Nigerian business stakeholders and government officials have enthusiastically applauded President Bola Tinubu’s sweeping economic reforms following a substantial $300 billion Foreign Direct Investment (FDI) commitment from Qatari investors targeting key strategic sectors of Africa’s largest economy.

The landmark commitment was announced during a high-profile reception for a delegation from Future Union Group, Qatar, led by Sheikh Abdul-Rahman Hamad N.H. Al-Thani, a member of the Qatari royal family, held on Saturday in Lagos, Nigeria’s commercial capital and economic nerve center.

Build the future you deserve. Get started with our top-tier Online courses: ACCA, HESI A2, ATI TEAS 7, HESI EXIT, NCLEX-RN, NCLEX-PN, and Financial Literacy. Let Serrari Ed guide your path to success. Enroll today.

The News Agency of Nigeria (NAN) reports that the Qatari delegation arrived in Nigeria specifically to explore substantial partnership opportunities in infrastructure development, energy production and distribution, oil and gas exploration and refining, agricultural modernization, and aviation sector expansion—all areas identified as critical to Nigeria’s economic transformation agenda under the current administration.

A Historic Investment Decision

Mr Adebowale Odutola, Chairman of Elan Vert Nigeria Ltd. and the principal facilitator of this groundbreaking visit, characterized the investment decision as a direct and measurable outcome of President Tinubu’s consistent and determined drive to rebuild international confidence in Nigeria’s economic fundamentals and investment climate after years of sluggish growth and capital flight.

“Today, we are making history that will be remembered for generations,” Odutola declared during the reception attended by business leaders, government officials, and diplomatic representatives. “These investors are bringing in $300 billion across key sectors of our economy; aviation, oil and gas, mining, and infrastructure. This is not just money—this is a vote of confidence in Nigeria’s future and its leadership.”

According to Odutola, this development provides concrete proof that Nigeria’s often-controversial economic reforms, which have included painful adjustments such as fuel subsidy removal and foreign exchange liberalization, are successfully attracting serious global attention from major international investors who had previously been hesitant or had withdrawn from African markets due to perceived risks and policy uncertainty.

“For years, many foreign investors were hesitant because of uncertainty surrounding policy consistency, regulatory frameworks, and currency convertibility,” she explained. “But now, the reforms have brought confidence back. Investors can see a clear roadmap, predictable policies, and a government committed to creating an enabling business environment that protects investments and facilitates profit repatriation.”

Odutola emphasized that the Qatari investors were particularly eager to partner with credible, established Nigerian businesses to create sustainable employment opportunities and generate broad-based wealth creation rather than merely extracting resources or pursuing short-term profit maximization strategies.

“They are not just investing capital; they want to build long-term partnerships that benefit both parties and contribute to Nigeria’s development,” she said. “They told us explicitly that Nigeria is now the investment bride of Africa—the most attractive destination for serious investors looking at the continent.”

She further noted that the investors would proceed to Abuja, Nigeria’s federal capital, to meet with key government agencies, regulatory bodies, and financial institutions to explore specific project financing opportunities and finalize partnership frameworks.

“This is not a ceremonial visit or a diplomatic courtesy call. They came prepared with detailed proposals, and substantive conversations will begin immediately,” she emphasized.

Restoring Investor Confidence Through Policy Reform

Dr Abdul-Azeez Adediran, popularly known as Jandor, Lead Visioner of the Lagos4Lagos Movement and co-facilitator of the visit, described the massive investment commitment as a resounding vote of confidence in President Tinubu’s leadership and his administration’s comprehensive reform policies that have sought to address structural economic challenges.

“Before Tinubu’s administration took office, the business climate was genuinely discouraging for both domestic and foreign investors,” Adediran explained. “The forex policy alone was a major concern for foreign investors who feared they wouldn’t be able to repatriate profits or access foreign currency for imports. But now, the reforms have restored faith and made Nigeria an investment-friendly environment.”

He explained that foreign investors could now repatriate their funds without the bureaucratic difficulties, delays, and artificial restrictions that had characterized previous administrations and had driven many international businesses to relocate operations to neighboring countries or abandon Nigerian investments entirely.

