1. How do I calculate the present value of an ordinary annuity online?

To calculate the present value of an ordinary annuity online, you can use a financial calculator that specifically handles ordinary annuities (where payments are made at the end of each period). You’ll need to input the following:

- PMT: The payment amount made each period

- r: The interest rate per period (e.g., monthly, annually)

- n: The total number of payment periods

The online calculator uses these values to compute the present value using the standard formula for present value of annuity:

PV=PMT×[r(1−(1+r)−n)]

This tells you how much a series of future payments is worth today. You can find excellent tools for the present value of an ordinary annuity on sites like Investopedia or Financial Mentor. For a comprehensive suite of financial tools, including a present value of the ordinary annuity calculator, visit Serrari Group.

Push boundaries, reach goals, achieve more. Whether it’s ACCA, HESI A2, ATI TEAS 7, HESI EXIT, NCLEX-RN, NCLEX-PN, or Financial Literacy, we’ve got the course to match your ambition. Start with Serrari Ed now.

2. What is the best online calculator for ordinary annuity present value?

The best online calculator for calculating present value of an ordinary annuity should be:

- Easy to use with clear input fields for PMT, interest rate, and number of periods

- Specifically labeled for “Ordinary Annuity” (not “Annuity Due”)

- Able to handle different frequencies (monthly, quarterly, annually)

- Transparent in its formula so users can understand how the result is computed

Look for calculators on finance websites, educational institutions, or financial planning platforms that clearly state they calculate present value for ordinary annuity payments made at the end of each period. Calculator.net offers a versatile finance calculator that can assist with this.

3. Where can I find a free present value calculator for ordinary annuities?

You can find free present value calculators for ordinary annuities by searching terms like:

- “Free present value of an ordinary annuity calculator”

- “Online PV of an ordinary annuity tool”

- “Ordinary annuity present value tool”

Many reputable financial and educational websites offer these tools for free. Make sure the calculator clearly indicates that it assumes payments are made at the end of each period, not the beginning (which would be an annuity due).

4. How is the present value of an ordinary annuity calculated using a calculator?

When you use a calculator to determine the present value of an ordinary annuity, it applies this ordinary annuity formula:

PV=PMT×[r(1−(1+r)−n)]

Where:

- = Present Value in Annuity

- PMT = Payment per period

- r = Interest rate per period (e.g., monthly if payments are monthly)

- n = Total number of periods

Step-by-step, the calculator will:

- Take the interest rate per period and compute (1+r)−n

- Subtract that value from 1

- Divide the result by r

- Multiply that by PMT to get the present value

This gives the current worth of all future payments, assuming they are made at the end of each period. This process helps you calculate ordinary annuity values accurately.

5. Which formula is used by present value ordinary annuity calculators?

The standard formula for present value of annuity for an ordinary annuity is:

PV=PMT×[r(1−(1+r)−n)]

Where:

- PV is the present value of the ordinary annuity

- PMT is the periodic payment

- r is the interest rate per period

- n is the number of periods

This ordinary annuity equation assumes that each payment is made after the end of each period, which defines an ordinary annuity. It discounts each payment back to its present value, then sums them to get the total present value. This is also known as the pv of ordinary annuity formula.

Fuel your success with knowledge that matters. Enroll in career-defining programs: ACCA, HESI A2, ATI TEAS 7, HESI EXIT, NCLEX-RN, NCLEX-PN, and Financial Literacy. Join Serrari Ed now and take control of your future.

6. How do I calculate present value for monthly ordinary annuity payments?

To calculate present value for monthly ordinary annuity payments, you need to:

- Adjust the interest rate to reflect monthly compounding:

If your annual interest rate is 6%, divide it by 12:

Monthly rate (r) = 0.06/12=0.005 (or 0.5%) - Adjust the number of periods to reflect monthly payments:

If the annuity lasts for 5 years and payments are monthly:

n=5×12=60 periods - Use the standard formula:

PV=PMT×[r(1−(1+r)−n)]

Example:

If PMT=$200/month, r=0.005, and n=60,

PV=200×[0.005(1−(1+0.005)−60)]

PV≈$10,379.66

This is the total value of all the monthly payments as of today, assuming they are made at the end of each month. This demonstrates how to find the pv of an ordinary annuity with monthly payments.

