Kenya has achieved a significant diplomatic and economic victory with China, securing a preliminary agreement that grants 98.2% of its exports duty-free access to the world’s second-largest economy. The breakthrough, announced on January 15, 2026, represents one of the most consequential trade engagements in Kenya’s recent history and signals a potential turning point in the country’s long-standing struggle with massive trade imbalances favoring Asian markets.

Trade and Industry Cabinet Secretary Lee Kinyanjui revealed that months of intensive bilateral negotiations with Beijing have yielded what he described as an “early harvest” framework—a preliminary trade arrangement that allows Kenyan goods to enter the Chinese market at zero duty while comprehensive negotiations continue toward a full bilateral agreement. This framework represents a “monumental progression” that positions Kenya to compete more effectively in the vast Chinese consumer market of over 1.4 billion people.

Build the future you deserve. Get started with our top-tier Online courses: ACCA, HESI A2, ATI TEAS 7, HESI EXIT, NCLEX-RN, NCLEX-PN, and Financial Literacy. Let Serrari Ed guide your path to success. Enroll today.

Addressing a Structural Disadvantage

The agreement comes against the backdrop of China’s broader decision, announced in June 2025, to extend duty-free and quota-free (DFQF) market access to African countries. However, that policy framework largely favored Least Developed Countries (LDCs), leaving developing economies such as Kenya outside its core benefits and at a competitive disadvantage compared to regional peers.

Cabinet Secretary Kinyanjui explained that Kenya found itself in an untenable position where several East African Community neighbors and other African states classified as LDCs enjoyed preferential access to the Chinese market, while Kenyan exporters faced tariff barriers that made their products less competitive. This structural inequality prompted Nairobi to initiate direct negotiations with Beijing aimed at securing market access terms comparable to those enjoyed by neighboring countries.

“We note that recently, the Chinese government announced a duty-free and quota-free (DFQF) market access for all goods originating from Africa. However, this provision primarily benefits only the Least Developed Countries within Africa, leaving developing countries like Kenya at a disadvantage,” Kinyanjui stated in his official announcement. “To mitigate this, we have initiated discussions with China to negotiate a bilateral trade agreement that aligns with the privileges enjoyed by our East African Community neighbours and other African nations.”

Foreign Affairs Principal Secretary Korir Sing’Oei disclosed that technical negotiations on the interim framework were concluded on December 19, 2025, just weeks before the public announcement. Both sides have exchanged tariff schedules and agreed on rules of origin—key procedural steps necessary to operationalize the arrangement and prevent trade circumvention.

The Trade Deficit Challenge

The urgency behind Kenya’s push for improved market access becomes clear when examining the bilateral trade statistics. Kenya’s trade relationship with China has become increasingly one-sided, with the deficit reaching Sh475.6 billion ($3.7 billion) in the first nine months of 2025—a 16.7% increase from Sh407.7 billion recorded during the same period in 2024.

According to data from the Kenya National Bureau of Statistics (KNBS), Kenya’s imports from China rose 14.5% to Sh489 billion between January and September 2025, up from Sh427.04 billion in the same period a year earlier. This reflects sustained demand for Chinese products used in construction, transport, energy, and manufacturing sectors. Meanwhile, exports to China declined sharply by 30.8% to Sh13.4 billion, down from Sh19.3 billion in the previous year.

The scale of the trade imbalance extends beyond just the bilateral relationship with China. According to Kenya’s third quarter 2025 Balance of Payments Statistical Release, the country’s overall trade deficit topped $9.3 billion in the first nine months of 2025, widening by approximately $400 million compared with the same period in 2024. Total imports climbed to $16.3 billion while revenue from exports slipped to $6.5 billion, highlighting Kenya’s heavy reliance on imported goods across all markets.

Asia accounted for 68.6% of Kenya’s total import bill in the third quarter of 2025, with China alone responsible for a significant portion. Bilateral trade between Kenya and China reached approximately $4.7 billion in 2024, up from $3.8 billion in 2023, but the flow remained heavily skewed in China’s favor.

