In a significant statistical overhaul, Nigeria, Africa’s most populous nation, has announced a substantial recalculation of its Gross Domestic Product (GDP), revealing an economy approximately 30% larger than previously estimated. This marks the first major statistical “rejig” in over a decade for the West African powerhouse, aiming to provide a more accurate and contemporary reflection of its rapidly evolving economic landscape.

The recalibration, spearheaded by Nigeria’s National Bureau of Statistics (NBS), involved shifting the base year for GDP calculation from 2010 to 2019. This crucial methodological update has propelled Nigeria’s 2024 GDP to N372.82 trillion (approximately $244 billion at current prices), a notable increase from the $187.76 billion previously estimated by institutions like the World Bank. The primary driver behind this upward revision is the inclusion of previously unmeasured or underrepresented sectors, most notably a booming digital services industry, the growing influence of pension funds, and a more comprehensive capture of the vast informal labor market that employs the majority of Nigerian residents.

The Mechanics of Rebasing: Unveiling Hidden Economic Activity

GDP rebasing is a standard statistical practice encouraged by development experts, particularly for emerging market economies. Its purpose is to update the benchmark year used for calculating national output, ensuring that the economic data accurately reflects structural changes, technological advancements, and the emergence of new industries. Economies, especially dynamic ones like Nigeria’s, undergo significant transformations over time, and without regular rebasing, GDP figures can become outdated and fail to capture the true size and composition of economic activity.

Why 2019 as the New Base Year?

The selection of 2019 as the new base year for Nigeria’s GDP calculation is strategic. The period between 2010 and 2019 witnessed profound shifts in the Nigerian economy. This decade saw:

- Explosive Growth in the Digital Services Industry: Nigeria has emerged as a vibrant hub for technological innovation in Africa. The period saw the rise of numerous fintech companies, e-commerce platforms, digital content creators, and a burgeoning tech startup ecosystem, particularly in cities like Lagos. Services such as mobile banking, online payments, ride-hailing apps, and digital marketing, which were nascent or non-existent in 2010, have become integral to daily life and commerce. These activities, previously difficult to quantify, now contribute significantly to national output. The inclusion of this “booming digital economy” is critical for an accurate picture of modern Nigeria.

- Expansion of Pension Funds: Nigeria’s pension industry has matured and expanded considerably since 2010. Pension funds manage substantial assets, which are then invested across various sectors of the economy, contributing to capital formation and financial deepening. Their growing financial muscle and role in investment were largely unaccounted for in the old GDP model.

- Formalizing the Informal Labour Market: The informal sector is a dominant feature of many developing economies, including Nigeria, where it employs a significant portion of the workforce—often over 90% of residents. This sector, encompassing everything from street vendors and small-scale artisans to informal transport and repair services, generates substantial economic value but is notoriously challenging to measure accurately due to its unrecorded nature. The NBS’s “most comprehensive” rebasing exercise aimed to better capture these activities, providing a more holistic view of the nation’s productive capacity.

Adeyemi Adeniran, head of the National Bureau of Statistics (NBS), emphasized the importance of this inclusivity at a press briefing in Abuja, stating, “Digital activities, pension fund administrators and the informal sector activities, where more than 90 per cent of Nigerians are employed, are now being measured.” This commitment to capturing the full spectrum of economic activity is vital for effective policy formulation and resource allocation.

Shifting Economic Composition: Agriculture’s Ascendancy

The rebasing exercise has not only increased the overall size of the Nigerian economy but also revealed a significant shift in its internal composition. Michael Famoroti, an economist and head of research at Lagos-based data company Stears, noted that the exercise “had shown that a change in the composition of the Nigerian economy was well under way, with agriculture firmly cementing its place as the largest contributor to national output and crude oil ‘barely’ contributing, at 5 per cent.”

