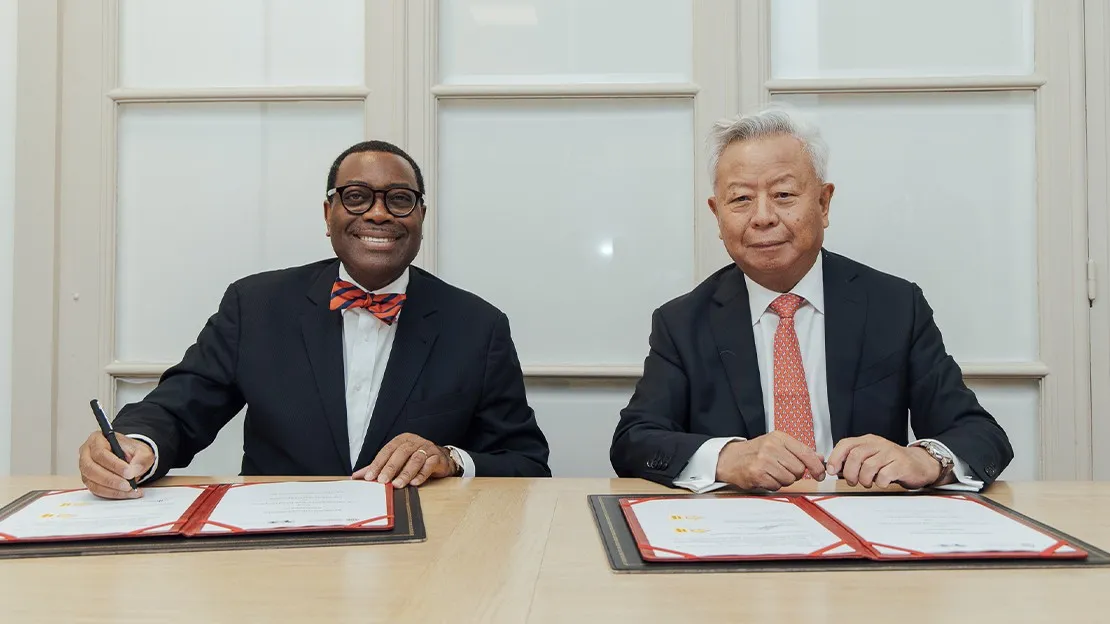

In a significant move set to accelerate sustainable economic development and infrastructure growth across the African continent, the African Development Bank (AfDB) and the Asian Infrastructure Investment Bank (AIIB) have officially renewed their collaborative agreement. The Memorandum of Understanding (MOU), signed on Saturday, June 28, by AfDB President Dr. Akinwumi Adesina and AIIB President and Chair of the Board of Directors Jin Liqun, marks a deepening of a partnership first established in 2018. This pivotal signing took place on the sidelines of a crucial meeting of Heads of Multilateral Development Banks (MDBs) in Paris, underscoring the growing importance of inter-institutional cooperation in addressing global development challenges.

This renewed commitment is poised to unlock substantial economic opportunities and drive critical infrastructure projects, aligning the strengths of two prominent multilateral financial institutions. The agreement is a testament to the shared vision of fostering inclusive growth and building resilient economies, particularly in a continent like Africa that holds immense potential but faces significant development hurdles.

Deepening a Strategic Alliance: Building on Past Success

The initial MOU signed in 2018 laid the groundwork for cooperation between the AfDB and AIIB, recognizing the complementary mandates and geographical focuses of both institutions. The renewal of this agreement signifies that the partnership has proven effective and is now ready to enter a more robust phase, leveraging lessons learned and expanding the scope of collaboration. This continuity provides a stable framework for long-term engagement, ensuring that development efforts are sustained and impactful.

Multilateral Development Banks play a crucial role in global development finance, providing not just capital but also technical expertise, policy advice, and a platform for knowledge sharing. The collaboration between the AfDB, which has deep expertise in African development contexts, and the AIIB, known for its focus on modern, sustainable infrastructure, creates a powerful synergy. This partnership is particularly vital as Africa continues its trajectory towards economic diversification and greater integration into the global economy.

