1. How do I calculate the future value of an ordinary annuity online?

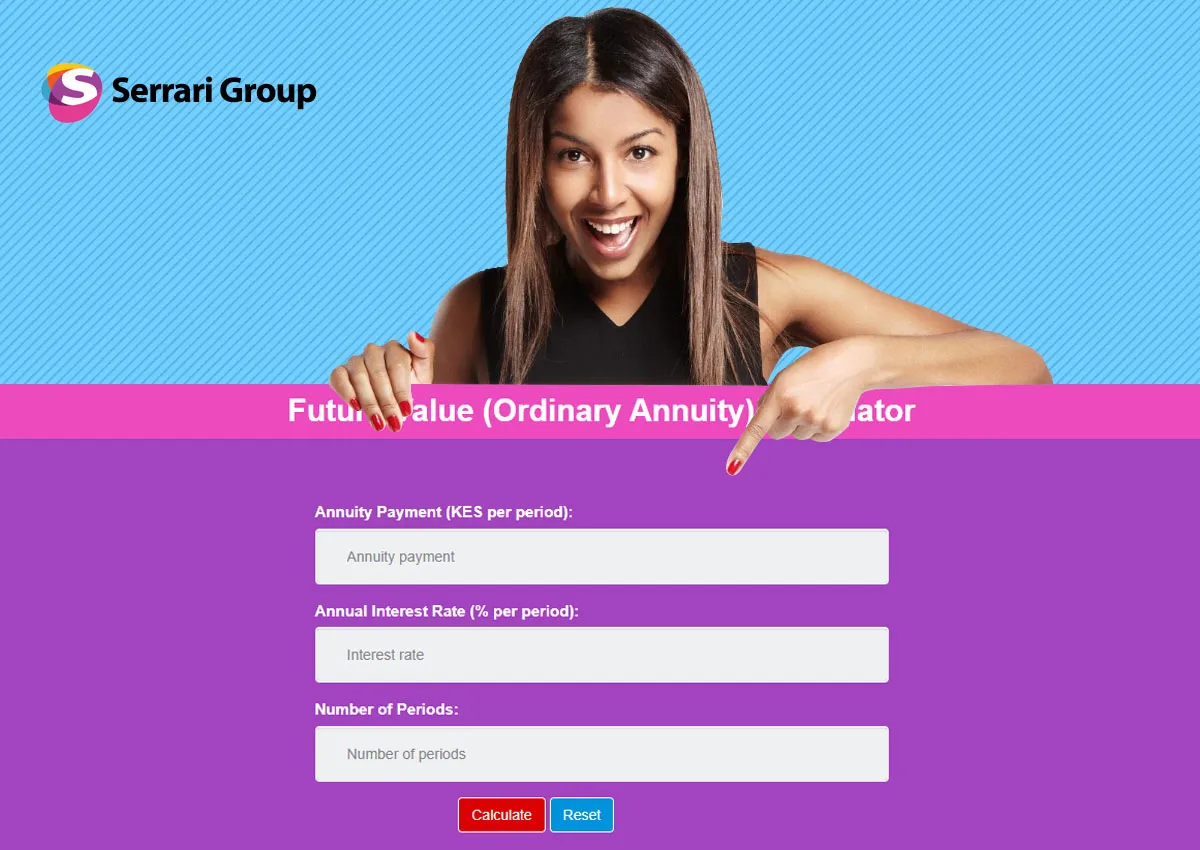

To calculate the future value of an ordinary annuity online, use a specialized calculator designed for annuities where payments are made at the end of each period. You’ll typically be asked to enter:

- PMT: The fixed payment amount per period

- r: The interest rate per period (e.g., monthly or yearly)

- n: The total number of periods

The calculator uses the following formula to compute the future value:

FV=PMT×[r((1+r)n−1)]

This result shows how much your series of regular payments will grow to in the future, assuming compound interest is applied and that payments are made at the end of each period, as per an ordinary annuity. You can find excellent future value ordinary annuity calculator tools on sites like Investopedia or Bankrate. For a comprehensive suite of financial tools, including a future value of the ordinary annuity calculator, visit Serrari Group.

