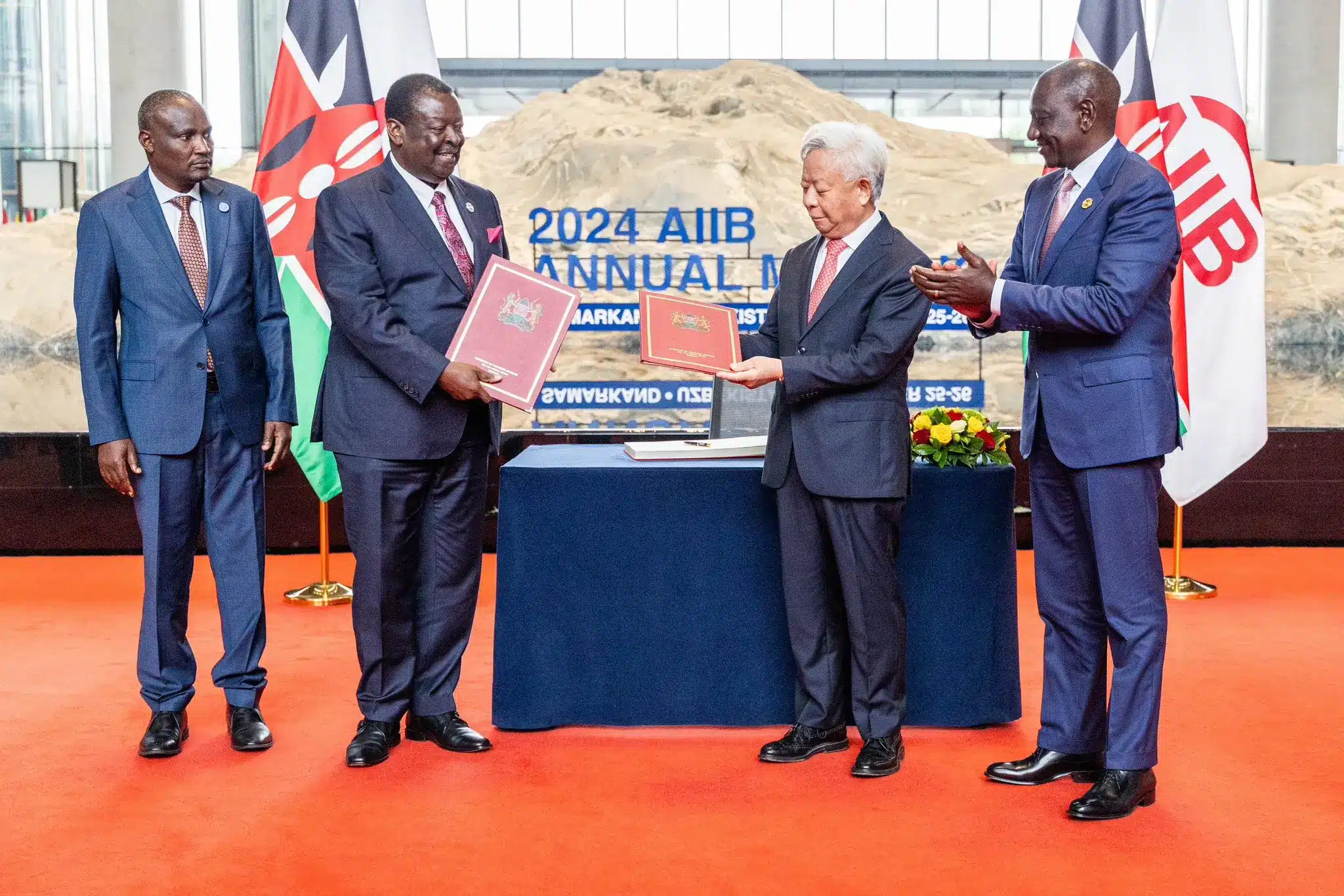

Kenya has formally joined the Asian Infrastructure Investment Bank (AIIB) as a fully paid member, marking a significant step in the country’s economic and infrastructural development. The announcement, made by President William Ruto on September 3, 2024, after a meeting with AIIB President and Board of Directors Chairman Jin Liqun in Beijing, China, opens new avenues for Kenya to access concessional funding for various programs. These programs include infrastructure development, climate change initiatives, connectivity projects, regional cooperation, and technology-enabled ventures.

The AIIB: An Overview

The Asian Infrastructure Investment Bank (AIIB) is a multilateral development institution that was established in 2016 with the mission of financing infrastructure for tomorrow in Asia and beyond. The institution, headquartered in Beijing, China, currently boasts 109 member countries and a capitalization of $100 billion. Its focus is on sustainable infrastructure projects that promote economic growth, reduce environmental impact, and enhance connectivity between regions.

The AIIB is highly regarded in the international financial community, as evidenced by its AAA credit rating from major international credit rating agencies. This rating denotes the lowest expectation of credit risk, making AIIB-backed projects attractive to investors and member states alike. The bank’s operations are guided by principles that align closely with global sustainability goals, including the United Nations Sustainable Development Goals (SDGs) and the Paris Agreement on climate change.

