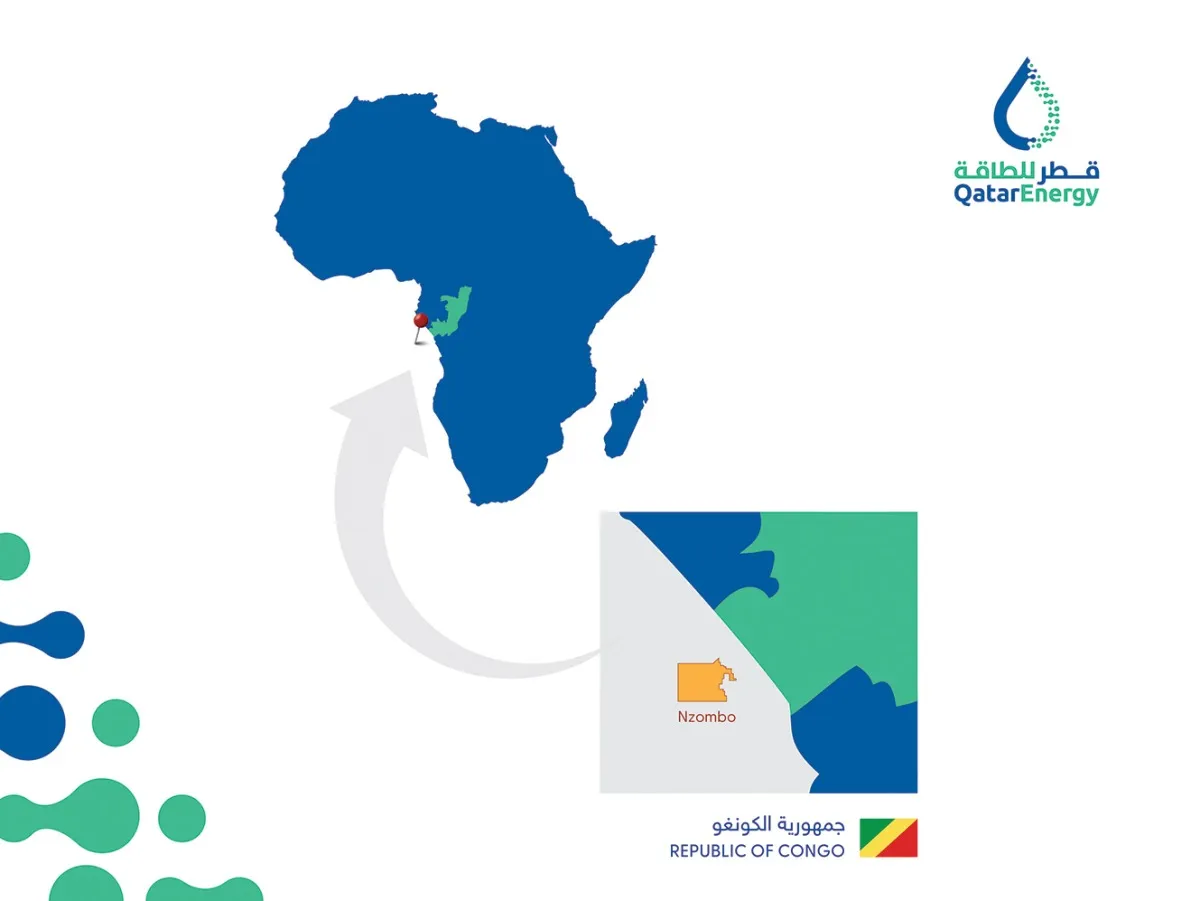

QatarEnergy and its partners were awarded an exploration license for the Nzombo offshore block in the Republic of Congo, further solidifying the Gulf state’s aggressive expansion strategy across Africa’s rapidly developing offshore oil and gas sector.

Push boundaries, reach goals, achieve more. Whether it’s ACCA, HESI A2, ATI TEAS 7, HESI EXIT, NCLEX-RN, NCLEX-PN, or Financial Literacy, we’ve got the Online course to match your ambition. Start with Serrari Ed now.

Strategic Partnership in Congo’s Offshore Waters

Under the terms of the Production Sharing Contract signed with the Congolese Government, QatarEnergy will hold a 35% participating interest in the block. TotalEnergies affiliate in Congo (the operator), will hold a 50% interest, while Société Nationale des Pétroles du Congo, the Congolese national oil company, will hold the remaining 15%.

