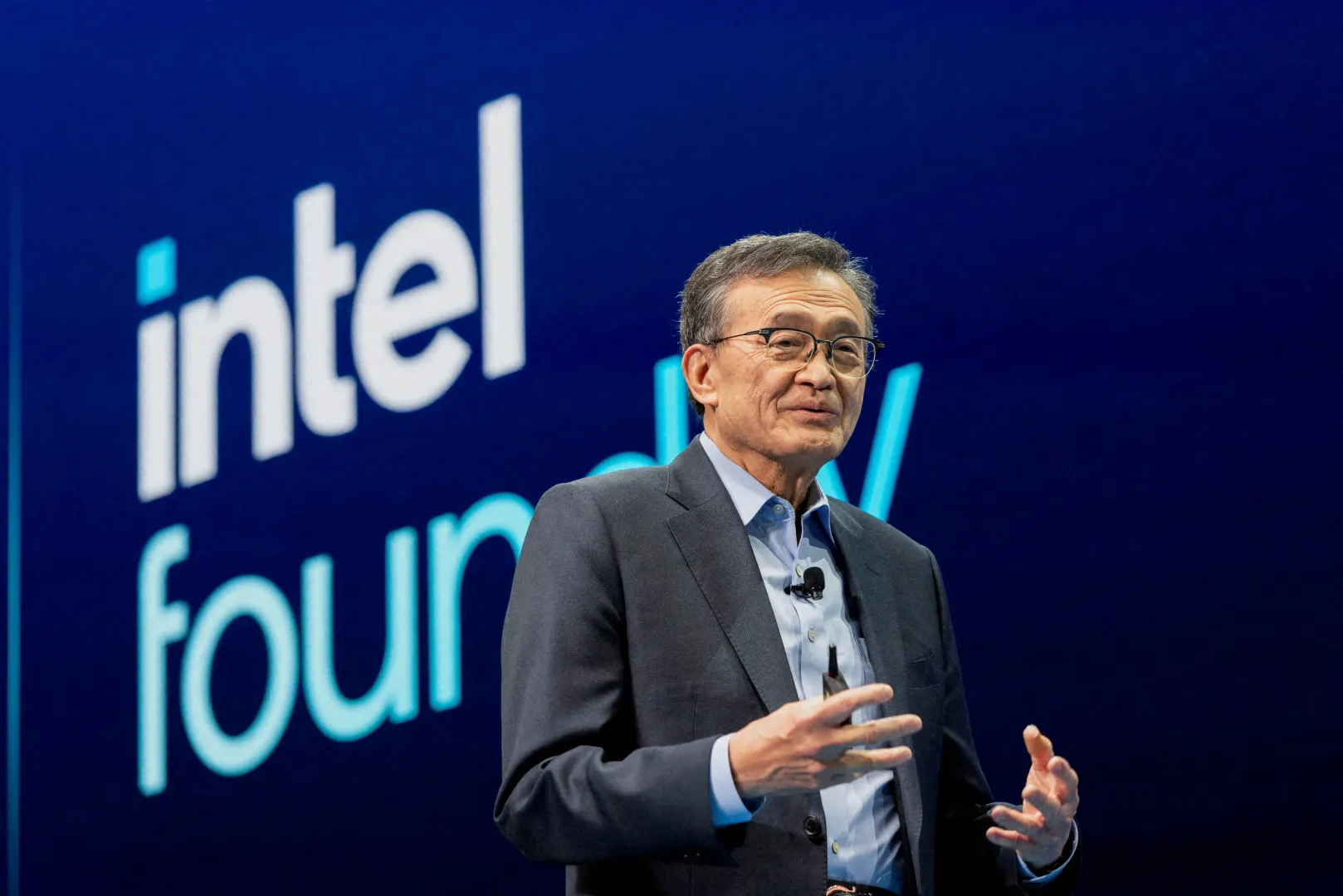

Intel Corporation’s chief executive Lip-Bu Tan made a significant homecoming to Malaysia on December 1, meeting with Prime Minister Datuk Seri Anwar Ibrahim and Minister of Digital Gobind Singh Deo as the American chipmaker announced an additional RM860 million (US$208 million) investment to strengthen its assembly and testing operations in the Southeast Asian nation. The announcement marks another chapter in what has become one of the semiconductor industry’s most enduring international partnerships, spanning more than half a century.

