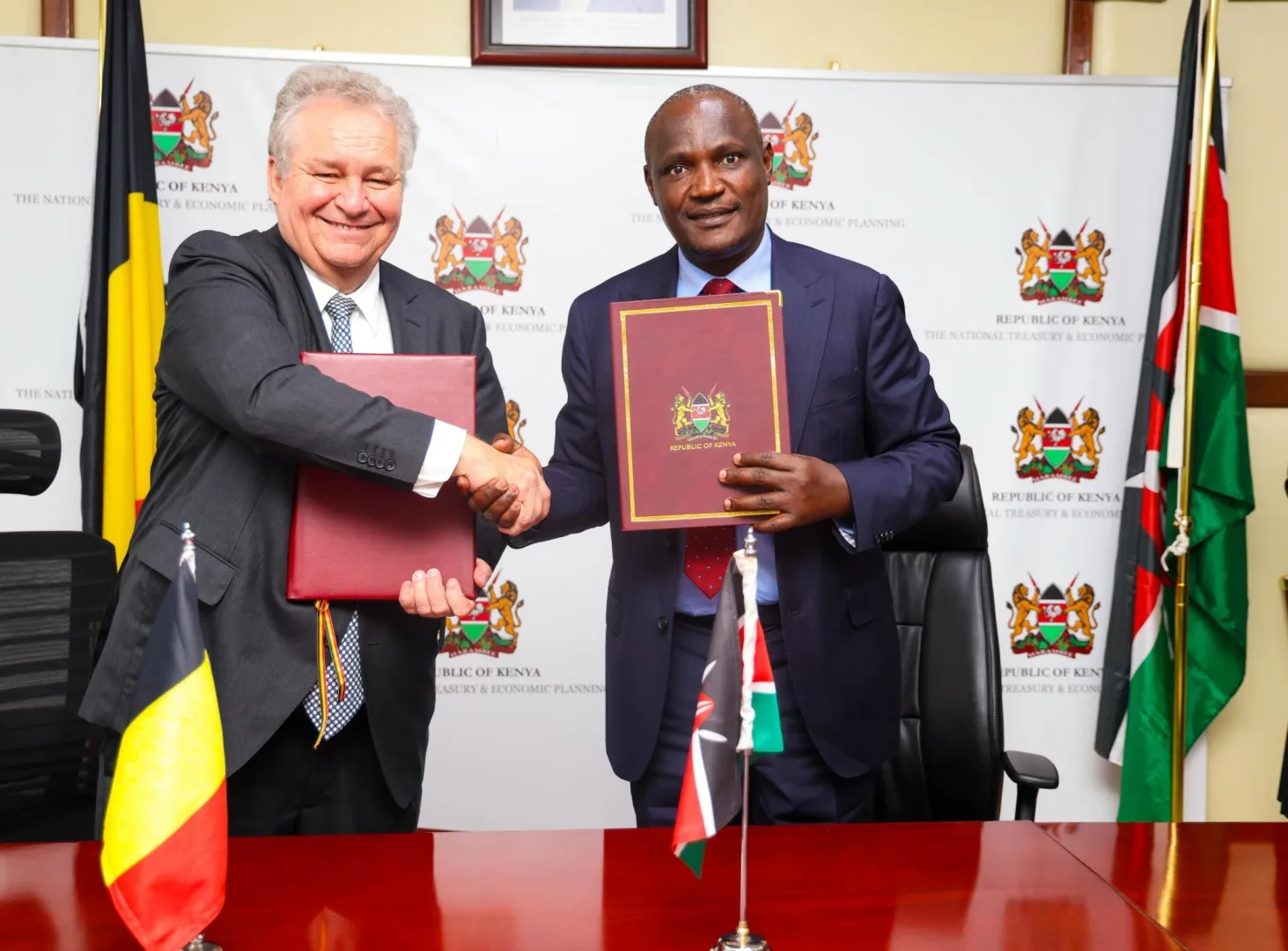

The Kenyan government has formalized a landmark bilateral agreement with Belgium designed to eliminate double taxation and prevent tax evasion for individuals and businesses operating between the two countries. The historic deal was signed on Tuesday, September 30, at the National Treasury offices in Nairobi, marking a pivotal moment in Kenya-Belgium economic relations.