Historically, Nigeria’s economy has been heavily reliant on crude oil exports, which have traditionally been the primary source of foreign exchange earnings and government revenue. However, years of underinvestment in the oil sector, pipeline vandalism, and a global push towards energy transition have seen oil’s contribution to GDP steadily decline. The new figures officially cement agriculture’s position as the dominant sector, reflecting the vast number of Nigerians engaged in farming and related activities, and highlighting the potential for diversification away from hydrocarbons. This shift is a positive indicator of a more resilient and broad-based economy, less susceptible to the volatility of global oil prices.

Historical Context and Africa’s Economic Landscape

Nigeria’s last GDP rebasing in 2014 was a landmark event. At that time, the statistical adjustment allowed Nigeria to surpass South Africa, briefly becoming the continent’s largest economy. This provided a significant psychological boost and attracted increased international attention. However, Nigeria lost that crown in 2023.

Following this latest rebasing, Nigeria’s economy remains the fourth largest on the continent, behind South Africa, Egypt, and Algeria. This ranking, while not reclaiming the top spot, still solidifies Nigeria’s position as a major economic force in Africa. The continuous need for such statistical updates in developing countries is critical, as highlighted by Famoroti: “It’s usually good to do these every 10 years or so especially in developing countries when the economy can change quite a bit. Add the emergence in the digital economy in that period and we needed an updated picture of the economy.”

The regular rebasing of GDP by emerging market economies is a practice encouraged by international financial institutions and development experts. It allows countries to better capture the size and structure of their national output, providing more accurate economic data that is reflective of their nascent and often rapidly transforming economies. This accuracy is crucial for policymakers, investors, and international organizations to make informed decisions and allocate resources effectively.

Debt Ratios and the Illusion of Fiscal Health

One of the most immediate and impactful consequences of the GDP recalculation is its effect on key macroeconomic indicators, particularly the country’s debt-to-GDP ratio. Prior to the model change, Nigeria’s debt-to-GDP ratio stood at 52%. Following the rebasing, this figure has significantly improved, now standing at about 40%.

This new ratio aligns perfectly with the Nigerian government’s self-imposed 40% debt ceiling and falls comfortably below the 55% level encouraged by international financial institutions such as the World Bank and the International Monetary Fund (IMF). On the surface, this appears to paint a healthier picture of Nigeria’s fiscal position, suggesting greater capacity to manage its debt burden.

However, economist Michael Famoroti voiced a critical concern: “My worry is that the higher GDP figure will embolden the government to be laxer with its debt sustainability. The debt-to-GDP ratio has already declined on the back of this. But that’s only masking the situation unfortunately.”

This warning highlights a crucial distinction: while the ratio has improved statistically, the underlying debt stock has not changed. The government still owes the same amount of money. A healthier ratio simply means the denominator (GDP) has increased, making the debt appear smaller relative to the economy’s size. If the government interprets this as a green light for increased borrowing without addressing fundamental issues of revenue generation and expenditure efficiency, it could exacerbate future fiscal challenges. The “masking” effect means that the perceived improvement might distract from the urgent need for structural reforms to ensure genuine debt sustainability. Nigeria’s broader debt challenges, including high debt service costs and reliance on volatile oil revenues, remain critical areas for attention.

Broader Economic Reforms and Challenges in Nigeria

The latest GDP rebasing comes amidst a period of significant economic reforms initiated by President Bola Tinubu. One of his most impactful decisions, taken in 2023, was the devaluation of Nigeria’s currency, the naira, to reflect its true market value and attract foreign investment. This measure, aimed at unifying multiple exchange rates and boosting liquidity in the foreign exchange market, has seen the naira lose more than 70% against the US dollar since its implementation.

While the devaluation was intended to make Nigeria more attractive to foreign investors by offering a more realistic exchange rate and improving the ease of doing business, it has had immediate and challenging consequences for ordinary Nigerians. The sharp depreciation of the currency has fueled inflation, significantly increasing the cost of imported goods and services, and eroding the purchasing power of households. This has led to a rise in the cost of living, posing a significant challenge for the government to manage public discontent while pushing through necessary reforms.