Six Pillars of Progress: A Blueprint for Sustainable Growth

The renewed MOU outlines continued collaboration in six strategically important areas, meticulously aligned with both the African Development Bank Group’s Ten-Year Strategy 2024–2033 and AIIB’s Corporate Strategy, including its Strategy on Financing Operations in Non-Regional Members. These priority areas represent critical sectors for Africa’s sustainable development:

(i) Green Infrastructure: Paving the Way for a Sustainable Future

The focus on green infrastructure is paramount, reflecting a global imperative to address climate change and promote environmental sustainability. For Africa, this translates into investments in renewable energy projects (solar, wind, hydropower), sustainable transport systems (electric mobility, efficient public transport), climate-resilient infrastructure (dams, irrigation systems, early warning systems), and nature-based solutions. Africa is particularly vulnerable to the impacts of climate change, despite contributing the least to global emissions. Investing in green infrastructure not only mitigates these impacts but also harnesses the continent’s vast renewable energy potential, ensuring cleaner energy access and fostering a low-carbon development path. This aligns with global climate goals, such as those outlined in the Paris Agreement, and positions Africa as a leader in sustainable development. Such projects also attract climate finance, which is increasingly available from international sources.

(ii) Industrialization: Driving Economic Transformation and Job Creation

Industrialization is a cornerstone of Africa’s economic transformation agenda. It involves developing robust manufacturing sectors, processing raw materials, and creating value-added products. This process is crucial for job creation, particularly for the continent’s burgeoning youth population, and for diversifying economies away from over-reliance on commodity exports. Infrastructure development, supported by the AfDB and AIIB, is fundamental to industrialization. This includes building industrial parks, improving access to reliable and affordable energy, enhancing transport networks for supply chains, and developing digital infrastructure to support modern manufacturing processes. By fostering industrial growth, the partnership aims to boost intra-African trade, strengthen regional value chains, and enhance Africa’s competitiveness in global markets.

(iii) Private Capital Mobilization, Including Public-Private Partnerships (PPPs): Bridging the Financing Gap

Africa faces a significant infrastructure financing gap, estimated to be in the tens of billions of dollars annually. While MDBs provide crucial public financing, private capital is indispensable to bridge this gap. This priority area focuses on innovative mechanisms to attract private investment into infrastructure projects. This includes co-financing arrangements, where both banks invest alongside private entities, and co-guaranteeing, where their AAA-ratings help de-risk projects for private investors, making them more attractive. Public-Private Partnerships (PPPs) are a key mechanism, allowing governments to leverage private sector expertise and capital for infrastructure development, while ensuring public benefit. The AfDB and AIIB’s involvement helps structure these complex deals, build investor confidence, and ensure projects are bankable and sustainable. This collaborative approach multiplies the impact of public funds by catalysing much larger private investments.

(iv) Cross-Border Connectivity: Fostering Regional Integration and Trade

Improved cross-border connectivity is vital for regional integration, trade facilitation, and the free movement of goods, services, and people across Africa. This priority encompasses the development of interconnected infrastructure networks, including roads, railways, ports, airports, and energy grids that span national borders. By enhancing connectivity, the partnership aims to reduce trade costs, improve market access for businesses, and foster greater economic integration within regional blocs like the African Continental Free Trade Area (AfCFTA). Efficient cross-border infrastructure also supports tourism, cultural exchange, and regional security. Projects in this area often require complex coordination between multiple countries, a role where MDBs like AfDB and AIIB can provide invaluable leadership and technical support.

(v) Digitalization: Powering Africa’s Digital Transformation

In the 21st century, digital infrastructure is as critical as physical infrastructure. This priority area focuses on expanding access to reliable and affordable broadband internet, developing data centers, and fostering digital literacy and innovation. Digitalization drives economic growth by enabling e-commerce, digital financial services, remote work, and online education. It enhances governance through e-government services and improves healthcare delivery through telemedicine. For Africa, bridging the digital divide is essential for ensuring that all citizens can participate in the global digital economy. The AfDB and AIIB’s collaboration will support projects that lay the foundational digital infrastructure, promote digital inclusion, and foster a vibrant digital ecosystem across the continent.