Kenya’s Strategic Membership in AIIB

Kenya’s decision to join the AIIB as a fully paid member is a strategic move aimed at leveraging the bank’s resources to accelerate its national development agenda. By becoming a member, Kenya gains access to concessional funding, which is typically offered at lower interest rates and with more favorable repayment terms than market-rate loans. This funding will be instrumental in supporting a wide range of projects, particularly those that align with the country’s Vision 2030 development blueprint.

President William Ruto, speaking after his meeting with AIIB officials, highlighted the importance of this membership for Kenya’s development trajectory. “Collaborating with partners like the AIIB enables us to unlock new capital and invest in infrastructure that is green, technology-enabled, and promotes regional connectivity,” Ruto said. He emphasized that Kenya’s partnership with the AIIB would be crucial in advancing the country’s efforts to combat climate change, enhance regional cooperation, and modernize its infrastructure.

Focus Areas: Infrastructure, Climate Change, and Technology

One of the primary areas where Kenya expects to benefit from AIIB membership is infrastructure development. Kenya, like many other African nations, faces significant infrastructure deficits that hinder economic growth and development. The AIIB, with its focus on sustainable infrastructure, presents a unique opportunity for Kenya to address these challenges.

The bank’s funding is expected to support a range of infrastructure projects, including the development of roads, railways, airports, energy pipelines, ports, and telecommunications networks. These projects are critical for enhancing Kenya’s connectivity both within the country and with its regional neighbors. Improved infrastructure will not only facilitate trade and investment but also contribute to the country’s goal of becoming a regional economic hub.

In addition to infrastructure, climate change is a key focus area for Kenya’s partnership with the AIIB. As a country that is particularly vulnerable to the impacts of climate change, Kenya has been actively seeking ways to mitigate these effects and transition to a more sustainable, low-carbon economy. The AIIB has committed to directing 50% of its approved financing to climate-related initiatives by 2025, making it a valuable partner in Kenya’s climate change efforts.

Projects supported by the AIIB in Kenya are likely to include investments in renewable energy, such as solar and wind power, as well as initiatives to improve energy efficiency and reduce greenhouse gas emissions. These efforts align with Kenya’s commitments under the Paris Agreement and its National Climate Change Action Plan, which outlines strategies for achieving a low-carbon, climate-resilient development path.

Another important area of collaboration is technology-enabled projects. As Kenya continues to position itself as a leader in the African digital economy, access to AIIB funding will support the development of technology infrastructure, including broadband networks, data centers, and smart city initiatives. These projects will not only enhance Kenya’s digital connectivity but also drive innovation and create new opportunities for economic growth.

The Global Context: AIIB’s Role in Multilateral Development

Kenya’s membership in the AIIB comes at a time when the global landscape of multilateral development banks (MDBs) is evolving. The AIIB, although relatively new, has quickly established itself as a major player in the field of international development finance. Unlike traditional MDBs, such as the World Bank and the International Monetary Fund (IMF), the AIIB has a more focused mandate on infrastructure and connectivity, particularly in Asia and the surrounding regions.

However, the bank’s influence extends beyond Asia, as evidenced by its growing membership and its involvement in projects across various continents. The AIIB’s approach to development finance is characterized by its emphasis on sustainability, innovation, and the mobilization of private capital. By collaborating with other MDBs and financial institutions, the AIIB aims to leverage its resources to achieve greater impact and reach.

For Kenya, joining the AIIB represents an opportunity to diversify its sources of development finance and reduce its reliance on traditional lenders. This is particularly important as the country faces growing debt levels and the need for more sustainable financing options. The AIIB’s concessional funding terms offer a more manageable alternative to commercial borrowing, which often comes with higher costs and shorter repayment periods.

Regional Implications: Strengthening East African Integration

Kenya’s membership in the AIIB also has significant regional implications, particularly in the context of East African integration. As one of the leading economies in the East African Community (EAC), Kenya plays a pivotal role in driving regional cooperation and economic integration. The AIIB’s focus on regional connectivity aligns with Kenya’s efforts to enhance trade and investment links with its neighbors.

Projects funded by the AIIB in Kenya are likely to have spillover effects across the region, improving infrastructure and connectivity that benefit multiple countries. For example, the development of transport corridors, such as roads and railways linking Kenya with Uganda, Tanzania, and other neighboring countries, will facilitate trade and boost economic activity across the region.

In addition, the AIIB’s support for climate-related initiatives in Kenya can serve as a model for other East African countries that are also grappling with the impacts of climate change. By demonstrating the benefits of sustainable infrastructure development, Kenya’s partnership with the AIIB can encourage other countries in the region to pursue similar paths.

Challenges and Opportunities: Navigating Kenya’s Development Agenda

While Kenya’s membership in the AIIB presents numerous opportunities, it also comes with challenges that must be carefully managed. One of the key challenges is ensuring that the projects funded by the AIIB are aligned with Kenya’s national development priorities and are implemented in a manner that maximizes their impact. This requires effective coordination between the Kenyan government, the AIIB, and other stakeholders involved in project planning and execution.

