1: How do I calculate my monthly mortgage payment?

To calculate your monthly mortgage payment, use this formula:

Monthly Payment=[P×r×(1+r)^n]/ [(1+r)^n–1]

Where:

- P = loan amount (principal)

- r = monthly interest rate (annual interest rate ÷12÷100)

- n = total number of monthly payments (loan term in years ×12)

Example:

If your loan is $200,000, interest rate is 5% annually, and loan term is 30 years:

r=5÷12÷100=0.004167

n=30×12=360

Monthly Payment=[(1+0.004167)360–1][200000×0.004167×(1+0.004167)360]≈$1,073.64 (approx.)

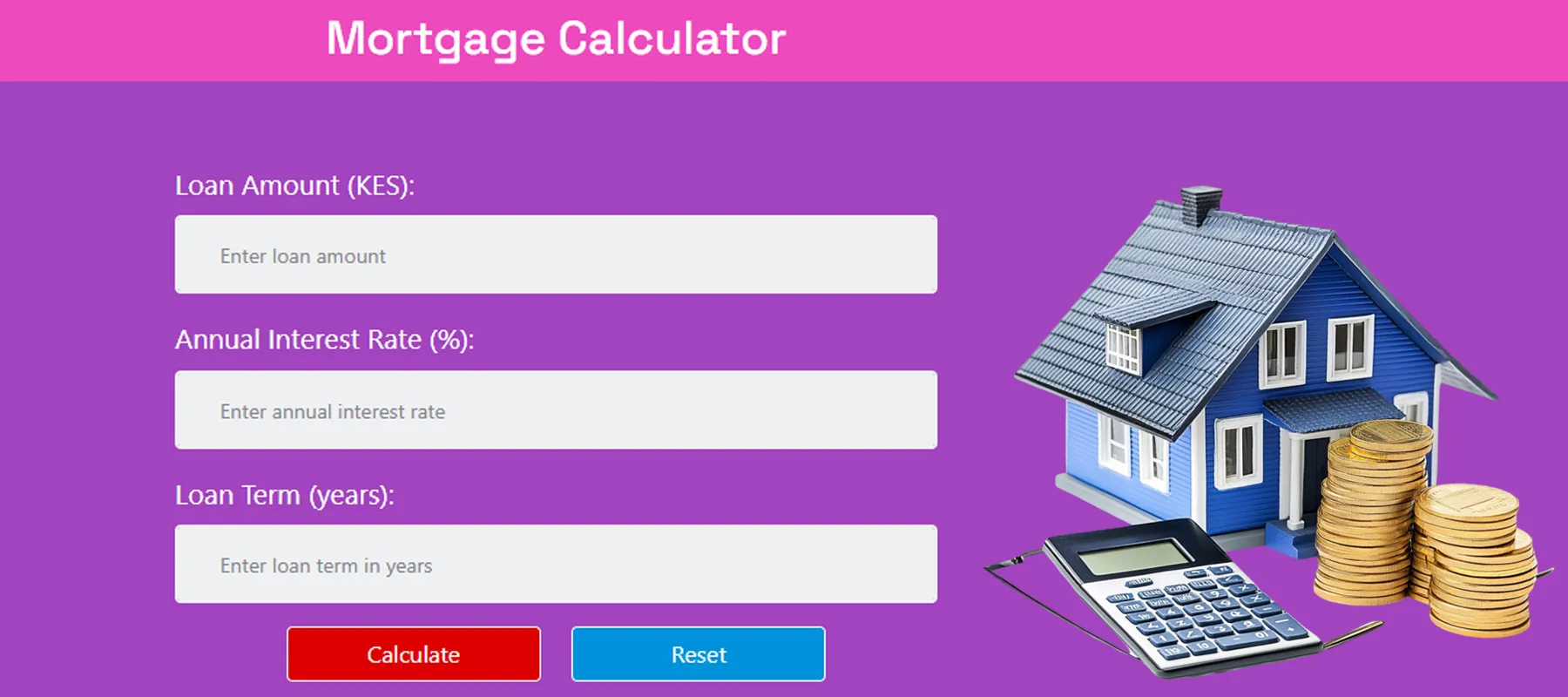

You can easily determine this with a mortgage calculator online. Reputable sites like NerdWallet, Bankrate, and Calculator.net offer excellent tools. For a comprehensive home loan mortgage calculator and other financial tools, visit Serrari Group.

Push boundaries, reach goals, achieve more. Whether it’s ACCA, HESI A2, ATI TEAS 7, HESI EXIT, NCLEX-RN, NCLEX-PN, or Financial Literacy, we’ve got the course to match your ambition. Start with Serrari Ed now.

2: What is the difference between principal and interest in a mortgage?

