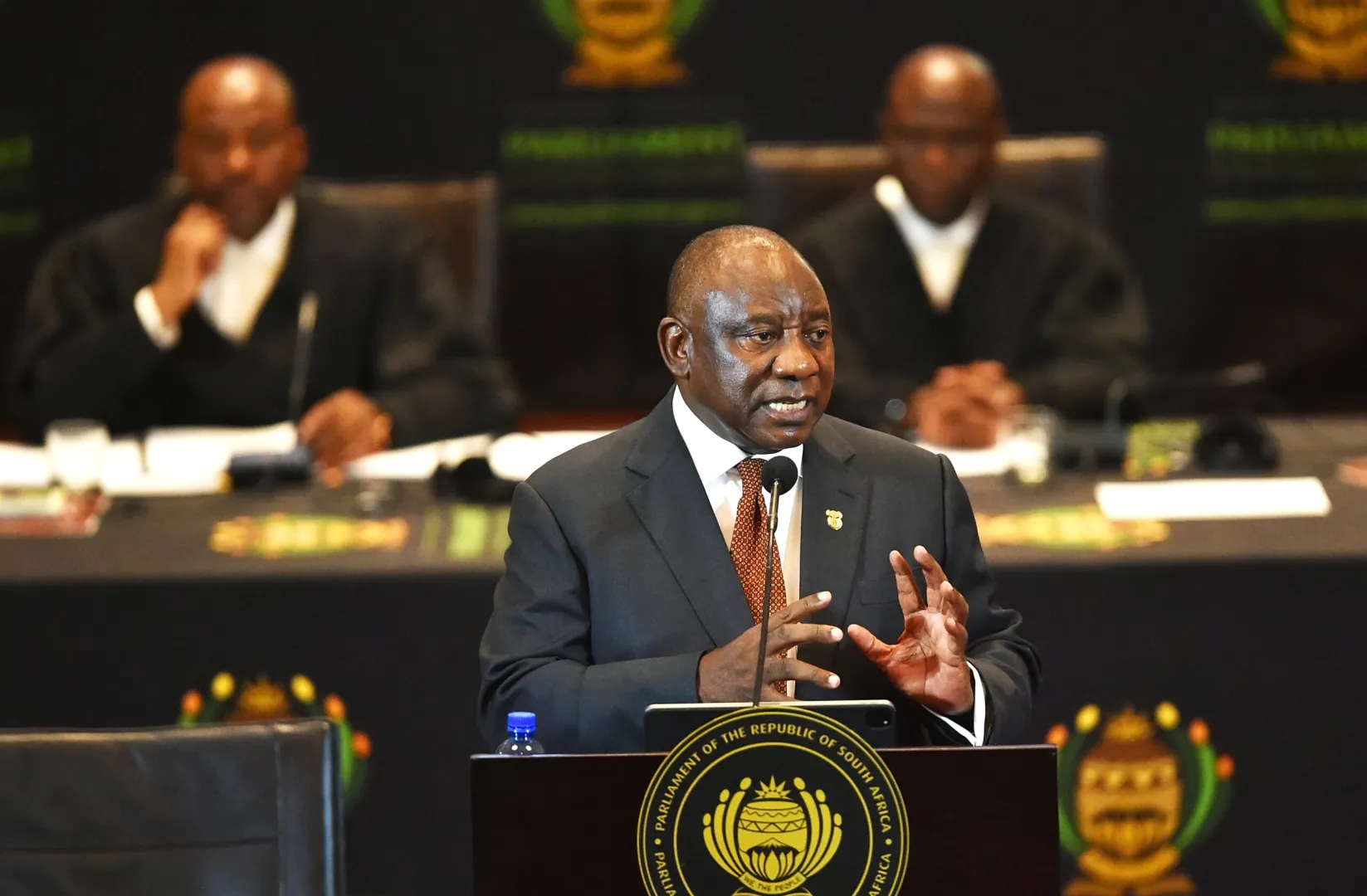

JOHANNESBURG, October 8, 2025 — South African President Cyril Ramaphosa has taken the extraordinary step of declaring an “economic emergency,” unveiling an ambitious 10-point recovery plan alongside the establishment of a dedicated “Economic War Room” within the Presidency as Africa’s most industrialized nation confronts converging crises threatening economic stability and social cohesion. The dramatic announcement comes as the ruling African National Congress (ANC) faces its own existential financial crisis while the country’s embattled power utility prepares for potentially explosive wage negotiations that could jeopardize recent improvements in electricity supply.