Another challenge is the management of Kenya’s growing debt levels. While concessional funding from the AIIB is more favorable than commercial borrowing, it still adds to the country’s debt burden. As Kenya continues to pursue its ambitious development agenda, it will be important to balance the need for investment with the imperative of maintaining debt sustainability.

To address these challenges, Kenya will need to strengthen its institutional capacity for project implementation and debt management. This includes improving the efficiency of public investment processes, enhancing transparency and accountability, and ensuring that projects are delivered on time and within budget. By doing so, Kenya can maximize the benefits of its partnership with the AIIB and achieve its long-term development goals.

Looking Ahead: The Future of Kenya-AIIB Cooperation

Kenya’s formal membership in the AIIB marks the beginning of a new chapter in the country’s development journey. With access to concessional funding and the support of a major multilateral development institution, Kenya is well-positioned to accelerate its infrastructure development, enhance regional connectivity, and address the challenges of climate change.

As Kenya continues to engage with the AIIB, the focus will be on identifying and prioritizing projects that have the greatest potential to drive economic growth and improve the lives of its citizens. This will require a strategic approach to project selection, as well as ongoing collaboration with the AIIB and other development partners.

The success of this partnership will also depend on Kenya’s ability to leverage the resources and expertise of the AIIB to build a more sustainable and resilient economy. By investing in green infrastructure, promoting regional integration, and embracing technology, Kenya can position itself as a leader in the African development landscape and set a positive example for other countries in the region.

Conclusion: A Strategic Partnership for Sustainable Development

Kenya’s formal membership in the Asian Infrastructure Investment Bank represents a strategic move that will have far-reaching implications for the country’s development. By joining the AIIB, Kenya gains access to valuable resources that will support its efforts to build sustainable infrastructure, combat climate change, and enhance regional connectivity.

This partnership comes at a critical time for Kenya, as the country seeks to accelerate its development agenda and achieve its Vision 2030 goals. With the support of the AIIB, Kenya is well-positioned to overcome its infrastructure challenges, reduce its carbon footprint, and drive economic growth that benefits all its citizens.

As Kenya embarks on this new journey with the AIIB, the focus will be on ensuring that the partnership delivers tangible results that contribute to the country’s long-term development. By working together, Kenya and the AIIB can build a brighter future for the country and the region as a whole.

hoto source: Google

By: Montel Kamau

Serrari Financial Analyst

4th September, 2024

Article, Financial and News Disclaimer

The Value of a Financial Advisor

While this article offers valuable insights, it is essential to recognize that personal finance can be highly complex and unique to each individual. A financial advisor provides professional expertise and personalized guidance to help you make well-informed decisions tailored to your specific circumstances and goals.

Beyond offering knowledge, a financial advisor serves as a trusted partner to help you stay disciplined, avoid common pitfalls, and remain focused on your long-term objectives. Their perspective and experience can complement your own efforts, enhancing your financial well-being and ensuring a more confident approach to managing your finances.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Readers are encouraged to consult a licensed financial advisor to obtain guidance specific to their financial situation.

Article and News Disclaimer

The information provided on www.serrarigroup.com is for general informational purposes only. While we strive to keep the information up to date and accurate, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability with respect to the website or the information, products, services, or related graphics contained on the website for any purpose. Any reliance you place on such information is therefore strictly at your own risk.

www.serrarigroup.com is not responsible for any errors or omissions, or for the results obtained from the use of this information. All information on the website is provided on an as-is basis, with no guarantee of completeness, accuracy, timeliness, or of the results obtained from the use of this information, and without warranty of any kind, express or implied, including but not limited to warranties of performance, merchantability, and fitness for a particular purpose.

In no event will www.serrarigroup.com be liable to you or anyone else for any decision made or action taken in reliance on the information provided on the website or for any consequential, special, or similar damages, even if advised of the possibility of such damages.

The articles, news, and information presented on www.serrarigroup.com reflect the opinions of the respective authors and contributors and do not necessarily represent the views of the website or its management. Any views or opinions expressed are solely those of the individual authors and do not represent the website's views or opinions as a whole.

The content on www.serrarigroup.com may include links to external websites, which are provided for convenience and informational purposes only. We have no control over the nature, content, and availability of those sites. The inclusion of any links does not necessarily imply a recommendation or endorsement of the views expressed within them.

Every effort is made to keep the website up and running smoothly. However, www.serrarigroup.com takes no responsibility for, and will not be liable for, the website being temporarily unavailable due to technical issues beyond our control.

Please note that laws, regulations, and information can change rapidly, and we advise you to conduct further research and seek professional advice when necessary.

By using www.serrarigroup.com, you agree to this disclaimer and its terms. If you do not agree with this disclaimer, please do not use the website.

www.serrarigroup.com, reserves the right to update, modify, or remove any part of this disclaimer without prior notice. It is your responsibility to review this disclaimer periodically for changes.

Serrari Group 2025