Introduction

On Tuesday, September 10, 2024, Kenya announced a ban on sugar imports from countries outside the Common Market for Eastern and Southern Africa (COMESA) and the East African Community (EAC). The move, spearheaded by the Ministry of Agriculture and Livestock Development, comes as Kenya’s sugar production levels improve, reducing the country’s reliance on external sources for sugar supply. Cabinet Secretary Andrew Karanja emphasized that the decision reflects the government’s efforts to safeguard the local sugar industry, boost domestic production, and protect consumers from high sugar prices.

Kenya’s sugar sector has faced various challenges over the years, ranging from poor management of sugar factories to unfavorable climatic conditions. However, the government is now banking on increased local production to meet domestic demand, which is approximately 950,000 metric tonnes annually. With the production level expected to surpass 800,000 metric tonnes this year, Kenya is set to reduce its dependency on external sugar imports, particularly from outside the COMESA and EAC blocs.

The Current State of Kenya’s Sugar Industry

Kenya’s sugar industry plays a significant role in the country’s economy, with 16 factories spread across different regions producing sugar for domestic consumption. According to data from the Ministry of Agriculture, Kenya’s sugar production has steadily increased over the past few years, reaching 800,000 metric tonnes in 2022. This improvement is notable compared to the 700,000 metric tonnes produced annually in previous years. The increase in production is a result of enhanced factory operations, better farming practices, and government interventions aimed at supporting the sugar sector.

In 2023, Kenya’s sugar production faced setbacks due to a severe drought that affected sugarcane yields, leading to reduced output. This shortfall necessitated the importation of sugar from countries outside the COMESA and EAC regions to bridge the gap and prevent a surge in prices. However, with better climatic conditions in 2024 and improved production capacity, Kenya is now confident in its ability to meet most of its sugar needs through local production, limiting the need for imports from external regions.

The Role of COMESA and EAC in Kenya’s Sugar Trade

Kenya’s participation in COMESA and the EAC plays a crucial role in its sugar trade. COMESA, a regional economic community comprising 21 member states, and the EAC, an intergovernmental organization with eight partner states, provide Kenya with access to preferential trade agreements that allow for the importation of sugar under favorable conditions. Through these trade blocs, Kenya has been able to import sugar from neighboring countries at reduced tariffs, ensuring a stable supply of the commodity while protecting its local industry from unfair competition.

Kenya’s sugar imports from COMESA and EAC member states are governed by sugar safeguards, which are set to expire in February 2025. These safeguards were implemented to protect Kenya’s sugar sector from the influx of cheaper sugar from countries with larger and more competitive industries. Under the safeguards, Kenya is allowed to import sugar from COMESA and EAC countries without facing the full brunt of international competition, allowing the local industry time to grow and stabilize.

As the expiry date for these safeguards approaches, there are concerns about how the local industry will cope with increased competition once the protective measures are lifted. The Kenyan government has expressed its commitment to ensuring that the sugar industry remains competitive and sustainable, even as it prepares for the expiration of the safeguards.

Impact of the Ban on Sugar Imports from Outside COMESA and EAC

The decision to ban sugar imports from outside the COMESA and EAC regions is expected to have several implications for Kenya’s sugar market. First and foremost, the move is intended to protect local sugar farmers and factories from the influx of cheap sugar from external markets, which could potentially harm the domestic industry. By limiting imports to COMESA and EAC member states, Kenya aims to create a more level playing field for its local producers, allowing them to compete more effectively in the market.