The rebasing, by presenting a larger economy, might indirectly support the narrative that Nigeria can absorb the shocks of these reforms and that its underlying economic strength is greater than perceived. This could potentially bolster investor confidence, as a larger GDP suggests a bigger market and greater capacity for growth and returns. However, the true test will be the government’s ability to translate this statistical improvement into tangible benefits for its citizens and to maintain a disciplined fiscal approach.

Senegal’s Parallel Path: Debt, Rebasing, and Transparency

Interestingly, Nigeria’s rebasing announcement follows a similar move by its West African neighbor, Senegal. Just last week, Senegal’s finance ministry announced its intention to rebase its GDP for the first time since 2018. This decision comes amidst a significant scandal involving hidden borrowing that threatens to push Senegal’s debt burden well over the current size of its economy.

The context of Senegal’s rebasing is particularly telling. Last year, the IMF suspended a bailout program for Senegal after billions of dollars in debt were misreported. The fund is currently awaiting the results of an investigation into the scandal, highlighting the critical importance of transparency and accurate data in international financial relations.

Bank of America analysts commented on Senegal’s situation, noting that “Rebasing could improve debt/GDP along with continued strong economic performance.” They added, “As such, the authorities may find this option appealing to resolve issues around the debt stock.” Indeed, Senegal’s dollar bonds have already rallied since the announcement, indicating investor optimism that a higher GDP figure could statistically alleviate debt concerns. Senegal’s current GDP calculations still use 2014 as a base year, making it ripe for an update that better reflects its recent economic growth and structural changes, including its emerging oil and gas sector.

The parallels between Nigeria and Senegal underscore a broader trend in developing economies: the strategic use of GDP rebasing to present a more favorable economic picture, particularly concerning debt metrics. While rebasing is a legitimate statistical exercise, its timing and context can be crucial. For countries grappling with high debt levels and transparency issues, a rebasing that significantly alters debt ratios can be viewed with a mix of optimism (for the statistical improvement) and caution (regarding the underlying fiscal realities). The emphasis on accurate and transparent data is paramount for maintaining investor trust and ensuring long-term fiscal stability.

Global Context and Future Outlook

The rebasing of Nigeria’s GDP is not just a domestic statistical exercise; it has implications for how the country is perceived on the global stage. Accurate GDP data is fundamental for:

- Policymakers: To formulate effective economic policies, allocate resources, and track progress towards national development goals.

- Investors: To assess market size, growth potential, and investment opportunities. A larger, more diverse economy can attract more foreign direct investment.

- International Organizations: For assessing a country’s economic health, determining aid allocations, and designing development programs.

- Credit Rating Agencies: For evaluating sovereign creditworthiness, which impacts borrowing costs.

For African development, better and more current data can inform more targeted development strategies and attract much-needed aid and investment. However, the fundamental challenges facing African economies – such as the need for continued diversification away from commodity dependence, massive infrastructure deficits, improving governance, and addressing poverty and inequality – remain. While rebasing provides a clearer snapshot, it does not inherently solve these deep-seated issues.

Nigeria’s path forward will involve leveraging the newfound clarity provided by this rebasing. The government must use this updated picture to:

- Reinforce Fiscal Discipline: Resist the temptation to increase borrowing simply because the debt-to-GDP ratio looks better. Focus on sustainable revenue generation and efficient public spending.

- Attract Targeted Investment: Highlight the growth of new sectors like digital services and agriculture to attract foreign investment beyond traditional oil and gas.

- Continue Structural Reforms: Address underlying challenges such as inflation, unemployment, and infrastructure gaps to ensure that statistical growth translates into tangible improvements in living standards for all Nigerians.

- Enhance Data Transparency: Maintain regular and transparent statistical updates to build and sustain international confidence.

