Intel Corporation (NASDAQ: INTC) saw a significant boost in its stock price on Monday after a Bloomberg report indicated that Apollo Global Management might make a multibillion-dollar investment in the tech giant. According to the report, Apollo could invest up to $5 billion, giving Intel a much-needed influx of capital as it navigates a competitive and rapidly evolving semiconductor market. The news comes at a time when Intel has been the subject of takeover rumors involving another chip making giant, Qualcomm, sparking both excitement and apprehension in the investment community.

Intel shares rose by more than 3% in early trading Monday, fueled by the Apollo news. This followed a similar 3% spike on Friday, driven by speculation about a possible Qualcomm merger. However, while Intel’s investors cheered the stock’s upward trajectory, Qualcomm shareholders were less enthusiastic. Qualcomm’s stock fell 3% on Friday and another 1.8% on Monday as reports of a potential Intel-Qualcomm merger circulated.

Apollo’s Interest in Intel

Apollo Global Management is no stranger to Intel, having already acquired an $11 billion stake in Intel’s Ireland-based manufacturing facility earlier this year. This ongoing partnership between the private equity firm and Intel indicates a deepening relationship, which could help Intel strengthen its manufacturing capabilities. An additional $5 billion investment from Apollo would not only bolster Intel’s balance sheet but could also be a vote of confidence in Intel’s ability to reclaim its position in the semiconductor space, where it has lagged behind competitors like Nvidia (NVDA) and Advanced Micro Devices (AMD).

Intel’s struggles have been pronounced in recent years. The company’s stock is down nearly 57% since the start of 2024, primarily due to challenges in maintaining a foothold in the burgeoning AI chip market. Nvidia and AMD have dominated this space, securing massive contracts with Big Tech players such as Amazon (AMZN), Google (GOOG), and Microsoft (MSFT), leaving Intel playing catch-up.

One of the key reasons behind Intel’s underperformance is its late entry into the AI race. While its competitors had already secured their positions with cutting-edge AI chips, Intel’s Gaudi AI processor debuted too late to capture major market interest. As noted by Patrick Moorhead, CEO of Moor Insights, the tech giants were already committed to developing their own AI chips by the time Intel entered the fray. This delay has led to a lukewarm reception for Intel’s AI offerings, despite its efforts to make inroads into this critical sector.

Qualcomm Merger: A Double-Edged Sword?

While Apollo’s investment could provide a lifeline to Intel, the rumors of a potential Qualcomm takeover have elicited mixed reactions. Should the deal go through, it would mark the largest tech merger since Microsoft’s $69 billion acquisition of Activision Blizzard in 2023. However, the scale of this potential deal has drawn scrutiny from industry experts and investors alike, particularly concerning antitrust regulations.

In recent years, the tech sector has faced heightened regulatory pressure, with antitrust regulators becoming more aggressive in blocking mergers they believe could stifle competition. Analysts from Stifel voiced concerns about the Qualcomm-Intel deal, likening it to other proposed mega-mergers that failed to gain regulatory approval, such as Nvidia’s attempt to acquire ARM Holdings and Broadcom’s unsuccessful bid for Qualcomm itself.

“Given the recent track record of regulators scrutinizing large tech mergers, it’s unlikely that the Qualcomm-Intel deal would sail through without significant hurdles,” Stifel analysts wrote in a note to investors. The U.S. Federal Trade Commission (FTC) and the European Commission have both shown a heightened willingness to intervene in large acquisitions, particularly when they involve companies with dominant market positions in critical industries like semiconductors.

Despite these challenges, Intel’s potential merger with Qualcomm is seen by some analysts as a way for Intel to reclaim its standing in the chipmaking world. Qualcomm has been a formidable player in mobile and wireless technologies, and a merger could create synergies that might enable the combined entity to challenge the dominance of Nvidia and AMD in AI chips. However, even if the merger were to clear regulatory hurdles, some experts argue that it might not be the right move for Intel.

Citi analysts, for example, have suggested that Intel should focus on its core strengths rather than trying to expand into new areas like foundry services, where it faces stiff competition. “We continue to believe Intel should exit the foundry business in the best interest of shareholders, as the company has a very small chance of becoming a profitable leading-edge foundry,” Citi analysts wrote.

