In a milestone achievement for East Africa’s telecommunications industry, Safaricom PLC (NSE: SCOM) reported total revenue of KES 388.7 billion (approximately $3 billion) for the year ended March 31, 2025—an 11.2 percent increase over the prior year. Net income climbed 10.8 percent to KES 69.8 billion, while Earnings Before Interest and Taxes (EBIT) surged 29.5 percent to KES 104.1 billion. The Board approved a total dividend payout of KES 48.08 billion, comprising a final 65 cents per share on top of the 55 cents interim dividend already distributed. These results cap off a five‑year transformation strategy that has steered Safaricom from a pure‐play telco toward a diversified “TechCo,” powered by digital platforms, financial services and community investment TechAfrica News The Star.

Record Financial Performance Anchored by Innovation

Safaricom’s topline growth was anchored in sustained innovation across its core and emerging businesses. Service revenue rose 10.8 percent to KES 371.4 billion, with voice, data and mobile‐money services all delivering double‑digit expansion. Voice revenue bucked a global downturn in traditional telephony by growing 1.8 percent to KES 81.9 billion, thanks to promotional bundles and enhanced network quality. Mobile‐data revenue jumped 16.5 percent to KES 78.5 billion, fueled by 4G‑to‑5G migrations and rising smartphone penetration. Meanwhile, M‑PESA—Safaricom’s flagship mobile‐money platform—contributed KES 161.1 billion to service revenue, up 15.1 percent year‑on‑year, as the company deepened its push into savings, credit and merchant solutions TechAfrica News.

With economies of scale kicking in, Safaricom’s operating free cash flow surged 15.8 percent to KES 148.9 billion, reinforcing its balance‑sheet strength. The capital‐expenditure program, which peaked earlier in the transformation cycle, has begun moderating, enabling the company to redeploy cash into high‑yielding tech initiatives and shareholder returns. Management highlighted that robust cost management and enhanced network efficiencies underpinned the EBIT margin expansion, as Safaricom achieved a rare trifecta of revenue growth, margin improvement and rising cash generation.

Driving Growth: M‑PESA’s Evolution and Connectivity Gains

Launched in 2007, M‑PESA has long been the backbone of Safaricom’s digital ecosystem. Celebrating its 18th anniversary last year, the service now handles over KES 5 trillion in annual transaction value and serves more than 40 million active users across Kenya and Ethiopia. In Kenya alone, active M‑PESA accounts grew by 10 percent to 28 million, with transaction volumes rising 14 percent. Safaricom has deepened M‑PESA’s value proposition by rolling out consumer lending (Fuliza overdrafts), merchant disbursements (Lipa Na M‑PESA), and wealth‑management products in partnership with local asset managers. This diversification drove the platform’s 15.2 percent year‑on‑year revenue growth, making it the single largest contributor (44.2 percent) to Kenyan service revenue .

On the connectivity front, Safaricom’s flagship mobile‑data business grew by 15.2 percent to KES 72.9 billion, supported by a rapid expansion of 4G coverage to 95 percent of the population and the live launch of its 5G network in Nairobi, Mombasa and Kisumu. Voice services—a segment under pressure in many markets—grew by 1.6 percent to KES 80.8 billion as Safaricom introduced innovative “booster” voice bundles and invested in voice‑over‑5G (Vo5G) technology to enhance call clarity. The company also accelerated its fixed‑broadband rollout, targeting underserved peri‑urban areas through fiber and microwave backhaul partnerships, setting the stage for converged home‐connectivity offerings.

Ethiopian Expansion: From Investment to Imminent Profitability

Safaricom broke new ground in 2022 by securing Ethiopia’s first privately‑operated telecom license in decades. In the 2025 financial year, Safaricom Ethiopia contributed nearly 10 percent of group revenue, processing over KES 20.6 billion in M‑PESA transactions and serving 8.8 million mobile subscribers across 3,141 live sites. Active M‑PESA users in Ethiopia reached 2.8 million, reflecting growing trust in mobile finance amid low banking penetration. Having surpassed the peak‑investment phase, management reaffirmed its expectation that the Ethiopian unit will break even by FY 2027, despite currency‑volatility headwinds and logistical challenges Reuters.

Safaricom’s Ethiopia play underscores a long‑term vision: replicating its Kenyan success on Africa’s second‑largest population base. The network rollout prioritizes rural and semi‑urban districts, leveraging modular tower designs and renewable‑powered base stations to manage operational costs. Meanwhile, M‑PESA’s expansion into savings, bill‑payment and merchant‑payments services is underway, in partnership with local microfinance institutions and utilities. By weaving digital finance with connectivity, Safaricom aims to accelerate financial inclusion in a market where only 15 percent of adults hold formal bank accounts.

Tech Innovation: 5G, Satellite Partnerships & the Road Ahead

While 4G remains the workhorse of Safaricom’s data business, the company is bullish on 5G as a catalyst for enterprise and consumer innovation. In April 2025, Safaricom simplified access to its 5G network—now covering all major urban centers—by slashing the price of consumer routers from KES 25,000 ($192) to just KES 3,000 ($23). Early adopters now deploy the technology for remote‑learning hubs, telemedicine clinics and precision‑agriculture sensors in Kenya’s agricultural heartlands TechCabal.