The agreement represents a significant milestone in strengthening economic and investment ties between the two nations. Present at the signing ceremony were Treasury Cabinet Secretary John Mbadi and Belgium’s Ambassador to Kenya, Peter Maddens, who both emphasized the transformative potential of this partnership.

Build the future you deserve. Get started with our top-tier Online courses: ACCA, HESI A2, ATI TEAS 7, HESI EXIT, NCLEX-RN, NCLEX-PN, and Financial Literacy. Let Serrari Ed guide your path to success. Enroll today.

Understanding the Framework

Speaking shortly after the signing, CS Mbadi emphasized the critical importance of the agreement in ensuring tax certainty and fairness for businesses and individuals engaged in cross-border activities. He stated that the framework is strategically designed to eliminate double taxation, create predictability in tax matters, and foster robust cross-border economic activity between Kenya and Belgium.

Double taxation occurs when the same income is taxed by two different countries, creating a significant burden for businesses and individuals operating internationally. This challenge has long been identified as a major barrier to cross-border investment and trade. The new agreement provides clear guidelines on which country has the primary right to tax different types of income, including dividends, interest, royalties, and business profits.

According to Mbadi, the deal goes beyond merely addressing double taxation. It also aims to tackle tax evasion through enhanced information exchange mechanisms and foster a more transparent and equitable tax system between the two nations. This aligns with global efforts led by the OECD’s BEPS initiative to combat tax avoidance and ensure that multinational companies and wealthy individuals pay their fair share of taxes.

Strategic Economic Implications

Mbadi highlighted the broader strategic goals of the agreement, stating that it will encourage more bilateral investment and solidify diplomatic and economic relations between Kenya and Belgium. The framework is expected to provide the certainty that investors need when making long-term investment decisions.

“This signing builds on the momentum of the 2024 Kenya-Belgium Political Consultations in Brussels, during which both countries reaffirmed their commitment to broaden cooperation in trade and investment,” Mbadi affirmed during the ceremony.

The Cabinet Secretary pointed to Kenya’s impressive current economic performance, noting that the country’s nominal GDP stands at Sh15 trillion (approximately $121.3 billion) as of 2024. He attributed this substantial growth to sound macroeconomic policies and a vibrant services sector, which continues to play a central role in Kenya’s economic resilience and expansion.

Kenya’s Competitive Advantages

Mbadi also emphasized Kenya’s strategic geographical advantage as a regional trade and logistics hub, along with its skilled and educated workforce, as key factors that make the country increasingly attractive to foreign investors. Kenya serves as the gateway to the East African Community market of over 300 million people and has established itself as the financial and commercial center of the region.

The country’s strategic location on the Indian Ocean, coupled with modern infrastructure including the Standard Gauge Railway and expanded port facilities at Mombasa, positions Kenya as an ideal base for companies looking to serve the broader East African market. Additionally, Kenya’s relatively stable political environment, compared to some regional neighbors, provides an added layer of security for foreign investors.

The Kenyan government has been implementing various reforms to improve the business environment, including streamlining business registration processes, enhancing the efficiency of the judiciary in handling commercial disputes, and investing in infrastructure development. These efforts have been aimed at moving Kenya up the rankings in global competitiveness indices.

One decision can change your entire career. Take that step with our Online courses in ACCA, HESI A2, ATI TEAS 7, HESI EXIT, NCLEX-RN, NCLEX-PN, and Financial Literacy. Join Serrari Ed and start building your brighter future today.

Belgium’s Perspective

Ambassador Maddens welcomed the agreement enthusiastically, describing it as a strategic milestone in the diplomatic and economic relationship between Kenya and Belgium. He emphasized that the deal fills a crucial gap in the bilateral framework that has existed between the two countries for decades.