“Today, Nigeria is arguably the number one investment destination in Africa,” Adediran declared. “The market is here—over 200 million consumers with growing purchasing power. The people are here—educated, entrepreneurial, and hungry for opportunity. And the opportunities are endless across virtually every economic sector.”

Adediran also highlighted the particular importance of renewable energy development and gas exploration as key focus areas for the Qatari investment, noting that Nigeria possesses enormous untapped potential in both sectors that could transform the nation’s energy landscape and support industrialization.

“We need strong, credible partners like Future Union to help us unlock our potential in clean energy and natural gas utilization,” he said. “This partnership can fundamentally redefine our energy future, reduce dependence on expensive diesel generators, and provide reliable power for manufacturing and industry.”

Legislative Support and Economic Ripple Effects

Mr Adedamola Kasunmu, Deputy Majority Leader of the Lagos State House of Assembly, characterized the arrival of such substantial Qatari investment as a direct reflection of President Tinubu’s growing global influence and the demonstrated effectiveness of his economic reform policies in changing international perceptions of Nigeria.

“This is a major vote of confidence in Nigeria’s economic direction and stability,” Kasunmu said. “Investors are no longer moving out of Nigeria but are actively returning and bringing fresh capital. The policies implemented in electricity sector reform, telecommunications liberalization, and financial services modernization are clearly working and producing measurable results.”

He noted that an investment of this magnitude would inevitably have significant ripple effects throughout the entire Nigerian economy, touching multiple sectors and generating benefits far beyond the direct investment targets.

“When $300 billion comes into critical sectors like infrastructure, energy, and agriculture, jobs will follow naturally—hundreds of thousands of direct jobs and potentially millions of indirect employment opportunities,” Kasunmu explained. “Industries that have been struggling or dormant will revive with improved infrastructure and reliable energy. Economic growth will be felt by ordinary Nigerians through increased employment, higher wages, and improved services.”

Kasunmu particularly praised the government’s focused effort on diversifying Nigeria’s economy away from overwhelming dependence on oil revenues, noting that “Nigeria is systematically regaining its reputation as Africa’s premier business hub and the gateway to West African markets.”

The Investor Perspective: Opportunity and Commitment

Dr Abdelgalil Sharaf, Chief Executive Officer of Future Union Group, expressed strong optimism about his organization’s future operations and growth prospects in Nigeria following the delegation’s initial site visits and stakeholder meetings.

“We arrived this morning and immediately saw endless opportunities that align perfectly with our investment criteria and strategic focus,” Sharaf said. “Nigeria has exactly what we need to build successful, sustainable businesses: people with talent and ambition, enormous untapped potential across multiple sectors, and a clear sense of national purpose under new leadership.”

He emphasized that Future Union Group’s approach focuses explicitly on long-term, sustainable investments that create lasting value rather than speculative ventures seeking quick returns.

“This is categorically not a short-term play or an opportunistic move,” Sharaf clarified. “We are here to stay for decades, to build substantial operations, and to contribute meaningfully to Nigeria’s growth story and economic transformation. Our commitment is measured in generations, not quarterly earnings reports.”

Maral Godalazian, International Regional Director and Partner at Future Union, also expressed genuine delight with the warmth, professionalism, and entrepreneurial spirit demonstrated by Nigerian business leaders and government officials during the delegation’s initial engagements.

“Nigeria is absolutely full of possibilities that we hadn’t fully appreciated before this visit,” she said. “We are genuinely happy to be here and excited to work with such passionate, capable, and forward-thinking people who understand both the challenges and opportunities.”

Mr Nabil Lakhel, Aviation Advisor for Future Union, added specific observations about Nigeria’s aviation sector potential: “We see clearly that there are numerous substantial projects to develop here in Nigeria across aviation infrastructure, aircraft leasing, maintenance facilities, and pilot training. We have a lot of concrete projects to launch here that will transform air travel and logistics.”