Principal is the original amount you borrowed. Interest is the cost you pay to borrow that money, calculated as a percentage of the remaining loan balance.

Each monthly mortgage payment includes:

- A portion that goes toward paying down the principal

- A portion that covers the interest cost

In the early years of a mortgage, most of your payment goes to interest. Over time, a larger portion reduces the principal. A mortgage calculator often provides a breakdown of these components.

3: How do I calculate the total interest paid on a mortgage?

Total Interest = (Monthly Payment × Total Number of Payments) – Loan Amount

Example:

From FAQ 1:

Monthly Payment = $1,073.64

Total payments = 360 months

Loan = $200,000

Total Interest = (1,073.64×360)–200,000

=386,510.40–200,000

=$186,510.40

This is the interest paid over 30 years. Many mortgage calculator tools will automatically display this total interest amount.

4: How do extra payments affect my mortgage?

Extra payments reduce the principal faster, which:

- Decreases total interest paid

- Shortens the loan term

Example:

If you pay an extra $100/month on a 30-year, $200,000 mortgage at 5%, you could save over $30,000 in interest and cut about 4–5 years off the loan.

Most mortgage calculator tools allow you to add extra payments to see the effect, providing a valuable mortgage simulation.

5: What is an amortization schedule and how is it used?

An amortization schedule is a table showing:

- Each monthly payment

- The portion going to interest

- The portion going to principal

- The remaining loan balance after each payment

It helps you:

- Track your payoff progress

- Understand how your payments are allocated

- Plan for refinancing or prepayment

Most mortgage calculator tools automatically generate this when you enter your loan info, making it a useful mtg calculator feature.

Fuel your success with knowledge that matters. Enroll in career-defining programs: ACCA, HESI A2, ATI TEAS 7, HESI EXIT, NCLEX-RN, NCLEX-PN, and Financial Literacy. Join Serrari Ed now and take control of your future.

6: How do property taxes and insurance affect my mortgage payment?

Your total monthly mortgage payment often includes more than just principal and interest. It may also include:

- Property Taxes

- Homeowner’s Insurance

- Private Mortgage Insurance (PMI) (if required)

This full payment is called PITI:

Principal + Interest + Taxes + Insurance

Example:

Principal & Interest = $1,073.64

Property Tax = $200/month

Insurance = $100/month

Total monthly payment = $1,073.64 + $200 + $100 = $1,373.64

Most lenders collect these extra costs in escrow. Many advanced home loan mortgage calculator tools allow you to include these figures for a more accurate total payment estimate.

7: How much mortgage can I afford based on my income?

A general rule is:

Your total housing costs should not exceed 28% of your gross monthly income.

Use this formula:

Maximum Affordable Payment = Monthly Income × 0.28

Example:

If your gross monthly income is $5,000:

$5,000×0.28=$1,400

You should aim for a mortgage (including taxes and insurance) around $1,400/month. This is a common calculation performed by a mortgage estimator or mtg calc tool.

8: What is PMI and when do I have to pay it?

PMI (Private Mortgage Insurance) is required when your down payment is less than 20% of the home’s price.

- It protects the lender if you default.

- It’s added to your monthly payment.

Example:

If you buy a $300,000 home with a 10% down payment ($30,000), you’ll likely pay PMI.

PMI typically costs 0.5% to 1.5% of the loan per year.

If your loan is $270,000:

PMI at 1% = $2,700/year = $225/month

Once your equity reaches 20%, PMI can often be canceled. Some advanced mortgage calculator tools can factor in PMI.

9: How is the mortgage interest rate calculated?

The interest rate is set by the lender and influenced by:

- Your credit score

- Loan type and term

- Market rates

- Down payment size

You do not calculate the rate yourself — but you use it in the mortgage formula.

To find the monthly rate, divide the annual rate by 12:

Example:

Annual rate = 6%

Monthly rate = 6÷12=0.5%, or 0.005 in mortgage calculator formulas.

10: How do I compare mortgage offers from different lenders?

Look beyond just the interest rate. Compare:

- APR (Annual Percentage Rate) – includes fees and gives a better idea of total cost

- Monthly payment

- Upfront fees (origination, closing costs)

- Loan terms (e.g., 15 vs 30 years)

- Total interest paid over time

Use a mortgage calculator for each offer by plugging in:

- Loan amount

- Interest rate

- Loan term

This helps you clearly see which offer is cheapest long-term and provides a useful mortgage simulation for your financial planning.

Ready to take your career to the next level? Join our dynamic courses: ACCA, HESI A2, ATI TEAS 7 , HESI EXIT , NCLEX – RN and NCLEX – PN, Financial Literacy!🌟 Dive into a world of opportunities and empower yourself for success. Explore more at Serrari Ed and start your exciting journey today! ✨