Conclusion: A Step Towards Economic Reality

Nigeria’s 2025 GDP rebasing is a crucial step towards presenting a more accurate and contemporary reflection of its economy. By incorporating dynamic new sectors and better capturing the informal market, the NBS has unveiled a larger and more diverse national output, with agriculture now firmly established as the primary economic driver. This statistical adjustment offers a welcome improvement in key metrics like the debt-to-GDP ratio, aligning it with international benchmarks.

However, as economists caution, this statistical improvement should not be mistaken for a fundamental resolution of Nigeria’s fiscal challenges. The true measure of success will be the government’s ability to capitalize on this updated economic picture by pursuing disciplined fiscal policies, continuing structural reforms, and fostering an environment that translates statistical growth into broad-based prosperity for its citizens. The experience of Senegal underscores the broader regional importance of accurate and transparent economic data for both national planning and international trust. As Nigeria navigates its economic future, the rebasing provides a clearer map, but the journey towards sustainable and inclusive growth still requires unwavering commitment and strategic action.

Ready to take your career to the next level? Join our dynamic courses: ACCA, HESI A2, ATI TEAS 7 , HESI EXIT , NCLEX – RN and NCLEX – PN, Financial Literacy!🌟 Dive into a world of opportunities and empower yourself for success. Explore more at Serrari Ed and start your exciting journey today! ✨

