Knight Frank Kenya, a leading property consultancy, has released its highly anticipated Kenya Market Update for H1 2025, painting a picture of remarkable resilience and growth across the country’s real estate landscape. The comprehensive analysis reveals a sector that has not only weathered recent economic challenges but emerged stronger, with a robust 5.6% growth rate that exceeds expectations and signals a fundamental shift in market dynamics.

The report’s findings come at a pivotal moment for Kenya’s economy, as the country navigates post-pandemic recovery while addressing infrastructure gaps that have historically constrained growth. With infrastructure investments reaching an unprecedented KSh 217.3 billion in the first half of 2025, the real estate sector is experiencing a transformation that extends far beyond traditional property development patterns.

One decision can change your entire career. Take that step with our Online courses in ACCA, HESI A2, ATI TEAS 7, HESI EXIT, NCLEX-RN, NCLEX-PN, and Financial Literacy. Join Serrari Ed and start building your brighter future today.

Economic Foundation: Stability Amid Global Uncertainty

Kenya’s macroeconomic environment has provided a solid foundation for real estate growth, with GDP expanding 4.90% in the first quarter of 2025 compared to the same period in the previous year. This performance aligns with broader projections, as the World Bank expects Kenya’s growth to recover to 4.9% on average during 2025-2027, driven by easing inflation, accommodative monetary policy, and increased credit growth.

The Central Bank of Kenya has played a crucial role in supporting this growth trajectory. The Monetary Policy Committee lowered the Central Bank Rate (CBR) to 9.50% at its August 12, 2025 meeting, continuing a trend of monetary easing designed to stimulate economic activity. This reduction represents the latest in a series of cuts, with the central bank having lowered rates by 0.25 percentage points from 9.75%.

According to Mastercard Economics Institute’s 2025 Economic Outlook for Kenya, GDP is projected to grow by 4.7% year over year, with consumer spending predicted to rise by 4% and consumer price inflation likely to stabilize at 4.8%. This economic stability has created an environment conducive to real estate investment and development.

Inflation management has been particularly successful, with the Knight Frank report noting that inflation remained within the Central Bank of Kenya’s target range of 2.5%–7.5% throughout the reporting period. The latest data shows inflation easing to 3.8% in May from April’s eight-month high of 4.1%, providing additional confidence for long-term property investments.

Infrastructure Revolution: The KSh 217 Billion Investment Drive

The standout feature of Kenya’s H1 2025 performance has been the government’s massive infrastructure commitment, with KSh 217.3 billion allocated for road development alone – representing a substantial 12.3% increase from 2024 levels. This investment surge reflects the government’s recognition that infrastructure development serves as the backbone for sustainable real estate growth.

Public-Private Partnerships (PPPs) have gained significant momentum, with 33 projects identified during the period – 8 currently active and 25 in the development pipeline. This approach leverages private sector expertise and capital while reducing the government’s direct financial burden, creating a more sustainable model for infrastructure development.

Among the flagship projects driving this transformation is the EU-backed Kwa Jomvu-Mariakani highway, supported by a substantial Euro 19 billion loan facility. This project will significantly enhance connectivity between Mombasa and inland regions, creating new opportunities for residential and commercial development along the corridor.

The Nairobi River Regeneration Project, valued at KES 50 billion, represents another cornerstone of the infrastructure push. This ambitious undertaking aims to transform Nairobi’s urban landscape while addressing critical environmental and public health challenges that have long plagued the capital city.

Additionally, the dualling of the Northern Bypass and developments within the Dongo Kundu Special Economic Zone (SEZ) are positioned to enhance connectivity and stimulate real estate growth along these key transportation corridors. The Dongo Kundu infrastructure projects have already contributed to a 20-25% property value surge in coastal areas between 2024-2025.

Office Market: The Flight to Quality Accelerates

The office sector has demonstrated remarkable resilience, with prime office occupancy rates climbing to an impressive 77.7% in H1 2025. This growth has been driven primarily by strong uptake in Grade A developments, including landmark projects such as The Cube, Eneo at Tatu City, and Purple Tower, which have set new standards for modern office accommodation in Nairobi.

