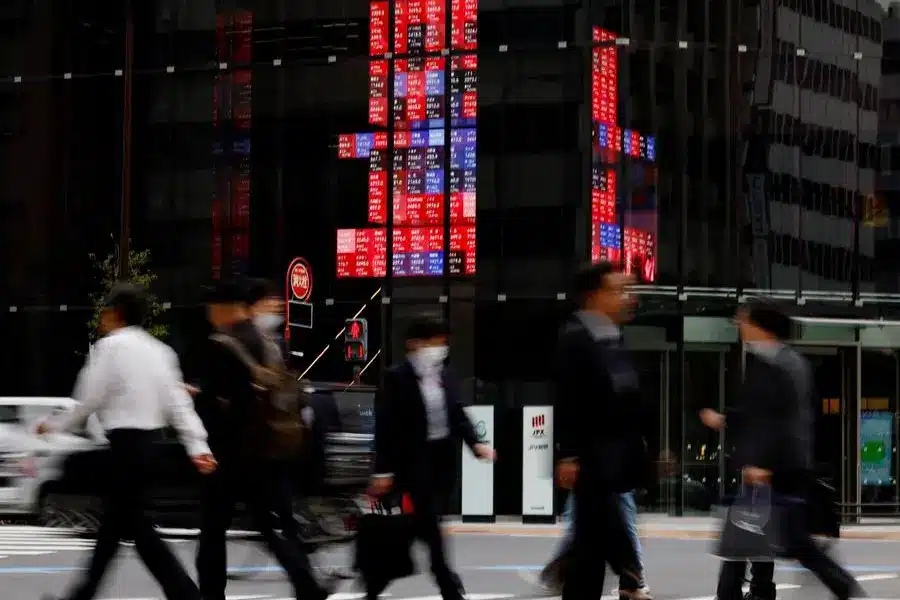

Japan’s government is deliberating a plan to raise the basic income tax threshold, introducing effective permanent tax cuts estimated at $51 billion. This move, a key component of a 39 trillion yen ($253 billion) economic stimulus package, aims to address persistent labor shortages, increase disposable income, and encourage private consumption. However, the proposal has sparked a debate over its potential implications for public finances and economic growth.

The measure marks a departure from the approach of most advanced economies, which have largely phased out pandemic-era stimulus policies. It reflects Japan’s continued struggle to balance economic growth, fiscal discipline, and labor market challenges in the post-pandemic world.

The Proposed Tax Threshold Increase

The ruling coalition’s stimulus plan considers raising the income tax threshold from the current 1.03 million yen ($6,674) annually to a higher level, possibly up to 1.78 million yen ($11,554). This proposal stems from negotiations with the opposition Democratic Party for the People (DPP), whose support is crucial for the coalition’s stability.

The DPP argues that the existing threshold discourages part-time workers and students from increasing their earnings, as surpassing the limit results in the loss of dependent tax benefits for their families. According to the Daiwa Research Institute, approximately 610,000 students deliberately limit their working hours to remain below the threshold.

An increase to 1.78 million yen could:

- Boost labor supply by an estimated 330 million hours annually.

- Add 456 billion yen to workers’ compensation.

- Increase private consumption by 319 billion yen.

Despite these potential benefits, policymakers indicate that a full increase to the 1.78 million yen threshold is unlikely. A smaller adjustment might be more feasible, given fiscal constraints and the broader economic implications.

Economic and Fiscal Implications

Impact on Public Finances

The proposed increase in the tax-free allowance would reduce annual tax revenues by an estimated 7 trillion to 8 trillion yen ($45.36 billion–$51.85 billion), posing a challenge for Japan’s already strained fiscal position.

With public debt exceeding twice the size of its economy—the highest among industrialized nations—Japan faces mounting pressure to maintain fiscal discipline. Analysts warn that such a significant revenue loss could jeopardize the government’s target of achieving a primary budget surplus in the next fiscal year. Saisuke Sakai, senior economist at Mizuho Research and Technologies, described the proposal as:

“Effectively a dole-out policy disguised as a labor issue. Concerns about Japan’s debt could intensify among investors.”

Funding the Stimulus Package

The government plans to allocate 13.9 trillion yen from its general account to mitigate rising household costs as part of the broader stimulus package. To cover this expenditure, Japan may issue approximately 10 trillion yen in new government bonds, according to JPMorgan.

However, the outlook for the fiscal year beginning in April 2025 remains uncertain. If the tax revisions proceed, they could significantly impact tax revenues and complicate budget planning.

Addressing Labor Shortages

Japan’s labor market is under strain due to its aging population and declining birth rates, which have led to a shrinking workforce. Raising the income tax threshold is seen as a strategy to encourage more part-time workers and students to work additional hours without fear of financial penalties.

However, critics point out that other disincentives, such as social security contribution thresholds, also deter part-time workers from increasing their hours. Addressing these barriers comprehensively will be essential to achieving meaningful improvements in labor supply.

Stimulus Package in Context

The 39 trillion yen stimulus package reflects Japan’s ongoing efforts to stimulate economic growth amid global uncertainties and domestic challenges, including rising inflation and slow wage growth. Key components of the package include:

- Subsidies for households to offset rising food and energy prices.

- Support for small and medium-sized enterprises (SMEs).