The Foundry Dilemma

Intel’s foundry business, which manufactures chips for other companies, has been a point of contention for some time. Despite CEO Pat Gelsinger’s ambitious plans to transform Intel into a world-class foundry player, the division has struggled to gain traction. Critics argue that Intel’s foundry operations are far behind those of Taiwan Semiconductor Manufacturing Company (TSMC) and Samsung, both of which dominate the global foundry market.

Gelsinger, however, remains optimistic about Intel’s future. Last week, Intel announced an expanded multibillion-dollar partnership with Amazon Web Services (AWS), along with securing $3 billion in funding from the U.S. government under the CHIPS Act. These developments are part of Intel’s broader strategy to pivot towards the high-margin foundry business, with Gelsinger touting the company’s progress during a public announcement.

“This news, combined with our AWS announcement, demonstrates the continued progress we are making to build a world-class foundry business,” Gelsinger said. The CHIPS Act funding is intended to boost domestic semiconductor manufacturing and reduce reliance on foreign suppliers, a move that aligns with Intel’s strategic goals.

However, the success of Intel’s foundry business is far from guaranteed. Competitors like TSMC have a well-established lead in manufacturing advanced chips, and it remains to be seen whether Intel can catch up. Some analysts, like Bernstein’s Stacy Rasgon, remain skeptical of Intel’s ability to compete effectively in this arena. Rasgon told Yahoo Finance on Monday that the Qualcomm deal, even if successful, would come with significant risks. “It’s hard to do a deal where I think the risk would justify the returns,” Rasgon noted.

What’s Next for Intel?

With Apollo’s potential $5 billion investment and the ongoing Qualcomm merger rumors, Intel finds itself at a critical crossroads. The company has struggled to keep up with the pace of innovation in the AI chip market, while its competitors have surged ahead. At the same time, regulatory scrutiny could derail any potential merger with Qualcomm, leaving Intel to chart a path forward independently.

Despite these uncertainties, Intel is not without options. The company’s expanded partnership with AWS, combined with U.S. government support through the CHIPS Act, could provide the momentum it needs to turn things around. However, Intel’s ability to regain its competitive edge will largely depend on its ability to execute on its foundry strategy and develop AI chips that can rival those of Nvidia and AMD.

For now, Intel’s stock price boost is a welcome reprieve for investors who have seen the company struggle throughout 2024. But whether this marks the beginning of a true turnaround for the tech giant remains to be seen.

As the semiconductor industry continues to evolve rapidly, Intel’s future will be shaped by its ability to adapt to new market realities, secure key partnerships, and navigate the complex regulatory landscape. With Apollo and Qualcomm in the mix, the next few months will be crucial for Intel’s long-term trajectory in the highly competitive world of chipmaking.