On the fixed‑broadband front, Safaricom is exploring strategic tie‑ups with satellite‐internet providers to extend high‑speed connectivity to off‑grid communities. As competition from global players such as Starlink intensifies, the telco is negotiating capacity‑leasing agreements that would blend its terrestrial fiber network with low‑Earth‐orbit satellite backhaul, reaching schools, health centers and SMEs in the last mile TechCabal.

Internally, Safaricom has ramped up investment in AI‑driven network‑optimization tools, predictive maintenance for cell sites, and data‑analytics platforms that monitor customer experience in real time. These “smart‑core” initiatives—running on hybrid cloud infrastructure—are designed to reduce service‐outage times by up to 40 percent and improve energy efficiency across the network.

Macroeconomic & Competitive Context

Safaricom’s stellar performance comes amid a stabilizing Kenyan economy. April 2025 inflation ticked up slightly to 4.1 percent, remaining comfortably within the Central Bank’s 2.5–7.5 percent target range. In April, the Central Bank surprised markets with a 75 basis‑point rate cut to 10.0 percent—the fifth consecutive reduction—to spur private‑sector lending and consumption. Meanwhile, the Stanbic Bank Kenya Purchasing Managers’ Index rose to 52.0 in April, signaling the strongest business‑activity expansion in 27 months Reuters.

On the regional stage, Airtel Africa is forecast to deliver over 20 percent revenue growth in FY 2025, outpacing MTN (17.2 percent) and Orange (9 percent), as it deepens its mobile‑money and broadband offerings in East Africa. Airtel’s mobile‑money revenue grew 29.9 percent in constant currency, contributing roughly 20 percent of total group revenue. While Airtel is gaining ground, Safaricom retains a leadership position in mobile‑money penetration, network quality and brand equity across Kenya The Economic Times.

Community Investment & ESG Leadership

Over its five‑year TechCo transformation, Safaricom invested over KES 18 billion in education, health, environmental conservation and economic‑empowerment programs. Key initiatives include:

- Education: The DigiSchool program has equipped over 500 schools with digital‑learning infrastructure, benefiting more than 200,000 students.

- Healthcare: The M‑Health Bus has delivered telemedicine services to 45 remote communities, conducting over 30,000 virtual consultations.

- Environment: Afforestation partnerships have planted over 2 million trees in Kenya’s arid regions, while “Bottle‑2‑Fuel” recycling centers convert plastic waste into cooking briquettes.

- Economic Empowerment: Through the Msitu Africa carbon‑credit platform, over 3,000 smallholder farmers earn supplementary income by sequestering carbon on their land.

These efforts not only align with Safaricom’s purpose‑led vision but also enhance social license to operate, reinforcing customer loyalty and reducing regulatory friction.

Strategic Outlook & Conclusion

Looking ahead, CEO Dr. Peter Ndegwa reiterated Safaricom’s ambition to become “Africa’s leading purpose‑led tech company by 2030.” Key strategic priorities include:

- Deepening Digital Finance: Scaling M‑PESA’s wealth‑management, credit and insurance products to underpin financial inclusion.

- Enterprise Digitization: Rolling out fiber‑to‑the‑office, cloud‑managed SD‑WAN and cybersecurity services to SMEs and corporates.

- Pan‑African Expansion: Leveraging Ethiopia as a launchpad into neighbouring markets—Uganda, South Sudan and Rwanda—either organically or via partnerships.

- Sustainability & ESG: Embedding circular‑economy principles across operations and achieving net‑zero emissions by 2045.

As Safaricom closes its FY 2025 chapter with record revenue, profit and social impact, the company stands at the nexus of connectivity, commerce and community. By continuing to harness cutting‑edge technology, prudent financial stewardship and purpose‑driven initiatives, Safaricom aims to write the next act of its success story—not just for Kenya, but for the broader continent’s digital future.

Ready to take your career to the next level? Join our dynamic courses: ACCA, HESI A2, ATI TEAS 7 , HESI EXIT , NCLEX – RN and NCLEX – PN, Financial Literacy!🌟 Dive into a world of opportunities and empower yourself for success. Explore more at Serrari Ed and start your exciting journey today! ✨