The expansion of flexible workspace operators has been particularly noteworthy, with companies like KOFISI and IWG significantly expanding their footprints across the capital. This trend reflects the evolving nature of work arrangements and the growing demand for flexible, technology-enabled office solutions that cater to both local and international businesses.

Business Process Outsourcing (BPO) firms have played a crucial role in reinforcing Nairobi’s position as a regional hub for professional services. The continued growth of this sector has created sustained demand for high-quality office space, particularly in areas with reliable infrastructure and connectivity.

However, the market has also revealed a clear dichotomy between property classes. While Grade A buildings thrive, Grade B properties face significant challenges due to oversupply and shifting tenant preferences toward modern, environmentally conscious facilities with superior amenities.

Mark Dunford, CEO of Knight Frank Kenya, emphasized this market dynamic: “The flight to quality is undeniable. Prime office spaces with ESG credentials and modern amenities continue to attract tenants, while secondary stock struggles. Landlords must prioritize adaptability to remain competitive in this tenant-favoring market.”

Residential Market: Steady Growth Amid Housing Demand

The prime residential market has demonstrated stable growth with sales prices increasing by 5.63% year-on-year, reflecting sustained demand from both domestic and international buyers. This growth has been particularly pronounced in Nairobi’s premium suburbs, where infrastructure improvements and enhanced security have attracted high-net-worth individuals and expatriate professionals.

Rental markets have shown even stronger performance, with prime residential rents growing by 7.96% year-on-year. This robust rental growth reflects several factors, including limited supply of quality housing, increasing urbanization, and growing demand from young professionals entering the job market.

The residential development pipeline remains robust, with approved building plans for residential developments accounting for 77% of total approvals during H1 2025. These approvals, valued at KES 54.2 billion, indicate strong developer confidence in the sector’s future prospects and reflect ongoing demand for housing across various price segments.

Real estate investment opportunities are expanding beyond traditional urban centers, with locations like Naivasha emerging as attractive destinations for both residential and commercial development. International investors are particularly attracted to Nairobi’s value proposition, where $1,200 per square meter can secure quality apartments in prime locations.

Hospitality Sector: Tourism Recovery Drives Investment

Kenya’s hospitality sector has shown remarkable recovery momentum, with international tourist arrivals increasing by 3.5% in early 2025. This growth has positioned Kenya as Africa’s fourth-best tourism destination, according to recent international rankings, reinforcing the country’s appeal as both a leisure and business travel hub.

The sector has attracted significant landmark investments, demonstrating international confidence in Kenya’s tourism potential. Marriott’s introduction of luxury tented camps in the world-renowned Masai Mara represents a significant vote of confidence in Kenya’s eco-tourism offerings, while Radisson Blu’s KSh 4.3 billion expansion in Nairobi signals strong demand for business hospitality services.

Serviced apartments have gained particular traction during this period, catering to evolving blended work-leisure travel trends that have emerged from changing business practices and remote work arrangements. This segment bridges traditional hotel accommodation and residential rentals, offering extended-stay options that appeal to business travelers and digital nomads.

Mark Dunford noted the sector’s evolution: “Kenya’s hospitality sector is redefining luxury through eco-conscious developments and experiential offerings. With major international brands looking to either increase their footprint or enter the market, the country is solidifying its status as one of Africa’s premier tourism and MICE destination.”

Build the future you deserve. Get started with our top-tier Online courses: ACCA, HESI A2, ATI TEAS 7, HESI EXIT, NCLEX-RN, NCLEX-PN, and Financial Literacy. Let Serrari Ed guide your path to success. Enroll today.

Capital Markets and Investment Vehicles

Kenya’s capital markets have reflected cautious optimism throughout H1 2025, with particular interest in infrastructure-linked investments. The success of instruments like the Talanta Stadium bond has highlighted growing confidence in infrastructure-backed securities, providing alternative investment vehicles for institutional and retail investors.