- Investments in green energy and digital infrastructure.

The Bank of Japan’s (BOJ) gradual shift away from its ultra-loose monetary policy adds another layer of complexity. Higher borrowing costs could constrain the government’s ability to finance large-scale stimulus measures, necessitating careful prioritization of spending.

Comparisons with Global Trends

Japan’s continued reliance on fiscal stimulus contrasts sharply with the approaches of other advanced economies. Countries such as the United States, Germany, and the United Kingdom have largely scaled back pandemic-era support programs, focusing instead on monetary tightening to combat inflation.

Japan’s situation is unique due to its decades-long struggle with deflation and stagnant growth. The government’s willingness to maintain stimulus measures underscores the persistent structural challenges facing the Japanese economy.

Public and Political Reactions

The tax threshold proposal has sparked mixed reactions among policymakers, economists, and the public.

Supporters

Proponents argue that the measure is necessary to:

- Alleviate financial pressure on households.

- Stimulate consumer spending.

- Address labor shortages and support economic growth.

The opposition DPP has championed the proposal as a way to reduce inequality and empower part-time workers and students.

Critics

Critics question the proposal’s long-term sustainability, warning that it could exacerbate Japan’s debt burden and undermine investor confidence. Others argue that the policy may have limited impact on labor supply without broader reforms to address structural barriers in the job market.

Future Outlook

As Japan deliberates the income tax threshold revision, the government faces a delicate balancing act:

- Stimulating Growth vs. Fiscal Discipline

Policymakers must weigh the short-term benefits of increased disposable income and labor supply against the long-term risks of rising debt and fiscal instability. - Comprehensive Labor Market Reforms

Beyond tax policy, addressing Japan’s labor shortages will require a holistic approach, including reforms to social security contributions, investments in automation, and measures to attract more women and foreign workers into the workforce. - Economic Diversification

To sustain growth, Japan must continue to invest in innovation, green energy, and digital transformation, while reducing its reliance on fiscal stimulus.

Conclusion

Japan’s consideration of raising the income tax threshold highlights the complexities of managing economic recovery and fiscal responsibility in a rapidly evolving global landscape. While the proposed measure offers potential benefits for households and labor supply, its broader implications for public finances and investor confidence cannot be overlooked.

As the government navigates these challenges, the success of its strategy will depend on its ability to implement balanced and forward-looking policies that address both immediate needs and long-term sustainability.

Ready to take your career to the next level? Join our dynamic courses: ACCA, HESI A2, ATI TEAS 7 and HESI EXIT !🌟 Dive into a world of opportunities and empower yourself for success. Explore more at Serrari Ed and start your exciting journey today! ✨

photo source: Google

By: Montel Kamau

Serrari Financial Analyst

25th November, 2024

Article, Financial and News Disclaimer

The Value of a Financial Advisor

While this article offers valuable insights, it is essential to recognize that personal finance can be highly complex and unique to each individual. A financial advisor provides professional expertise and personalized guidance to help you make well-informed decisions tailored to your specific circumstances and goals.

Beyond offering knowledge, a financial advisor serves as a trusted partner to help you stay disciplined, avoid common pitfalls, and remain focused on your long-term objectives. Their perspective and experience can complement your own efforts, enhancing your financial well-being and ensuring a more confident approach to managing your finances.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Readers are encouraged to consult a licensed financial advisor to obtain guidance specific to their financial situation.

Article and News Disclaimer

The information provided on www.serrarigroup.com is for general informational purposes only. While we strive to keep the information up to date and accurate, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability with respect to the website or the information, products, services, or related graphics contained on the website for any purpose. Any reliance you place on such information is therefore strictly at your own risk.

www.serrarigroup.com is not responsible for any errors or omissions, or for the results obtained from the use of this information. All information on the website is provided on an as-is basis, with no guarantee of completeness, accuracy, timeliness, or of the results obtained from the use of this information, and without warranty of any kind, express or implied, including but not limited to warranties of performance, merchantability, and fitness for a particular purpose.

In no event will www.serrarigroup.com be liable to you or anyone else for any decision made or action taken in reliance on the information provided on the website or for any consequential, special, or similar damages, even if advised of the possibility of such damages.

The articles, news, and information presented on www.serrarigroup.com reflect the opinions of the respective authors and contributors and do not necessarily represent the views of the website or its management. Any views or opinions expressed are solely those of the individual authors and do not represent the website's views or opinions as a whole.

The content on www.serrarigroup.com may include links to external websites, which are provided for convenience and informational purposes only. We have no control over the nature, content, and availability of those sites. The inclusion of any links does not necessarily imply a recommendation or endorsement of the views expressed within them.

Every effort is made to keep the website up and running smoothly. However, www.serrarigroup.com takes no responsibility for, and will not be liable for, the website being temporarily unavailable due to technical issues beyond our control.

Please note that laws, regulations, and information can change rapidly, and we advise you to conduct further research and seek professional advice when necessary.

By using www.serrarigroup.com, you agree to this disclaimer and its terms. If you do not agree with this disclaimer, please do not use the website.

www.serrarigroup.com, reserves the right to update, modify, or remove any part of this disclaimer without prior notice. It is your responsibility to review this disclaimer periodically for changes.

Serrari Group 2025