The Malaysian-born executive’s visit carries particular significance as Intel deepens its commitment to the country where it established its first international manufacturing facility in 1972, transforming a muddy paddy field in Penang into what would eventually become one of the company’s most critical global operations. Anwar announced the fresh investment following his meeting with Tan, emphasizing that it reflects confidence in Malaysia’s long-term industrial planning, particularly the New Industrial Master Plan 2030.

Build the future you deserve. Get started with our top-tier Online courses: ACCA, HESI A2, ATI TEAS 7, HESI EXIT, NCLEX-RN, NCLEX-PN, and Financial Literacy. Let Serrari Ed guide your path to success. Enroll today.

A Personal Dimension to Strategic Partnership

Tan’s appointment as Intel’s chief executive in March 2025 brought a personal dimension to the company’s longstanding relationship with Malaysia. Born in Muar, Johor, in 1959, Tan brings decades of semiconductor industry experience, having previously served as CEO of Cadence Design Systems from 2009 to 2021, where he led a transformation that doubled the company’s revenue and delivered extraordinary shareholder returns. His Malaysian heritage resonates deeply in a country where Intel has been a cornerstone employer and industrial partner since the early 1970s.

In a separate courtesy call, Tan and senior members of Intel’s leadership team met with Gobind to discuss semiconductor advancement, AI development, and talent growth—areas the Digital Minister described as crucial to Malaysia’s aspirations as the country looks toward 2026. The discussions reflected Intel’s evolving vision for Malaysia as more than just a traditional assembly hub, potentially envisioning expanded roles in supporting AI workloads and applications as these technologies become increasingly central to the semiconductor industry’s future.

“Since 1972, Intel has played a pivotal role in Malaysia’s social and economic development through its contributions to high-tech manufacturing, design and development, global services, and community impact,” Gobind stated in a LinkedIn post following the meeting. “They remain a key partner in Malaysia’s digitalization journey.”

Advanced Packaging Facility Approaches Completion

The new investment comes as Intel’s advanced packaging facility in Penang approaches a major milestone. Anwar revealed that the RM12 billion facility is now 99% complete, representing one of Intel’s most substantial investments in Southeast Asia. The facility, part of a broader US$7 billion expansion announced in 2021, positions Malaysia at the forefront of advanced packaging technology—a critical capability as the semiconductor industry moves beyond traditional chip manufacturing to sophisticated three-dimensional packaging solutions.

“Intel also expressed its appreciation for the continuous support of the Malaysian government, particularly for the development of the advanced packaging facility in Penang,” Anwar stated in a post on X. The Penang facility will serve as Intel’s first overseas facility for advanced 3D chip packaging, utilizing the company’s Foveros technology, with Malaysia eventually becoming Intel’s largest production base for this critical technology.

Advanced packaging has become increasingly important as chipmakers seek to improve performance and efficiency while managing the physical limitations of continuing Moore’s Law. The technology allows multiple chiplets to be integrated into a single package, offering enhanced performance and capabilities that would be difficult or impossible to achieve with traditional monolithic chip designs.

Strategic Context: Geopolitical Realignment and Regional Manufacturing

The timing of Tan’s visit and Intel’s investment announcement carries particular significance given the broader context of US export restrictions on advanced semiconductor technology to China, which have prompted chipmakers to recalibrate their regional strategies. While Intel’s Malaysian operations focus on assembly and testing rather than advanced manufacturing subject to the most stringent controls, the company’s increased investment signals a strategic bet on Southeast Asia’s growing role in the global semiconductor ecosystem.

The semiconductor export controls implemented since 2022 have reshaped global supply chains, creating incentives for companies to diversify their manufacturing footprint across multiple regions. Malaysia’s established infrastructure, skilled workforce, and supportive government policies position it as an increasingly attractive destination for companies seeking to reduce concentration risk while maintaining access to high-quality manufacturing capabilities.

The geopolitical dynamics have accelerated what was already a trend toward supply chain diversification, with companies seeking to balance efficiency with resilience. Malaysia’s neutral stance in global trade tensions, combined with its mature semiconductor ecosystem, makes it particularly well-positioned to benefit from this recalibration.

Five Decades of Industrial Evolution

Intel’s Malaysian presence spans over five decades, during which the company has established itself as an integral part of the country’s manufacturing ecosystem. The company’s first production facility outside the United States was established in Penang in 1972 with an initial investment of US$1.6 million and a workforce of just 100 employees clad in batik. Today, Intel employs over 15,000 people across its Penang and Kulim campuses, making it one of the company’s largest sites outside the United States.