Strategic Economic Implications

The zero-duty access agreement carries profound strategic implications that extend far beyond simple tariff reduction. Cabinet Secretary Kinyanjui emphasized that the introduction of zero-duty access will “unlock vast economic potential for Kenyan exporters, allowing for diversification of our export basket, especially in the agricultural sector, which is the mainstay of our economy.”

Agriculture remains the backbone of Kenya’s economy and a major source of employment, accounting for a significant share of the country’s GDP and employing millions of Kenyans directly and indirectly. The early harvest framework is expected to have its most immediate impact on agricultural exports, particularly products such as tea, coffee, avocados, and macadamia nuts—sectors that government officials say have strong growth potential in China’s rapidly expanding consumer market.

Kenya’s major exports to China have traditionally included tea, coffee, titanium ore, and scrap metal. However, export performance has been hampered by several factors, including the closure of the Kwale titanium mines, which significantly reduced shipments of titanium ores over the past two years. The mines had previously been one of Kenya’s top export commodities to China, and their closure contributed to the sharp contraction in export earnings.

The government projects that the expanded market access will stimulate production, attract investment into export-oriented industries, and create significant employment opportunities across value chains. “This development is expected to generate considerable employment opportunities and bring tangible benefits to our economy,” the Trade ministry’s statement emphasized.

Beyond trade flows, the agreement positions Kenya to leverage China’s vast consumer base while reinforcing its standing as a regional manufacturing and export hub within East Africa. With reduced tariffs, Kenyan exporters are expected to diversify their export basket and increase volumes of products destined for China, moving beyond traditional commodity exports toward processed foods and other value-added goods.

Export Performance Context

The China deal comes at a time when Kenya’s overall export performance has shown modest but uneven improvement. According to the Q3 2025 Balance of Payments Statistical Release, total export earnings rose to KSh 289.4 billion in the third quarter of 2025, up from KSh 282.4 billion in the corresponding quarter of 2024, representing 2.5% growth. However, this expansion was primarily supported by stronger exports to Africa and Europe, not Asia.

Africa remained Kenya’s largest export destination, accounting for 44.6% of total export earnings after recording a 15.3% increase. This performance was driven by sharply higher exports to the Democratic Republic of Congo (57.5%), Uganda (34.5%), Egypt (31.1%), and Rwanda (10.9%), underpinned by petroleum re-exports, tea, potatoes, and motor spirit shipments.

Exports to Europe also strengthened, with foreign exchange earnings rising 5.2% to KSh 60.8 billion, supported by increased shipments of cut flowers and macadamia nuts, particularly to the Netherlands and Kazakhstan.

In stark contrast, exports to Asia declined by 14.2% to KSh 68.0 billion, reflecting reduced earnings from the United Arab Emirates, India, Pakistan, and Yemen. This contraction underscores Kenya’s limited penetration into Asian markets despite the region’s dominance in global trade and its position as Kenya’s primary source of imports.

One decision can change your entire career. Take that step with our Online courses in ACCA, HESI A2, ATI TEAS 7, HESI EXIT, NCLEX-RN, NCLEX-PN, and Financial Literacy. Join Serrari Ed and start building your brighter future today.

The AGOA Extension Factor

The China breakthrough occurs within a complex geopolitical and trade context involving multiple major economies. Just days before the China announcement, the United States House of Representatives passed a bill to extend the African Growth and Opportunity Act (AGOA) for three years, with 340 lawmakers voting in favor and 54 against. The bill now moves to the US Senate for consideration.

AGOA, which came into effect in 2000, provides duty-free access to the US market for a wide range of products from participating African countries. Kenya is among the programme’s top beneficiaries, with substantial annual export earnings tied to the US market, particularly from apparel and textiles, coffee, and nuts. In 2024 alone, Kenya exported goods worth about Ksh60.7 billion to the US, mostly apparel.

Cabinet Secretary Kinyanjui welcomed the AGOA extension as a “critical milestone in U.S.-Africa trade relations,” noting that it has “renewed certainty in Kenya’s textile and apparel industry, which has been operating under uncertainty in recent months.” The textile and apparel industries operating within Kenya’s Export Processing Zones employ over 80,000 people directly and an additional 250,000 indirectly.