Build the future you deserve. Get started with our top-tier Online courses: ACCA, HESI A2, ATI TEAS 7, HESI EXIT, NCLEX-RN, NCLEX-PN, and Financial Literacy. Let Serrari Ed guide your path to success. Enroll today.

The declaration represents one of the most significant interventions in South Africa’s economic management since the democratic transition three decades ago, signaling the government’s recognition that conventional policy approaches have proven insufficient to address structural challenges including mass unemployment, anemic growth, infrastructure deficits, and declining living standards for millions of citizens. By framing the situation as an emergency requiring extraordinary measures, Ramaphosa seeks to mobilize political will and bureaucratic capacity for implementation of reforms long advocated but rarely executed with sustained commitment.

The Economic War Room: Accountability Through Centralized Coordination

At the heart of Ramaphosa’s emergency response sits the newly created Economic War Room, a task force positioned within the Presidency designed to overcome the coordination failures, bureaucratic inertia, and accountability deficits that have historically undermined South African policy implementation. This institutional innovation reflects lessons from other countries where centralized monitoring units have successfully driven government performance improvements by tracking deliverables, identifying bottlenecks, and applying political pressure to underperforming departments.

“We are treating this as an emergency because it is one,” Ramaphosa emphasized during the initiative’s launch. “The Economic War Room will ensure that government departments are held accountable, that delivery is tracked, and that South Africans see the impact of our actions.” The President’s language deliberately evokes crisis response frameworks, suggesting a departure from business-as-usual governance toward more urgent, results-oriented approaches.

The War Room’s mandate encompasses coordinating government performance across multiple dimensions including job creation, state efficiency improvements, and industrial growth acceleration. By consolidating oversight within the Presidency rather than distributing responsibility across ministries with competing priorities and bureaucratic cultures, the mechanism aims to break through siloed operations that have historically prevented coordinated policy implementation. Success will depend critically on the unit’s authority to compel departmental action, access to real-time performance data, and political backing to hold senior officials accountable for failures.

The 10-Point Plan: Comprehensive Strategy or Familiar Promises?

The ANC’s 10-point plan represents the substantive policy agenda that the Economic War Room will coordinate and monitor. While specific details of all ten points were not fully elaborated in initial announcements, the framework encompasses job creation as a central priority—addressing South Africa’s catastrophic unemployment crisis where official rates exceed 30 percent and youth unemployment approaches 60 percent in some measurements.

State efficiency improvements constitute another pillar, acknowledging widespread recognition that South African government departments frequently fail to execute mandates effectively despite substantial budgets. Corruption, capacity deficits, political interference in professional administration, and dysfunctional procurement systems have created a public sector that often frustrates rather than facilitates economic activity. Reforms targeting these pathologies—including professionalizing civil service recruitment, strengthening anti-corruption enforcement, and streamlining regulatory processes—could yield substantial economic dividends.

Industrial growth acceleration features prominently, reflecting aspirations to revitalize manufacturing sectors that have struggled amid global competition, infrastructure constraints, and policy uncertainty. South Africa’s industrial base has eroded substantially over recent decades, with manufacturing’s GDP share declining and job losses mounting in traditional sectors. Reversing this trajectory requires addressing multiple binding constraints including electricity reliability, logistics efficiency, skills availability, and regulatory predictability—challenges requiring sustained policy attention rather than short-term interventions.

Additional elements likely include infrastructure investment acceleration, particularly in transportation and digital connectivity; small business support through regulatory relief and financing access; skills development addressing mismatches between education outputs and labor market demands; and measures promoting investment in priority sectors including renewable energy, mining beneficiation, and agricultural value chains.

Context: Persistent Unemployment and Sluggish Growth

Ramaphosa’s emergency declaration acknowledges realities that South Africans experience daily but that official discourse has often downplayed. The country’s economic growth has remained disappointingly weak for over a decade, rarely exceeding 2 percent annually and frequently falling below population growth rates—dynamics that translate into declining per capita incomes and shrinking opportunities for the majority.

Unemployment has reached catastrophic levels by any international standard, with the official rate hovering around 32-33 percent and the expanded definition including discouraged workers exceeding 40 percent. Youth unemployment presents particularly stark challenges, with the majority of young people unable to secure formal employment despite relatively high secondary and tertiary education completion rates. This jobs crisis creates social instability, perpetuates poverty across generations, and represents massive waste of human potential.