The journey from that modest beginning to today’s sophisticated operations has not been without challenges. In May 1975, a fire destroyed the original A1 plant in Penang, with only the cafeteria left standing. The recovery effort that followed would become legendary within Intel’s corporate culture. The company kept paying its Malaysian workers throughout the crisis and worked around the clock to resume operations, an effort that strengthened both the facility’s capabilities and Intel’s commitment to its Malaysian workforce.

Intel’s operations in Malaysia encompass high-tech manufacturing, design and development, and global services delivery. The company has invested over US$5 billion in its Malaysian facilities since 1972, creating a comprehensive ecosystem that extends far beyond basic assembly operations. The facilities in Penang and Kulim play crucial roles in Intel’s global manufacturing network, with all wafers produced at Intel’s fabs around the world eventually making their way to Malaysia for assembly, testing, and advanced packaging.

One decision can change your entire career. Take that step with our Online courses in ACCA, HESI A2, ATI TEAS 7, HESI EXIT, NCLEX-RN, NCLEX-PN, and Financial Literacy. Join Serrari Ed and start building your brighter future today.

Investing in Human Capital and Local Innovation

Intel’s Malaysian expansion extends beyond physical infrastructure to encompass significant investments in human capital development. The company has committed RM2.8 million over the past two years to collaborate with education and training institutions through elective subjects and research and development projects. This approach aligns with Malaysia’s broader strategy to position itself not merely as a manufacturing destination but as a comprehensive technology ecosystem capable of supporting innovation across the semiconductor value chain.

The focus on talent development reflects an understanding that sustainable competitive advantage in the semiconductor industry requires more than just physical infrastructure. Intel has been instrumental in developing Malaysia’s technical workforce, working closely with the Penang Skills Development Centre and other institutions to ensure a steady pipeline of skilled workers capable of operating and maintaining increasingly sophisticated manufacturing equipment.

“All these investments reflect the confidence of a global company in Malaysia as a key partner in driving innovation, strengthening the local talent ecosystem, and maintaining the nation’s competitiveness on the world stage,” Anwar noted. The human capital investments are particularly significant given the semiconductor industry’s ongoing talent shortage, with companies globally competing for skilled engineers and technicians capable of working with advanced manufacturing technologies.

Malaysia’s New Industrial Master Plan 2030

The fresh investment comes as Malaysia implements its New Industrial Master Plan 2030, unveiled in September 2023 as a strategic blueprint to enhance the nation’s industrial sector with a specific focus on digital and information and communication technology industries. The plan adopts a mission-based approach with four key missions: advancing economic complexity, accelerating digitalization, pushing for net zero emissions, and safeguarding economic security and inclusivity.

The NIMP 2030 aims to boost the manufacturing sector’s GDP contribution by 6.5% annually, potentially translating into a substantial RM587.5 billion contribution to Malaysia’s total GDP by 2030. The plan specifically targets the electrical and electronics sector, including IC design and wafer fabrication activities, as key areas for high-value investment and development.

Intel’s investment announcement aligns perfectly with the NIMP 2030’s objectives, particularly its focus on attracting and facilitating investment in targeted high-value activities and integrating value chains to stimulate cross-sectoral innovation. The plan recognizes that Malaysia’s existing strengths in semiconductor assembly and testing provide a foundation for moving up the value chain into more sophisticated operations like advanced packaging and design.

Government Support as Competitive Advantage

The Malaysian government’s proactive support has emerged as a key differentiator in attracting semiconductor investments. Gobind emphasized the Ministry’s readiness to work alongside Intel to explore new opportunities and strengthen Malaysia’s position in the global technology landscape. “The Ministry stands ready to work alongside Intel to explore new opportunities and strengthen our position in the global technology landscape,” he said. “We look forward to continuing this partnership and unlocking greater shared value in the years ahead.”

This government support manifests in multiple forms, from infrastructure development and tax incentives to facilitation of permits and licenses for expansion projects. The Malaysian Investment Development Authority (MIDA) has adopted an “ecosystem approach” to investment promotion, continuously mapping and analyzing the semiconductor ecosystem to identify gaps and opportunities for strategic investments.

The government’s commitment extends to workforce development as well, with initiatives to upskill and reskill the current workforce to meet the demands of Industry 4.0. The emphasis on creating a comprehensive support ecosystem—rather than simply offering tax breaks—reflects a sophisticated understanding of what modern semiconductor manufacturers need to succeed.

