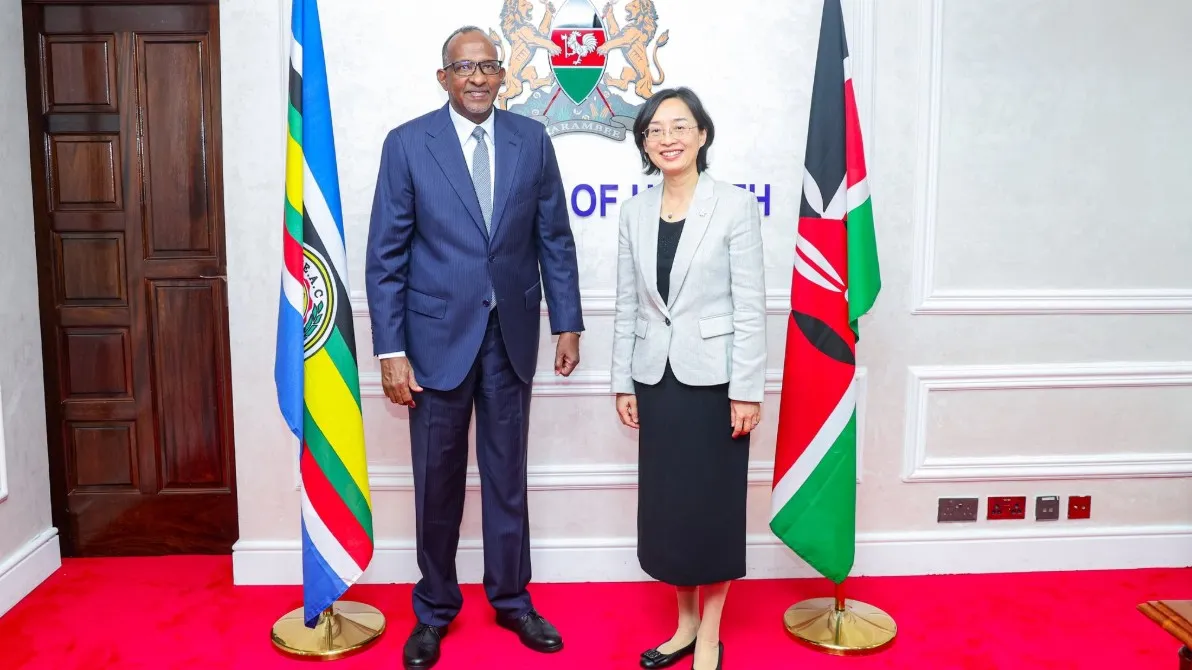

In a monumental stride towards self-reliance and regional leadership in healthcare, Kenya has officially embarked on a transformative Ksh65 billion partnership with China. This landmark agreement, announced on Monday, June 9, 2025, following high-level discussions between Kenya’s Cabinet Secretary for Health, Aden Duale, and China’s Ambassador to Kenya, Guo Haiyan, is set to establish state-of-the-art local manufacturing hubs for vaccines and pharmaceuticals by 2028. This strategic collaboration is poised to reshape Kenya’s health landscape, promising to strengthen supply chains, curtail import dependency, and create significant employment opportunities.

A Vision for Health Independence: Learning from Global Challenges

The vision underpinning this ambitious initiative extends far beyond mere industrial growth; it is a profound declaration of intent. As Cabinet Secretary Duale articulated, “This transformative partnership is not just about medicine—it is about sovereignty, security, and sustainability in healthcare.” His words resonate deeply in a world still grappling with the profound lessons of the COVID-19 pandemic, which starkly exposed the vulnerabilities of global supply chains and the disproportionate impact on nations reliant on external medical supplies.

The COVID-19 pandemic served as a painful reminder of Africa’s precarious position in the global health ecosystem. When the world clamored for vaccines, many developing countries found themselves at the back of the queue, highlighting severe inequities in access to life-saving interventions. Before COVID-19, a sobering reality existed: less than 1% of the vaccines procured and delivered in Africa were actually produced on the continent. This glaring disparity spurred a renewed global and continental push for increased local manufacturing, recognizing that true health security cannot exist without the capacity to produce essential medical products domestically.

Kenya’s proactive move to establish its own domestic manufacturing capabilities is a powerful manifestation of its commitment to health sovereignty as highlighted by the African Constituency Bureau. This is not just a policy decision; it’s a pledge to ensure that every Kenyan citizen has consistent and equitable access to vital treatments, regardless of global fluctuations or geopolitical shifts. This strategic decision aims to buffer Kenya from future health crises, transforming it from a net importer to a producer, innovator, and eventually, an exporter of health solutions. This proactive stance aligns with the broader African Union’s ambitious goal of manufacturing 60% of the continent’s vaccine needs by 2040, a target supported by critical initiatives like the African Vaccine Manufacturing Accelerator (AVMA) and the Partnerships for African Vaccine Manufacturing (PAVM), which aim to unlock significant financing and address critical gaps in Africa’s biomanufacturing landscape.

