In a development that has stirred both excitement and speculation in financial circles, Kenya’s central bank has made a surprising move by cutting its benchmark interest rate for the first time in over four years. The Monetary Policy Committee (MPC) of the Central Bank of Kenya (CBK) announced on August 6, 2024, that it has decided to lower the key rate from 13% to 12.75%. This unexpected decision signals a significant shift in the country’s monetary policy and comes as Kenya’s inflation rate has hit a four-year low.

Understanding the Rate Cut

The decision to reduce the benchmark interest rate is notable, especially considering the CBK’s previous stance of maintaining a steady rate for an extended period. For over four years, the CBK had kept the rate unchanged, focusing on stabilizing the exchange rate and anchoring inflation expectations. The rate cut signifies a move towards stimulating economic activity, reflecting confidence in the current economic environment.

Governor Kamau Thugge, in his announcement, highlighted that the central bank’s previous measures have been successful in reducing overall inflation to below the midpoint of the target range. “The MPC noted that its previous measures have successfully lowered overall inflation, stabilized the exchange rate, and anchored inflationary expectations,” Thugge said. This indicates that the bank’s policies have achieved their intended goals, paving the way for this policy adjustment.

The Rationale Behind the Decision

The rate cut comes in the context of a declining inflation rate, which has reached levels not seen in the past four years. This achievement is attributed to a combination of effective monetary policies and improved domestic conditions. By lowering the interest rate, the central bank aims to support economic growth, encourage investment, and provide a boost to various sectors of the economy.

This strategic shift is expected to have a ripple effect across the economy. Lower interest rates generally reduce borrowing costs for businesses and consumers, potentially leading to increased spending and investment. This can stimulate economic growth and create a more favorable environment for both local and international investors.

The Global Context

Kenya’s decision to cut rates aligns with a broader global trend where many central banks are easing monetary policies to support economic stability. As inflation moderates in major economies such as the United States, China, and India, Kenya’s move reflects an effort to align with these global trends and leverage the benefits of a more accommodative monetary policy.

The global economic landscape is characterized by moderated inflation rates and ongoing geopolitical uncertainties. In this context, Kenya’s rate cut is seen as a proactive step to enhance the country’s economic stability and capitalize on global growth prospects. The reduced interest rate could make Kenya an attractive destination for investment, particularly as global growth in key economies potentially boosts trade and investment opportunities.

Economic Outlook and Implications

Kenya’s economic outlook appears promising, with several positive indicators emerging. The real GDP growth for the first quarter of 2024 was robust, and projections suggest an annual growth rate of 5.4%. This growth rate indicates a stable and expanding economy, creating a favorable environment for investment and economic development.

Additionally, Kenya’s current account deficit has been reduced, and there has been a notable increase in goods exports, particularly from the agriculture sector. These improvements reflect a strengthening of the country’s economic fundamentals and a positive trade balance. The agricultural sector, which plays a crucial role in Kenya’s economy, has shown resilience and growth, contributing to the overall economic stability.

Challenges and Risks

Despite the positive economic trends, there are challenges and risks that could impact Kenya’s economic stability. Recent protests and high business costs are potential risks that need to be addressed to maintain investor confidence and economic performance.

Protests, often driven by socio-economic issues, can disrupt business operations and impact economic stability. High business costs can erode profit margins and deter investment. Addressing these challenges will be crucial for ensuring sustained economic growth and maintaining a favorable investment climate.

Investor Perspective

For investors, the rate cut presents both opportunities and considerations. On one hand, the lower benchmark rate can reduce borrowing costs and make financing more accessible, potentially boosting investment across various sectors. On the other hand, investors should remain aware of the potential risks associated with recent socio-economic challenges.

The improved economic outlook and lower interest rates could make Kenya an attractive destination for investment, especially in sectors poised for growth. However, investors need to stay informed about the evolving political and economic landscape to make well-informed decisions.

Strategic Adjustments and Future Outlook

Looking ahead, Kenya’s central bank is expected to continue its strategic adjustments based on economic developments. The MPC’s approach will likely remain flexible and responsive to ensure that Kenya’s monetary policy supports sustainable growth while managing inflationary pressures.

The rate cut could be a precursor to further policy adjustments, depending on how inflation and economic conditions evolve. The central bank’s proactive stance and commitment to monitoring policy impacts are positive signs for investors and the broader economy.

Conclusion

Kenya’s decision to cut its benchmark interest rate for the first time in over four years marks a significant shift in the country’s economic policy. The rate cut reflects a positive shift in Kenya’s economic conditions, driven by a decrease in headline inflation and improved economic fundamentals. While the move aligns with global trends of easing monetary policies, it also highlights the central bank’s confidence in the country’s economic stability and growth prospects.

As Kenya navigates both global and domestic economic challenges, the central bank’s proactive approach and strategic adjustments will play a crucial role in shaping the country’s economic trajectory. For investors, the rate cut offers opportunities to explore Kenya’s evolving investment landscape, but it also necessitates a cautious approach in light of potential risks.

In summary, Kenya’s rate cut represents a significant milestone in its economic policy journey, providing a glimpse into the country’s evolving monetary strategy and its commitment to fostering a stable and growth-oriented economic environment.