“This agreement opens up new opportunities for cooperation in trade, business, and investment between our two nations,” Ambassador Maddens stated. “Belgian companies have long been interested in the Kenyan market, and this treaty removes one of the key obstacles that prevented deeper engagement.”

Belgium, known for its strong pharmaceutical, chemical, and diamond industries, as well as its position as a major European logistics hub, brings significant investment potential to Kenya. The treaty is expected to facilitate increased Belgian investment in sectors such as healthcare, manufacturing, logistics, and financial services.

Part of a Broader Strategy

The signing follows a similar agreement between Kenya and the Czech Republic, which was concluded just a week earlier. On Tuesday, September 23, the Treasury confirmed that CS Mbadi signed a double taxation avoidance agreement with Czech Ambassador Nicol Adamcová, demonstrating the government’s coordinated approach to expanding its network of tax treaties.

These back-to-back deals reflect the Kenyan government’s continued and intensified effort to attract foreign investment and streamline cross-border tax policies. The strategy represents a comprehensive approach to making Kenya a more attractive destination for foreign direct investment while ensuring that the country benefits appropriately from international business activities.

Kenya has been actively expanding its network of double taxation agreements with various countries around the world. These agreements are part of a broader strategy to integrate Kenya more deeply into the global economy and attract the investment needed to achieve the country’s Vision 2030 development goals.

Technical Provisions and Implementation

While the specific technical details of the Kenya-Belgium agreement are yet to be fully disclosed, such treaties typically include provisions covering various types of income and economic activities. These usually encompass guidelines on the taxation of business profits, dividends, interest payments, royalties, capital gains, and employment income.

The agreement likely includes mechanisms for resolving disputes between the tax authorities of the two countries and procedures for taxpayers to claim relief from double taxation. It may also contain provisions for the exchange of tax information between Kenyan and Belgian authorities, which is crucial for preventing tax evasion and ensuring compliance.

Implementation of the agreement will require both countries to complete their respective domestic ratification processes. In Kenya, this typically involves approval by the National Assembly before the treaty can enter into force. Once ratified, the Kenya Revenue Authority (KRA) will be responsible for implementing the provisions of the agreement and providing guidance to taxpayers on how to benefit from its provisions.

Impact on Businesses and Individuals

For businesses operating between Kenya and Belgium, the agreement provides much-needed clarity and certainty. Companies will be able to plan their operations and investments with greater confidence, knowing that they will not face unexpected double taxation. This is particularly important for Belgian companies looking to establish operations in Kenya or Kenyan companies seeking to expand into the Belgian or broader European market.

Individual taxpayers who work or have investments in both countries will also benefit significantly. The agreement will provide clear rules on where different types of income should be taxed, reducing the administrative burden and potential for disputes. This is especially relevant for professionals, consultants, and entrepreneurs who operate across borders.

The treaty is also expected to facilitate increased trade in services between the two countries. With clearer tax rules, Belgian companies may be more willing to provide services to Kenyan clients, and vice versa, knowing that the tax treatment of their income will be predictable and fair.

Regional and Global Context

Kenya’s efforts to expand its network of tax treaties come at a time when international tax cooperation is receiving increased attention globally. The Organisation for Economic Co-operation and Development (OECD) has been leading efforts to combat base erosion and profit shifting (BEPS), which involves multinational companies shifting profits to low-tax jurisdictions to minimize their overall tax burden.

By signing comprehensive tax treaties with developed countries like Belgium and the Czech Republic, Kenya is positioning itself as a responsible player in the global tax system. This can enhance the country’s reputation and make it more attractive to legitimate foreign investors who value transparency and predictability in tax matters.

The agreement also reflects the growing economic ties between Africa and Europe. As European countries seek to diversify their economic partnerships and African nations work to attract investment for development, tax treaties provide an essential foundation for mutually beneficial economic relationships.

Looking Ahead

The successful conclusion of these agreements represents just the beginning of what Kenyan officials hope will be a new era of enhanced investment and economic cooperation. The Treasury is reportedly in discussions with several other countries about similar agreements, as part of a comprehensive strategy to make Kenya a premier investment destination in Africa.