One decision can change your entire career. Take that step with our Online courses in ACCA, HESI A2, ATI TEAS 7, HESI EXIT, NCLEX-RN, NCLEX-PN, and Financial Literacy. Join Serrari Ed and start building your brighter future today.

Strategic Sectors and Investment Focus Areas

The $300 billion investment commitment, while extraordinary in scale, will be strategically deployed across several priority sectors identified through extensive preliminary research and stakeholder consultation:

Infrastructure Development: Nigeria faces a massive infrastructure deficit estimated at hundreds of billions of dollars across transportation networks, port facilities, urban development, and utilities. The Qatari investment will target critical infrastructure projects including highways, railways, port modernization, and urban mass transit systems that can unlock economic growth and improve quality of life.

Energy Sector: Both renewable energy and conventional energy infrastructure will receive substantial investment. This includes solar and wind power generation facilities, gas-fired power plants, electricity transmission and distribution networks, and energy storage solutions. Nigeria’s chronic electricity shortage has long hampered industrial development and economic growth.

Oil and Gas: Despite the push toward diversification, Nigeria’s oil and gas sector remains critically important for government revenues and foreign exchange earnings. Investments will focus on exploration, refining capacity expansion, petrochemical development, and gas infrastructure to monetize Nigeria’s enormous gas reserves that have historically been flared or left undeveloped.

Agriculture: With a rapidly growing population and substantial arable land, Nigeria imports billions of dollars in food annually despite having agricultural potential to be self-sufficient and export to regional markets. Investments will target commercial farming, agricultural processing, cold chain logistics, and agricultural technology to boost productivity and reduce post-harvest losses.

Aviation: Nigeria’s aviation sector requires modernization across airports, aircraft acquisition, maintenance facilities, and air traffic management systems. As Africa’s most populous country and largest economy, Nigeria represents a substantial aviation market with growth potential.

Nigeria-Qatar Relations and Regional Cooperation

NAN reports that this engagement is expected to open significant new frontiers of cooperation between Nigeria and Qatar, particularly in infrastructure, energy, agriculture, technology, and bilateral trade relationships. The relationship extends beyond purely commercial considerations to encompass diplomatic, cultural, and strategic dimensions.

Qatar, despite its small geographic size and population, has emerged as a major global investor through its sovereign wealth fund and state-backed investment vehicles, deploying capital across diverse markets and sectors worldwide. The decision to commit such substantial resources to Nigeria reflects both confidence in the country’s economic trajectory and strategic interest in strengthening Qatar’s position in African markets.

The Future Union Group describes itself as an organization dedicated to supporting sustainable investments across Africa, focusing specifically on projects that stimulate broad-based economic growth, strengthen regional economies, and generate positive social impacts beyond pure financial returns. This mission statement aligns well with Nigeria’s development priorities under the Tinubu administration.

Historical Context: Nigeria’s Economic Challenges and Reform Efforts

To fully appreciate the significance of this investment commitment, it’s essential to understand the economic challenges Nigeria has confronted in recent years. Africa’s most populous nation and largest economy has struggled with multiple interconnected problems including heavy dependence on oil revenues, chronic electricity shortages, infrastructure deficits, high inflation, currency instability, and capital flight as investors lost confidence.

President Tinubu, who took office in May 2023, immediately embarked on controversial but necessary economic reforms. His administration removed costly fuel subsidies that were consuming enormous government revenues while primarily benefiting smugglers and the wealthy. He also liberalized the foreign exchange market, ending the multiple exchange rate system that had created arbitrage opportunities, encouraged corruption, and distorted economic decision-making.

These reforms, while economically sound according to most analysts, initially caused hardship for ordinary Nigerians as fuel prices surged and the naira depreciated sharply against major currencies. Inflation accelerated, and living costs increased significantly. However, the administration argued these short-term pains were necessary to create a sustainable economic foundation for long-term growth.

The Qatari investment commitment suggests that international investors have assessed these reforms positively and believe Nigeria is now on a more sustainable economic trajectory with clearer policies, better governance, and improved prospects for profitable operations.

