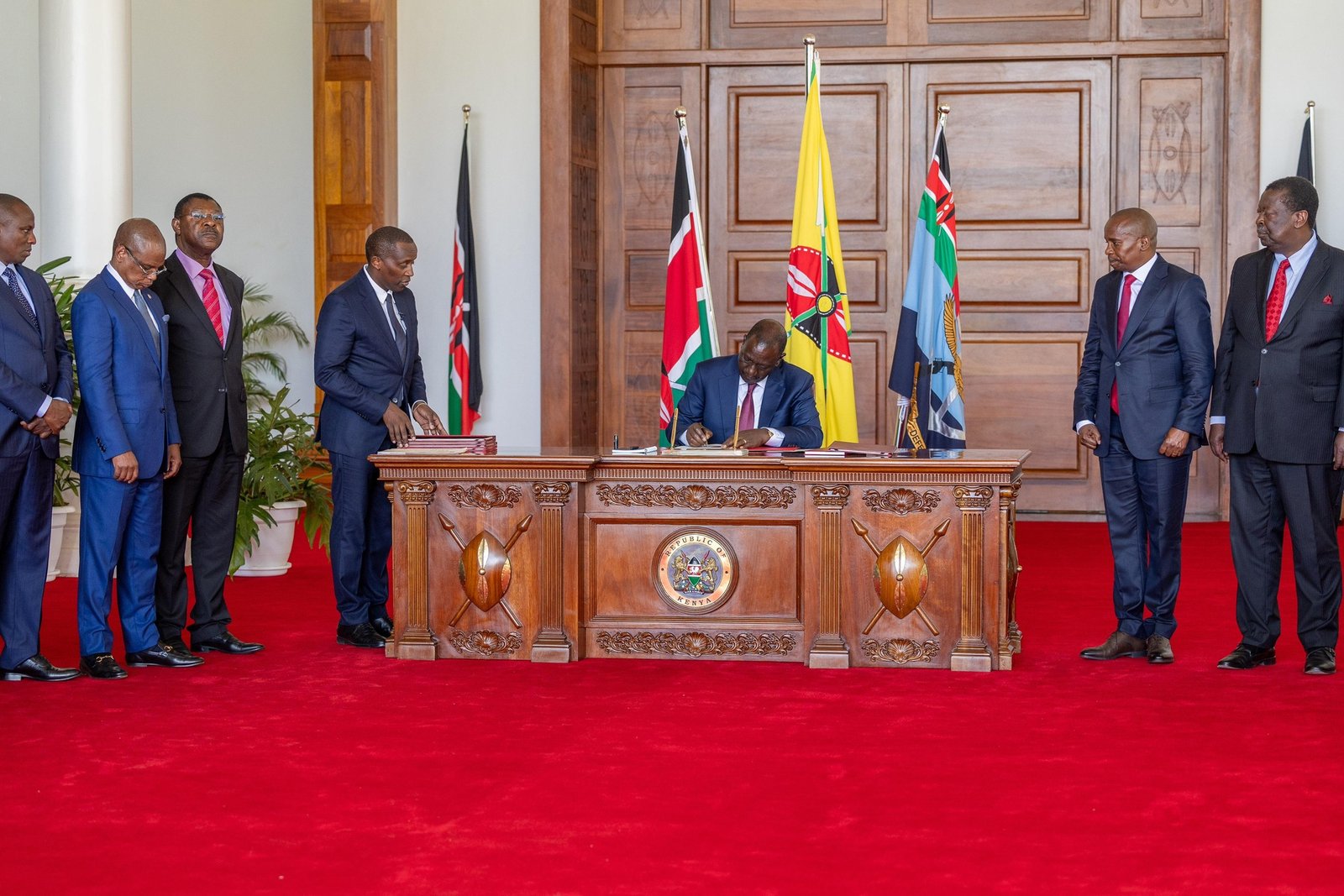

In a significant step toward modernizing Kenya’s governance and economic landscape, President William Ruto on Wednesday signed into law seven critical bills at State House, Nairobi. These laws, which span tax reform, infrastructure management, anti-corruption measures, and business regulation, are designed to align Kenya with global best practices while fostering local development and governance efficiency.

Among the most notable pieces of legislation is the Tax Laws (Amendment) Bill, which introduces sweeping changes to the nation’s tax regime, aiming to alleviate the burden on taxpayers while attracting investment and promoting local industries.