Power sector challenges, while improved from the crisis years of relentless load-shedding, remain precarious. Eskom’s generation fleet continues operating with minimal reserve margins, aging infrastructure, and maintenance backlogs that could trigger renewed supply shortfalls. The utility’s financial sustainability remains questionable despite bailouts and tariff increases, with operational inefficiencies and debt service consuming resources that should fund capital investment and system reliability improvements.

Currency Stability Amid Turbulence: A Silver Lining

Despite the economic emergency declaration and multiple concurrent crises, South Africa’s rand demonstrated relative stability, trading around R17.21 to the dollar on Tuesday—a level that suggests investor resilience amid domestic and global volatility. This currency performance, supported by foreign reserves rising to $67.9 billion from $65.9 billion in August, exceeds some analysts’ expectations and provides authorities with greater policy flexibility than volatile currency conditions would permit.

The rand’s stability partly reflects South Africa’s deep and liquid financial markets, which continue attracting portfolio investment despite economic underperformance and political uncertainties. High real interest rates—with the South African Reserve Bank maintaining restrictive monetary policy to control inflation—make rand-denominated assets attractive to yield-seeking international investors. Additionally, commodity price cycles influence the currency, with South Africa’s substantial mineral exports benefiting from sustained global demand for platinum group metals, gold, and other resources.

However, currency stability should not be mistaken for economic health. Portfolio investment flows that support the rand can reverse quickly if risk perceptions change, and South Africa has experienced multiple episodes where sudden capital outflows triggered sharp currency depreciation. The current stability provides a window for implementing reforms, but it does not eliminate urgency or reduce the need for addressing structural economic weaknesses.

One decision can change your entire career. Take that step with our Online courses in ACCA, HESI A2, ATI TEAS 7, HESI EXIT, NCLEX-RN, NCLEX-PN, and Financial Literacy. Join Serrari Ed and start building your brighter future today.

Eskom Wage Negotiations: Potential Flashpoint

Parallel to the government’s economic emergency response, Eskom faces potentially contentious wage negotiations with organized labor. The utility’s largest union is demanding a 15 percent pay increase—more than four times the current inflation rate—following Eskom’s partial stabilization of the national grid after years of devastating rolling blackouts that crippled businesses and disrupted households.

The wage demand reflects several dynamics. First, Eskom workers have endured years of operational pressure, long hours, and public criticism during the load-shedding crisis. With electricity supply improved, unions argue that workers deserve compensation for their contributions to stabilization. Second, cost-of-living pressures weigh on workers across income levels, with food and fuel costs remaining elevated despite moderating inflation. Third, unions operate in competitive political environments where militant positions strengthen leadership credibility with members.

From Eskom’s perspective, a 15 percent wage increase would impose substantial additional costs on a utility already struggling with financial sustainability. The company’s spokesperson, Daphne Mokwena, declined to discuss specific wage demands, noting that formal negotiations had not yet commenced. This diplomatic silence likely reflects internal deliberations about negotiating strategies and fiscal constraints limiting the utility’s ability to accommodate union demands without further tariff increases or government bailouts.

Analysts warn that the standoff could reignite tensions in the energy sector, potentially disrupting the fragile power recovery that has brought relief to businesses and households. While strike action remains a possibility if negotiations deadlock, both sides face strong incentives to reach accommodation. Eskom cannot afford extended work stoppages that would compromise grid stability, while unions recognize that aggressive action threatening electricity supply risks public backlash and political intervention against workers’ interests.

The wage negotiations unfold against broader questions about public sector compensation in South Africa. Government and state-owned enterprise wage bills consume substantial portions of budgets, constraining resources available for capital investment and service delivery. Yet workers argue that executive mismanagement and corruption—not employee compensation—explain poor performance, and that front-line staff should not bear adjustment costs for failures they did not cause.

ANC’s Insolvency Crisis: Political Implications

Adding complexity to South Africa’s multifaceted crisis, the ruling ANC itself confronts potential insolvency. Reports indicate that the party’s bank accounts have been attached to settle debts exceeding $4.5 million—a development threatening access to over $55 million in state funding and private contributions ahead of crucial local elections scheduled for next year.