The extension will protect nearly 70,000 jobs in the country’s export processing zones and provides breathing room for Kenya to pursue discussions on a bilateral trade agreement with the United States that would cover additional sectors beyond AGOA’s current scope.

Some reports have suggested that Kenya faced pressure from Washington regarding the timing and scope of the China trade deal. The South China Morning Post reported that the US was pressing Kenya to abandon the China trade pact in exchange for renewal of duty-free trade privileges under AGOA. However, Kenyan officials have maintained that the country is pursuing a balanced approach that maximizes benefits from relationships with both major economies.

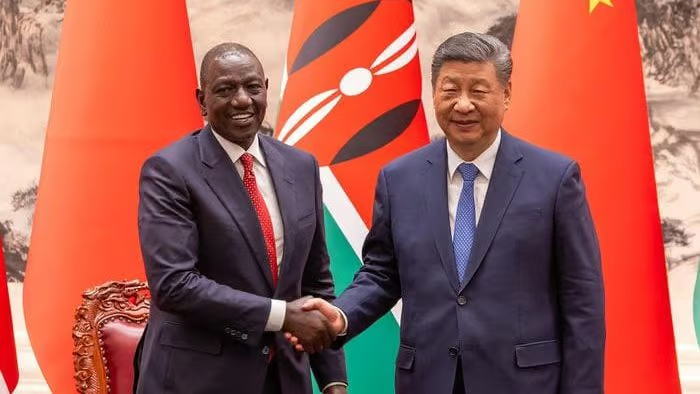

President William Ruto has been navigating this delicate balance carefully, having raised the trade imbalance issue directly with Chinese authorities during his four-day state visit to China in April 2025. The discussions culminated in what Ruto described at the time as an agreement for reciprocal arrangements between Kenya and China “to remove all the tariffs on our tea, coffee, avocado, and all other agricultural exports.”

Implementation Challenges and Opportunities

While the zero-duty access represents a significant policy achievement, the extent of actual gains will depend critically on Kenya’s ability to address several structural challenges that have historically limited export competitiveness.

First, Kenyan exporters must scale production capacity to meet potential demand from the Chinese market. Many agricultural and manufacturing sectors currently operate below their potential capacity, constrained by factors including limited access to finance, inadequate infrastructure, and supply chain bottlenecks.

Second, meeting China’s regulatory and quality standards poses a substantial challenge. Chinese import regulations, particularly for agricultural products, require stringent phytosanitary and quality-assurance compliance. These compliance costs, combined with limited direct logistics connections and freight volatility, have raised delivery prices and eroded profit margins for Kenyan exporters.

Third, Kenya must move up the value chain rather than relying primarily on raw or minimally processed exports. The trade data reveals that Kenya’s export basket to China remains heavily concentrated in a limited number of commodities and semi-processed products. Without greater value addition through processing and manufacturing, the benefits of tariff elimination will remain constrained.

The government has acknowledged these challenges. Kenya’s push for improved market access aligns with its Integrated National Export Development and Promotion Strategy, launched in 2018 to diversify markets beyond traditional Western destinations. Envoys have been posted to key Asian capitals, including Beijing, to open new opportunities and reduce reliance on a narrow range of products.

Before the COVID-19 pandemic, the Kenya Export Promotion and Branding Agency had intensified marketing campaigns in China, targeting agricultural regions and specific consumer segments. These efforts will need to be revived and expanded to capitalize on the new market access opportunities.

The Broader China-Africa Trade Context

Kenya’s agreement must be understood within the broader evolution of China’s trade relationship with Africa. In recent years, China has steadily expanded market access for African countries as part of its strategy to deepen economic engagement with the continent.

Effective from December 1, 2024, China granted zero-tariff treatment to all least developed countries (LDCs) with which it has diplomatic relations, including 33 African nations, on 100% of their products. The policy was subsequently extended to all 53 African countries with diplomatic ties to China, though the implementation timeline and specific terms varied by country classification.

For African LDCs, the zero-tariff policy showed immediate results. Since its launch through March 2025, China’s imports from African LDCs rose 15.2% year-on-year, reaching $21.42 billion. Chinese imports of African coffee surged by 70.4%, while cocoa bean imports rose by 56.8% in the first quarter of 2025.