Malaysia’s Semiconductor Ecosystem: From Assembly to Innovation

Malaysia’s semiconductor journey has evolved significantly since Intel first arrived in 1972. The country now accounts for 13% of the global chip testing and packaging market and ranks as the world’s seventh-largest exporter of semiconductors. The industry employs over half a million people in the electrical and electronics sector, working with global chipmakers including STMicroelectronics, Infineon Technologies, and Renesas Electronics.

The ecosystem includes three main groups: outsourced semiconductor assembly and testing (OSAT) providers, automated test equipment suppliers, and designers and manufacturers of high-performance test sockets. This comprehensive ecosystem provides the supporting infrastructure that makes Malaysia attractive for major investments like Intel’s advanced packaging facility. Companies can find local suppliers for specialized equipment and services, reducing supply chain complexity and logistics costs.

Recent announcements by other major players underscore Malaysia’s growing importance in the global semiconductor landscape. Taiwan-based Foxconn has announced plans to build a 300-mm wafer fab in Malaysia, operating on 28-nm to 40-nm process nodes with capacity to produce 40,000 wafers per month. These additional investments create network effects, strengthening the overall ecosystem and making Malaysia even more attractive for future semiconductor investments.

Regional Implications and Competitive Dynamics

The strengthened Intel-Malaysia partnership carries implications beyond bilateral relations, potentially influencing how other semiconductor companies view Southeast Asia’s role in their supply chain strategies. As companies seek to diversify operations amid ongoing geopolitical uncertainties, Malaysia’s combination of established infrastructure, skilled workforce, and supportive government policies positions it as an increasingly attractive destination.

However, Malaysia faces competition from other Southeast Asian nations also seeking to attract semiconductor investments. Vietnam has emerged as another significant manufacturing hub, with Intel operating major facilities there as well. Thailand and the Philippines also compete for semiconductor investments, each offering different advantages in terms of labor costs, infrastructure, and government incentives.

The focus on AI development in the discussions between Tan and Gobind suggests Intel sees Malaysia as more than just a traditional assembly hub. The company potentially envisions expanded roles in supporting AI workloads and applications as the technology becomes increasingly central to the semiconductor industry’s future. This vision aligns with Malaysia’s aspirations under the NIMP 2030 to establish itself as a generative AI hub and transform 3,000 factories into smart factories by 2030.

Looking Forward: Challenges and Opportunities

As the global semiconductor industry continues navigating complex geopolitical dynamics while pursuing technological advancement, Intel’s deepening commitment to Malaysia—now led by a Malaysian-born CEO—demonstrates how strategic partnerships between governments and industry can create mutual value in an increasingly fragmented global landscape.

The semiconductor industry faces numerous challenges ahead, from managing supply chain complexity and talent shortages to navigating trade restrictions and meeting growing demand for computing power. Malaysia’s success in attracting and retaining major semiconductor investments will depend on its ability to continue upgrading its capabilities, developing its workforce, and maintaining a business-friendly environment that supports innovation.

Intel’s expanded investment in Malaysia represents a vote of confidence not just in the country’s current capabilities but in its potential for future growth and development. The nearly complete advanced packaging facility in Penang will give Intel significant new capabilities in one of the most critical and rapidly evolving areas of semiconductor manufacturing. As chips become increasingly complex and multi-layered, advanced packaging becomes essential for achieving the performance levels demanded by AI, high-performance computing, and other cutting-edge applications.

For Malaysia, Intel’s continued investment validates the government’s industrial strategy and provides a foundation for further development of the semiconductor ecosystem. The challenge now lies in leveraging this anchor investment to attract complementary investments in areas like chip design, materials science, and specialized manufacturing equipment. Success in these efforts could transform Malaysia from a primarily assembly and testing hub into a more comprehensive semiconductor ecosystem spanning the full value chain.

The presence of a Malaysian-born CEO at the helm of one of the world’s largest semiconductor companies also carries symbolic significance, demonstrating the global impact of Malaysia’s technical talent and the potential for deeper collaboration between Intel and Malaysian institutions. Tan’s leadership brings both his extensive industry expertise and his personal connection to the country, potentially opening doors for even deeper engagement in areas like research and development, advanced technology deployment, and workforce development.