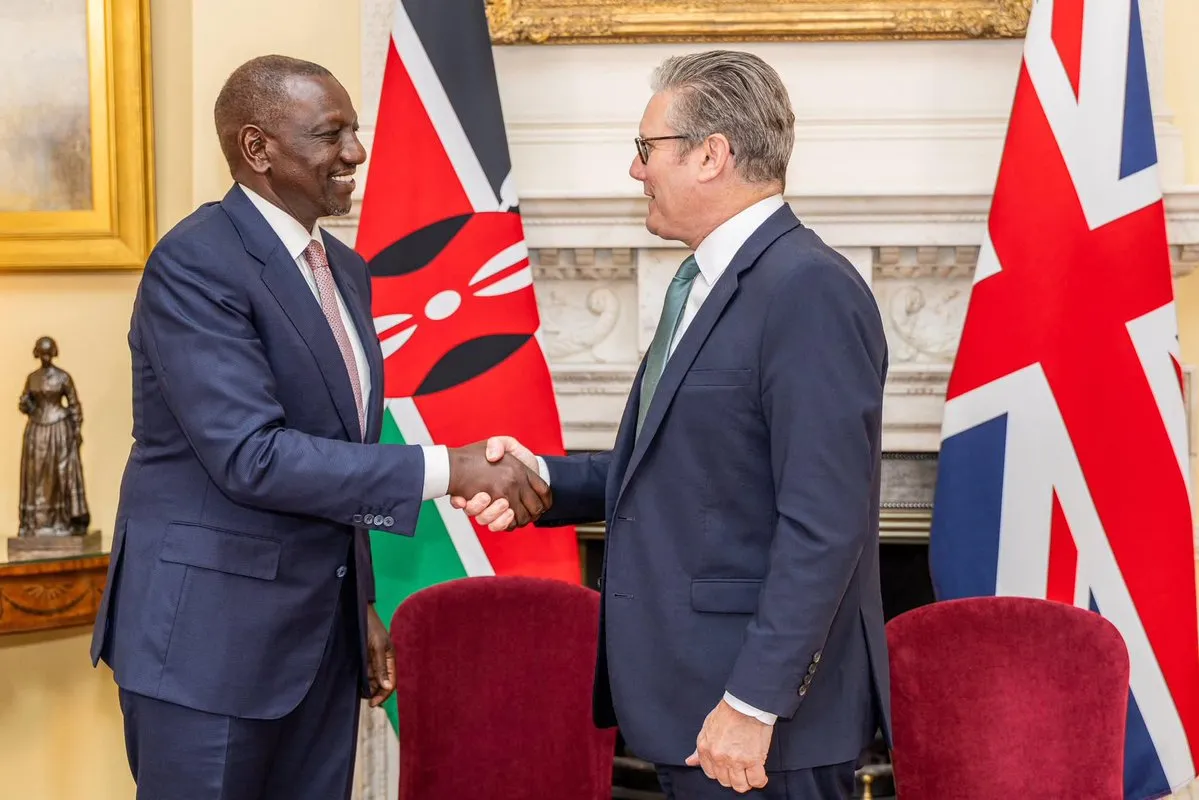

photo source: Google

By: Montel Kamau

Serrari Financial Analyst

7th August, 2024

Article, Financial and News Disclaimer

The Value of a Financial Advisor

While this article offers valuable insights, it is essential to recognize that personal finance can be highly complex and unique to each individual. A financial advisor provides professional expertise and personalized guidance to help you make well-informed decisions tailored to your specific circumstances and goals.

Beyond offering knowledge, a financial advisor serves as a trusted partner to help you stay disciplined, avoid common pitfalls, and remain focused on your long-term objectives. Their perspective and experience can complement your own efforts, enhancing your financial well-being and ensuring a more confident approach to managing your finances.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Readers are encouraged to consult a licensed financial advisor to obtain guidance specific to their financial situation.

Article and News Disclaimer

The information provided on www.serrarigroup.com is for general informational purposes only. While we strive to keep the information up to date and accurate, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability with respect to the website or the information, products, services, or related graphics contained on the website for any purpose. Any reliance you place on such information is therefore strictly at your own risk.

www.serrarigroup.com is not responsible for any errors or omissions, or for the results obtained from the use of this information. All information on the website is provided on an as-is basis, with no guarantee of completeness, accuracy, timeliness, or of the results obtained from the use of this information, and without warranty of any kind, express or implied, including but not limited to warranties of performance, merchantability, and fitness for a particular purpose.

In no event will www.serrarigroup.com be liable to you or anyone else for any decision made or action taken in reliance on the information provided on the website or for any consequential, special, or similar damages, even if advised of the possibility of such damages.

The articles, news, and information presented on www.serrarigroup.com reflect the opinions of the respective authors and contributors and do not necessarily represent the views of the website or its management. Any views or opinions expressed are solely those of the individual authors and do not represent the website's views or opinions as a whole.

The content on www.serrarigroup.com may include links to external websites, which are provided for convenience and informational purposes only. We have no control over the nature, content, and availability of those sites. The inclusion of any links does not necessarily imply a recommendation or endorsement of the views expressed within them.

Every effort is made to keep the website up and running smoothly. However, www.serrarigroup.com takes no responsibility for, and will not be liable for, the website being temporarily unavailable due to technical issues beyond our control.

Please note that laws, regulations, and information can change rapidly, and we advise you to conduct further research and seek professional advice when necessary.

By using www.serrarigroup.com, you agree to this disclaimer and its terms. If you do not agree with this disclaimer, please do not use the website.

www.serrarigroup.com, reserves the right to update, modify, or remove any part of this disclaimer without prior notice. It is your responsibility to review this disclaimer periodically for changes.

Serrari Group 2025