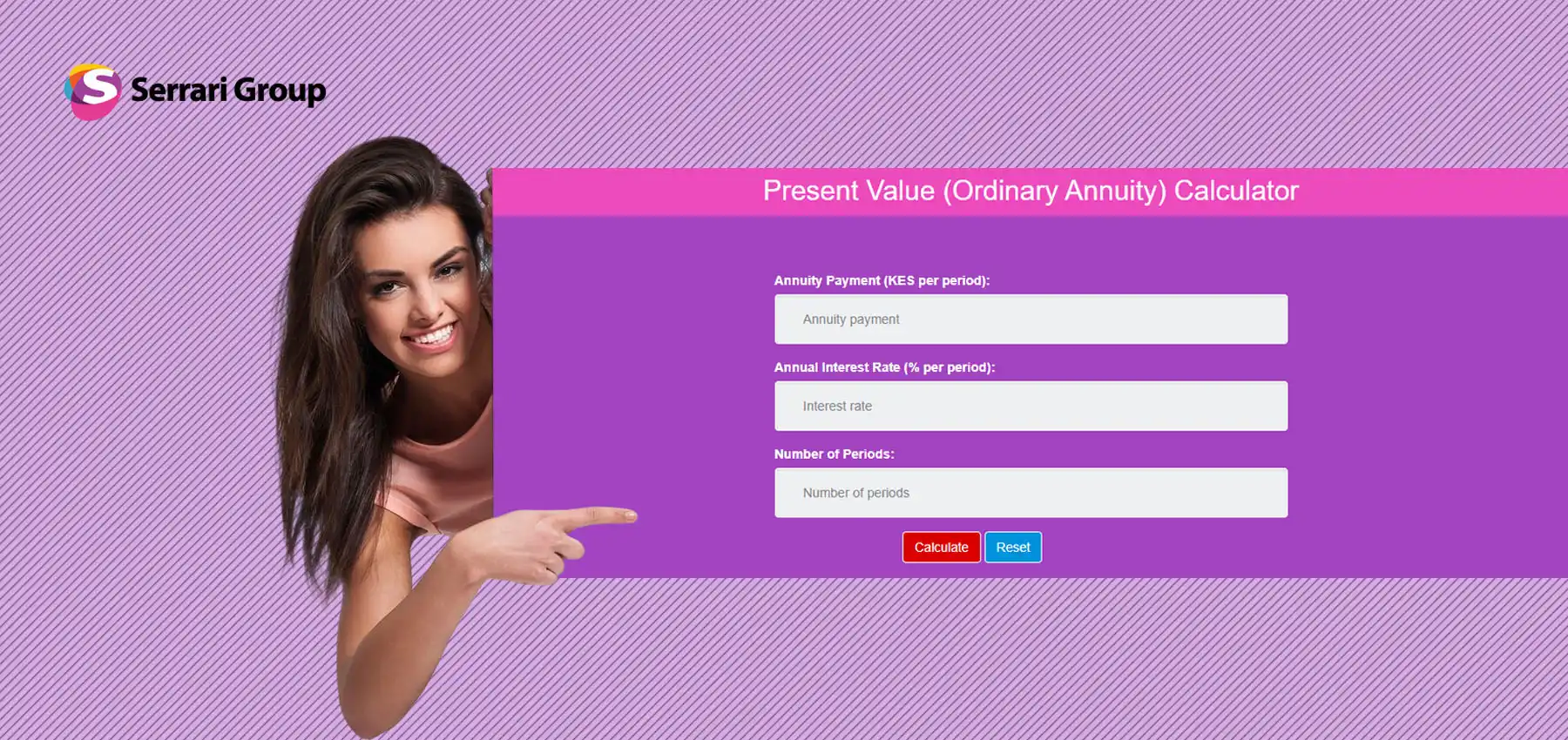

7. What inputs do I need for an online ordinary annuity present value calculator?

To use an ordinary annuity present value calculator, you typically need the following three inputs:

- Payment amount (PMT): The fixed amount paid each period

- Interest rate per period (r): This could be monthly, quarterly, or annually depending on the payment frequency

- Number of periods (n): The total number of payments

Optional Inputs (on more advanced calculators):

- Payment frequency: Monthly, quarterly, annually

- Start/end date: To calculate actual timeframes (less common)

- Compounding frequency: How often the interest is applied (e.g., monthly or annually)

Once entered, the calculator uses the standard present value formula to compute the current value of the ordinary annuity.

8. Can I calculate the present value of fixed periodic payments online?

Yes, you can easily calculate the present value of fixed periodic payments online using a Present Value (Ordinary Annuity) Calculator. The tool is designed specifically to compute the present worth of a series of equal payments made at regular intervals at the end of each period.

To do so, you’ll input:

- The fixed payment amount (e.g., $500 per month)

- The interest rate per period (e.g., 0.75% monthly)

- The number of periods (e.g., 36 months)

The calculator will apply the ordinary annuity equation:

PV=PMT×[r(1−(1+r)−n)]

This gives the present value — what those future payments are worth today under the given interest rate.

9. Is there a simple tool to find the current value of future annuity payments?

Yes, a Present Value (Ordinary Annuity) Calculator is the ideal tool for finding the current value of future annuity payments. It’s especially useful if the payments:

- Are equal in amount

- Occur at regular intervals

- Are made at the end of each period

The calculator requires just a few inputs — payment amount, interest rate per period, and number of periods — and then instantly provides the total present value of an ordinary annuity using a standard formula. This is commonly used in personal finance (e.g., for retirement income), business valuation, and loan amortization.

10. How do I use interest rate and number of periods to get present value of an ordinary annuity?

To use the interest rate and number of periods to get present value of an ordinary annuity, follow these steps:

- Convert the annual interest rate to a rate per period (if necessary).

For example, 6% annually becomes 0.5% per month if compounded monthly. - Multiply the number of years by the number of periods per year to get total periods (n).

For instance, 10 years × 12 months = 120 periods - Plug into the formula:

PV=PMT×[r(1−(1+r)−n)]

Where:

- r is the interest rate per period

- n is the total number of periods

- PMT is the payment made at the end of each period

This ordinary annuity formula discounts each future payment back to its value today, giving you the total present value of the ordinary annuity.

Ready to take your career to the next level? Join our dynamic courses: ACCA, HESI A2, ATI TEAS 7 , HESI EXIT , NCLEX – RN and NCLEX – PN, Financial Literacy!🌟 Dive into a world of opportunities and empower yourself for success. Explore more at Serrari Ed and start your exciting journey today! ✨