The Ksh65 Billion Catalyst: Building a Pharmaceutical Powerhouse

The Ksh65 billion investment (approximately $500 million USD), leveraging advanced Chinese technology and expertise, is designed to propel Kenya into a formidable pharmaceutical powerhouse in Africa by 2028. This timeline is ambitious yet critical, reflecting the urgency of building a resilient and self-sufficient healthcare ecosystem. The deal specifically focuses on establishing state-of-the-art local production hubs equipped with cutting-edge Chinese medical technology. This means moving beyond simple packaging or “fill and finish” operations to engaging in more complex aspects of manufacturing, potentially including the production of active pharmaceutical ingredients (APIs) where feasible, and the development of various vaccine technologies. While specific technologies weren’t detailed in the immediate announcement, advanced vaccine manufacturing can encompass platforms like inactivated virus vaccines (a traditional strength of Chinese manufacturers like Sinovac’s CoronaVac), viral vector vaccines, or even newer mRNA technologies. The ability to handle diverse platforms will be key to Kenya’s versatility in addressing various health challenges.

The core objective is to significantly reduce Kenya’s heavy reliance on medical imports, which has historically drained valuable foreign exchange reserves and left the nation vulnerable to external shocks. By strengthening local pharmaceutical supply chains, Kenya aims to ensure that essential medicines and vaccines are readily available, affordable, and consistently supplied to its population. This move is not merely about macroeconomic indicators; it’s about the very real impact on individual lives – ensuring a child doesn’t miss a crucial immunization, or a patient with a chronic illness doesn’t face interrupted treatment due to global shortages or supply chain disruptions. The lessons from the COVID-19 pandemic regarding supply chain flexibility and proactive risk management are clearly being applied here.

“Our goal is to make Kenya the regional hub for health product manufacturing. We want to stop being net importers of health solutions and become producers, exporters, and innovators,” CS Duale emphasized. This vision extends beyond national borders. Once domestic needs are met, Kenya plans to export its pharmaceutical products to neighboring countries, contributing to regional health security and fostering economic integration across East Africa. This transformation will position Kenya as a beacon of medical progress on the continent, potentially mirroring the success of other regional hubs for health product manufacturing outlined in initiatives like the Pharmaceutical Manufacturing Plan for Africa (PMPA) by AUDA-NEPAD.

From Aid to Empowerment: A New Era of Co-Investment

A significant philosophical and practical shift in Kenya’s approach to healthcare financing is evident in this partnership. Cabinet Secretary Duale explicitly highlighted the country’s transition from a model of donor dependency to one of co-investment in health innovation. “We are moving from a model where we wait for aid, to one where we co-invest in solutions that benefit both our nations. Let us innovate together,” he urged, addressing the Chinese delegation.

This philosophy underscores a mature and forward-thinking approach to international partnerships. It acknowledges that true sustainable progress in healthcare requires shared responsibility, mutual benefit, and a strategic move away from traditional aid structures that can sometimes perpetuate reliance rather than foster self-sufficiency. By advocating for a co-investment model, Kenya is positioning itself not as a passive recipient, but as an active participant and co-creator in global health solutions. This fosters a sense of ownership, accountability, and long-term sustainability, paving the way for enduring partnerships built on shared goals rather than transient assistance.

China’s extensive history of engagement in Africa’s healthcare sector provides a unique context for this evolution. Since the 1950s, China has built over 120 health facilities in developing countries, with more than 80% of these in Africa. They have also provided medical equipment, donated drugs, and dispatched thousands of medical teams to numerous African nations. In recent years, Chinese firms like Huawei have significantly contributed to Kenya’s health infrastructure, particularly in rural health digitization and training thousands of health workers. Duale specifically praised Huawei’s efforts, noting that their “contribution to rural health digitisation and training thousands of health workers shows the true spirit of partnership.” This established track record provides a robust foundation for the expanded partnership in pharmaceutical manufacturing. The experience gained from these previous projects, coupled with China’s rapid advancements in biotechnology and manufacturing, positions them as a valuable and experienced partner in Kenya’s journey towards health self-reliance.

