1. How do I calculate simple interest online?

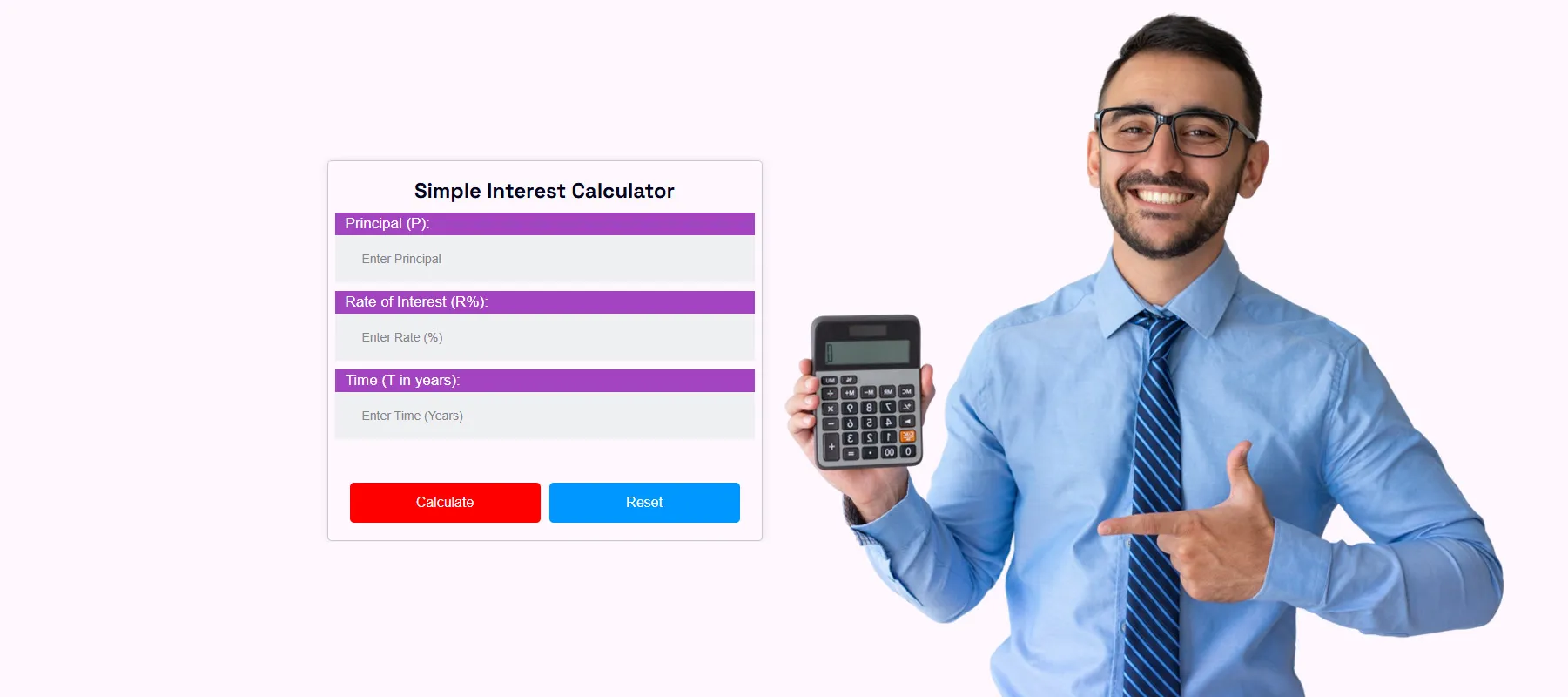

To calculate simple interest online, use a dedicated Simple Interest Calculator that requires you to input:

- Principal (P): The initial amount of money

- Rate of interest (R): The annual interest rate in percentage

- Time (T): The time the money is invested or borrowed for, usually in years

The calculator uses the equation for simple interest:

Simple Interest (SI)=100(P×R×T)

Example:

If you invest $1,000 at 5% annual interest for 3 years:

SI=100(1000×5×3)=$150

The calculator instantly shows the interest earned and often also provides the total amount (Principal + Interest). You can find reliable simple interest calculator tools on sites like NerdWallet or Calculator.net. For a comprehensive suite of financial tools, including a simple interest calculator, visit Serrari Group.

Push boundaries, reach goals, achieve more. Whether it’s ACCA, HESI A2, ATI TEAS 7, HESI EXIT, NCLEX-RN, NCLEX-PN, or Financial Literacy, we’ve got the course to match your ambition. Start with Serrari Ed now.

2. What is the best free simple interest calculator?

The best free simple interest calculator should:

- Be easy to use with clear fields for principal, rate, and time

- Provide instant results for both interest earned and total amount

- Support various time formats (years, months, days)

- Allow quick conversions between currency types or units (optional)

Reputable options are typically found on:

- Financial education websites

- Personal finance blogs

- Bank or credit union websites

- Online math tools or calculator directories

Always ensure the tool uses the correct equation for simple interest and doesn’t default to compound calculations unless stated.