(vi) Policy-Based Financing: Creating an Enabling Environment

Policy-based financing involves providing financial support to countries that are undertaking critical policy reforms and institutional strengthening. This area is crucial for creating a stable, transparent, and predictable environment that attracts investment and ensures the long-term sustainability of development projects. It can include support for reforms in areas such as public financial management, regulatory frameworks, governance, and sector-specific policies that promote sustainable development. By engaging in policy dialogue and providing financial incentives for reforms, the AfDB and AIIB can help African governments build stronger institutions, improve their business environments, and enhance their capacity to plan, implement, and manage complex infrastructure projects effectively. This holistic approach ensures that infrastructure investments are not isolated but are part of a broader strategy for sustainable development.

A Landmark Achievement: The Egypt Sustainable Panda Bond

The existing cooperation between the African Development Bank and AIIB has already yielded tangible results, most notably in providing guarantees to support the issuance of Egypt’s first Sustainable Panda Bond in 2023, valued at RMB 3.5 billion (approximately USD 480 million). This historic issuance was a groundbreaking achievement for several reasons:

- First African Sovereign Bond in Chinese Interbank Market: It marked the first time an African sovereign entity successfully placed a bond in China’s interbank bond market. A “Panda Bond” is a renminbi-denominated bond issued by a non-Chinese issuer in mainland China. This opened up a new, significant source of capital for African nations, diversifying their financing options beyond traditional Western markets.

- De-risking and Investor Confidence: The guarantees provided by the AfDB and AIIB, both triple-A-rated multilateral banks, were instrumental in de-risking the transaction. These guarantees acted as a credit enhancement, significantly reducing the perceived risk for Chinese investors. This enabled Egypt to secure highly competitive terms for the bond, including a favorable interest rate, and attracted a broad base of investor confidence.

- Sustainable Focus: The bond was designated as a “Sustainable Panda Bond,” meaning the proceeds are earmarked for projects with environmental and social benefits. This aligns with both banks’ commitment to sustainable development and signals a growing trend in global finance towards green and social bonds. For Egypt, it allowed the financing of projects related to renewable energy, clean transportation, and social infrastructure.

- Demonstration of Partnership Effectiveness: The success of the Egypt Panda Bond serves as a powerful example of how the AfDB and AIIB can leverage their combined financial strength and expertise to facilitate innovative financing solutions for African countries. It showcases their ability to navigate complex international financial markets and mobilize capital for critical development needs. This precedent is likely to encourage other African nations to explore similar financing avenues.

Leadership Vision: Accelerating Africa’s Development Agenda

The statements from the presidents of both institutions underscore the strategic importance and ambitious goals of this renewed partnership.

Dr. Akinwumi Adesina, President of the African Development Bank, emphasized that this collaboration “continues to be an effective pathway to provide economic development for our member countries, especially in infrastructure.” He highlighted a specific, ambitious target: “By reaffirming today, we are boosting energy access by accelerating Mission 300 which is targeting to connect 300 million people to electricity by 2030.”

Mission 300 is a flagship initiative of the AfDB, aiming to achieve universal energy access in Africa by 2030. Energy access is a foundational pillar for all aspects of development. Without reliable and affordable electricity, it is challenging to power industries, light up homes and schools, run hospitals, and enable digital connectivity. Accelerating Mission 300 through partnerships like this means more children can study after dark, more businesses can operate efficiently, more healthcare facilities can provide critical services, and more communities can thrive. This aligns directly with the AfDB’s “High 5s” strategic priorities: Light up and Power Africa, Feed Africa, Industrialize Africa, Integrate Africa, and Improve the Quality of Life for the People of Africa. The Bank sees energy as the “lifeblood” of economic growth and human development, making this partnership a direct contributor to improving the quality of life for millions.

