1. What is the formula to calculate the present value of a lump sum?

To calculate the present value of a lump sum that will be received in the future, you use this present value of a lump sum formula:

Present Value = Future Value / (1 + r)^n

Where:

- Future Value is the amount you expect to receive in the future

- r is the interest rate per period (as a decimal)

- n is the number of periods (typically years)

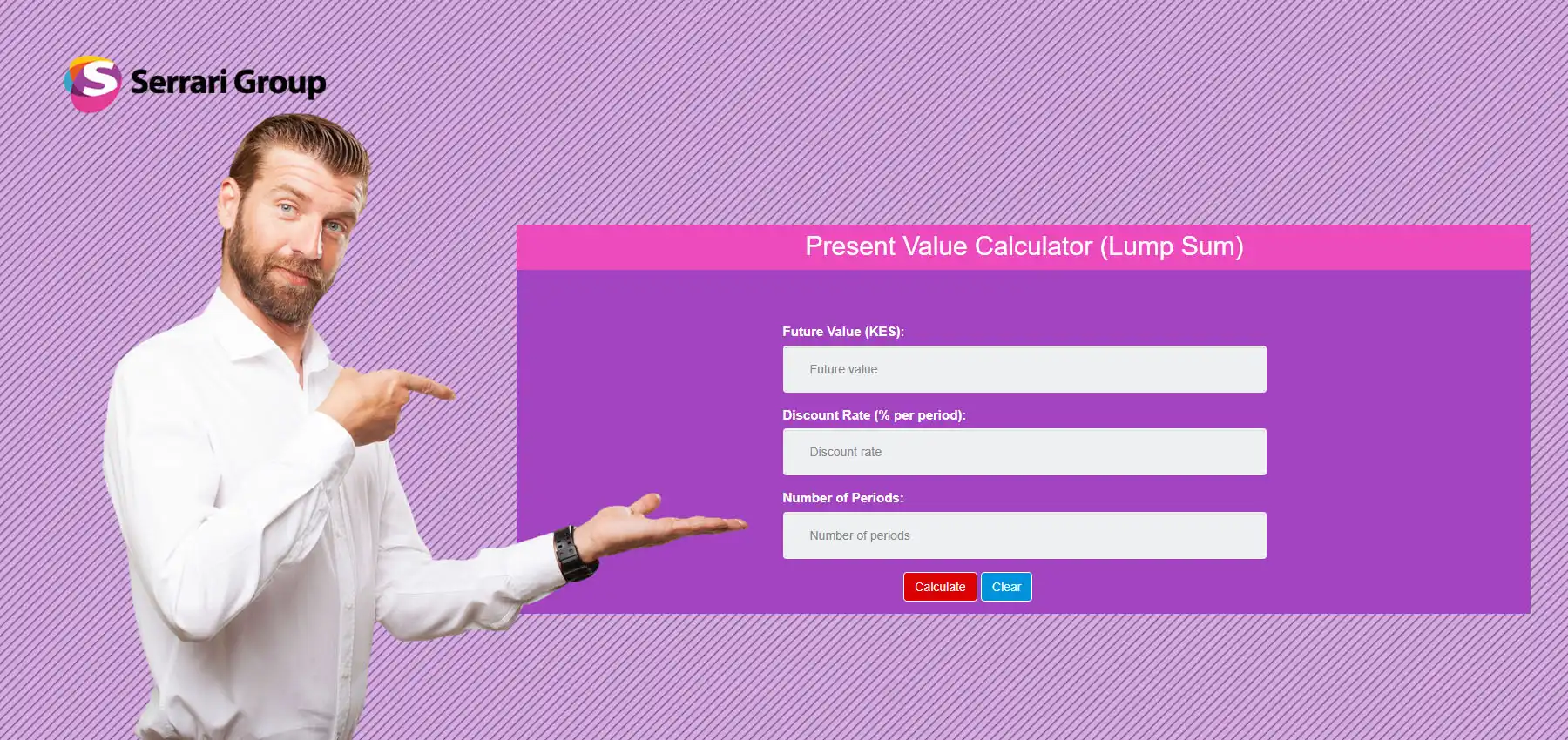

This formula discounts the future amount back to its value in today’s terms, using compound interest logic. You can find calculators for the present value of a lump sum on sites like Investopedia or Calculator.net. For a comprehensive calculator, visit Serrari Group.

Push boundaries, reach goals, achieve more. Whether it’s ACCA, HESI A2, ATI TEAS 7, HESI EXIT, NCLEX-RN, NCLEX-PN, or Financial Literacy, we’ve got the course to match your ambition. Start with Serrari Ed now.

2. How do I determine the present value of a future amount?

To determine the present value of a lump sum, you need three inputs:

- The future amount (e.g., $10,000)

- The annual interest or discount rate (e.g., 6%)

- The time period until the amount is received (e.g., 5 years)

Formula:

Present Value = Future Value / (1 + r)^n

Example:

If you expect to receive $10,000 five years from now and the interest rate is 6%:

r = 6 / 100 = 0.06

n = 5

Present Value = 10,000 / (1 + 0.06)^5

= 10,000 / (1.3382)

= $7,472.58

So, $10,000 received five years from now is worth $7,472.58 today at 6% interest.

