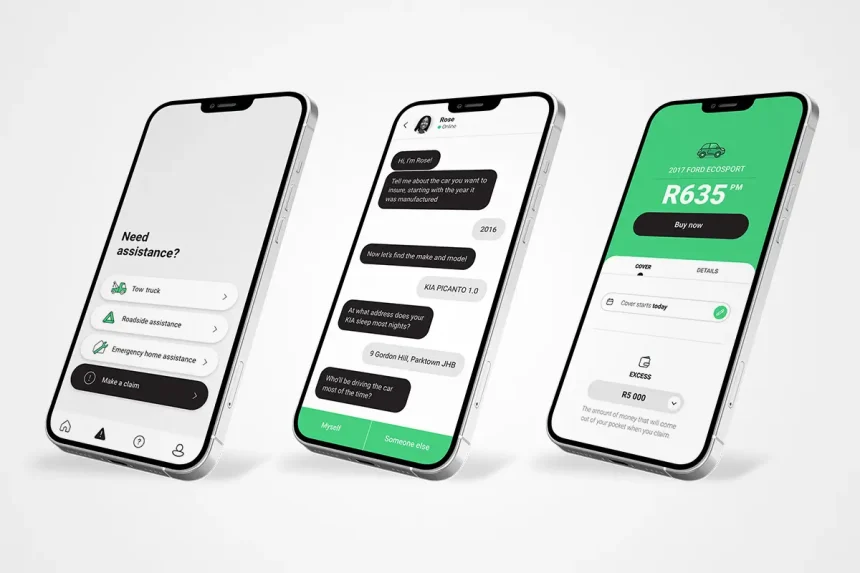

Launched in 2018, Naked has positioned itself as a pioneer in South Africa’s digital insurance market, offering customers a seamless and fully automated process for purchasing and managing car, home, and single-item insurance policies. The platform is designed to eliminate traditional bottlenecks in insurance—most notably, the need for human intervention.

Using advanced AI algorithms, the platform assesses risk, generates instant quotes in under 90 seconds, and allows users to adjust their coverage or file claims directly through its intuitive mobile app. By leveraging automation, Naked reduces operating costs while enhancing customer experience, setting a new standard for how insurance is delivered.

This unique approach also allows the company to achieve profitable unit economics, as its automated underwriting system improves risk selection and pricing efficiency. Naked’s ability to process insurance sales and manage claims without human involvement distinguishes it from traditional insurers and has contributed to its rapid rise in the South African market.

Innovative Revenue and Social Responsibility Model

One of Naked’s standout features is its fixed-percentage revenue model, which addresses one of the longstanding issues in the insurance industry: the potential conflict of interest in claims processing. Unlike traditional insurers, Naked redirects surplus funds from unclaimed premiums to charitable causes selected by its policyholders. This socially responsible approach has helped the company build trust and loyalty among its customers while aligning with broader trends toward ethical business practices.

“We believe insurance should not only protect people financially but also contribute positively to society,” said Alex Thomson, Co-Founder of Naked. “By creating a system where surplus funds are given back to the community, we’re redefining the role of insurance in people’s lives.”

Expanding AI Capabilities and Regulatory Compliance

The newly raised funds will allow Naked to scale its operations, further develop its AI capabilities, and ensure compliance with evolving regulatory requirements. A portion of the investment will also go toward establishing a cell captive structure within Hollard Specialist Insurance. This move will require the company to maintain capital reserves to cover extreme loss scenarios, ensuring financial stability and adherence to South Africa’s stringent insurance regulations.

“We’re thrilled to secure this investment, which marks a major milestone in our journey to define a new category of insurance,” said Thomson. “It’s a strong vote of confidence from both our existing shareholders and our new investor, BlueOrchard.”

BlueOrchard, a global impact investment manager, focuses on projects that enhance financial resilience and promote social inclusion. Richard Hardy, Private Equity Investment Director for Africa at BlueOrchard, emphasized that Naked’s mission aligns closely with the firm’s InsuResilience Investment Fund strategy. “Naked’s focus on using technology to expand access to insurance fits perfectly with our goals. This funding will help broaden its reach and develop innovative products that strengthen the financial resilience of its customers,” Hardy said.

Tackling Africa’s Insurance Gap

Africa remains one of the most underinsured regions globally, with low penetration rates attributed to economic barriers, lack of trust in traditional insurers, and limited access to financial services. Naked is tackling these challenges head-on by leveraging digital technology to make insurance more accessible and affordable for underserved populations.

The platform’s mobile-first approach is particularly significant in South Africa, where smartphone penetration continues to rise, even in low-income households. By eliminating the need for brokers and paperwork, Naked makes it possible for users to secure insurance coverage within minutes, even in remote or underserved areas.

This digital transformation aligns with broader trends in Africa, where fintech and insurtech startups are leveraging technology to bridge financial inclusion gaps. In recent years, the region has witnessed a surge in digital innovation, from mobile money platforms like M-Pesa to micro-insurance solutions designed for smallholder farmers. Naked’s success adds momentum to this wave of innovation, demonstrating the potential for tech-driven solutions to address systemic challenges in financial services.