Key Highlights of the Tax Laws (Amendment) Bill

The Tax Laws (Amendment) Bill, introduced by National Assembly Majority Leader Kimani Ichung’wah, is seen as a cornerstone of President Ruto’s Bottom-Up Economic Transformation Agenda. The bill seeks to harmonize Kenya’s tax system with international standards, targeting equity, transparency, and economic growth.

- Deductions for Contributions to Post-Retirement Funds: One of the most taxpayer-friendly reforms allows individuals to deduct contributions to post-retirement medical funds and the Affordable Housing Levy from their taxable income. This measure is expected to reduce the financial strain on employees and retirees while encouraging long-term savings.

- Boosting Homeownership: The bill increases the mortgage interest deduction limit from KSh 300,000 to KSh 360,000 annually, a move designed to make homeownership more attainable for Kenyans.

- Encouraging Agricultural Growth: Local farmers stand to benefit from excise duty exemptions for spirits made from agricultural products, a measure aimed at supporting agribusiness and enhancing rural economies.

- Taxing Global Firms: The introduction of an economic presence tax for non-residents and a minimum top-up tax for multinational corporations ensures fair contribution from global firms operating in Kenya.

“The amendments will promote local manufacturing, enhance agricultural growth, and incentivize investment in Kenya,” read a summary of the Bill. These provisions are expected to provide significant relief for small and medium enterprises (SMEs) and support local industry.

Enhancing Tax Administration: Kenya Revenue Authority (Amendment) Bill

The Kenya Revenue Authority (Amendment) Bill was also signed into law, marking another milestone in strengthening Kenya’s tax administration framework. The bill empowers the Kenya Revenue Authority (KRA) Commissioner-General to appoint Deputy Commissioners, a move aimed at improving operational efficiency and streamlining tax collection processes.

Further, the KRA will now deepen its collaboration with educational institutions such as the Kenya School of Revenue Administration (KESRA) to enhance training and capacity-building initiatives for revenue officers. This collaboration is expected to address the skills gap in tax administration, ensuring that the agency keeps pace with modern tax practices.

Streamlining Governance: Kenya Roads Board (Amendment) Bill

Another critical piece of legislation, the Kenya Roads Board (Amendment) Bill, reduces the membership of the board from 13 to nine members. This aligns with the Mwongozo Code of Governance for State Corporations, which emphasizes lean and efficient leadership structures.

The streamlined board is expected to improve the oversight and execution of road infrastructure projects, a vital component of Kenya’s economic development strategy. With better governance in the roads sector, the country hopes to expedite ongoing projects and address persistent challenges such as maintenance and funding gaps.

Strengthening Anti-Corruption Efforts: Ethics and Anti-Corruption Commission (Amendment) Bill

The Ethics and Anti-Corruption Commission (Amendment) Bill introduces stricter qualifications for the Chairperson of the Commission, requiring credentials equivalent to those of a High Court judge. This measure aims to enhance the Commission’s leadership and effectiveness in tackling corruption, a persistent challenge in Kenya’s governance landscape.

By empowering the Commission with qualified leadership, the government is reinforcing its commitment to accountability and transparency. This amendment is expected to improve public trust in anti-corruption efforts while ensuring robust oversight of public institutions.

Improving Regulatory Compliance: Statutory Instruments (Amendment) Bill

The Statutory Instruments (Amendment) Bill introduces mechanisms to ensure stricter compliance with regulatory requirements. Parliament now has the authority to publish the nullity of regulations that are improperly submitted, enhancing transparency and legal clarity for businesses and the public.

This bill also raises penalties for non-compliance, aiming to deter businesses from bypassing regulatory frameworks. The move is expected to foster a more transparent and accountable business environment, critical for attracting foreign investment.

Transforming the Business Landscape: Business Laws (Amendment) Bill

The Business Laws (Amendment) Bill brings transformative changes to Kenya’s financial and business environment. Key provisions include:

- Increased Core Capital Requirements for Banks: By mandating higher core capital thresholds, the government aims to strengthen the stability of Kenya’s financial institutions.

- Licensing Framework for Non-Deposit-Taking Credit Providers: This provision introduces greater oversight in the credit market, ensuring consumer protection and reducing predatory lending practices.

- Enhanced Consumer Protection: The bill includes measures to safeguard consumers in financial transactions, fostering trust in the financial services sector.

These changes are expected to make Kenya’s business environment more competitive and resilient, supporting the growth of SMEs and enhancing the ease of doing business.

Revitalizing Manufacturing: Tax Procedures (Amendment) Bill

The Tax Procedures (Amendment) Bill introduces simplified compliance processes for small businesses and small-scale farmers, making it easier for these groups to meet tax obligations.