Skepticism and Due Diligence Considerations

While the announcement has generated considerable enthusiasm among government officials and business stakeholders, experienced observers note that large investment commitments do not always translate fully into actual capital deployment. The history of African development includes numerous instances of substantial investment pledges that were subsequently reduced, delayed, or abandoned as due diligence revealed challenges or as economic conditions changed.

Critical factors that will determine whether this $300 billion commitment materializes fully include political stability, policy consistency across electoral cycles, security conditions, infrastructure readiness, regulatory efficiency, and the broader global economic environment. Nigeria will need to maintain reform momentum, address security challenges in various regions, and continue improving its business environment to ensure these investments proceed as planned.

Additionally, the scale of the commitment—$300 billion represents an extraordinary sum even for a major economy—raises questions about implementation timelines, phasing, and whether the figure represents firm commitments or includes aspirational targets contingent on various conditions being met.

Conclusion: A Potential Turning Point

If successfully implemented, the Qatari investment could represent a genuine turning point in Nigeria’s economic development trajectory, providing capital, technology, and expertise across critical sectors while creating substantial employment and demonstrating to other international investors that Nigeria has addressed previous concerns about policy uncertainty and business climate challenges.

For President Tinubu’s administration, the investment commitment validates controversial reform decisions and provides political ammunition against critics who argued the reforms were causing unnecessary hardship without delivering tangible benefits. Successfully executing projects funded by this investment could significantly boost the administration’s popularity and credibility.

For ordinary Nigerians, the ultimate measure of success will be whether these investments translate into better infrastructure, more reliable electricity, increased employment opportunities, and improved living standards. The coming months and years will reveal whether this announcement represents the beginning of a new era of prosperity or another case of promising commitments that fail to fully materialize.

What remains clear is that Nigeria’s economic reform efforts are being noticed internationally, and major investors are expressing willingness to commit substantial capital—a dramatically different situation from just a few years ago when capital flight and investor pessimism dominated narratives about Africa’s largest economy.

Ready to take your career to the next level? Join our Online courses: ACCA, HESI A2, ATI TEAS 7 , HESI EXIT , NCLEX – RN and NCLEX – PN, Financial Literacy!🌟 Dive into a world of opportunities and empower yourself for success. Explore more at Serrari Ed and start your exciting journey today! ✨

Track GDP, Inflation and Central Bank rates for top African markets with Serrari’s comparator tool.

See today’s Treasury bonds and Money market funds movement across financial service providers in Kenya, using Serrari’s comparator tools.