However, analysts note that while tariff elimination is important, it represents only one barrier to trade. Other challenges including logistics infrastructure, quality standards, market information asymmetries, and limited integration into Asian production value chains continue to constrain African export potential.

China-Africa trade reached $295.6 billion in 2024, setting a record high for the fourth consecutive year and marking the 16th consecutive year of growth. However, Africa ran a significant trade deficit of over $60 billion with China in 2024, with the continent spending $178.76 billion on Chinese imports while earning $116.79 billion from exports to China.

Strategic Positioning and Regional Implications

Kenya’s successful negotiation may serve as a template for other African middle-income countries seeking similar arrangements with China. As a developing country rather than an LDC, Kenya occupies a middle position shared by other economically significant African nations including Nigeria, Ghana, and Morocco. These countries have been left outside China’s unilateral LDC preference schemes despite their pivotal roles in regional trade and economic development.

The agreement also positions Kenya more competitively within the East African Community (EAC). While several EAC members like Tanzania and Uganda benefit from LDC status and thus already enjoy duty-free access to China, Kenya’s separate bilateral arrangement ensures it can compete on equal footing despite its different classification status.

From China’s perspective, the arrangement with Kenya demonstrates flexibility in its Africa engagement strategy and responsiveness to concerns raised by African leaders about trade imbalances. During the Forum on China-Africa Cooperation (FOCAC) summits, leaders including South Africa’s President Ramaphosa and Uganda’s President Museveni have called for fairer trade terms to address existing imbalances.

By extending preferential access beyond just LDCs, China positions itself as a more equitable partner compared to some Western trade frameworks. The European Union’s “Everything But Arms” scheme, for instance, provides similar duty-free quota-free access but exclusively for LDCs, leaving middle-income African countries without comparable benefits from Brussels.

Looking Ahead: From Early Harvest to Comprehensive Agreement

The current framework is explicitly described as an “early harvest” arrangement—a term in trade negotiations referring to initial benefits implemented quickly while more comprehensive discussions continue. Cabinet Secretary Kinyanjui indicated that while the 98.2% duty-free access provides immediate relief, negotiations toward a comprehensive economic partnership agreement targeting 100% access are ongoing.

The remaining 1.8% of tariff lines not covered by the early harvest framework will be addressed in subsequent negotiation phases. Government officials have expressed optimism that the final comprehensive agreement will provide even broader market access across all product categories.

However, the agreement has not yet been formalized through Kenya’s domestic approval process. Reports indicate that the China trade deal remains pending approval by Kenya’s Cabinet, Parliament, and the President. This procedural requirement allows for domestic consultation and ensures parliamentary oversight of the agreement’s terms and implications.

As negotiations advance beyond the early harvest phase, analysts will be watching several key metrics: how quickly Kenyan exporters can translate zero-duty access into sustained export growth; whether the agreement leads to meaningful diversification of Kenya’s export basket; and most critically, whether it can reshape the country’s long-standing trade deficit with Asia.

Success will ultimately be measured not just in policy terms but in tangible economic outcomes: increased foreign exchange earnings, job creation in export-oriented sectors, attraction of investment into processing and manufacturing facilities, and gradual rebalancing of the bilateral trade relationship toward greater equity.

Conclusion: A Strategic Turning Point or Incremental Progress?

The 98.2% zero-duty market access agreement with China represents unquestionably the most significant trade policy development in Kenya’s relationship with Asia in recent years. It addresses a structural disadvantage that had placed Kenyan exporters at a competitive disadvantage compared to regional peers and opens theoretical access to a market of over 1.4 billion consumers.

Yet the agreement’s ultimate impact will depend less on the policy itself and more on Kenya’s capacity to leverage the opportunity effectively. The persistence of massive trade deficits despite previous market access initiatives suggests that tariff elimination alone cannot resolve deep-seated competitiveness challenges.

Kenya must simultaneously address production capacity constraints, invest in quality infrastructure and certification systems, develop stronger logistics and distribution networks connecting to Asian markets, and most importantly, move systematically up the value chain from raw commodity exports toward processed and manufactured goods that generate greater employment and value addition.