The Nzombo block covers an area of 1,053 square kilometers with water depths of more than 1,000 meters, located about 90 kilometers off the coast of Pointe-Noire. Importantly, the block is positioned close to TotalEnergies’ existing Moho production facilities, which currently produce 140,000 barrels per day and represent more than half of Congo’s total oil production.

Commenting on the occasion, His Excellency Saad Sherida Al-Kaabi, the Minister of State for Energy Affairs, the President and CEO of QatarEnergy, said: “We are pleased to be awarded this promising offshore block in the Republic of Congo, and to work alongside our valued partners and the Congolese Government.”

Minister Al-Kaabi added: “I would like to take this opportunity to thank the Government of the Republic of Congo for their valuable cooperation, and we look forward to delivering on a successful exploration campaign in collaboration with our partners and stakeholders.”

QatarEnergy’s Global Offshore Expansion Strategy

The Congo award represents QatarEnergy’s continued aggressive expansion in international offshore exploration, particularly in Africa. As one of the world’s third-largest oil companies by reserves, QatarEnergy has systematically positioned itself as a major player in global offshore exploration, with the company participating in 13 high-impact wells in 2025 alone – more than any other explorer globally.

QatarEnergy’s African portfolio has grown significantly in recent years. The company holds interests in three exploration licenses offshore Namibia, where it recently acquired a 27.5% working interest in Block 2813B near the Venus discovery. In May 2024, QatarEnergy also signed agreements for stakes in two exploration sites off the coast of Egypt, partnering with ExxonMobile and Egyptian authorities.

The company’s global expansion extends beyond Africa. In March 2023, QatarEnergy acquired stakes in two Canadian exploration blocks offshore Newfoundland and Labrador from ExxonMobil, and in July 2024, partnered with Chevron for a 20% working interest in block 5 off the coast of Suriname.

Republic of Congo’s Offshore Oil Renaissance

The award comes at a time when the Republic of Congo is experiencing a renaissance in its offshore oil sector. TotalEnergies recently announced a $600 million investment to bolster exploration and production activities in Congo’s offshore Moho Nord field in 2024, demonstrating continued international confidence in the country’s hydrocarbon potential.

Congo’s proven oil reserves of 1.8 billion barrels and 284 billion cubic meters of natural gas have attracted significant international investment. The country has created an enabling business environment that has successfully attracted and retained foreign investment, avoiding the bureaucratic stagnation that has plagued other African nations.

The Moho Nord field, operated by TotalEnergies since 2017, represents the largest oil project ever undertaken in the Republic of Congo. The deep offshore project, situated 75 kilometers off the Congolese coast, showcases cutting-edge deep offshore operating expertise and produces 140,000 barrels of oil per day – more than half of the country’s total production.

Strategic Location and Development Potential

The Nzombo block’s strategic positioning near existing infrastructure presents significant advantages for future development. Located approximately 100 kilometers off Pointe-Noire, the block benefits from proximity to TotalEnergies’ established Moho production complex, which includes floating production units and subsea infrastructure.

According to TotalEnergies Senior Vice-President Exploration Kevin McLachlan: “This award of a promising Exploration permit, with the material Nzombo prospect, reflects our continued strategy of expanding our Exploration portfolio with high impact prospects, which can be developed leveraging our existing facilities, and confirms our longstanding partnership with the Republic of the Congo.”

The work program includes drilling one exploration well, expected to spud before the end of 2025. This timing aligns with broader industry trends, as Westwood Global Energy Group forecasts that 65-75 high-impact wells will be completed globally in 2025, with African offshore prospects featuring prominently.

Africa’s Offshore Oil Boom

The Nzombo award occurs within the context of Africa’s broader offshore oil boom. Total capital expenditures for oil and gas exploration in Africa rose from $3.4 billion in 2020 to $5.1 billion in 2022, with the continent becoming a global hotspot for hydrocarbon exploration.

Areas covering 886,000 km² – larger than France and Italy combined – have been licensed since 2017 for new oil and gas exploration in Africa. Of the 45 African countries where the oil and gas industry is currently exploring, 18 are “frontier countries” with little or no existing production, including Namibia, Uganda, and Somalia.

Offshore energy capital expenditures are projected to exceed $300 billion globally in 2025, marking a new high for offshore oil and gas markets. African countries are expected to feature prominently in this investment wave, with major developments including Shell’s Nigerian Bonga North Phase 1 tieback and Eni’s Baleine Phase 3 FPSO in Côte d’Ivoire.