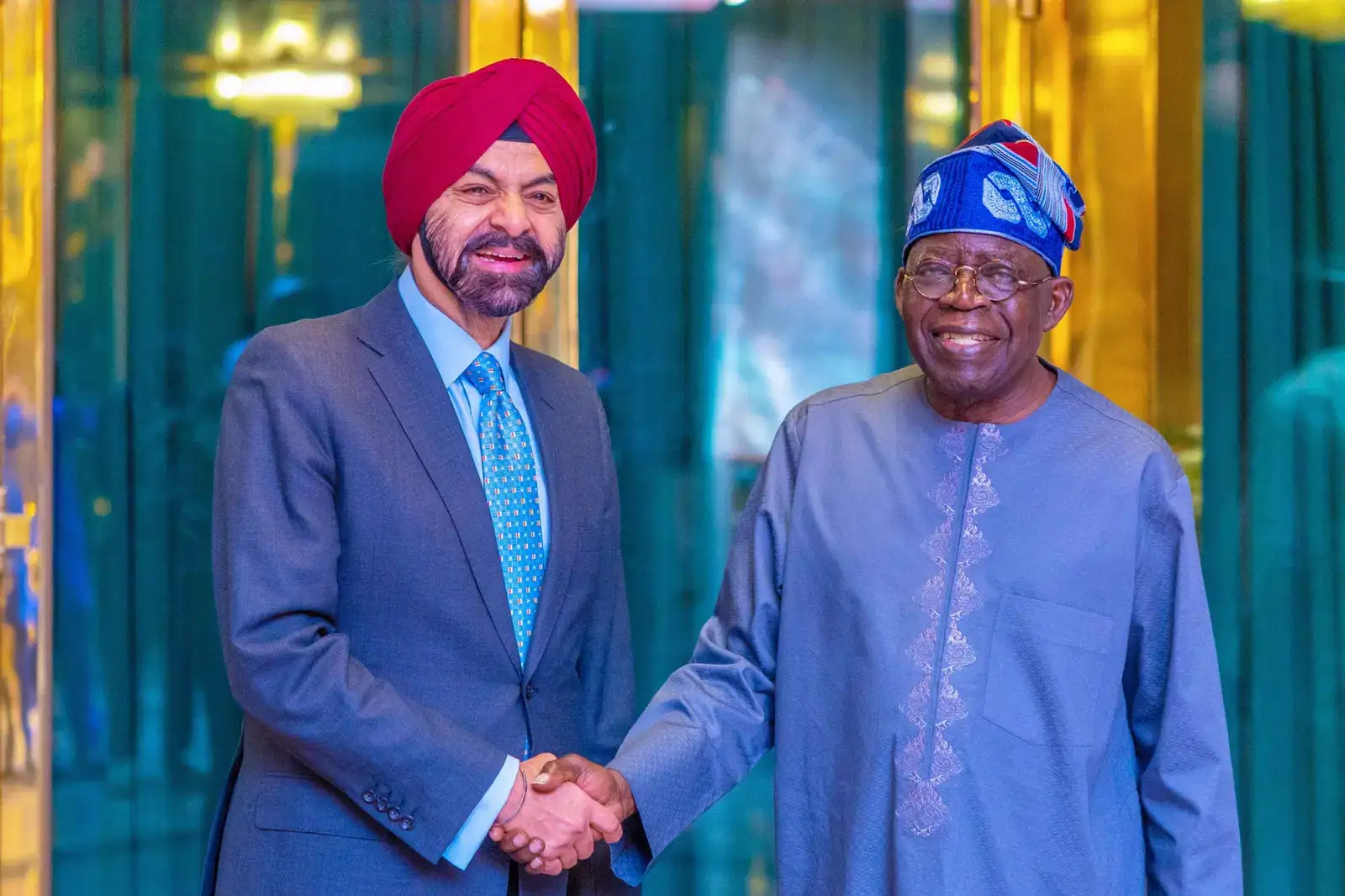

Photo Source: Google

By: Montel Kamau

Serrari Financial Analyst

24th July, 2025

Article, Financial and News Disclaimer

The Value of a Financial Advisor

While this article offers valuable insights, it is essential to recognize that personal finance can be highly complex and unique to each individual. A financial advisor provides professional expertise and personalized guidance to help you make well-informed decisions tailored to your specific circumstances and goals.

Beyond offering knowledge, a financial advisor serves as a trusted partner to help you stay disciplined, avoid common pitfalls, and remain focused on your long-term objectives. Their perspective and experience can complement your own efforts, enhancing your financial well-being and ensuring a more confident approach to managing your finances.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Readers are encouraged to consult a licensed financial advisor to obtain guidance specific to their financial situation.

Article and News Disclaimer

The information provided on www.serrarigroup.com is for general informational purposes only. While we strive to keep the information up to date and accurate, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability with respect to the website or the information, products, services, or related graphics contained on the website for any purpose. Any reliance you place on such information is therefore strictly at your own risk.

www.serrarigroup.com is not responsible for any errors or omissions, or for the results obtained from the use of this information. All information on the website is provided on an as-is basis, with no guarantee of completeness, accuracy, timeliness, or of the results obtained from the use of this information, and without warranty of any kind, express or implied, including but not limited to warranties of performance, merchantability, and fitness for a particular purpose.

In no event will www.serrarigroup.com be liable to you or anyone else for any decision made or action taken in reliance on the information provided on the website or for any consequential, special, or similar damages, even if advised of the possibility of such damages.

The articles, news, and information presented on www.serrarigroup.com reflect the opinions of the respective authors and contributors and do not necessarily represent the views of the website or its management. Any views or opinions expressed are solely those of the individual authors and do not represent the website's views or opinions as a whole.

The content on www.serrarigroup.com may include links to external websites, which are provided for convenience and informational purposes only. We have no control over the nature, content, and availability of those sites. The inclusion of any links does not necessarily imply a recommendation or endorsement of the views expressed within them.

Every effort is made to keep the website up and running smoothly. However, www.serrarigroup.com takes no responsibility for, and will not be liable for, the website being temporarily unavailable due to technical issues beyond our control.

Please note that laws, regulations, and information can change rapidly, and we advise you to conduct further research and seek professional advice when necessary.

By using www.serrarigroup.com, you agree to this disclaimer and its terms. If you do not agree with this disclaimer, please do not use the website.

www.serrarigroup.com, reserves the right to update, modify, or remove any part of this disclaimer without prior notice. It is your responsibility to review this disclaimer periodically for changes.

Serrari Group 2025