The government’s commitment to pursuing opportunities that “enhance our trade capabilities and strengthen our partnerships on the world stage” will be tested in the implementation phase. The early harvest framework provides a foundation, but converting that foundation into sustained export growth, job creation, and genuine reduction in trade imbalances will require coordinated effort across government agencies, the private sector, and development partners.

As Kenya navigates between its relationships with China and the United States—both offering different types of market access and both carrying different strategic implications—the country’s ability to maximize benefits from multiple partnerships while maintaining policy autonomy will prove crucial. The zero-duty China deal, combined with AGOA extension, provides Kenya with a rare moment of opportunity to diversify its export markets and reduce over-reliance on any single destination.

Whether this moment translates into transformative economic impact or remains primarily symbolic will become clear in the coming years as implementation proceeds and export performance data reveals the agreement’s real-world effects on Kenya’s trade balance, employment generation, and economic diversification objectives.

Ready to take your career to the next level? Join our Online courses: ACCA, HESI A2, ATI TEAS 7 , HESI EXIT , NCLEX – RN and NCLEX – PN, Financial Literacy!🌟 Dive into a world of opportunities and empower yourself for success. Explore more at Serrari Ed and start your exciting journey today! ✨

Track GDP, Inflation and Central Bank rates for top African markets with Serrari’s comparator tool.

See today’s Treasury bonds and Money market funds movement across financial service providers in Kenya, using Serrari’s comparator tools.

photo source: Google

By: Montel Kamau

Serrari Financial Analyst

20th January, 2026

Article, Financial and News Disclaimer

The Value of a Financial Advisor

While this article offers valuable insights, it is essential to recognize that personal finance can be highly complex and unique to each individual. A financial advisor provides professional expertise and personalized guidance to help you make well-informed decisions tailored to your specific circumstances and goals.

Beyond offering knowledge, a financial advisor serves as a trusted partner to help you stay disciplined, avoid common pitfalls, and remain focused on your long-term objectives. Their perspective and experience can complement your own efforts, enhancing your financial well-being and ensuring a more confident approach to managing your finances.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Readers are encouraged to consult a licensed financial advisor to obtain guidance specific to their financial situation.

Article and News Disclaimer

The information provided on www.serrarigroup.com is for general informational purposes only. While we strive to keep the information up to date and accurate, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability with respect to the website or the information, products, services, or related graphics contained on the website for any purpose. Any reliance you place on such information is therefore strictly at your own risk.

www.serrarigroup.com is not responsible for any errors or omissions, or for the results obtained from the use of this information. All information on the website is provided on an as-is basis, with no guarantee of completeness, accuracy, timeliness, or of the results obtained from the use of this information, and without warranty of any kind, express or implied, including but not limited to warranties of performance, merchantability, and fitness for a particular purpose.

In no event will www.serrarigroup.com be liable to you or anyone else for any decision made or action taken in reliance on the information provided on the website or for any consequential, special, or similar damages, even if advised of the possibility of such damages.

The articles, news, and information presented on www.serrarigroup.com reflect the opinions of the respective authors and contributors and do not necessarily represent the views of the website or its management. Any views or opinions expressed are solely those of the individual authors and do not represent the website's views or opinions as a whole.

The content on www.serrarigroup.com may include links to external websites, which are provided for convenience and informational purposes only. We have no control over the nature, content, and availability of those sites. The inclusion of any links does not necessarily imply a recommendation or endorsement of the views expressed within them.

Every effort is made to keep the website up and running smoothly. However, www.serrarigroup.com takes no responsibility for, and will not be liable for, the website being temporarily unavailable due to technical issues beyond our control.

Please note that laws, regulations, and information can change rapidly, and we advise you to conduct further research and seek professional advice when necessary.

By using www.serrarigroup.com, you agree to this disclaimer and its terms. If you do not agree with this disclaimer, please do not use the website.

www.serrarigroup.com, reserves the right to update, modify, or remove any part of this disclaimer without prior notice. It is your responsibility to review this disclaimer periodically for changes.

Serrari Group 2025