Mr. Jin Liqun, President and Chair of the Board of Directors of the Asian Infrastructure Investment Bank, echoed this sentiment, stating: “The renewal of our partnership with the African Development Bank reflects AIIB’s commitment to supporting sustainable development beyond Asia. Through this collaboration, we can leverage our combined expertise to deliver transformative projects that will benefit millions across the continent and create prosperity through quality infrastructure investment.”

Mr. Jin’s remarks highlight AIIB’s expanding global footprint and its dedication to its core mission of financing “Infrastructure for Tomorrow.” This philosophy emphasizes sustainability, green principles, technological innovation, and regional connectivity in all its investments. By partnering with the AfDB, AIIB gains deeper insights into the specific needs and contexts of African development, ensuring that its investments are not only financially sound but also socially impactful and environmentally responsible. The focus on “quality infrastructure” means building projects that are durable, efficient, and provide long-term benefits to communities, avoiding white elephants and ensuring value for money.

The Institutions Behind the Partnership

Understanding the mandates and strengths of the two collaborating institutions provides further context for the significance of this MOU.

The African Development Bank (AfDB): Established in 1964, the African Development Bank Group is Africa’s premier development finance institution. Its mission is to spur sustainable economic development and social progress in its regional member countries (RMCs), thus contributing to poverty reduction. The AfDB provides financial and technical support for a wide range of projects, including infrastructure, agriculture, human capital development, and private sector development. With 81 member countries (54 African and 27 non-African), the Bank is a crucial voice for Africa on the global stage and a key driver of the continent’s development agenda, particularly through its “High 5s” priorities.

The Asian Infrastructure Investment Bank (AIIB): The Asian Infrastructure Investment Bank began operations in 2016 and has rapidly emerged as a significant player in the multilateral development finance landscape. Dedicated to financing “infrastructure for tomorrow,” AIIB places sustainability at its core. It now boasts 110 approved members worldwide, with a substantial capitalization of USD 100 billion, and holds a coveted AAA-rating from major international credit rating agencies. AIIB collaborates with partners to mobilize capital and invest in infrastructure and other productive sectors that foster sustainable economic development and enhance regional connectivity, not just in Asia but increasingly across the globe, as evidenced by this renewed partnership with the AfDB.

Addressing Africa’s Infrastructure Gap: A Collaborative Imperative

Africa faces a substantial infrastructure deficit, which is a major impediment to its economic growth and social development. Estimates suggest that the continent needs to invest between $130 billion and $170 billion annually to meet its infrastructure needs, yet it faces a financing gap of $68 billion to $108 billion per year. This gap spans across energy, transport, water, and digital infrastructure.

Partnerships between MDBs like the AfDB and AIIB are not just beneficial; they are a collaborative imperative to address this colossal challenge. By pooling resources, sharing expertise, and co-financing projects, these institutions can achieve a scale and impact that would be difficult for any single entity to accomplish alone. This collaboration also sends a strong signal to private investors, demonstrating confidence and reducing perceived risks, thereby catalyzing further private sector participation.

Global Development Finance and the SDGs

The renewed AfDB-AIIB MOU is a prime example of the evolving landscape of global development finance, characterized by increasing collaboration among MDBs to tackle complex, interconnected global challenges such as climate change, poverty, and inequality. This partnership directly contributes to several of the United Nations Sustainable Development Goals (SDGs):

- SDG 7: Affordable and Clean Energy: Through initiatives like Mission 300 and investments in green infrastructure.

- SDG 8: Decent Work and Economic Growth: By fostering industrialization and creating economic opportunities.

- SDG 9: Industry, Innovation, and Infrastructure: Directly addressing the core mandate of both banks to build resilient infrastructure and promote inclusive and sustainable industrialization.

- SDG 17: Partnerships for the Goals: Embodying the spirit of global cooperation to achieve the 2030 Agenda for Sustainable Development.

While the path ahead for Africa’s development is filled with opportunities, it also presents challenges, including project implementation complexities, governance issues, and debt sustainability concerns. However, strong partnerships built on trust, shared vision, and effective risk mitigation strategies, as demonstrated by the AfDB-AIIB collaboration, are crucial for navigating these challenges. The vast untapped potential of Africa – its young population, abundant natural resources, and growing markets – makes it an attractive destination for sustainable investment.