As Intel continues its ambitious expansion plans globally, including major investments in the United States and Europe under various government incentive programs, Malaysia’s role as a key manufacturing and assembly hub appears secure. The company’s RM860 million investment, while modest compared to the RM12 billion advanced packaging facility, signals ongoing commitment to expanding capabilities and capacity to meet growing global demand for semiconductors.

The semiconductor industry’s importance to global economic competitiveness and national security ensures that investments like Intel’s in Malaysia will continue to receive significant attention from policymakers and industry observers alike. As companies navigate an increasingly complex geopolitical environment while trying to meet surging demand for computing power, Malaysia’s neutral stance, mature ecosystem, and supportive policies position it well for continued success in attracting and retaining strategic semiconductor investments.

Catch Up With Our Other Headlines

2nd December, 2025

Mastercard and AXIAN Launch Integrated Financial Ecosystem Across Five African Nations

India’s GDP Growth Hits 8.2% as Private Sector Takes the Wheel

ASX Downturn: Technology Outage and $5 Billion Takeover Collapse Fuel Market Uncertainty

Africa’s Top Economists Convene to Forge a New Path for Sustainable and Inclusive Growth

Superior Homes Launches ‘The Orchards’ as Northlands City’s Premier Residential Anchor

Kenya Ranked Africa’s Most Competitive Economy in IMD 2025 Index

Ready to take your career to the next level? Join our Online courses: ACCA, HESI A2, ATI TEAS 7 , HESI EXIT , NCLEX – RN and NCLEX – PN, Financial Literacy!🌟 Dive into a world of opportunities and empower yourself for success. Explore more at Serrari Ed and start your exciting journey today! ✨

Track GDP, Inflation and Central Bank rates for top African markets with Serrari’s comparator tool.

See today’s Treasury bonds and Money market funds movement across financial service providers in Kenya, using Serrari’s comparator tools.

photo source: Google

By: Montel Kamau

Serrari Financial Analyst

2nd December, 2025

Article, Financial and News Disclaimer

The Value of a Financial Advisor

While this article offers valuable insights, it is essential to recognize that personal finance can be highly complex and unique to each individual. A financial advisor provides professional expertise and personalized guidance to help you make well-informed decisions tailored to your specific circumstances and goals.

Beyond offering knowledge, a financial advisor serves as a trusted partner to help you stay disciplined, avoid common pitfalls, and remain focused on your long-term objectives. Their perspective and experience can complement your own efforts, enhancing your financial well-being and ensuring a more confident approach to managing your finances.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Readers are encouraged to consult a licensed financial advisor to obtain guidance specific to their financial situation.

Article and News Disclaimer

The information provided on www.serrarigroup.com is for general informational purposes only. While we strive to keep the information up to date and accurate, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability with respect to the website or the information, products, services, or related graphics contained on the website for any purpose. Any reliance you place on such information is therefore strictly at your own risk.

www.serrarigroup.com is not responsible for any errors or omissions, or for the results obtained from the use of this information. All information on the website is provided on an as-is basis, with no guarantee of completeness, accuracy, timeliness, or of the results obtained from the use of this information, and without warranty of any kind, express or implied, including but not limited to warranties of performance, merchantability, and fitness for a particular purpose.

In no event will www.serrarigroup.com be liable to you or anyone else for any decision made or action taken in reliance on the information provided on the website or for any consequential, special, or similar damages, even if advised of the possibility of such damages.

The articles, news, and information presented on www.serrarigroup.com reflect the opinions of the respective authors and contributors and do not necessarily represent the views of the website or its management. Any views or opinions expressed are solely those of the individual authors and do not represent the website's views or opinions as a whole.

The content on www.serrarigroup.com may include links to external websites, which are provided for convenience and informational purposes only. We have no control over the nature, content, and availability of those sites. The inclusion of any links does not necessarily imply a recommendation or endorsement of the views expressed within them.

Every effort is made to keep the website up and running smoothly. However, www.serrarigroup.com takes no responsibility for, and will not be liable for, the website being temporarily unavailable due to technical issues beyond our control.

Please note that laws, regulations, and information can change rapidly, and we advise you to conduct further research and seek professional advice when necessary.

By using www.serrarigroup.com, you agree to this disclaimer and its terms. If you do not agree with this disclaimer, please do not use the website.

www.serrarigroup.com, reserves the right to update, modify, or remove any part of this disclaimer without prior notice. It is your responsibility to review this disclaimer periodically for changes.

Serrari Group 2025