However, Real Estate Investment Trusts (REITs) continue to face challenges, with interest remaining subdued despite stable pricing over the reporting period. Charles Macharia, Senior Research Analyst at Knight Frank Kenya, observed: “Kenya’s capital markets reflect cautious optimism, with the success of instruments like the Talanta Stadium bond highlighting growing confidence in infrastructure-linked investments. Meanwhile, the REITs market continues to show untapped potential, maintaining stable prices amid limited activity.”

The shift in investor attention toward asset-backed securities represents a broader evolution in Kenya’s capital markets, as sophisticated investors seek alternatives to traditional equity and bond investments. This trend could provide new financing mechanisms for real estate development while offering investors exposure to the property sector through liquid, regulated instruments.

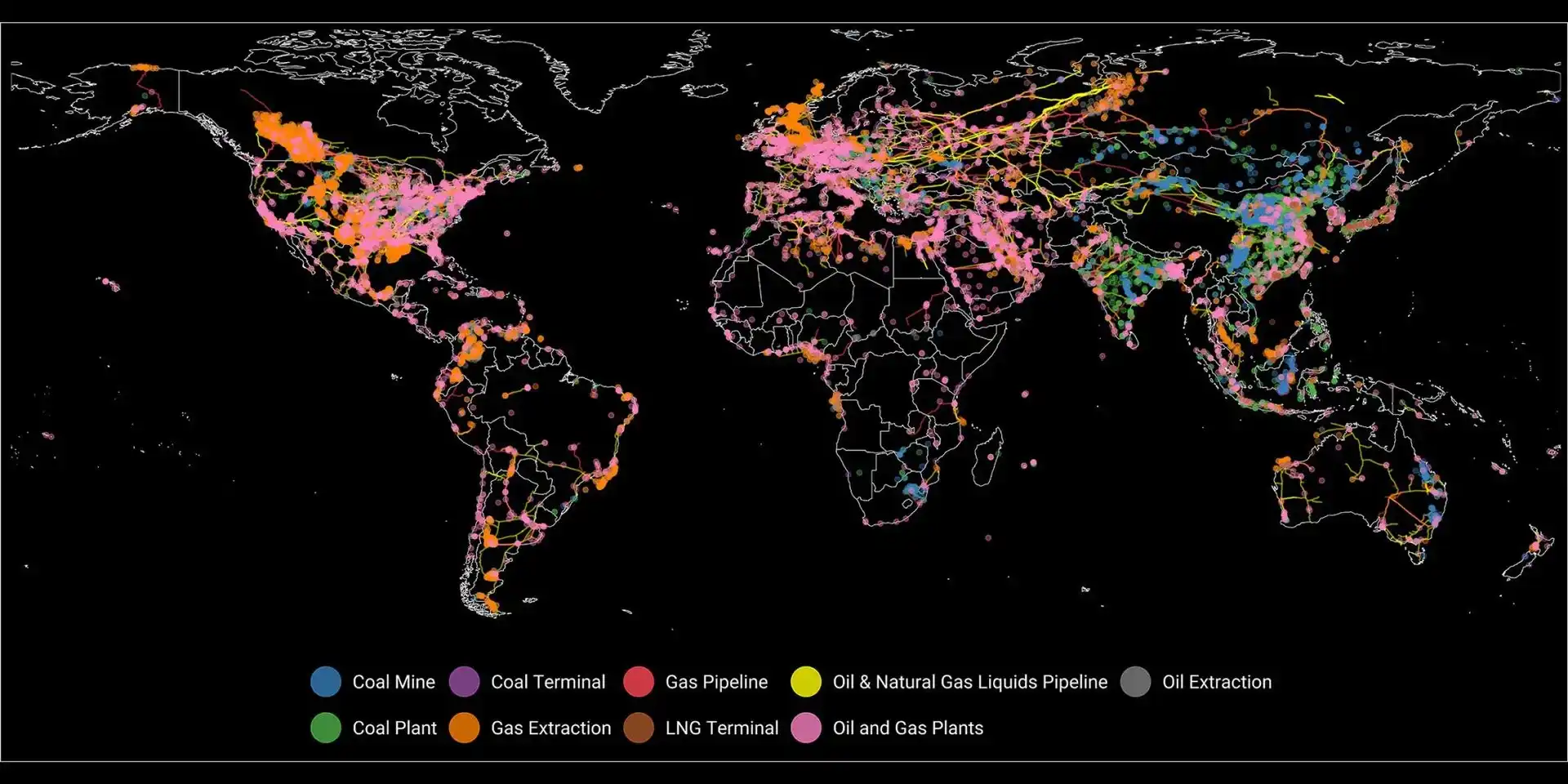

Regional Infrastructure Connectivity

Kenya’s infrastructure development extends beyond urban centers, with roads, expressways, rail networks like the Standard Gauge Railway (SGR), and bypasses opening up satellite towns and rural areas for investment. This connectivity expansion is transforming previously overlooked areas into prime real estate opportunities with significant appreciation potential.

The Standard Gauge Railway continues to play a transformative role in opening up new development corridors, particularly between Nairobi and Mombasa. Communities along the SGR route have experienced increased economic activity and property development, as improved transportation links reduce travel times and enhance access to major urban centers.

Ongoing infrastructure projects such as the Nairobi Expressway and expansion of Mombasa port are expected to boost property values in surrounding areas, creating ripple effects that extend well beyond the immediate project zones.

Coastal Property Boom

Kenya’s coastal region has emerged as a particular success story within the broader real estate narrative. Improved road infrastructure has made Kilifi and Malindi more accessible, boosting demand for vacation homes and retirement properties, with coastal properties offering rental yields as high as 8% annually.

The coastal property market benefits from several converging factors: improved infrastructure access, growing domestic tourism, international investor interest, and Kenya’s established reputation as a stable destination for property investment. These dynamics have created a sustained demand for both residential and hospitality properties along the coast.

Monetary Policy Support

