1. What is the Rule of 72 and how is it used?

The Rule of 72 is a quick, mental math formula used to estimate how long it will take for an investment to double in value at a fixed annual rate of interest. It’s also known as the law of 72 calculator or the 72 rule calculator.

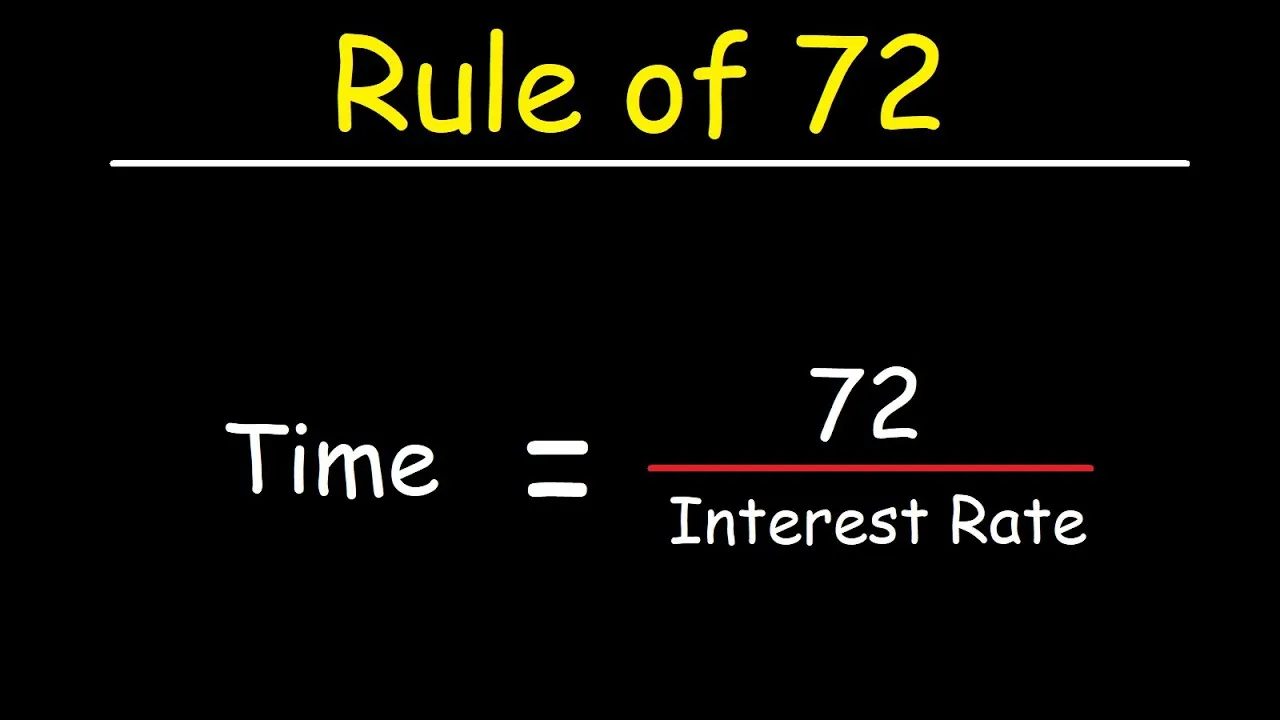

Formula:

Time to double (in years) = 72 divided by Interest rate

Example:

If the annual interest rate is 6%, then the time to double is:

72 ÷ 6 = 12 years

So, your investment will double in approximately 12 years at 6% interest. You can find online tools to help with the rule of 72 calculator on sites like Investopedia or Bankrate. For a comprehensive suite of financial tools, including a rule of 72 calculator, visit Serrari Group.

Push boundaries, reach goals, achieve more. Whether it’s ACCA, HESI A2, ATI TEAS 7, HESI EXIT, NCLEX-RN, NCLEX-PN, or Financial Literacy, we’ve got the course to match your ambition. Start with Serrari Ed now.

2. How do I calculate how long it takes to double my money with the Rule of 72?

To calculate the time, divide 72 by the annual interest rate expressed as a whole number (not a decimal). This is the core of figuring compound interest quickly.

Formula:

Time = 72 divided by Interest Rate

Example:

If your investment grows at 8% annually:

72 ÷ 8 = 9 years

It will take 9 years for the money to double at 8% interest. This is a practical application of the power of 72 calculator.

3. Can the Rule of 72 be used for different interest rates?

Yes, the Rule of 72 works best for interest rates between 6% and 10%, but it can still give a close approximation for other rates. The accuracy slightly decreases for very high or very low rates, but it remains a useful mental shortcut.

