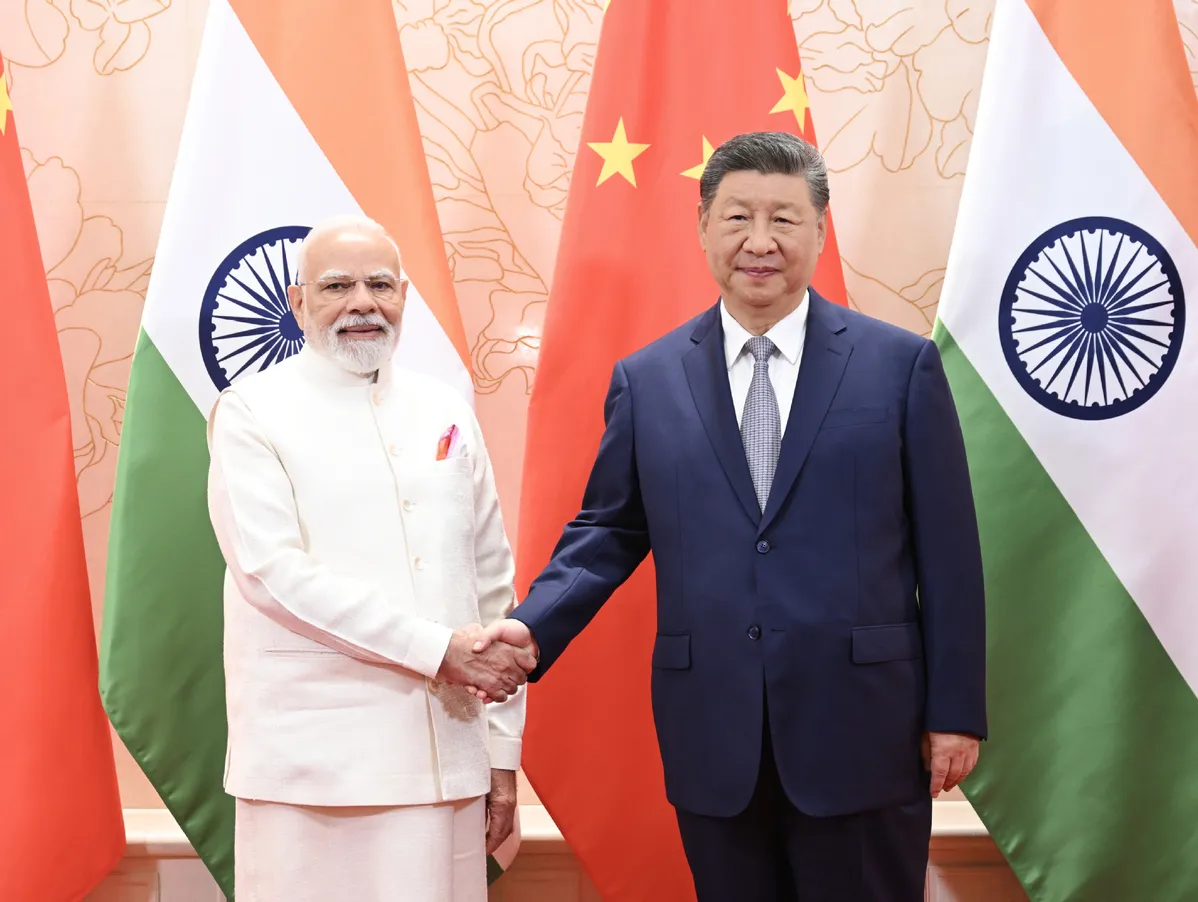

The plan to restart India-China direct flights was announced by PM Modi after he met Chinese President Xi Jinping on the sidelines of the SCO Summit in Tianjin.

India and China are set to resume direct flights for the first time since the pandemic, in signs of a thaw in relations amid rising global trade uncertainties and mounting economic pressure from US tariff policies that have forced both Asian giants to seek stronger bilateral cooperation.

Push boundaries, reach goals, achieve more. Whether it’s ACCA, HESI A2, ATI TEAS 7, HESI EXIT, NCLEX-RN, NCLEX-PN, or Financial Literacy, we’ve got the Online course to match your ambition. Start with Serrari Ed now.

Historic Diplomatic Breakthrough at SCO Summit

India-China ties are on an upswing at a time when US tariffs have added to economic uncertainties in the world’s two most populous nations. The landmark announcement was made by Prime Minister Narendra Modi as he met Chinese President Xi Jinping on the sidelines of the Shanghai Cooperation Organisation summit in Tianjin on Sunday, marking his first visit to China in seven years.

The meeting comes at a crucial juncture as both countries face increased economic pressure from Washington. US President Donald Trump’s decision to impose punitive 50% tariffs on Indian goods over New Delhi’s continuing purchase of Russian oil has accelerated India’s diplomatic outreach to Beijing and other Eurasian partners.