Conclusion: A Catalyst for Africa’s Prosperity

The renewed Memorandum of Understanding between the African Development Bank and the Asian Infrastructure Investment Bank is more than just a formal agreement; it is a powerful statement of intent and a practical roadmap for accelerating Africa’s sustainable development. By strategically focusing on green infrastructure, industrialization, private capital mobilization, cross-border connectivity, digitalization, and policy-based financing, the partnership addresses the continent’s most pressing needs.

The success of initiatives like the Egypt Sustainable Panda Bond serves as a tangible reminder of the transformative potential of this collaboration. As both Dr. Adesina and Mr. Jin articulated, this alliance is designed to deliver transformative projects that will benefit millions, create prosperity through quality infrastructure investment, and ultimately contribute to a more resilient, integrated, and prosperous Africa. The future of Africa’s development is increasingly collaborative, and this renewed partnership stands as a shining example of how international cooperation can drive meaningful and sustainable change.

Ready to take your career to the next level? Join our dynamic courses: ACCA, HESI A2, ATI TEAS 7 , HESI EXIT , NCLEX – RN and NCLEX – PN, Financial Literacy!🌟 Dive into a world of opportunities and empower yourself for success. Explore more at Serrari Ed and start your exciting journey today! ✨

photo source: Google

By: Montel Kamau

Serrari Financial Analyst

1st July, 2025

Article, Financial and News Disclaimer

The Value of a Financial Advisor

While this article offers valuable insights, it is essential to recognize that personal finance can be highly complex and unique to each individual. A financial advisor provides professional expertise and personalized guidance to help you make well-informed decisions tailored to your specific circumstances and goals.

Beyond offering knowledge, a financial advisor serves as a trusted partner to help you stay disciplined, avoid common pitfalls, and remain focused on your long-term objectives. Their perspective and experience can complement your own efforts, enhancing your financial well-being and ensuring a more confident approach to managing your finances.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Readers are encouraged to consult a licensed financial advisor to obtain guidance specific to their financial situation.

Article and News Disclaimer

The information provided on www.serrarigroup.com is for general informational purposes only. While we strive to keep the information up to date and accurate, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability with respect to the website or the information, products, services, or related graphics contained on the website for any purpose. Any reliance you place on such information is therefore strictly at your own risk.

www.serrarigroup.com is not responsible for any errors or omissions, or for the results obtained from the use of this information. All information on the website is provided on an as-is basis, with no guarantee of completeness, accuracy, timeliness, or of the results obtained from the use of this information, and without warranty of any kind, express or implied, including but not limited to warranties of performance, merchantability, and fitness for a particular purpose.

In no event will www.serrarigroup.com be liable to you or anyone else for any decision made or action taken in reliance on the information provided on the website or for any consequential, special, or similar damages, even if advised of the possibility of such damages.

The articles, news, and information presented on www.serrarigroup.com reflect the opinions of the respective authors and contributors and do not necessarily represent the views of the website or its management. Any views or opinions expressed are solely those of the individual authors and do not represent the website's views or opinions as a whole.

The content on www.serrarigroup.com may include links to external websites, which are provided for convenience and informational purposes only. We have no control over the nature, content, and availability of those sites. The inclusion of any links does not necessarily imply a recommendation or endorsement of the views expressed within them.

Every effort is made to keep the website up and running smoothly. However, www.serrarigroup.com takes no responsibility for, and will not be liable for, the website being temporarily unavailable due to technical issues beyond our control.

Please note that laws, regulations, and information can change rapidly, and we advise you to conduct further research and seek professional advice when necessary.

By using www.serrarigroup.com, you agree to this disclaimer and its terms. If you do not agree with this disclaimer, please do not use the website.

www.serrarigroup.com, reserves the right to update, modify, or remove any part of this disclaimer without prior notice. It is your responsibility to review this disclaimer periodically for changes.

Serrari Group 2025