Kenya has made a significant step in bolstering its international economic relations by finalizing a landmark Double Taxation Agreement (DTA) with Singapore. This agreement, reached on the sidelines of the United Nations General Assembly (UNGA) in New York, marks Singapore as the 50th nation to establish such an arrangement with Kenya. The DTA aims to eliminate the burden of double taxation, which has long been a barrier to cross-border trade and investment between the two nations.

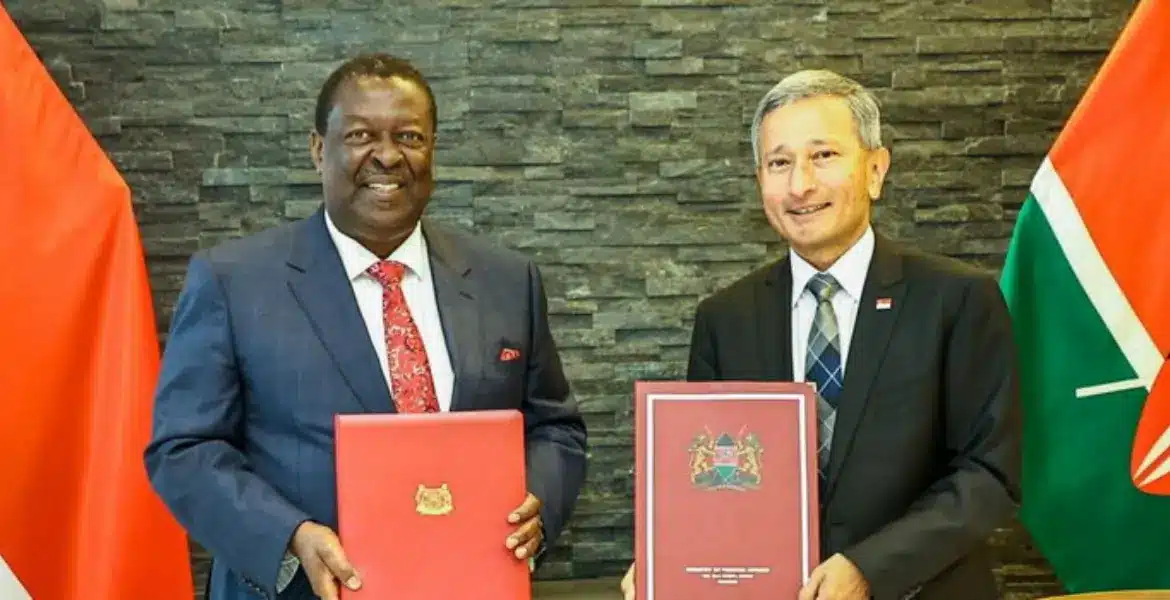

The agreement was signed by Kenya’s Prime Cabinet Secretary Musalia Mudavadi and Singapore’s Foreign Affairs Minister Vivian Balakrishnan, replacing a previous agreement dating back to 2018. This enhanced DTA reflects the evolving economic relationship between the two countries and is expected to have significant implications, particularly for businesses in key sectors like shipping, logistics, and financial technology (fintech), where Singapore already maintains a strong presence in Kenya.

Double Taxation Agreement: A Pathway to Increased Economic Cooperation

The Double Taxation Agreement between Kenya and Singapore is more than just a tax arrangement—it is a strategic move to promote bilateral trade, investment, and cooperation. Double taxation occurs when income is taxed both in the country where it is earned and in the country of residence. This often discourages foreign investment and complicates international business. The DTA aims to prevent this by outlining clear rules regarding the allocation of taxation rights between the two countries.

For Kenyan and Singaporean businesses operating across borders, this agreement ensures they are not taxed twice on the same profits, thus reducing the financial burden and providing a more predictable business environment. It provides a comprehensive framework for determining which country has the primary right to tax various forms of income, including profits from business activities, dividends, interest, and royalties.

Key Provisions of the Agreement

The new DTA encompasses several important provisions designed to benefit both nations and their business communities. Among the most critical aspects is the taxation of profits from international shipping and air transport. Under the agreement, such profits will be taxable only in the country where the business is headquartered. This provision is especially beneficial for shipping and airline industries, both of which are integral to Kenya and Singapore’s economies.

Additionally, the DTA covers businesses with permanent establishments in either country. Such businesses can deduct operational expenses, including administrative and executive costs, from their taxable income, thus lowering the tax burden on cross-border operations. Notably, some sectors, such as banking, have been granted specific exceptions to avoid the exploitation of loopholes regarding interest and royalty payments. These measures ensure fairness and transparency in the tax regime, preventing businesses from shifting profits to avoid taxes.

For individuals, the DTA provides clarity on income taxation for cross-border professional services, reducing confusion over which country has the right to tax income. This provision is particularly relevant for expatriates, consultants, and professionals working between the two nations. By reducing the chances of double taxation, the DTA promotes the movement of skilled labor and expertise between Kenya and Singapore.

Broader Implications for Key Sectors

The signing of the DTA is expected to have a profound impact on several industries, particularly those with established operations in both Kenya and Singapore. One of the primary sectors poised to benefit is shipping and logistics. Singapore, being one of the world’s largest maritime hubs, has a vested interest in ensuring smooth cross-border operations with Kenya, a key player in East Africa’s port and shipping industry. Kenyan port management, particularly in Mombasa, stands to gain from this agreement, which simplifies tax obligations and fosters increased investment in port infrastructure.

Another sector set to benefit is financial technology (fintech). Singapore has emerged as a global leader in fintech, with companies such as Grab, Sea Group, and DBS Bank leading innovations in mobile payments, digital banking, and blockchain. Kenya, home to M-Pesa and other fintech innovations, has also been a major player in the digital economy. The DTA will encourage more Singaporean fintech firms to enter the Kenyan market, providing opportunities for collaboration and growth in this dynamic sector.