To protect local industries, the bill restores import duties on certain raw materials, providing a much-needed boost to Kenya’s struggling steel sector. By promoting local manufacturing, the government aims to reduce reliance on imports and create jobs in the manufacturing industry.

Broader Implications and Observations

President Ruto’s signing of these seven bills underscores his administration’s commitment to economic transformation and governance reform. Together, these legislative measures provide a robust framework for addressing Kenya’s most pressing challenges, including economic inequality, corruption, and regulatory inefficiency.

Witnessing the historic signing ceremony were prominent government officials, including Attorney General Dorcas Oduor, Speaker of the National Assembly Moses Wetang’ula, Cabinet Prime Secretary Musalia Mudavadi, Treasury CS John Mbadi, and MPs Kimani Ichung’wah and Kimani Kuria. Their presence underscored the collective effort behind these legislative milestones.

As Kenya continues to position itself as a regional economic hub, these reforms signal the government’s readiness to create an environment that supports business growth, enhances public service delivery, and addresses systemic governance issues.

The implementation of these laws will be closely watched, as their success depends on effective enforcement and stakeholder collaboration. However, their passage marks a decisive step forward in realizing President Ruto’s vision for a more prosperous and equitable Kenya.

With these reforms in place, Kenya is well on its way to fostering sustainable growth, attracting foreign investment, and improving the quality of life for its citizens. The coming months will be critical as the government translates these legislative frameworks into tangible outcomes, ensuring that the benefits of these laws are felt across all levels of society.

Ready to take your career to the next level? Join our dynamic courses: ACCA, HESI A2, ATI TEAS 7 , HESI EXIT and NCLEX – RN !🌟 Dive into a world of opportunities and empower yourself for success. Explore more at Serrari Ed and start your exciting journey today! ✨

Photo source: Google

By: Montel Kamau

Serrari Financial Analyst

12th December, 2024

Article, Financial and News Disclaimer

The Value of a Financial Advisor

While this article offers valuable insights, it is essential to recognize that personal finance can be highly complex and unique to each individual. A financial advisor provides professional expertise and personalized guidance to help you make well-informed decisions tailored to your specific circumstances and goals.

Beyond offering knowledge, a financial advisor serves as a trusted partner to help you stay disciplined, avoid common pitfalls, and remain focused on your long-term objectives. Their perspective and experience can complement your own efforts, enhancing your financial well-being and ensuring a more confident approach to managing your finances.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Readers are encouraged to consult a licensed financial advisor to obtain guidance specific to their financial situation.

Article and News Disclaimer

The information provided on www.serrarigroup.com is for general informational purposes only. While we strive to keep the information up to date and accurate, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability with respect to the website or the information, products, services, or related graphics contained on the website for any purpose. Any reliance you place on such information is therefore strictly at your own risk.

www.serrarigroup.com is not responsible for any errors or omissions, or for the results obtained from the use of this information. All information on the website is provided on an as-is basis, with no guarantee of completeness, accuracy, timeliness, or of the results obtained from the use of this information, and without warranty of any kind, express or implied, including but not limited to warranties of performance, merchantability, and fitness for a particular purpose.

In no event will www.serrarigroup.com be liable to you or anyone else for any decision made or action taken in reliance on the information provided on the website or for any consequential, special, or similar damages, even if advised of the possibility of such damages.

The articles, news, and information presented on www.serrarigroup.com reflect the opinions of the respective authors and contributors and do not necessarily represent the views of the website or its management. Any views or opinions expressed are solely those of the individual authors and do not represent the website's views or opinions as a whole.

The content on www.serrarigroup.com may include links to external websites, which are provided for convenience and informational purposes only. We have no control over the nature, content, and availability of those sites. The inclusion of any links does not necessarily imply a recommendation or endorsement of the views expressed within them.

Every effort is made to keep the website up and running smoothly. However, www.serrarigroup.com takes no responsibility for, and will not be liable for, the website being temporarily unavailable due to technical issues beyond our control.

Please note that laws, regulations, and information can change rapidly, and we advise you to conduct further research and seek professional advice when necessary.

By using www.serrarigroup.com, you agree to this disclaimer and its terms. If you do not agree with this disclaimer, please do not use the website.

www.serrarigroup.com, reserves the right to update, modify, or remove any part of this disclaimer without prior notice. It is your responsibility to review this disclaimer periodically for changes.

Serrari Group 2025