Example:

- At 4% interest, time = 72 ÷ 4 = 18 years

- At 12% interest, time = 72 ÷ 12 = 6 years

These are not exact results but are close to actual compound interest calculations. A rule of 72 formula calculator can provide more precise figures if needed.

4. Does the Rule of 72 work with compound interest only?

Yes, the Rule of 72 assumes compound interest, not simple interest. That’s because compound interest leads to exponential growth, which the rule is estimating. This is why it’s sometimes called the power of 72 calculator.

If you were earning simple interest, your investment would grow linearly, not exponentially, and the Rule of 72 would not give an accurate estimate of when the investment doubles.

5. Can the Rule of 72 be used in reverse to find the interest rate needed to double an investment?

Yes, you can reverse the rule of 72 formula calculator to estimate the required interest rate to double your money in a certain number of years.

Formula:

Interest Rate = 72 divided by Time

Example:

If you want your investment to double in 9 years:

72 ÷ 9 = 8%

You would need an 8% annual interest rate to double your investment in 9 years. This is a handy way to estimate compound interest needs.

Fuel your success with knowledge that matters. Enroll in career-defining programs: ACCA, HESI A2, ATI TEAS 7, HESI EXIT, NCLEX-RN, NCLEX-PN, and Financial Literacy. Join Serrari Ed now and take control of your future.

6. How accurate is the Rule of 72 for estimating investment growth?

The Rule of 72 is a simplified estimation, not an exact method. Its accuracy depends on the interest rate. It is most accurate between 6% and 10% annual interest. Outside this range, it becomes less precise because it doesn’t account for the nuances of continuous or monthly compounding.

For example:

- At 8% interest:

- Exact doubling time using logarithms = log(2) ÷ log(1 + 0.08) ≈ 9.01 years

- Rule of 72: 72 ÷ 8 = 9 years — very close

- At 2% interest:

- Exact: ≈ 35 years

- Rule of 72: 72 ÷ 2 = 36 years — fairly close

So while not perfect, it’s a quick and useful tool for estimation, especially when you need to figure compound interest mentally.

7. What is the formula for the Rule of 72 in plain terms?

The Rule of 72 formula calculator in plain terms is:

Time to double = 72 divided by interest rate

Where:

- Time is in years

- Interest rate is expressed as a whole number (e.g., use 6 for 6%, not 0.06)

If you want to rearrange it to find the interest rate:

Interest rate = 72 divided by time

These simple formulas make it easy to mentally estimate compound interest or how long it will take to double money.

8. Why is the number 72 used in the Rule of 72?

The number 72 is used because it is a convenient approximation derived from the natural logarithm of 2, which is involved in doubling. Mathematically:

ln(2) ≈ 0.693

For compound interest with annual compounding, the doubling time is calculated as:

Time = ln(2) divided by ln(1 + r)

When r is small, ln(1 + r) ≈ r, so:

Time ≈ 0.693 divided by r

Multiplying both numerator and denominator by 100 gives:

Time ≈ 69.3 divided by (r × 100)

For simplicity, 69.3 is rounded up to 72 to make it divisible by many common interest rates like 6, 8, 9, and 12. This makes mental calculations easier and is the basis for the law of 72 calculator.

9. How can I use the Rule of 72 for inflation calculations?

You can also use the Rule of 72 to understand how inflation erodes your purchasing power. Instead of interest rate, substitute the inflation rate into the formula.

Formula:

Time for prices to double = 72 divided by Inflation rate

Example:

If inflation is 4% per year:

72 ÷ 4 = 18 years

This means that if inflation stays at 4%, the cost of goods and services will double in about 18 years — showing how inflation reduces your money’s value over time. This is another powerful application of the power of 72 calculator.

10. Can the Rule of 72 be applied to population growth or debt?

Yes, the Rule of 72 can be used to estimate any quantity growing at a constant percentage rate, including:

- Population growth

- National debt

- Prices of goods

- Energy consumption

Example – Population Growth:

If a country’s population grows at 3% annually:

72 ÷ 3 = 24 years

The population will double in about 24 years.

Example – Debt:

If your credit card debt grows at 18% annually (compounded):

72 ÷ 18 = 4 years

Your debt could double in just 4 years if unpaid — a stark warning about compounding interest on loans. This versatility makes the 72 rule calculator a broadly useful tool.

Ready to take your career to the next level? Join our dynamic courses: ACCA, HESI A2, ATI TEAS 7 , HESI EXIT , NCLEX – RN and NCLEX – PN, Financial Literacy!🌟 Dive into a world of opportunities and empower yourself for success. Explore more at Serrari Ed and start your exciting journey today! ✨