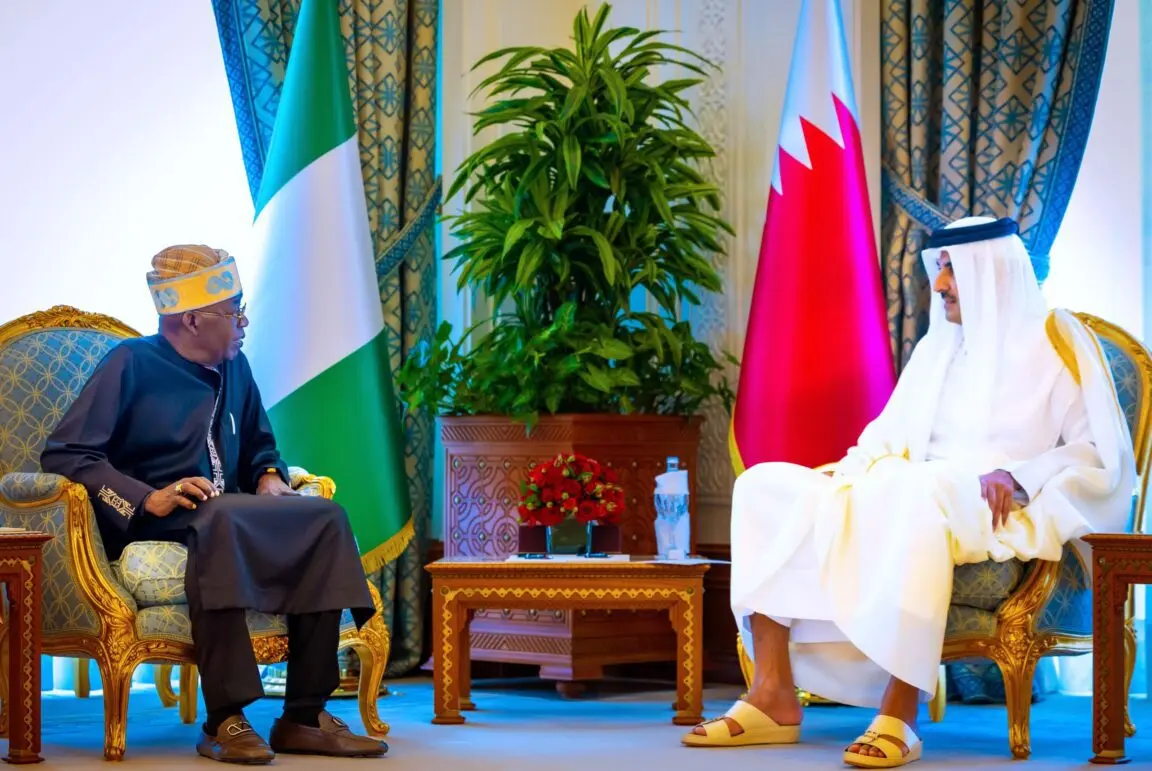

Photo source: Google

By: Montel Kamau

Serrari Financial Analyst

13th October, 2025

Article, Financial and News Disclaimer

The Value of a Financial Advisor

While this article offers valuable insights, it is essential to recognize that personal finance can be highly complex and unique to each individual. A financial advisor provides professional expertise and personalized guidance to help you make well-informed decisions tailored to your specific circumstances and goals.

Beyond offering knowledge, a financial advisor serves as a trusted partner to help you stay disciplined, avoid common pitfalls, and remain focused on your long-term objectives. Their perspective and experience can complement your own efforts, enhancing your financial well-being and ensuring a more confident approach to managing your finances.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Readers are encouraged to consult a licensed financial advisor to obtain guidance specific to their financial situation.

Article and News Disclaimer

The information provided on www.serrarigroup.com is for general informational purposes only. While we strive to keep the information up to date and accurate, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability with respect to the website or the information, products, services, or related graphics contained on the website for any purpose. Any reliance you place on such information is therefore strictly at your own risk.

www.serrarigroup.com is not responsible for any errors or omissions, or for the results obtained from the use of this information. All information on the website is provided on an as-is basis, with no guarantee of completeness, accuracy, timeliness, or of the results obtained from the use of this information, and without warranty of any kind, express or implied, including but not limited to warranties of performance, merchantability, and fitness for a particular purpose.

In no event will www.serrarigroup.com be liable to you or anyone else for any decision made or action taken in reliance on the information provided on the website or for any consequential, special, or similar damages, even if advised of the possibility of such damages.

The articles, news, and information presented on www.serrarigroup.com reflect the opinions of the respective authors and contributors and do not necessarily represent the views of the website or its management. Any views or opinions expressed are solely those of the individual authors and do not represent the website's views or opinions as a whole.

The content on www.serrarigroup.com may include links to external websites, which are provided for convenience and informational purposes only. We have no control over the nature, content, and availability of those sites. The inclusion of any links does not necessarily imply a recommendation or endorsement of the views expressed within them.

Every effort is made to keep the website up and running smoothly. However, www.serrarigroup.com takes no responsibility for, and will not be liable for, the website being temporarily unavailable due to technical issues beyond our control.

Please note that laws, regulations, and information can change rapidly, and we advise you to conduct further research and seek professional advice when necessary.

By using www.serrarigroup.com, you agree to this disclaimer and its terms. If you do not agree with this disclaimer, please do not use the website.

www.serrarigroup.com, reserves the right to update, modify, or remove any part of this disclaimer without prior notice. It is your responsibility to review this disclaimer periodically for changes.

Serrari Group 2025