3. Why is present value important in financial planning?

Present value of a lump sum allows you to compare the value of money today versus money in the future, which is crucial when evaluating:

- Investment opportunities

- Retirement savings

- Loan offers

- Business decisions

Using present value helps you make informed choices by answering: “What is the value today of an amount I will receive (or pay) in the future?”

It accounts for:

- The time value of money

- The effect of interest or discount rates

- The opportunity cost of capital

Without present value analysis, long-term financial comparisons would be misleading.

4. What interest rate should I use when calculating present value?

The interest rate (also called the discount rate) you should use depends on the context:

- Investment planning: Use your expected rate of return

- Loan or bond analysis: Use the market interest rate or yield

- Inflation-adjusted decisions: Use a real (inflation-adjusted) rate

- Opportunity cost: Use the return from the next best alternative investment

Example:

If you could earn 5% annually in a savings account, use 5% as your discount rate. It represents the cost of waiting for future money instead of having it today.

5. How does the number of periods affect present value?

The more periods (years) you have to wait for a future sum, the lower its present value of a lump sum — assuming a positive interest rate. That’s because the longer you wait, the less that future amount is worth today.

Formula again:

Present Value = Future Value / (1 + r)^n

As n (the number of years) increases, the denominator gets larger, and the present value decreases.

Example:

Future Value = $10,000

Interest rate = 6%

After 2 years:

Present Value = 10,000 / (1.06)^2 = 10,000 / 1.1236 = $8,899.79

After 10 years:

Present Value = 10,000 / (1.06)^10 = 10,000 / 1.7908 = $5,586.00

This shows how time erodes the present value of future cash flows.

Fuel your success with knowledge that matters. Enroll in career-defining programs: ACCA, HESI A2, ATI TEAS 7, HESI EXIT, NCLEX-RN, NCLEX-PN, and Financial Literacy. Join Serrari Ed now and take control of your future.

6. How do you calculate present value with monthly compounding?

To calculate the present value of a lump sum with monthly compounding, the present value of a lump sum formula adjusts the annual interest rate and the number of years to monthly terms:

PV = FV / (1 + r/n)^(n * t)

Where:

- FV is the future value

- r is the annual interest rate (as a decimal)

- n is the number of compounding periods per year (for monthly, n = 12)

- t is the number of years

Example:

If you want to find the present value of $10,000 to be received in 5 years at an annual interest rate of 6%, compounded monthly:

PV = 10000 / (1 + 0.06/12)^(12 * 5)

PV = 10000 / (1 + 0.005)^60

PV ≈ 10000 / 1.34885

PV ≈ $7,414.13

7. What’s the difference between present value and discounted cash flow?

Present value of a lump sum is a specific case of discounted cash flow (DCF).

- Present Value (PV) refers to the value today of a single future sum.

- Discounted Cash Flow (DCF) refers to the sum of present values of a series of future cash flows.

PV formula for lump sum:

PV = FV / (1 + r)^t

DCF formula for multiple cash flows:

DCF = CF1 / (1 + r)^1 + CF2 / (1 + r)^2 + … + CFn / (1 + r)^n

So, PV is for one future lump sum; DCF is used when evaluating projects, investments, or income streams over time.

8. Why is present value important in finance?

Present value of a lump sum helps in determining the current worth of a future amount of money. It is essential in finance because it:

- Allows comparison of cash flows received at different times

- Is used in investment valuation (like stocks, bonds, and projects)

- Helps in loan calculations and retirement planning

- Aids decision-making when choosing between financial alternatives

In essence, it accounts for the time value of money, a core principle in financial theory.

9. How does inflation affect present value?

Inflation reduces the purchasing power of money over time.

So, higher inflation -> lower present value of a lump sum in the future.

To adjust for inflation, you can use the real interest rate in the PV formula.

Real Interest Rate = Nominal Interest Rate – Inflation Rate

Example:

If the nominal rate is 8% and inflation is 3%, the real rate is 5%.

Use 5% in the PV formula to get a better idea of the value in today’s dollars.

10. How accurate is a present value calculator?

A present value of a lump sum calculator is extremely accurate if you input correct values for future amount, interest rate, time, and compounding frequency. However:

- Accuracy depends on predictable variables (like stable interest rates)

- Inflation, market risks, and changing discount rates can affect real outcomes

- It assumes all else remains constant, which rarely happens in real-world finance

Still, it’s a reliable tool for baseline planning, investment comparison, and time-value analysis. You might also find a present value of a lump sum table useful for quick reference, though calculators provide precise figures.

Ready to take your career to the next level? Join our dynamic courses: ACCA, HESI A2, ATI TEAS 7 , HESI EXIT , NCLEX – RN and NCLEX – PN, Financial Literacy!🌟 Dive into a world of opportunities and empower yourself for success. Explore more at Serrari Ed and start your exciting journey today! ✨