This collaboration is also indicative of China’s broader “Health Silk Road” initiative, which views health cooperation as a key element of its expansive Belt and Road Initiative (BRI). Through this framework, China aims to expand its global influence by supporting health development in partner countries, aligning with their stated goals of promoting a shared future for humanity. China’s President Xi Jinping has previously pledged substantial support to Africa’s health sector, including sending medical teams, implementing anti-malarial projects, promoting Chinese companies to invest in drug production, and supporting the Africa CDC. This deep-rooted, evolving engagement creates a fertile ground for the success of the Kenya-China pharmaceutical deal.

Investing in Human Capital: The Bedrock of Sustainable Healthcare

Recognizing that cutting-edge facilities are only as effective as the skilled people who operate and innovate within them, the Chinese delegation’s offer of 500 full scholarships for Kenyan students to pursue health sciences in China, coupled with 20 annual exchange programs for healthcare professionals, is a pivotal component of this agreement. This significant investment in human capital development is a testament to the long-term vision of the partnership.

As Duale aptly noted, “This is a powerful investment in Kenya’s future leadership in the health sector. Our young professionals will gain world-class knowledge and exposure, enabling us to lead in both practice and policy.” Equipping a new generation of Kenyan healthcare professionals with advanced knowledge, skills, and global perspectives is crucial for the sustainable growth and operation of the local pharmaceutical industry. These individuals will be the researchers, scientists, engineers, quality control specialists, and public health experts who drive innovation, ensure product safety, and manage complex manufacturing processes. This initiative directly addresses a critical challenge in many developing countries: the chronic shortage of skilled professionals in biomanufacturing, research and development (R&D), and regulatory affairs. It aims to actively counter the ‘brain drain’ that has historically plagued African health sectors by creating attractive opportunities and advanced training, both locally and abroad. Kenya’s healthcare workforce currently faces challenges such as inequitable distribution, poor employment conditions, and a lack of reliable data, making such human capital development strategies paramount for building a resilient workforce as highlighted by the Kenya Medical Association (KMA).

Furthermore, the establishment of a Kenya-China Health Cooperation Taskforce, proposed by Duale, will be instrumental in ensuring the effective and timely implementation of this ambitious undertaking. This dedicated team will be tasked with coordinating efforts, harmonizing strategic priorities, and fast-tracking bilateral agreements. This structured approach will provide a clear roadmap for success and accountability in this multifaceted project, ensuring that the knowledge and skills gained through scholarships and exchange programs are effectively integrated into Kenya’s burgeoning pharmaceutical sector.

The Broader Context: Kenya’s Universal Health Coverage Drive

This vaccine and pharmaceutical manufacturing initiative is intrinsically linked to Kenya’s broader healthcare reform agenda, particularly the ongoing reforms under the new Social Health Authority (SHA). The SHA is a cornerstone of the government’s commitment to achieving Universal Health Coverage (UHC) as detailed by IEA Kenya, a transformative goal that aims to ensure all citizens have access to essential, high-quality health services without suffering financial hardship. Kenya’s UHC Policy 2020–2030 aims to achieve this by ensuring that all individuals receive the healthcare they need, irrespective of their socio-economic status.

A robust local pharmaceutical industry is a critical enabler for UHC. By producing medicines and vaccines domestically, Kenya can achieve several vital objectives:

- Reduce Costs: Local production can lead to significantly lower prices for essential medicines, making them more affordable and accessible to a larger segment of the population. This directly addresses the burden of out-of-pocket expenses, a major barrier to healthcare access for millions of Kenyans. When medicines are produced closer to home, the costs associated with international shipping, tariffs, and intermediary markups are dramatically reduced, making healthcare more economically viable for the average family.

- Improve Availability and Reliability: Domestic manufacturing ensures a consistent supply of crucial drugs, minimizing stock-outs and reducing the reliance on often unpredictable and volatile global markets. This is particularly vital for routine immunization programs, which are fundamental to public health and preventing outbreaks, and for managing chronic diseases that require uninterrupted access to medication. It provides a reliable supply chain insulated from external disruptions, ensuring that essential treatments are always within reach.

- Enhance Quality Control: Local oversight of manufacturing processes allows for stringent quality assurance and regulatory compliance, building trust in domestically produced medicines. This is crucial for patient safety and efficacy, ensuring that what Kenyans consume is of the highest standard and meets international benchmarks.

- Foster Economic Growth and Job Creation: The establishment of manufacturing hubs creates a wide array of jobs across various sectors, from highly skilled researchers and technicians to production line workers, logistics personnel, and administrative staff. This significantly contributes to economic diversification, job creation, and overall socio-economic development, lifting communities out of poverty and improving living standards. Projections for the East African Community (EAC) pharmaceutical industry indicate potential for tens of thousands of new jobs by 2027 under various growth rates, underscoring the substantial economic impact of such initiatives.