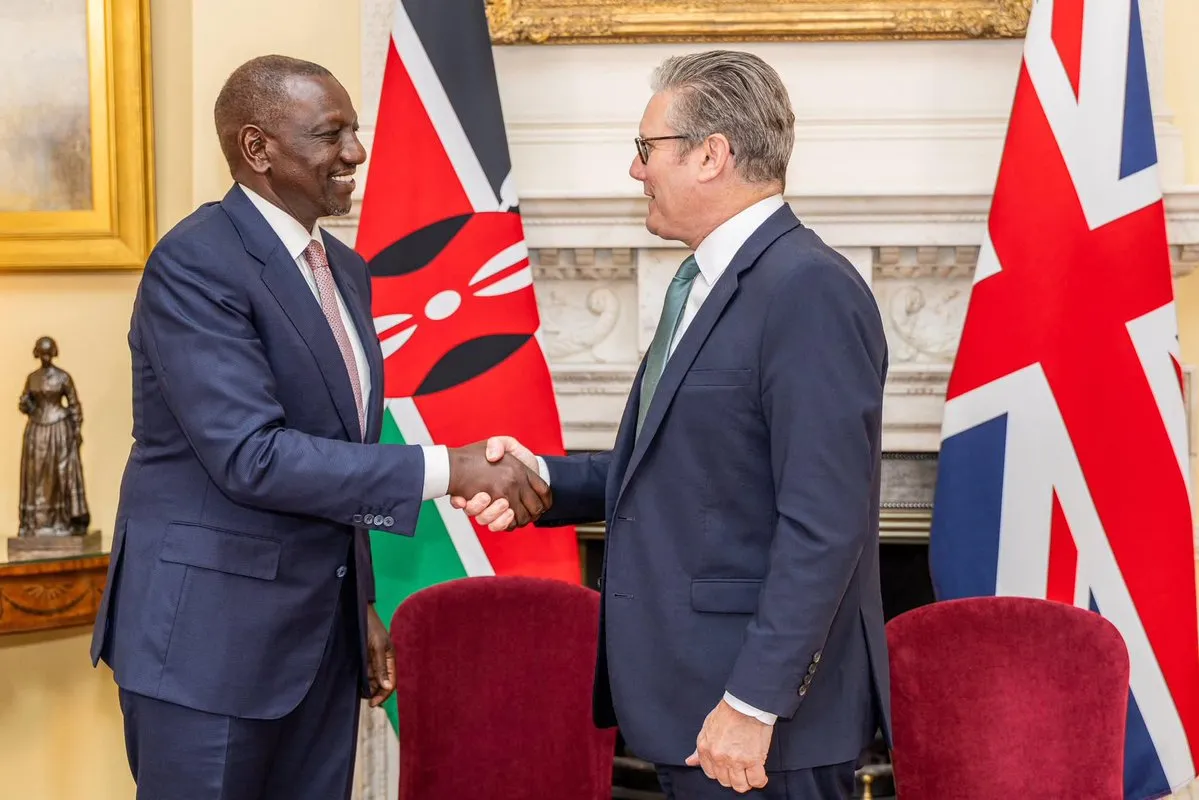

photo source: Google

By: Montel Kamau

Serrari Financial Analyst

9th May, 2025

Article, Financial and News Disclaimer

The Value of a Financial Advisor

While this article offers valuable insights, it is essential to recognize that personal finance can be highly complex and unique to each individual. A financial advisor provides professional expertise and personalized guidance to help you make well-informed decisions tailored to your specific circumstances and goals.

Beyond offering knowledge, a financial advisor serves as a trusted partner to help you stay disciplined, avoid common pitfalls, and remain focused on your long-term objectives. Their perspective and experience can complement your own efforts, enhancing your financial well-being and ensuring a more confident approach to managing your finances.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Readers are encouraged to consult a licensed financial advisor to obtain guidance specific to their financial situation.

Article and News Disclaimer

The information provided on www.serrarigroup.com is for general informational purposes only. While we strive to keep the information up to date and accurate, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability with respect to the website or the information, products, services, or related graphics contained on the website for any purpose. Any reliance you place on such information is therefore strictly at your own risk.

www.serrarigroup.com is not responsible for any errors or omissions, or for the results obtained from the use of this information. All information on the website is provided on an as-is basis, with no guarantee of completeness, accuracy, timeliness, or of the results obtained from the use of this information, and without warranty of any kind, express or implied, including but not limited to warranties of performance, merchantability, and fitness for a particular purpose.

In no event will www.serrarigroup.com be liable to you or anyone else for any decision made or action taken in reliance on the information provided on the website or for any consequential, special, or similar damages, even if advised of the possibility of such damages.

The articles, news, and information presented on www.serrarigroup.com reflect the opinions of the respective authors and contributors and do not necessarily represent the views of the website or its management. Any views or opinions expressed are solely those of the individual authors and do not represent the website's views or opinions as a whole.

The content on www.serrarigroup.com may include links to external websites, which are provided for convenience and informational purposes only. We have no control over the nature, content, and availability of those sites. The inclusion of any links does not necessarily imply a recommendation or endorsement of the views expressed within them.

Every effort is made to keep the website up and running smoothly. However, www.serrarigroup.com takes no responsibility for, and will not be liable for, the website being temporarily unavailable due to technical issues beyond our control.

Please note that laws, regulations, and information can change rapidly, and we advise you to conduct further research and seek professional advice when necessary.

By using www.serrarigroup.com, you agree to this disclaimer and its terms. If you do not agree with this disclaimer, please do not use the website.

www.serrarigroup.com, reserves the right to update, modify, or remove any part of this disclaimer without prior notice. It is your responsibility to review this disclaimer periodically for changes.

Serrari Group 2025