During the bilateral meeting, PM Modi emphasized the broader significance of India-China cooperation, stating: “The interests of 2.8 billion people of both countries are linked to our cooperation. This will also pave the way for the welfare of humanity. We are committed to taking our relations forward based on mutual trust, respect and sensitivity.”

Aviation Industry Transformation Since 2020

The resumption of direct flights represents a significant milestone in post-pandemic aviation recovery and bilateral diplomatic normalization. Direct passenger flights between India and China were suspended after the pandemic in early 2020, and the connection never resumed after diplomatic relations hit a low point following border clashes at Galwan Valley.

Before the suspension, the aviation sector between the two countries was robust and growing. Chinese carriers dominated with a 70% market share, while Indian operators Air India and IndiGo held 30%. Chinese carriers operated 42 direct flights every week, including Air China flying from Beijing to Mumbai four times a week and five times to Delhi.

The scale of pre-pandemic connectivity was substantial: China Southern Airlines operated twice daily service to Guangzhou from Delhi, China Eastern Airlines operated eight flights a week including a daily Delhi-Shanghai flight, and Shandong Airlines flew four times a week to Delhi from Kunming. Among Indian carriers, Air India flew to Shanghai five times a week from New Delhi, while IndiGo operated daily flights between Chengdu-Delhi and Guangzhou-Kolkata.

Airlines Ready for Immediate Resumption

India’s aviation landscape has undergone dramatic transformation since the last Air China flight landed in Delhi in January 2020. IndiGo, which had around 250 planes at the end of December 2019, now operates 400 aircraft. Air India has transitioned from government ownership to become a Tata Group company, while new players like Akasa Air have entered the market.

IndiGo CEO Pieter Elbers has confirmed the airline’s readiness to restart flights between the two countries once services are cleared, expressing confidence that IndiGo is fully prepared to resume operations. The carrier had previously announced a Mumbai-Chengdu daily flight from mid-March 2020, but that never materialized due to the pandemic.

Air India, now under Tata ownership, is expected to resume flying these routes as well, potentially competing more aggressively for Chinese market share than during its government-owned era. The resumption will also see renewed competition with Chinese carriers including Air China, China Southern, and China Eastern, which previously operated extensive networks connecting major cities of both countries.

Economic Imperatives Drive Diplomatic Reset

The flight resumption is part of a broader diplomatic and economic reset between the world’s two largest developing economies. In August, India and China agreed to facilitate bilateral trade and investments, while in July, India allowed tourist visas for Chinese nationals after years of curbs.

This warming of ties comes against the backdrop of challenging relations with Washington. The ongoing thaw in India-China relations accelerated after Trump imposed additional 25% tariffs on Indian imports, raising the overall tariff burden to 50% – the highest in Asia. These economic pressures have pushed both Delhi and Beijing toward greater cooperation despite longstanding strategic differences.

Chinese Foreign Minister Wang Yi’s recent visit to New Delhi resulted in tangible outcomes, with China agreeing to resume the supply of critical commodities to India, including fertilizers, rare earth minerals, and tunnel boring machines – all essential for India’s agriculture and infrastructure sectors.

Massive Trade Potential and Current Imbalances

The economic stakes of improved India-China relations are enormous. China is India’s largest trading partner, with bilateral trade crossing $136.2 billion in 2023-24, though this relationship remains heavily skewed in China’s favor.

India faces its largest trade deficit with any single country in its relationship with China. India’s trade deficit with China reached $99.2 billion for the year ended March 2025, up from about $85 billion the previous year, with total imports from Beijing touching an all-time high of $113.45 billion.

China remains a vital supplier of industrial goods to India, particularly in electronics, machinery, and chemicals. Several key Indian industries show heavy dependence on Chinese imports: for chemical-based active pharmaceutical ingredients, China supplies 70% of India’s requirements, while for biosimilar APIs it supplies almost 90%. China is also India’s key supplier of electronics, electricals, and machinery.

Before the 2020 suspension, bilateral air traffic was significant, with 816,000 passengers in FY 2019 and 770,000 passengers in FY 2020. By comparison, India-US passenger traffic was approximately 1.1 million in FY 2020, indicating substantial pent-up demand for resumed India-China connectivity.

Build the future you deserve. Get started with our top-tier Online courses: ACCA, HESI A2, ATI TEAS 7, HESI EXIT, NCLEX-RN, NCLEX-PN, and Financial Literacy. Let Serrari Ed guide your path to success. Enroll today.

Border Resolution Paves Way for Normalization

The announcement of flight resumption follows significant progress on the contentious border issue that has dominated India-China relations for decades. PM Modi confirmed that Indian and Chinese special representatives had reached an understanding on managing border tensions.