The ANC’s financial troubles reflect deeper organizational challenges afflicting a liberation movement struggling to adapt to routine democratic governance. Party membership and subscription revenues have declined substantially from peak levels, while operational costs remain elevated. Factionalism within the party has diverted resources toward internal battles rather than electoral preparation. Financial controls have proven inadequate, with irregular expenditures and questionable contracts contributing to the debt accumulation.

State funding for political parties in South Africa operates through formulas based on electoral performance and parliamentary representation. The ANC’s dominant position ensures substantial public funding, but access to these resources depends on maintaining banking relationships and avoiding legal attachments. If creditors successfully block party accounts, the ANC could face severe constraints on normal operations including staff salaries, office expenses, and campaign activities.

Party insiders fear the financial blow could weaken the ANC’s campaign capacity and deepen internal divisions already threatening organizational cohesion. The 2024 national elections saw the ANC lose its parliamentary majority for the first time since 1994, forcing coalition formation with opposition parties including the Democratic Alliance. Local elections present opportunities for opposition parties to further erode ANC dominance at municipal level, particularly if financial constraints limit the ruling party’s campaigning effectiveness.

The ANC’s financial crisis carries implications beyond partisan politics. As the party that led South Africa’s liberation struggle and has governed continuously since democracy, the ANC’s institutional health affects political stability and policy continuity. While many South Africans welcome increased political competition and ANC accountability, organizational collapse could create governance vacuums and factional conflicts with destabilizing consequences.

Legal and Regulatory Complications

South Africa’s crisis environment includes significant legal and regulatory developments affecting economic management. Lobby group AfriForum successfully obtained a temporary court order halting Eskom’s $2.8 billion settlement with the National Energy Regulator of South Africa (Nersa), characterizing the deal as “unlawful and lacking transparency.”

The ruling has been celebrated as a victory for public accountability, with AfriForum arguing that opaque regulatory agreements undermine democratic oversight and enable continued mismanagement. However, the court intervention complicates Eskom’s financial restructuring efforts, which depend on regulatory certainty regarding tariff determinations and historical debt resolutions. The case illustrates tensions between transparency demands, regulatory efficiency, and utilities’ operational requirements—balances that South African institutions continue negotiating.

Separately, the Government Employees Pension Fund (GEPF) announced a temporary freeze on new “two-pot” withdrawal applications from October 7-21 for system upgrades. The two-pot retirement system, recently implemented, allows limited pre-retirement withdrawals from pension savings—a reform addressing liquidity needs while attempting to preserve retirement security. The temporary freeze, while operationally necessary for system maintenance, inconveniences members relying on accessing savings and highlights implementation challenges accompanying financial system reforms.

Business Sentiment and Defensive Positioning

Underlying South Africa’s economic challenges is widespread business caution reflected in corporate behavior. South African companies are holding record cash deposits worth approximately $96 billion, adopting defensive financial strategies amid economic uncertainty. This liquidity hoarding, while prudent from individual firm perspectives, creates macroeconomic headwinds by reducing investment, employment creation, and demand that would stimulate growth.

Businesses cite multiple factors justifying conservative financial management: policy uncertainty affecting long-term planning, infrastructure unreliability increasing operational risks, regulatory complexity raising compliance costs, and political instability creating governance concerns. Until confidence improves regarding South Africa’s economic trajectory and policy environment, corporations will likely maintain defensive postures prioritizing balance sheet strength over growth investment.

International Dimensions and Investor Perceptions

South Africa’s crisis unfolds as international investors reassess emerging market exposures amid global monetary policy divergence, geopolitical tensions, and growth slowdowns in major economies. The country’s credit ratings, while avoiding further downgrades recently, remain below investment grade from major agencies—a status limiting institutional investment and raising borrowing costs for government and corporations.

Yet despite challenges, South Africa retains advantages including sophisticated financial markets, strong legal and accounting frameworks, diversified economy, and abundant natural resources. International investors give South Africa “benefit of the doubt,” as evidenced by rand stability and continued portfolio inflows, but this patience is not unlimited. Failure to demonstrate credible reform implementation and economic turnaround could trigger reassessment with significant capital flow consequences.

The Path Forward: Implementation Challenges

Ramaphosa’s economic emergency declaration and 10-point plan represent necessary acknowledgment of crisis conditions and articulation of response framework. However, South Africa’s history includes multiple economic strategies, summit agreements, and reform commitments that generated initial optimism before foundering on implementation challenges, political resistance, and bureaucratic incapacity.