3. Where can I find a simple interest calculator with principal, rate, and time inputs?

You can find many such calculators by searching:

- “Simple interest calculator with principal rate time”

- “Free online simple interest tool”

- “Simple interest calculator yearly or monthly”

Look for tools that offer clearly labeled input boxes for:

- Principal (P)

- Interest Rate (R) (as an annual percentage)

- Time (T) (in years, or allow months/days as optional formats)

A good calculator will immediately return:

- Simple Interest earned

- Total Accumulated Value (Principal + Interest)

These tools are ideal for evaluating personal loans, short-term savings, or straightforward interest earnings.

4. How is simple interest different from compound interest in calculations?

The main difference lies in how the interest is applied:

- Simple Interest is calculated only on the principal amount throughout the investment or loan period.

- Compound Interest is calculated on the principal plus accumulated interest, leading to exponential growth.

Equation for simple interest:

SI=100(P×R×T)

Formula for Compound Interest:

CI=P×(1+100R)T−P

Where:

- = Principal

- R = Annual interest rate

- T = Time in years

Simple interest results in linear growth, while compound interest grows faster over time due to reinvested interest. Simple interest is often used in short-term loans and some bank products. You can learn more about the differences on sites like Investopedia.

5. What formula does a simple interest calculator use?

A simple interest calculator uses the standard equation for simple interest:

Simple Interest=100(Principal×Rate×Time)

Where:

- Principal (P) = Initial investment or loan amount

- Rate (R) = Annual interest rate (in %)

- Time (T) = Time period in years

Example:

For P=$2,000, R=6%, T=2 years:

SI=100(2000×6×2)=$240

The total amount payable (A) is:

A=Principal+Simple Interest=$2,000+$240=$2,240

This formula for simple interest assumes the interest is not reinvested, and that it remains constant throughout the time period.

Fuel your success with knowledge that matters. Enroll in career-defining programs: ACCA, HESI A2, ATI TEAS 7, HESI EXIT, NCLEX-RN, NCLEX-PN, and Financial Literacy. Join Serrari Ed now and take control of your future.

6. Can I calculate interest earned on a loan using simple interest?

Yes, you can calculate interest earned on a loan using simple interest, especially if the loan agreement follows a non-compounding structure. Many short-term loans, car loans, or personal finance products use simple interest formulas for easier repayment tracking.

To do this, apply the simple interest formula:

SI=100(Principal×Rate×Time)

Where:

- Principal is the loan amount

- Rate is the annual interest rate (%)

- Time is the duration of the loan in years (or a fraction thereof)

Example:

If you borrow $10,000 at 8% interest for 1.5 years:

SI=100(10,000×8×1.5)=$1,200

So, you’d owe $1,200 in interest, and your total repayment would be $11,200. Always check the loan terms — some lenders may switch to compound interest models for longer durations or missed payments.

7. How do I calculate simple interest over months or years?

To calculate simple interest over months or years, adjust the time (T) component of the equation for simple interest accordingly:

Formula:

SI=100(Principal×Rate×Time)

- If time is in years, use it as-is.

- If time is in months, convert months to years by dividing by 12.

- If time is in days, divide the number of days by 365 (or 360 for commercial interest).

Examples:

- For 6 months →T=6/12=0.5 years

- For 90 days →T=90/365≈0.2466 years

Use Case:

If you invest $3,000 at 4% for 6 months:

SI=100(3000×4×0.5)=$60

This allows flexibility in using the simple interest calculator for shorter or non-annual periods.

8. What inputs are needed for a simple interest calculator?

A typical simple interest calculator requires three main inputs:

- Principal (P) – The amount of money invested or borrowed

- Annual Interest Rate (R) – In percentage format (e.g., 5%)

- Time (T) – Usually in years, but many calculators allow for months or days

Optional features on advanced calculators may include:

- Dropdowns to select time units (years, months, days)

- Total value output (Principal + Interest)

- Currency symbol selector

Once all inputs are entered, the calculator uses the equation for simple interest:

SI=100(P×R×T)

It then typically displays both Simple Interest and Total Accrued Amount.

9. Is there an easy tool to calculate simple interest for savings or investments?

Yes, there are many simple, user-friendly tools online to calculate simple interest on savings or fixed investments using the simple interest model. These tools are especially helpful when:

- The interest is not compounded

- The timeframe is short (e.g., savings bonds, certificates of deposit, or fixed-term deposits)

- You want to see straightforward growth without reinvestment

Search for:

- “Simple interest savings calculator”

- “Straight interest earnings calculator”

Enter your deposit amount, rate, and time period, and the tool will return the interest earned and total future value. These tools are ideal for comparing basic investment products.

10. How accurate are online simple interest calculators?

Online simple interest calculators are highly accurate, as long as:

- You enter the correct principal, interest rate, and time

- The calculator is based on the correct equation for simple interest

- You’re calculating based on simple interest (not compound)

Since simple interest does not involve compounding, the math is straightforward and the margin for error is minimal.

However, accuracy can vary depending on:

- Whether the calculator uses 365-day or 360-day year convention for daily interest

- Whether it allows fractional time periods (e.g., 2.5 years)

- Currency and rounding settings (if applicable)

For loans, savings, or quick comparisons, these tools are very reliable, and often used for educational, financial, and business purposes.

Ready to take your career to the next level? Join our dynamic courses: ACCA, HESI A2, ATI TEAS 7 , HESI EXIT , NCLEX – RN and NCLEX – PN, Financial Literacy!🌟 Dive into a world of opportunities and empower yourself for success. Explore more at Serrari Ed and start your exciting journey today! ✨