The supportive monetary policy environment has been crucial to the real estate sector’s performance. The central bank’s decision to cut rates reflects the necessity to boost lending to the private sector and stimulate growth, creating more favorable conditions for property financing and development.

The CBK Monetary Policy Committee has continued to reduce the Central Bank Rate with a 50 basis point cut in February 2025, lowering it to 10.75% from 11.25% in December 2024. This accommodative stance has improved access to credit for both developers and end-users, supporting increased transaction volumes across all property segments.

The lower interest rate environment has particularly benefited the residential mortgage market, where reduced borrowing costs have improved affordability for homebuyers and supported increased transaction volumes.

Challenges and Market Dynamics

Despite the overall positive performance, the real estate sector continues to face several challenges that require careful navigation. The oversupply situation in certain segments, particularly Grade B office buildings, highlights the importance of understanding specific market dynamics rather than applying broad sector generalizations.

Currency stability has been another area of focus, with the Kenyan shilling experiencing early-year volatility before stabilizing against the USD. This stabilization has been crucial for international investor confidence and has supported continued foreign investment in the property sector.

The rental market dynamics reveal interesting trends, with prime residential properties commanding significant rental growth while some secondary locations struggle with vacancy rates and pricing pressure.

Future Outlook and Investment Opportunities

Looking ahead, several factors position Kenya’s real estate sector for continued growth throughout the remainder of 2025 and beyond. The government’s sustained commitment to infrastructure development, combined with supportive monetary policy and improving economic fundamentals, creates a favorable environment for property investment.

Investors in Kenya’s real estate industry are bullish for better prospects in 2025, majorly driven by rising demand for land in satellite towns and government-driven special economic zones developments. This optimism reflects both current market performance and expectations for continued policy support.

The development of special economic zones, improved transportation networks, and growing international business presence all contribute to positive long-term fundamentals for the real estate sector.

Investment Strategy Implications

For investors, the Knight Frank report highlights the importance of location selection and property quality in maximizing returns. The clear preference for Grade A office space and prime residential properties suggests that successful investment strategies must prioritize quality over quantity.