Agribusiness is another area where the DTA could have a significant impact. Singapore relies heavily on food imports, while Kenya is a major agricultural exporter. By removing tax barriers, the DTA paves the way for greater agricultural trade, benefiting Kenyan farmers and agribusiness companies looking to expand their exports to Asia.

Additional Agreements and Broader Cooperation

The Double Taxation Agreement is part of a broader framework of cooperation between Kenya and Singapore. In addition to the DTA, the two countries have signed a series of Memorandums of Understanding (MoUs) aimed at enhancing collaboration in other areas, such as climate change, skills development, and the digital economy. These agreements reflect the shared goals of both nations to address global challenges and foster sustainable economic growth.

The MoU on climate change, for instance, focuses on joint efforts to combat global warming, reduce greenhouse gas emissions, and promote the development of carbon credit markets. This is particularly timely as both Kenya and Singapore are vulnerable to the impacts of climate change. Kenya’s economy relies heavily on agriculture, which is highly sensitive to changes in weather patterns, while Singapore faces rising sea levels and extreme weather events. By working together, the two countries hope to make progress on meeting their climate commitments under the Paris Agreement.

In the area of skills development, the partnership between Kenya and Singapore is expected to bring new opportunities for knowledge transfer and capacity building. Singapore’s success in education and vocational training provides a model for Kenya, which is looking to improve its workforce’s skills in areas such as technology, engineering, and healthcare. By sharing best practices and fostering collaboration between educational institutions, the two countries can help build a more competitive and skilled workforce.

Strategic Significance for Kenya

For Kenya, this agreement is a vital part of its broader strategy to position itself as a key economic player in Africa and beyond. Often compared to Singapore in terms of its economic aspirations, Kenya seeks to replicate the city-state’s success in becoming a global business hub. Singapore’s rise from a small, resource-scarce island to a leading financial and trade center offers valuable lessons for Kenya as it works to diversify its economy, attract foreign investment, and expand its global trade relationships.

The DTA and accompanying agreements will likely boost Kenya’s efforts to attract more foreign direct investment (FDI) and position itself as a gateway for Asian companies looking to invest in Africa. Kenya’s strategic location, well-developed infrastructure, and dynamic business environment make it an attractive destination for investors, and the DTA with Singapore enhances its appeal by providing a clear and stable tax regime.

Conclusion

The Double Taxation Agreement between Kenya and Singapore represents a significant milestone in the economic relationship between the two nations. By removing the burden of double taxation and providing clarity on cross-border tax obligations, the DTA opens the door to increased trade, investment, and cooperation. Sectors such as shipping, logistics, fintech, and agribusiness are set to benefit from the agreement, while additional partnerships in areas like climate change and skills development further strengthen the ties between the two countries.

As Kenya continues to pursue its goal of becoming a leading economic powerhouse in Africa, the DTA with Singapore serves as a crucial step toward that vision. By fostering a more business-friendly environment and promoting collaboration across key sectors, the agreement is poised to deliver lasting economic benefits for both Kenya and Singapore.

photo source: Google

By: Montel Kamau

Serrari Financial Analyst

25th September 2024

Article, Financial and News Disclaimer

The Value of a Financial Advisor

While this article offers valuable insights, it is essential to recognize that personal finance can be highly complex and unique to each individual. A financial advisor provides professional expertise and personalized guidance to help you make well-informed decisions tailored to your specific circumstances and goals.

Beyond offering knowledge, a financial advisor serves as a trusted partner to help you stay disciplined, avoid common pitfalls, and remain focused on your long-term objectives. Their perspective and experience can complement your own efforts, enhancing your financial well-being and ensuring a more confident approach to managing your finances.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Readers are encouraged to consult a licensed financial advisor to obtain guidance specific to their financial situation.

Article and News Disclaimer

The information provided on www.serrarigroup.com is for general informational purposes only. While we strive to keep the information up to date and accurate, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability with respect to the website or the information, products, services, or related graphics contained on the website for any purpose. Any reliance you place on such information is therefore strictly at your own risk.

www.serrarigroup.com is not responsible for any errors or omissions, or for the results obtained from the use of this information. All information on the website is provided on an as-is basis, with no guarantee of completeness, accuracy, timeliness, or of the results obtained from the use of this information, and without warranty of any kind, express or implied, including but not limited to warranties of performance, merchantability, and fitness for a particular purpose.

In no event will www.serrarigroup.com be liable to you or anyone else for any decision made or action taken in reliance on the information provided on the website or for any consequential, special, or similar damages, even if advised of the possibility of such damages.

The articles, news, and information presented on www.serrarigroup.com reflect the opinions of the respective authors and contributors and do not necessarily represent the views of the website or its management. Any views or opinions expressed are solely those of the individual authors and do not represent the website's views or opinions as a whole.

The content on www.serrarigroup.com may include links to external websites, which are provided for convenience and informational purposes only. We have no control over the nature, content, and availability of those sites. The inclusion of any links does not necessarily imply a recommendation or endorsement of the views expressed within them.

Every effort is made to keep the website up and running smoothly. However, www.serrarigroup.com takes no responsibility for, and will not be liable for, the website being temporarily unavailable due to technical issues beyond our control.

Please note that laws, regulations, and information can change rapidly, and we advise you to conduct further research and seek professional advice when necessary.

By using www.serrarigroup.com, you agree to this disclaimer and its terms. If you do not agree with this disclaimer, please do not use the website.

www.serrarigroup.com, reserves the right to update, modify, or remove any part of this disclaimer without prior notice. It is your responsibility to review this disclaimer periodically for changes.

Serrari Group 2025