As Kenya continues to develop its economy and infrastructure, clear and fair tax arrangements with major trading partners will be crucial. These agreements not only facilitate investment but also ensure that Kenya receives its fair share of tax revenue from economic activities taking place within its borders or involving its residents.

The coming months will be critical as both countries work through the ratification process and begin implementing the provisions of the agreement. Businesses and individuals in both countries are advised to consult with tax professionals to understand how the treaty affects their specific situations and how they can benefit from its provisions.

For Kenya, these agreements represent an important step toward achieving its economic development objectives and solidifying its position as a leading economy in East Africa and the broader continent. The success of these initiatives will likely be measured not just in the volume of investment attracted, but in the quality of economic partnerships formed and the sustainable development outcomes achieved.

Ready to take your career to the next level? Join our Online courses: ACCA, HESI A2, ATI TEAS 7 , HESI EXIT , NCLEX – RN and NCLEX – PN, Financial Literacy!🌟 Dive into a world of opportunities and empower yourself for success. Explore more at Serrari Ed and start your exciting journey today! ✨

Track GDP, Inflation and Central Bank rates for top African markets with Serrari’s comparator tool.

See today’s Treasury bonds and Money market funds movement across financial service providers in Kenya, using Serrari’s comparator tools.

Photo source: Google

By: Montel Kamau

Serrari Financial Analyst

1st October, 2025

Article, Financial and News Disclaimer

The Value of a Financial Advisor

While this article offers valuable insights, it is essential to recognize that personal finance can be highly complex and unique to each individual. A financial advisor provides professional expertise and personalized guidance to help you make well-informed decisions tailored to your specific circumstances and goals.

Beyond offering knowledge, a financial advisor serves as a trusted partner to help you stay disciplined, avoid common pitfalls, and remain focused on your long-term objectives. Their perspective and experience can complement your own efforts, enhancing your financial well-being and ensuring a more confident approach to managing your finances.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Readers are encouraged to consult a licensed financial advisor to obtain guidance specific to their financial situation.

Article and News Disclaimer

The information provided on www.serrarigroup.com is for general informational purposes only. While we strive to keep the information up to date and accurate, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability with respect to the website or the information, products, services, or related graphics contained on the website for any purpose. Any reliance you place on such information is therefore strictly at your own risk.

www.serrarigroup.com is not responsible for any errors or omissions, or for the results obtained from the use of this information. All information on the website is provided on an as-is basis, with no guarantee of completeness, accuracy, timeliness, or of the results obtained from the use of this information, and without warranty of any kind, express or implied, including but not limited to warranties of performance, merchantability, and fitness for a particular purpose.

In no event will www.serrarigroup.com be liable to you or anyone else for any decision made or action taken in reliance on the information provided on the website or for any consequential, special, or similar damages, even if advised of the possibility of such damages.

The articles, news, and information presented on www.serrarigroup.com reflect the opinions of the respective authors and contributors and do not necessarily represent the views of the website or its management. Any views or opinions expressed are solely those of the individual authors and do not represent the website's views or opinions as a whole.

The content on www.serrarigroup.com may include links to external websites, which are provided for convenience and informational purposes only. We have no control over the nature, content, and availability of those sites. The inclusion of any links does not necessarily imply a recommendation or endorsement of the views expressed within them.

Every effort is made to keep the website up and running smoothly. However, www.serrarigroup.com takes no responsibility for, and will not be liable for, the website being temporarily unavailable due to technical issues beyond our control.

Please note that laws, regulations, and information can change rapidly, and we advise you to conduct further research and seek professional advice when necessary.

By using www.serrarigroup.com, you agree to this disclaimer and its terms. If you do not agree with this disclaimer, please do not use the website.

www.serrarigroup.com, reserves the right to update, modify, or remove any part of this disclaimer without prior notice. It is your responsibility to review this disclaimer periodically for changes.

Serrari Group 2025