Success requires overcoming deeply entrenched obstacles. State capacity deficits—reflecting years of political deployments over meritocratic appointments, corruption undermining institutional functioning, and budget constraints limiting resources—cannot be remedied quickly. Vested interests benefiting from current arrangements will resist reforms threatening privileges. Coalition governance dynamics create additional complexity, requiring negotiation and compromise among parties with different ideological orientations and constituencies.

The Economic War Room’s effectiveness depends on translating monitoring and accountability into actual performance improvements. Previous oversight mechanisms have struggled to move beyond reporting failures to compelling corrective action, particularly when political considerations protect underperforming officials. Whether this iteration succeeds where predecessors faltered remains uncertain.

Ultimately, South Africa’s trajectory depends on political will for difficult choices, administrative capacity for effective implementation, and social cohesion enabling reforms benefiting long-term prosperity even if imposing near-term adjustment costs. The emergency declaration signals recognition that business-as-usual approaches have failed. Whether this recognition translates into sustained reform implementation or proves another false start will determine whether South Africa reverses decline or continues struggling with crises that undermine the promise of its democratic transition.

Ready to take your career to the next level? Join our Online courses: ACCA, HESI A2, ATI TEAS 7 , HESI EXIT , NCLEX – RN and NCLEX – PN, Financial Literacy!🌟 Dive into a world of opportunities and empower yourself for success. Explore more at Serrari Ed and start your exciting journey today! ✨

Track GDP, Inflation and Central Bank rates for top African markets with Serrari’s comparator tool.

See today’s Treasury bonds and Money market funds movement across financial service providers in Kenya, using Serrari’s comparator tools.

Photo source: Google

By: Montel Kamau

Serrari Financial Analyst

8th October, 2025

Article, Financial and News Disclaimer

The Value of a Financial Advisor

While this article offers valuable insights, it is essential to recognize that personal finance can be highly complex and unique to each individual. A financial advisor provides professional expertise and personalized guidance to help you make well-informed decisions tailored to your specific circumstances and goals.

Beyond offering knowledge, a financial advisor serves as a trusted partner to help you stay disciplined, avoid common pitfalls, and remain focused on your long-term objectives. Their perspective and experience can complement your own efforts, enhancing your financial well-being and ensuring a more confident approach to managing your finances.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Readers are encouraged to consult a licensed financial advisor to obtain guidance specific to their financial situation.

Article and News Disclaimer

The information provided on www.serrarigroup.com is for general informational purposes only. While we strive to keep the information up to date and accurate, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability with respect to the website or the information, products, services, or related graphics contained on the website for any purpose. Any reliance you place on such information is therefore strictly at your own risk.

www.serrarigroup.com is not responsible for any errors or omissions, or for the results obtained from the use of this information. All information on the website is provided on an as-is basis, with no guarantee of completeness, accuracy, timeliness, or of the results obtained from the use of this information, and without warranty of any kind, express or implied, including but not limited to warranties of performance, merchantability, and fitness for a particular purpose.

In no event will www.serrarigroup.com be liable to you or anyone else for any decision made or action taken in reliance on the information provided on the website or for any consequential, special, or similar damages, even if advised of the possibility of such damages.

The articles, news, and information presented on www.serrarigroup.com reflect the opinions of the respective authors and contributors and do not necessarily represent the views of the website or its management. Any views or opinions expressed are solely those of the individual authors and do not represent the website's views or opinions as a whole.

The content on www.serrarigroup.com may include links to external websites, which are provided for convenience and informational purposes only. We have no control over the nature, content, and availability of those sites. The inclusion of any links does not necessarily imply a recommendation or endorsement of the views expressed within them.

Every effort is made to keep the website up and running smoothly. However, www.serrarigroup.com takes no responsibility for, and will not be liable for, the website being temporarily unavailable due to technical issues beyond our control.

Please note that laws, regulations, and information can change rapidly, and we advise you to conduct further research and seek professional advice when necessary.

By using www.serrarigroup.com, you agree to this disclaimer and its terms. If you do not agree with this disclaimer, please do not use the website.

www.serrarigroup.com, reserves the right to update, modify, or remove any part of this disclaimer without prior notice. It is your responsibility to review this disclaimer periodically for changes.

Serrari Group 2025