“After the disengagement on the border, an atmosphere of peace and stability has been created,” Modi said, referring to the October 2024 agreement on patrolling arrangements along the Line of Actual Control (LAC) that led to disengagement and resolution of the conflict that began with the deadly 2020 Galwan Valley clashes.

The border progress has enabled people-centric initiatives beyond aviation. PM Modi announced the resumption of the Kailash Mansarovar Yatra, the pilgrimage route to Mount Kailash in Tibet that had been suspended for five years. Both governments have also pledged to restart border trade at three designated trading points and resume issuing visas.

Strategic Context: SCO as Alternative Framework

Modi’s participation in the SCO Summit represents India’s renewed engagement with multilateral frameworks that offer alternatives to Western-dominated institutions. The Shanghai Cooperation Organisation brings together China, India, Iran, Pakistan, and Russia – countries that collectively govern 40% of the global population and preside over vast energy reserves.

India had previously maintained some distance from the SCO, with Modi skipping last year’s summit and opting for virtual participation during India’s 2022-2023 presidency. However, the deterioration in India-US relations has prompted New Delhi to rediscover the utility of alternative multilateral frameworks.

The SCO meeting provided an opportunity for broader regional engagement, with delegations from 16 official partner and observer countries including Cambodia, Egypt, Saudi Arabia, UAE, Bahrain, Qatar, Kuwait, and NATO member Turkey. This broad participation demonstrates the organization’s growing influence as a platform for Global South cooperation.

Technology Transfer and Investment Challenges

Despite the diplomatic progress, significant challenges remain in the technology and investment spheres. China’s recent restrictions on high-tech manufacturing have already demonstrated potential disruptions for Indian industries. In July 2025, China reportedly recalled over 300 engineers from Foxconn’s iPhone plant in India, highlighting Beijing’s ability to restrict technology transfer.

India has responded by partnering with Taiwan, the US, South Korea, and Japan to secure engineers and critical manufacturing equipment, demonstrating its strategy of diversifying technology partnerships while engaging with China on trade and diplomatic fronts.

The investment relationship remains modest relative to the countries’ economic size. According to China’s Ministry of Commerce, Chinese investments to India in 2023 totaled only $60.37 million, with cumulative investments reaching $3.2 billion since 2015. India’s cumulative FDI into China through March 2025 was $2.5 billion since April 2000.

Aviation Market Dynamics and Competition

The resumption of flights will unfold in a dramatically changed aviation landscape. Aviation experts note that Chinese carriers traditionally held advantages through air services agreements linked to weekly frequencies, giving them a head start in market re-entry.

However, Indian carriers have strengthened significantly since 2020. IndiGo’s expansion to 400 aircraft and Air India’s privatization under Tata ownership position them to compete more effectively for market share. The emergence of new players like Akasa Air adds another dimension to the competitive landscape.

Aviation analyst Ameya Joshi notes that “India-China flight resumption has been long overdue and irrespective of the hostilities, trade has been going on over the years. The direct flights will help traders and airlines alike, with traders currently traveling via third country and airlines able to cater to this traffic.”

Currently, travelers between India and China must use hub connections through Hong Kong, Singapore, or other regional airports, adding time and cost to business and leisure travel. The resumption of direct services is expected to benefit not just aviation companies but entire sectors including tourism, technology transfer, and trade facilitation.

Regional Implications and Global Context

The India-China aviation resumption occurs within broader shifts in global economic and diplomatic alignments. Both countries face the challenge of maintaining strategic autonomy while responding to US tariff pressures and evolving global supply chains.

Xi Jinping’s message during the meeting emphasized viewing each other as “development opportunities, not threats,” reflecting Beijing’s interest in stable relations with India as both countries navigate complex relationships with Washington. The Chinese president stressed the need to separate the border issue from the broader relationship and called for a long-term strategic outlook.

This pragmatic approach aligns with both countries’ emphasis on strategic autonomy in foreign policy. As Foreign Policy notes, the meeting should be seen as reaffirmation of both countries’ commitment to independent foreign policy strategies that resist alignment with any single global power.

Economic Vulnerability and Interdependence

Despite the positive momentum, the relationship involves significant asymmetries and vulnerabilities. India’s heavy reliance on Chinese imports creates potential leverage points for Beijing in future disputes. As noted by the US Institute of Peace, India’s economic vulnerability vis-à-vis China is pronounced due to the significant trade imbalance and dependence on Chinese imports in critical sectors.

However, this interdependence also creates incentives for stable relations. China benefits from access to India’s large and growing market, while India’s manufacturing sector requires Chinese intermediate goods and raw materials to remain competitive globally. Several industries in India, from pharmaceuticals to electronics, have become deeply integrated with Chinese supply chains.