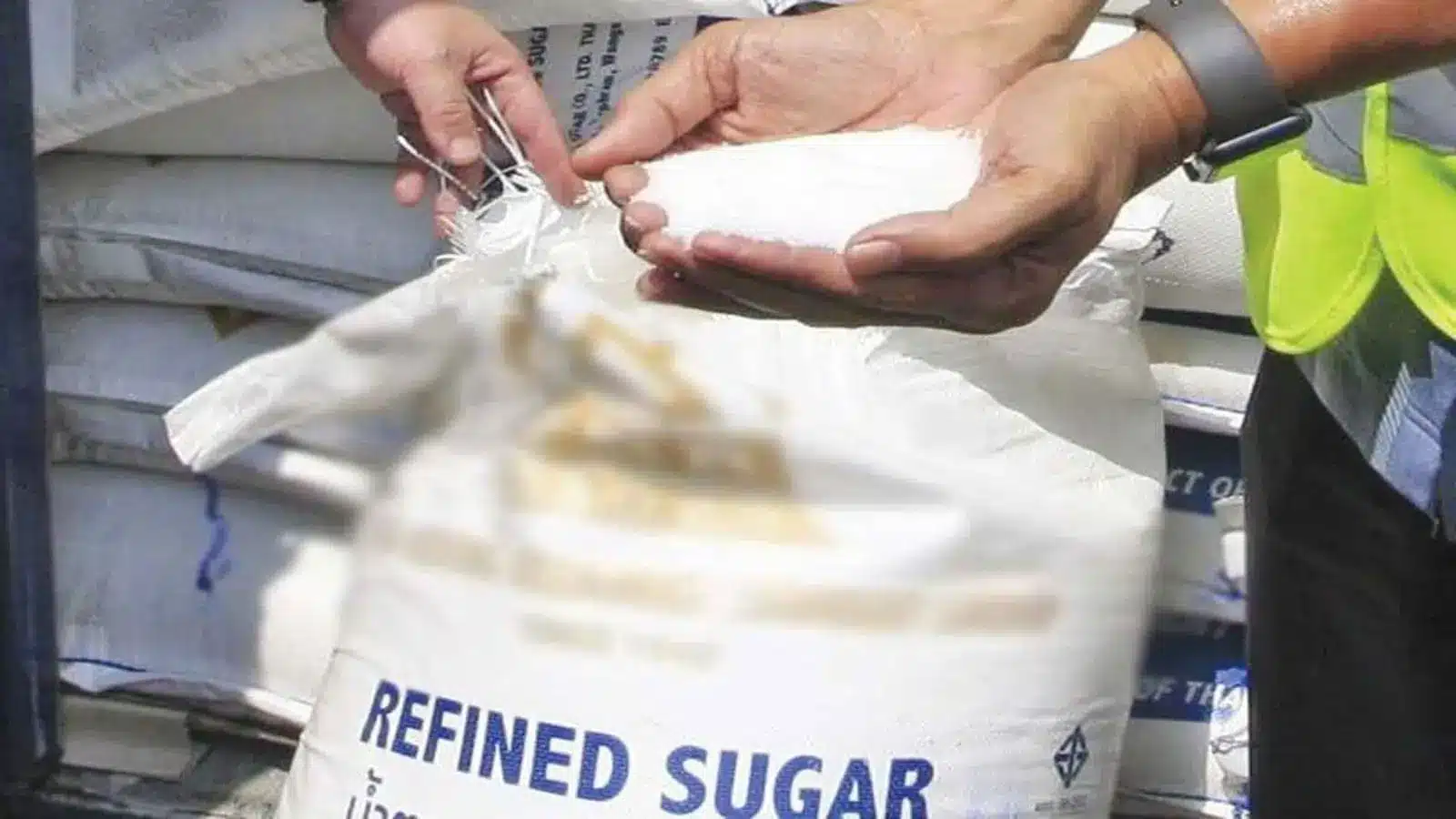

In recent years, Kenya has struggled with the issue of sugar smuggling through porous borders, which has exacerbated the challenges faced by the local industry. The ban on imports from outside the regional trade blocs, coupled with increased security measures to prevent smuggling, is expected to help stabilize the market and ensure that local producers can sell their sugar at fair prices.

Cabinet Secretary Andrew Karanja highlighted the government’s efforts to combat illegal sugar imports, stating that security agencies have been deployed to address the issue. The crackdown on smuggling is expected to reduce the availability of illicit sugar in the market, which has often undercut the prices of locally produced sugar and negatively impacted the profitability of Kenyan sugar factories.

The Role of Climate Change and Drought in Sugar Production

Kenya’s sugar production is heavily dependent on favorable weather conditions, particularly sufficient rainfall to support sugarcane farming. In 2023, the country experienced a severe drought, which significantly reduced sugarcane yields and, consequently, sugar output. The drought not only affected Kenya’s sugar industry but also had a broader impact on the agricultural sector, leading to food shortages and increased food prices.

The 2023 drought underscored the vulnerability of Kenya’s sugar industry to climate change and the need for more resilient farming practices. As the country continues to grapple with the effects of climate variability, there is growing recognition of the need to adopt sustainable agricultural practices that can help mitigate the impact of adverse weather conditions on sugarcane farming.

In response to these challenges, the Kenyan government has implemented several initiatives aimed at improving the resilience of the sugar industry. These include investing in irrigation infrastructure, promoting climate-smart agriculture, and providing financial support to sugarcane farmers affected by drought. The government is also working with stakeholders in the sugar industry to develop strategies that can help cushion the sector against future climate-related shocks.