Build the future you deserve. Get started with our top-tier Online courses: ACCA, HESI A2, ATI TEAS 7, HESI EXIT, NCLEX-RN, NCLEX-PN, and Financial Literacy. Let Serrari Ed guide your path to success. Enroll today.

Technological Advancements and Deep-Water Capabilities

The Nzombo block’s water depths exceeding 1,000 meters place it in the deep-water category, requiring advanced technological capabilities and significant investment. Deep-water and ultra-deep-water exploration has become increasingly important as the industry seeks to unlock previously inaccessible reserves.

QatarEnergy’s participation demonstrates the company’s technical capabilities in challenging offshore environments. The partnership with TotalEnergies, a leader in deep offshore operations, provides access to cutting-edge technology and operational expertise essential for success in Congo’s offshore waters.

The offshore drilling market is experiencing significant technological advancement, with companies investing heavily in upgrading existing fleets and building new high-tech drilling platforms capable of operating in ultra-deep waters. Deep-water drilling rigs currently dominate with 50% market share, driven by increased exploration in deep-water fields.

Regional Energy Security and Economic Development

Congo’s offshore development aligns with broader African energy security objectives. The country has successfully diversified its energy portfolio, with the first export of LNG to Italy in February 2024 from the Tango floating LNG facility, a partnership with Italian energy company Eni with expected capacity of 4.5 billion cubic meters per year.

The African Energy Chamber has praised Congo as a model for other African nations, highlighting the country’s success in creating an enabling business environment that attracts international investment while maximizing local economic benefits.

Congo’s approach contrasts sharply with challenges faced by neighboring Democratic Republic of Congo, where TotalEnergies has declined to connect Congolese oil blocks to the East African Crude Oil Pipeline, citing capacity constraints and operational complexities.

Environmental Considerations and ESG Compliance

The offshore project occurs amid growing regulatory and environmental oversight across Africa’s energy sector. Recent regulatory frameworks in South Africa and Namibia have imposed stricter ESG standards, reshaping offshore oil risks and investor strategies across the continent.

However, Congo’s regulatory environment has remained stable and investor-friendly. The country’s Gas Master Plan, currently in final stages, will provide a framework incentivizing gas sector development while serving as a roadmap for harnessing resources for both domestic consumption and export.

Environmental compliance remains a priority for all partners. TotalEnergies has implemented zero routine flaring, waste heat recovery, and complete reinjection of produced water in its Congo operations, demonstrating commitment to minimizing environmental impact.

Market Dynamics and Investment Climate

The timing of the Nzombo award reflects favorable market dynamics for African offshore investment. Offshore drilling companies are expected to spend north of $50 billion on new greenfield projects in 2025, potentially unlocking over 8 billion barrels of oil equivalent.

Global oil demand continues growing, with expectations of reaching 103.9 million barrels per day in 2025. This sustained demand, combined with deepwater and ultra-deepwater drilling trends, creates favorable conditions for projects like Nzombo.

The Middle East region, including Qatar, holds the largest offshore drilling market share at 40%, driven by substantial oil and gas reserves and increasing investments in offshore exploration. QatarEnergy’s expansion into African offshore markets represents logical geographical diversification from its Middle Eastern base.

Partnership Dynamics and Operational Expertise

The Nzombo partnership leverages each participant’s core strengths. TotalEnergies brings extensive deep offshore operational experience and existing infrastructure in Congo, while QatarEnergy provides financial resources and global market access. The Congolese national oil company SNPC ensures local participation and knowledge of regulatory frameworks.

This collaborative model has proven successful in Congo’s offshore sector. TotalEnergies has operated in the Republic of Congo for nearly 50 years and currently operates nearly half of the country’s domestic production. The company’s deep offshore expertise was showcased in the Moho Nord project, which combines two types of floating units – a floating production unit and tension leg platform – situated 350 meters apart.

The partnership structure also aligns with global trends toward risk sharing in high-impact exploration, where companies increasingly seek to diversify risks through strategic partnerships rather than pursuing solo exploration programs.

Future Development Timeline and Expectations

The Nzombo exploration program follows an aggressive timeline, with drilling expected to commence before the end of 2025. This schedule aligns with both TotalEnergies’ broader African exploration campaign and QatarEnergy’s global high-impact well program.

Success at Nzombo could trigger accelerated development given the proximity to existing Moho infrastructure. The Congo Offshore System, an 835-kilometer pipeline operated by TotalEnergies, provides established export infrastructure connecting offshore production to the Djeno terminal.