The resumption of flights is expected to facilitate not just passenger traffic but also trade relationships, business partnerships, and technology collaboration. Enhanced connectivity could help address some trade imbalances by making it easier for Indian companies to explore Chinese markets and for Chinese firms to establish operations in India.

Future Prospects and Implementation Timeline

While the announcement represents significant progress, practical implementation will require coordination between aviation authorities, airlines, and governments of both countries. Indian airlines have been asked by the government to prepare for flights to China at short notice, with possible formal announcements following the SCO Summit.

The resumption is expected to begin with major routes connecting Delhi, Mumbai, Bangalore, and Chennai with Beijing, Shanghai, Guangzhou, and Chengdu. Airlines will need to negotiate slot allocations, pricing, and scheduling while both governments finalize regulatory frameworks for resumed operations.

Tourism industry stakeholders anticipate significant benefits from restored connectivity. Before the suspension, Chinese tourists represented a growing segment of India’s inbound tourism, while Indian business travelers and tourists frequently visited China for commercial and leisure purposes.

The timing of the resumption coincides with both countries’ economic recovery priorities. India seeks to boost manufacturing and exports under its “Make in India” initiative, while China aims to stabilize its economy amid external pressures. Enhanced aviation connectivity could support both objectives by facilitating business relationships, technology transfer, and investment flows.

The restart of India-China direct flights represents more than restored aviation routes – it symbolizes a pragmatic reset in relations between two civilizations that must navigate complex geopolitical realities while pursuing shared prosperity for nearly three billion people. As both nations face mounting pressures from changing global dynamics, their ability to maintain stable, productive relations will significantly influence regional stability and global economic development.

Ready to take your career to the next level? Join our Online courses: ACCA, HESI A2, ATI TEAS 7 , HESI EXIT , NCLEX – RN and NCLEX – PN, Financial Literacy!🌟 Dive into a world of opportunities and empower yourself for success. Explore more at Serrari Ed and start your exciting journey today! ✨

Track GDP, Inflation and Central Bank rates for top African markets with Serrari’s comparator tool.

See today’s Treasury bonds and Money market funds movement across financial service providers in Kenya, using Serrari’s comparator tools.

Photo source: Google

By: Montel Kamau

Serrari Financial Analyst

1st September, 2025

Article, Financial and News Disclaimer

The Value of a Financial Advisor

While this article offers valuable insights, it is essential to recognize that personal finance can be highly complex and unique to each individual. A financial advisor provides professional expertise and personalized guidance to help you make well-informed decisions tailored to your specific circumstances and goals.

Beyond offering knowledge, a financial advisor serves as a trusted partner to help you stay disciplined, avoid common pitfalls, and remain focused on your long-term objectives. Their perspective and experience can complement your own efforts, enhancing your financial well-being and ensuring a more confident approach to managing your finances.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Readers are encouraged to consult a licensed financial advisor to obtain guidance specific to their financial situation.

Article and News Disclaimer

The information provided on www.serrarigroup.com is for general informational purposes only. While we strive to keep the information up to date and accurate, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability with respect to the website or the information, products, services, or related graphics contained on the website for any purpose. Any reliance you place on such information is therefore strictly at your own risk.

www.serrarigroup.com is not responsible for any errors or omissions, or for the results obtained from the use of this information. All information on the website is provided on an as-is basis, with no guarantee of completeness, accuracy, timeliness, or of the results obtained from the use of this information, and without warranty of any kind, express or implied, including but not limited to warranties of performance, merchantability, and fitness for a particular purpose.

In no event will www.serrarigroup.com be liable to you or anyone else for any decision made or action taken in reliance on the information provided on the website or for any consequential, special, or similar damages, even if advised of the possibility of such damages.

The articles, news, and information presented on www.serrarigroup.com reflect the opinions of the respective authors and contributors and do not necessarily represent the views of the website or its management. Any views or opinions expressed are solely those of the individual authors and do not represent the website's views or opinions as a whole.

The content on www.serrarigroup.com may include links to external websites, which are provided for convenience and informational purposes only. We have no control over the nature, content, and availability of those sites. The inclusion of any links does not necessarily imply a recommendation or endorsement of the views expressed within them.

Every effort is made to keep the website up and running smoothly. However, www.serrarigroup.com takes no responsibility for, and will not be liable for, the website being temporarily unavailable due to technical issues beyond our control.

Please note that laws, regulations, and information can change rapidly, and we advise you to conduct further research and seek professional advice when necessary.

By using www.serrarigroup.com, you agree to this disclaimer and its terms. If you do not agree with this disclaimer, please do not use the website.

www.serrarigroup.com, reserves the right to update, modify, or remove any part of this disclaimer without prior notice. It is your responsibility to review this disclaimer periodically for changes.

Serrari Group 2025