The Future of Insurance in Emerging Markets

Naked’s success is a testament to the growing appetite for disruptive technologies in the insurance sector, particularly in emerging markets where traditional systems often fail to meet the needs of a diverse and rapidly changing customer base. As digital transformation continues to reshape industries worldwide, insurance is increasingly seen as a sector ripe for innovation.

Globally, the insurtech market has been expanding at an unprecedented pace, with investments in the sector reaching record levels. According to industry analysts, the global insurtech market is expected to grow from $10 billion in 2023 to over $25 billion by 2028, driven by advancements in AI, blockchain, and data analytics. Naked’s ability to attract significant funding highlights Africa’s potential to become a key player in this burgeoning industry.

The company’s approach also underscores the importance of sustainability and social impact in driving investor interest. By combining cutting-edge technology with a commitment to community empowerment, Naked is setting a benchmark for what insurance in the 21st century can look like.

Scaling Beyond South Africa

With its latest funding, Naked is well-positioned to expand its footprint beyond South Africa. While the company has not yet announced specific plans for regional or international expansion, its scalable platform and proven success in its home market make it a strong candidate for growth across other African countries and beyond.

The African insurance market is projected to grow significantly in the coming years, fueled by urbanization, rising incomes, and increasing awareness of financial protection. By entering new markets, Naked could tap into this growth potential while continuing to address systemic challenges such as affordability and accessibility.

However, expansion will not be without challenges. Competing with entrenched insurers, navigating diverse regulatory environments, and adapting to local market conditions will require strategic planning and execution. Still, with strong backing from investors like BlueOrchard and Hollard, Naked appears well-equipped to overcome these hurdles.

Conclusion

The $38 million Series B2 funding round represents a watershed moment not only for Naked but also for Africa’s insurtech sector as a whole. As the largest insurtech investment in the continent’s history, it underscores the potential for technology to transform financial services and address critical gaps in insurance coverage.

By leveraging AI to create a seamless, customer-centric experience, Naked is not just redefining how insurance is delivered—it’s also setting new standards for transparency, efficiency, and social responsibility. With its eyes set on further innovation and growth, Naked is poised to play a leading role in shaping the future of insurance in Africa and beyond.

Ready to take your career to the next level? Join our dynamic courses: ACCA, HESI A2, ATI TEAS 7 , HESI EXIT , NCLEX – RN and NCLEX – PN, Financial Literacy!🌟 Dive into a world of opportunities and empower yourself for success. Explore more at Serrari Ed and start your exciting journey today! ✨

photo source: Google

By: Montel Kamau

Serrari Financial Analyst

28th January, 2025

Article, Financial and News Disclaimer

The Value of a Financial Advisor

While this article offers valuable insights, it is essential to recognize that personal finance can be highly complex and unique to each individual. A financial advisor provides professional expertise and personalized guidance to help you make well-informed decisions tailored to your specific circumstances and goals.

Beyond offering knowledge, a financial advisor serves as a trusted partner to help you stay disciplined, avoid common pitfalls, and remain focused on your long-term objectives. Their perspective and experience can complement your own efforts, enhancing your financial well-being and ensuring a more confident approach to managing your finances.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Readers are encouraged to consult a licensed financial advisor to obtain guidance specific to their financial situation.

Article and News Disclaimer

The information provided on www.serrarigroup.com is for general informational purposes only. While we strive to keep the information up to date and accurate, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability with respect to the website or the information, products, services, or related graphics contained on the website for any purpose. Any reliance you place on such information is therefore strictly at your own risk.

www.serrarigroup.com is not responsible for any errors or omissions, or for the results obtained from the use of this information. All information on the website is provided on an as-is basis, with no guarantee of completeness, accuracy, timeliness, or of the results obtained from the use of this information, and without warranty of any kind, express or implied, including but not limited to warranties of performance, merchantability, and fitness for a particular purpose.

In no event will www.serrarigroup.com be liable to you or anyone else for any decision made or action taken in reliance on the information provided on the website or for any consequential, special, or similar damages, even if advised of the possibility of such damages.

The articles, news, and information presented on www.serrarigroup.com reflect the opinions of the respective authors and contributors and do not necessarily represent the views of the website or its management. Any views or opinions expressed are solely those of the individual authors and do not represent the website's views or opinions as a whole.

The content on www.serrarigroup.com may include links to external websites, which are provided for convenience and informational purposes only. We have no control over the nature, content, and availability of those sites. The inclusion of any links does not necessarily imply a recommendation or endorsement of the views expressed within them.

Every effort is made to keep the website up and running smoothly. However, www.serrarigroup.com takes no responsibility for, and will not be liable for, the website being temporarily unavailable due to technical issues beyond our control.

Please note that laws, regulations, and information can change rapidly, and we advise you to conduct further research and seek professional advice when necessary.

By using www.serrarigroup.com, you agree to this disclaimer and its terms. If you do not agree with this disclaimer, please do not use the website.

www.serrarigroup.com, reserves the right to update, modify, or remove any part of this disclaimer without prior notice. It is your responsibility to review this disclaimer periodically for changes.

Serrari Group 2025