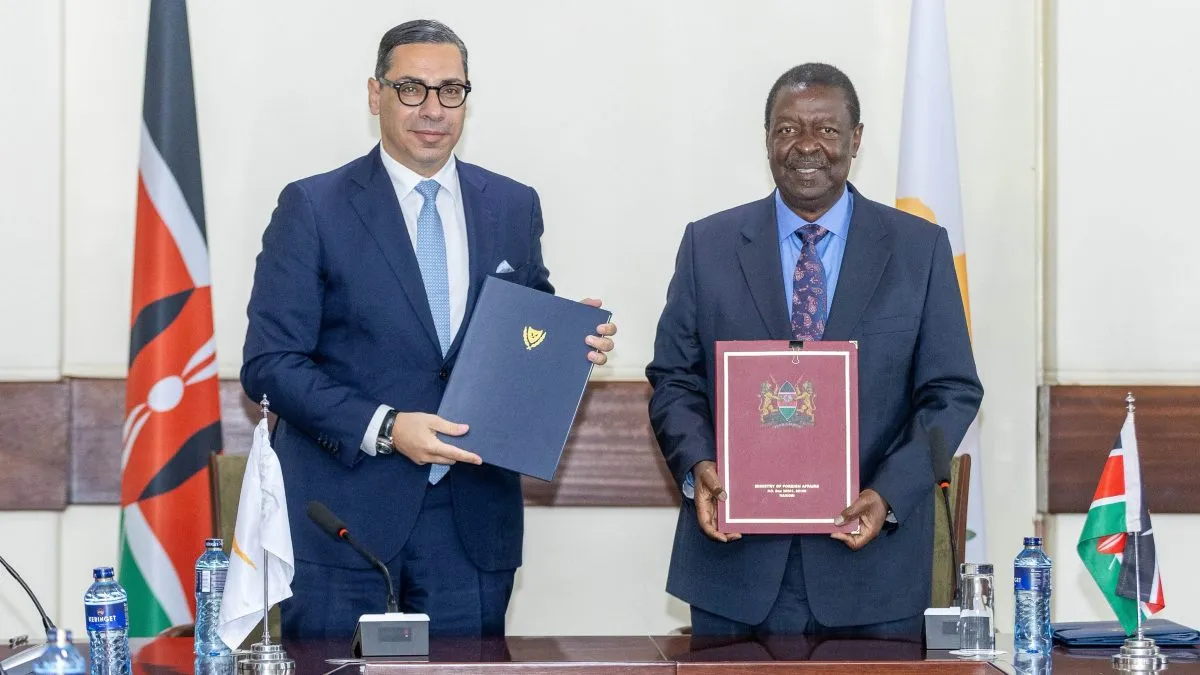

photo source: Google

By: Montel Kamau

Serrari Financial Analyst

24th September, 2024

Article, Financial and News Disclaimer

The Value of a Financial Advisor

While this article offers valuable insights, it is essential to recognize that personal finance can be highly complex and unique to each individual. A financial advisor provides professional expertise and personalized guidance to help you make well-informed decisions tailored to your specific circumstances and goals.

Beyond offering knowledge, a financial advisor serves as a trusted partner to help you stay disciplined, avoid common pitfalls, and remain focused on your long-term objectives. Their perspective and experience can complement your own efforts, enhancing your financial well-being and ensuring a more confident approach to managing your finances.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Readers are encouraged to consult a licensed financial advisor to obtain guidance specific to their financial situation.

Article and News Disclaimer

The information provided on www.serrarigroup.com is for general informational purposes only. While we strive to keep the information up to date and accurate, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability with respect to the website or the information, products, services, or related graphics contained on the website for any purpose. Any reliance you place on such information is therefore strictly at your own risk.

www.serrarigroup.com is not responsible for any errors or omissions, or for the results obtained from the use of this information. All information on the website is provided on an as-is basis, with no guarantee of completeness, accuracy, timeliness, or of the results obtained from the use of this information, and without warranty of any kind, express or implied, including but not limited to warranties of performance, merchantability, and fitness for a particular purpose.

In no event will www.serrarigroup.com be liable to you or anyone else for any decision made or action taken in reliance on the information provided on the website or for any consequential, special, or similar damages, even if advised of the possibility of such damages.

The articles, news, and information presented on www.serrarigroup.com reflect the opinions of the respective authors and contributors and do not necessarily represent the views of the website or its management. Any views or opinions expressed are solely those of the individual authors and do not represent the website's views or opinions as a whole.

The content on www.serrarigroup.com may include links to external websites, which are provided for convenience and informational purposes only. We have no control over the nature, content, and availability of those sites. The inclusion of any links does not necessarily imply a recommendation or endorsement of the views expressed within them.

Every effort is made to keep the website up and running smoothly. However, www.serrarigroup.com takes no responsibility for, and will not be liable for, the website being temporarily unavailable due to technical issues beyond our control.

Please note that laws, regulations, and information can change rapidly, and we advise you to conduct further research and seek professional advice when necessary.

By using www.serrarigroup.com, you agree to this disclaimer and its terms. If you do not agree with this disclaimer, please do not use the website.

www.serrarigroup.com, reserves the right to update, modify, or remove any part of this disclaimer without prior notice. It is your responsibility to review this disclaimer periodically for changes.

Serrari Group 2025