Industry analysts expect multiple high-impact African offshore wells in 2025, with up to 70% of African drilling occurring in frontier and emerging basins. The Nzombo program represents part of this broader continental exploration surge, with outcomes potentially influencing further investment in Congo’s offshore sector.

Broader Implications for African Energy Development

The QatarEnergy-TotalEnergies partnership in Congo exemplifies evolving dynamics in African energy development, where Gulf state investment increasingly complements European operator expertise. This model provides African nations access to both technical capabilities and diversified funding sources.

Congo’s success in attracting sustained international investment demonstrates the importance of stable regulatory frameworks and enabling business environments. The country’s approach offers lessons for other African nations seeking to develop their offshore hydrocarbon resources while balancing foreign investment with domestic economic benefits.

The Nzombo award also reflects broader geopolitical shifts in global energy investment, where Middle Eastern companies increasingly look to Africa for growth opportunities while diversifying away from domestic reserves.

As QatarEnergy and its partners prepare for the Nzombo exploration campaign, the project represents more than a single offshore license – it symbolizes the continued evolution of Africa’s offshore energy sector and the growing role of strategic international partnerships in unlocking the continent’s vast hydrocarbon potential. With drilling set to commence before year-end, the industry will closely watch outcomes that could influence the trajectory of offshore investment across West and Central Africa.

Ready to take your career to the next level? Join our Online courses: ACCA, HESI A2, ATI TEAS 7 , HESI EXIT , NCLEX – RN and NCLEX – PN, Financial Literacy!🌟 Dive into a world of opportunities and empower yourself for success. Explore more at Serrari Ed and start your exciting journey today! ✨

Track GDP, Inflation and Central Bank rates for top African markets with Serrari’s comparator tool.

See today’s Treasury bonds and Money market funds movement across financial service providers in Kenya, using Serrari’s comparator tools.

Photo source: Google

By: Montel Kamau

Serrari Financial Analyst

1st September, 2025

Article, Financial and News Disclaimer

The Value of a Financial Advisor

While this article offers valuable insights, it is essential to recognize that personal finance can be highly complex and unique to each individual. A financial advisor provides professional expertise and personalized guidance to help you make well-informed decisions tailored to your specific circumstances and goals.

Beyond offering knowledge, a financial advisor serves as a trusted partner to help you stay disciplined, avoid common pitfalls, and remain focused on your long-term objectives. Their perspective and experience can complement your own efforts, enhancing your financial well-being and ensuring a more confident approach to managing your finances.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Readers are encouraged to consult a licensed financial advisor to obtain guidance specific to their financial situation.

Article and News Disclaimer

The information provided on www.serrarigroup.com is for general informational purposes only. While we strive to keep the information up to date and accurate, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability with respect to the website or the information, products, services, or related graphics contained on the website for any purpose. Any reliance you place on such information is therefore strictly at your own risk.

www.serrarigroup.com is not responsible for any errors or omissions, or for the results obtained from the use of this information. All information on the website is provided on an as-is basis, with no guarantee of completeness, accuracy, timeliness, or of the results obtained from the use of this information, and without warranty of any kind, express or implied, including but not limited to warranties of performance, merchantability, and fitness for a particular purpose.

In no event will www.serrarigroup.com be liable to you or anyone else for any decision made or action taken in reliance on the information provided on the website or for any consequential, special, or similar damages, even if advised of the possibility of such damages.

The articles, news, and information presented on www.serrarigroup.com reflect the opinions of the respective authors and contributors and do not necessarily represent the views of the website or its management. Any views or opinions expressed are solely those of the individual authors and do not represent the website's views or opinions as a whole.

The content on www.serrarigroup.com may include links to external websites, which are provided for convenience and informational purposes only. We have no control over the nature, content, and availability of those sites. The inclusion of any links does not necessarily imply a recommendation or endorsement of the views expressed within them.

Every effort is made to keep the website up and running smoothly. However, www.serrarigroup.com takes no responsibility for, and will not be liable for, the website being temporarily unavailable due to technical issues beyond our control.

Please note that laws, regulations, and information can change rapidly, and we advise you to conduct further research and seek professional advice when necessary.

By using www.serrarigroup.com, you agree to this disclaimer and its terms. If you do not agree with this disclaimer, please do not use the website.

www.serrarigroup.com, reserves the right to update, modify, or remove any part of this disclaimer without prior notice. It is your responsibility to review this disclaimer periodically for changes.

Serrari Group 2025