The infrastructure investment wave creates opportunities for strategic land acquisition along planned development corridors, while the hospitality sector’s recovery opens possibilities for tourism-related property investments.

Conclusion: A Sector Transformed

Kenya’s real estate sector’s 5.6% growth in H1 2025 represents more than statistical improvement – it signals a fundamental transformation in how the sector operates and delivers value. The combination of record infrastructure investment, supportive monetary policy, and growing international confidence has created conditions for sustained growth.

The KSh 217 billion infrastructure investment represents a clear commitment from the government to address longstanding connectivity and development challenges. As these projects reach completion over the coming years, their impact on property values and development opportunities is expected to be substantial.

The sector’s performance during H1 2025 provides a strong foundation for continued growth, with multiple indicators suggesting that the positive trends will extend well into the second half of the year and beyond.

Ready to take your career to the next level? Join our Online courses: ACCA, HESI A2, ATI TEAS 7 , HESI EXIT , NCLEX – RN and NCLEX – PN, Financial Literacy!🌟 Dive into a world of opportunities and empower yourself for success. Explore more at Serrari Ed and start your exciting journey today! ✨

Track GDP, Inflation and Central Bank rates for top African markets with Serrari’s comparator tool.

See today’s Treasury bonds and Money market funds movement across financial service providers in Kenya, using Serrari’s comparator tools.

photo source: Google

By: Montel Kamau

Serrari Financial Analyst

19th August, 2025

Article, Financial and News Disclaimer

The Value of a Financial Advisor

While this article offers valuable insights, it is essential to recognize that personal finance can be highly complex and unique to each individual. A financial advisor provides professional expertise and personalized guidance to help you make well-informed decisions tailored to your specific circumstances and goals.

Beyond offering knowledge, a financial advisor serves as a trusted partner to help you stay disciplined, avoid common pitfalls, and remain focused on your long-term objectives. Their perspective and experience can complement your own efforts, enhancing your financial well-being and ensuring a more confident approach to managing your finances.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Readers are encouraged to consult a licensed financial advisor to obtain guidance specific to their financial situation.

Article and News Disclaimer

The information provided on www.serrarigroup.com is for general informational purposes only. While we strive to keep the information up to date and accurate, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability with respect to the website or the information, products, services, or related graphics contained on the website for any purpose. Any reliance you place on such information is therefore strictly at your own risk.

www.serrarigroup.com is not responsible for any errors or omissions, or for the results obtained from the use of this information. All information on the website is provided on an as-is basis, with no guarantee of completeness, accuracy, timeliness, or of the results obtained from the use of this information, and without warranty of any kind, express or implied, including but not limited to warranties of performance, merchantability, and fitness for a particular purpose.

In no event will www.serrarigroup.com be liable to you or anyone else for any decision made or action taken in reliance on the information provided on the website or for any consequential, special, or similar damages, even if advised of the possibility of such damages.

The articles, news, and information presented on www.serrarigroup.com reflect the opinions of the respective authors and contributors and do not necessarily represent the views of the website or its management. Any views or opinions expressed are solely those of the individual authors and do not represent the website's views or opinions as a whole.

The content on www.serrarigroup.com may include links to external websites, which are provided for convenience and informational purposes only. We have no control over the nature, content, and availability of those sites. The inclusion of any links does not necessarily imply a recommendation or endorsement of the views expressed within them.

Every effort is made to keep the website up and running smoothly. However, www.serrarigroup.com takes no responsibility for, and will not be liable for, the website being temporarily unavailable due to technical issues beyond our control.

Please note that laws, regulations, and information can change rapidly, and we advise you to conduct further research and seek professional advice when necessary.

By using www.serrarigroup.com, you agree to this disclaimer and its terms. If you do not agree with this disclaimer, please do not use the website.

www.serrarigroup.com, reserves the right to update, modify, or remove any part of this disclaimer without prior notice. It is your responsibility to review this disclaimer periodically for changes.

Serrari Group 2025