- Attract Further Investment: The success of this partnership could attract further foreign direct investment into Kenya’s burgeoning pharmaceutical sector, creating a virtuous cycle of growth and technological advancement.

- Develop Ancillary Industries: The growth of a sophisticated pharmaceutical industry will also spur the development of related sectors, such as specialized packaging, local raw material supply chains, chemical production, advanced logistics, and robust research and development capabilities, creating a broader, more integrated industrial ecosystem within the country. This creates a ripple effect of economic benefits across multiple sectors.

The transition from the National Hospital Insurance Fund (NHIF) to the Social Health Insurance Fund (SHIF) under the SHA signifies a profound move towards a more comprehensive and equitable health insurance system. The success of SHIF in covering all Kenyans, regardless of their socioeconomic background, will be immeasurably bolstered by the availability of affordable, locally produced medical products. This synergy between health financing reforms and domestic production capacity is central to achieving true UHC. Beyond the SHA, Kenya has also enacted other significant healthcare reforms, including the Primary Health Care Act, the Facility Improvement Financing Act, and the Digital Health Act in 2023, all designed to strengthen the legal and operational framework for a robust and accessible healthcare system as outlined by PATH. These legislative changes provide a solid foundation for the ambitious goals set by the Kenya-China partnership.

The Road Ahead: Navigating Challenges and Maximizing Opportunities

While the potential benefits of this landmark deal are immense, the journey to becoming a regional pharmaceutical hub is not without its complexities and challenges. These hurdles are common across African nations aiming for similar goals and require strategic foresight and concerted effort:

- Regulatory Harmonization and Quality Assurance: Perhaps one of the most critical challenges is ensuring that locally produced vaccines and medicines meet stringent international quality standards, such as those set by the World Health Organization (WHO) Prequalification (PQ) program analyzed by Rethink Priorities. This requires robust National Regulatory Authorities (NRAs) that are well-funded, independent, and capable of rigorous oversight, including Good Manufacturing Practices (GMP). Many African countries still lack the WHO ‘Maturity Level 3’ standard required for WHO endorsement of domestically manufactured vaccines. Kenya will need to continuously strengthen its regulatory framework to ensure global competitiveness and patient safety.

- Sustainable Funding and Investment: While the initial Ksh65 billion is a significant catalyst, sustained investment will be needed for ongoing research and development (R&D), expansion of facilities, and maintaining cutting-edge technology. Attracting additional private sector investment, exploring innovative financing tools like volume guarantees, and ensuring favorable long-term financing mechanisms will be crucial for the industry’s sustained growth and competitiveness.

- Workforce Development and Retention: Despite the generous scholarship and exchange programs, building a sufficiently skilled and experienced workforce across all levels—from research scientists and biomanufacturing technicians to quality control specialists and supply chain managers—will take time and continuous effort. The issue of ‘brain drain’, where trained professionals seek opportunities abroad due to better remuneration or working conditions, must also be actively addressed through attractive career pathways, competitive salaries, and conducive working environments within Kenya. The Kenya Medical Association (KMA) has highlighted these challenges and proposed a National Health Services Commission to better manage the healthcare workforce as highlighted by the Kenya Medical Association (KMA).

- Raw Material Sourcing: A significant portion of pharmaceutical production still relies on imported raw materials and active pharmaceutical ingredients (APIs) according to STM Journals. This dependency can still pose vulnerabilities to global supply chain disruptions. Developing local capacities for producing APIs and other key inputs will be a crucial long-term goal to truly enhance self-sufficiency and supply chain resilience. This requires investment in chemical industries and biotechnology infrastructure.

- Market Dynamics and Procurement Policies: Ensuring a consistent and predictable demand for locally produced medicines, both domestically and regionally, will be crucial for the financial viability of these manufacturing hubs. African governments’ political commitment to purchase locally produced vaccines and medicines is vital. This may involve implementing preferential procurement policies for African-made products within public health systems and regional blocs, to create a guaranteed market and foster investor confidence.

- Intellectual Property (IP) Rights: Navigating intellectual property rights for new technologies and vaccine formulations can be complex. Technology transfer agreements must be carefully structured to facilitate genuine capacity building and knowledge sharing without creating undue dependencies or stifling local innovation. This requires clear legal frameworks and negotiations.

- Infrastructure Gaps: Beyond the manufacturing facilities themselves, reliable access to essential utilities like stable electricity and clean water, as well as efficient logistics and transportation networks, are fundamental for a thriving pharmaceutical industry. Investments in these foundational infrastructures must accompany the manufacturing push.