The Importance of Sugar to Kenya’s Economy

The sugar industry is a vital component of Kenya’s economy, providing employment to thousands of people, particularly in the western region of the country, where sugarcane farming is a major economic activity. The industry supports over 250,000 smallholder farmers who grow sugarcane on approximately 220,000 hectares of land. In addition to providing direct employment, the sugar industry also supports various ancillary industries, including transport, manufacturing, and retail.

Sugarcane farming is also a source of revenue for the government, with taxes and levies collected from sugar production and trade contributing to the national budget. However, the industry has faced several challenges in recent years, including mismanagement, corruption, and outdated infrastructure. These issues have hindered the growth of the sector and made it difficult for Kenyan sugar producers to compete with more efficient producers in other countries.

To address these challenges, the Kenyan government has implemented a series of reforms aimed at reviving the sugar industry. These reforms include the privatization of state-owned sugar factories, the introduction of new technologies to improve efficiency, and the establishment of policies to support smallholder farmers. The government’s goal is to create a competitive and sustainable sugar industry that can meet the country’s domestic demand while also contributing to export earnings.

Conclusion

Kenya’s decision to ban sugar imports from outside the COMESA and EAC trade blocs marks a significant step in the government’s efforts to protect and revitalize the local sugar industry. With improved production levels and a commitment to addressing issues such as smuggling and climate change, Kenya is poised to reduce its reliance on external sugar sources and strengthen its domestic industry.

As the February 2025 expiration of sugar safeguards approaches, the Kenyan government faces the challenge of ensuring that the local industry remains competitive in the face of increased competition from international markets. By investing in infrastructure, supporting farmers, and implementing effective policies, Kenya can create a sustainable sugar industry that benefits both producers and consumers. The ban on external sugar imports is just one of many steps in this journey toward a more resilient and self-sufficient sugar sector.

Photo source: Google

By: Montel Kamau

Serrari Financial Analyst

11th September, 2024

Article, Financial and News Disclaimer

The Value of a Financial Advisor

While this article offers valuable insights, it is essential to recognize that personal finance can be highly complex and unique to each individual. A financial advisor provides professional expertise and personalized guidance to help you make well-informed decisions tailored to your specific circumstances and goals.

Beyond offering knowledge, a financial advisor serves as a trusted partner to help you stay disciplined, avoid common pitfalls, and remain focused on your long-term objectives. Their perspective and experience can complement your own efforts, enhancing your financial well-being and ensuring a more confident approach to managing your finances.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Readers are encouraged to consult a licensed financial advisor to obtain guidance specific to their financial situation.

Article and News Disclaimer

The information provided on www.serrarigroup.com is for general informational purposes only. While we strive to keep the information up to date and accurate, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability with respect to the website or the information, products, services, or related graphics contained on the website for any purpose. Any reliance you place on such information is therefore strictly at your own risk.

www.serrarigroup.com is not responsible for any errors or omissions, or for the results obtained from the use of this information. All information on the website is provided on an as-is basis, with no guarantee of completeness, accuracy, timeliness, or of the results obtained from the use of this information, and without warranty of any kind, express or implied, including but not limited to warranties of performance, merchantability, and fitness for a particular purpose.

In no event will www.serrarigroup.com be liable to you or anyone else for any decision made or action taken in reliance on the information provided on the website or for any consequential, special, or similar damages, even if advised of the possibility of such damages.

The articles, news, and information presented on www.serrarigroup.com reflect the opinions of the respective authors and contributors and do not necessarily represent the views of the website or its management. Any views or opinions expressed are solely those of the individual authors and do not represent the website's views or opinions as a whole.

The content on www.serrarigroup.com may include links to external websites, which are provided for convenience and informational purposes only. We have no control over the nature, content, and availability of those sites. The inclusion of any links does not necessarily imply a recommendation or endorsement of the views expressed within them.

Every effort is made to keep the website up and running smoothly. However, www.serrarigroup.com takes no responsibility for, and will not be liable for, the website being temporarily unavailable due to technical issues beyond our control.

Please note that laws, regulations, and information can change rapidly, and we advise you to conduct further research and seek professional advice when necessary.

By using www.serrarigroup.com, you agree to this disclaimer and its terms. If you do not agree with this disclaimer, please do not use the website.

www.serrarigroup.com, reserves the right to update, modify, or remove any part of this disclaimer without prior notice. It is your responsibility to review this disclaimer periodically for changes.

Serrari Group 2025