However, the opportunities far outweigh these challenges. Kenya’s strong political will, demonstrated by its ambitious UHC agenda and its direct engagement with partners like China, creates a powerful synergy. Coupled with China’s proven technological prowess and substantial financial commitment, this partnership is well-positioned for success. The establishment of a dedicated task force, significant human capital development initiatives, and a clear shift towards a co-investment model demonstrate a comprehensive and strategic approach to overcoming potential hurdles. This partnership signals a commitment not just to build physical infrastructure, but to foster an entire ecosystem conducive to pharmaceutical innovation and production.

Conclusion: A New Dawn for Kenya’s Healthcare and Regional Health Security

The Ksh65 billion deal between Kenya and China marks a new dawn for Kenya’s healthcare sector. It signifies a decisive move towards self-sufficiency, resilience, and regional leadership in pharmaceutical manufacturing. This strategic alliance represents more than just a financial transaction; it embodies a shared vision for a healthier, more secure, and economically prosperous future.

By focusing on local production of essential medicines and vaccines, robust human capital development, and a collaborative, co-investment approach to financing, Kenya is not just building factories; it is building a fortified national health security architecture. It is empowering its people with access to life-saving treatments, creating sustainable economic opportunities, and enhancing its standing as a key player in Africa’s health landscape. This initiative is a testament to the power of strategic partnerships and a clear, unwavering vision. The journey to becoming a pharmaceutical powerhouse by 2028 is ambitious, but with this landmark agreement and a dedicated commitment from both Kenya and China, the nation is well on its way to achieving its health sovereignty goals and setting a powerful precedent for sustainable health development across the entire African continent.

Ready to take your career to the next level? Join our dynamic courses: ACCA, HESI A2, ATI TEAS 7 , HESI EXIT , NCLEX – RN and NCLEX – PN, Financial Literacy!🌟 Dive into a world of opportunities and empower yourself for success. Explore more at Serrari Ed and start your exciting journey today! ✨

photo source: Google

By: Montel Kamau

Serrari Financial Analyst

10th June, 2025

Article, Financial and News Disclaimer

The Value of a Financial Advisor

While this article offers valuable insights, it is essential to recognize that personal finance can be highly complex and unique to each individual. A financial advisor provides professional expertise and personalized guidance to help you make well-informed decisions tailored to your specific circumstances and goals.

Beyond offering knowledge, a financial advisor serves as a trusted partner to help you stay disciplined, avoid common pitfalls, and remain focused on your long-term objectives. Their perspective and experience can complement your own efforts, enhancing your financial well-being and ensuring a more confident approach to managing your finances.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Readers are encouraged to consult a licensed financial advisor to obtain guidance specific to their financial situation.

Article and News Disclaimer

The information provided on www.serrarigroup.com is for general informational purposes only. While we strive to keep the information up to date and accurate, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability with respect to the website or the information, products, services, or related graphics contained on the website for any purpose. Any reliance you place on such information is therefore strictly at your own risk.

www.serrarigroup.com is not responsible for any errors or omissions, or for the results obtained from the use of this information. All information on the website is provided on an as-is basis, with no guarantee of completeness, accuracy, timeliness, or of the results obtained from the use of this information, and without warranty of any kind, express or implied, including but not limited to warranties of performance, merchantability, and fitness for a particular purpose.

In no event will www.serrarigroup.com be liable to you or anyone else for any decision made or action taken in reliance on the information provided on the website or for any consequential, special, or similar damages, even if advised of the possibility of such damages.

The articles, news, and information presented on www.serrarigroup.com reflect the opinions of the respective authors and contributors and do not necessarily represent the views of the website or its management. Any views or opinions expressed are solely those of the individual authors and do not represent the website's views or opinions as a whole.

The content on www.serrarigroup.com may include links to external websites, which are provided for convenience and informational purposes only. We have no control over the nature, content, and availability of those sites. The inclusion of any links does not necessarily imply a recommendation or endorsement of the views expressed within them.

Every effort is made to keep the website up and running smoothly. However, www.serrarigroup.com takes no responsibility for, and will not be liable for, the website being temporarily unavailable due to technical issues beyond our control.

Please note that laws, regulations, and information can change rapidly, and we advise you to conduct further research and seek professional advice when necessary.

By using www.serrarigroup.com, you agree to this disclaimer and its terms. If you do not agree with this disclaimer, please do not use the website.

www.serrarigroup.com, reserves the right to update, modify, or remove any part of this disclaimer without prior notice. It is your responsibility to review this disclaimer periodically for changes.

Serrari Group 2025