Push boundaries, reach goals, achieve more. Whether it’s ACCA, HESI A2, ATI TEAS 7, HESI EXIT, NCLEX-RN, NCLEX-PN, or Financial Literacy, we’ve got the course to match your ambition. Start with Serrari Ed now.

2. What is the best online calculator for the future value of regular payments?

The best online calculator for future value of regular payments should have the following features:

- A clean interface that clearly distinguishes between ordinary annuity and annuity due

- Input fields for payment amount, interest rate, and number of periods

- Ability to select or define payment frequency (monthly, quarterly, annually)

- Clear labeling and explanation of the calculation method

You can find these calculators on reputable finance sites, personal finance blogs, educational platforms, or banking websites. Make sure it specifies that payments are made at the end of each period, which is the definition of an ordinary annuity. At Serrari, we offer various financial calculators to aid your financial journey.

3. Where can I find a free future value ordinary annuity calculator?

To find a free future value ordinary annuity calculator, search terms like:

- “Free future value of an ordinary annuity calculator”

- “Online annuity future value tool”

- “Future value of periodic payments calculator”

Look for calculators that are:

- Hosted by financial institutions, education websites, or investment planning platforms, such as Calculator.net or Fervent Learning.

- Clearly indicate that they handle ordinary annuities (payments made at the end of each period)

- Do not require sign-ups or subscriptions

Avoid tools labeled only as “annuity calculators” unless they specify ordinary annuity, since some might default to annuity due calculations instead.

4. What formula is used to calculate the future value of an ordinary annuity?

The standard formula used to calculate the future value of an ordinary annuity is:

FV=PMT×[r((1+r)n−1)]

Where:

- = Future Value

- PMT = Payment per period

- r = Interest rate per period

- n = Total number of periods

This formula assumes that each payment is made at the end of each period (ordinary annuity), and that the interest is compounded at the same frequency as the payment schedule. The formula works by calculating the accumulated value of each payment growing with compound interest until the end of the term. This is a core concept for understanding the fv of an ordinary annuity.

5. How do I calculate the future value of monthly annuity payments?

To calculate the future value of monthly annuity payments using an ordinary annuity model, follow these steps:

- Convert the annual interest rate to a monthly rate:

For example, 6% annually = 0.06/12=0.005 (or 0.5%) monthly - Multiply the number of years by 12 to get the total number of months:

For example, 5 years = 5×12=60 periods - Use the standard future value formula:

FV=PMT×[r((1+r)n−1)]

Example:

If you contribute $200 at the end of every month for 5 years at 6% annual interest:

PMT=200

r=0.005

n=60

Then:

FV=200×[0.005((1+0.005)60−1)]

FV≈200×348.85=$69,770

This amount reflects how much you’ll have after 5 years of monthly contributions with monthly compounding. This calculation is a practical application of the future value of an ordinary annuity.

Fuel your success with knowledge that matters. Enroll in career-defining programs: ACCA, HESI A2, ATI TEAS 7, HESI EXIT, NCLEX-RN, NCLEX-PN, and Financial Literacy. Join Serrari Ed now and take control of your future.

6. What inputs are needed for a future value ordinary annuity calculator?

To use a Future Value (Ordinary Annuity) Calculator, you will typically need to provide the following three main inputs:

- Payment Amount (PMT): The fixed amount paid at the end of each period

- Interest Rate per Period (r): This is often based on the annual rate divided by the number of periods per year

- Number of Periods (n): Total number of payments over the entire term

Optional inputs some calculators may allow:

- Payment Frequency: Monthly, quarterly, or annually

- Compounding Frequency: How often interest is applied (usually matches payment frequency)

- Future Value Date: To show the calendar date the annuity ends

With these inputs, the calculator applies the standard future value formula:

FV=PMT×[r((1+r)n−1)]

This tells you how much your series of payments will grow to at the end of the term. Understanding these inputs is key to effectively using any future value of the ordinary annuity calculator.

7. How does an ordinary annuity differ from an annuity due in future value calculations?

The key difference lies in the timing of the payments:

- Ordinary Annuity: Payments are made at the end of each period.

- Annuity Due: Payments are made at the beginning of each period.

Because payments in an annuity due occur earlier, each payment has one extra period to earn interest. This means:

- The future value annuity due is always higher than that of an ordinary annuity, assuming all else (PMT, r, n) is the same.

Formula comparison:

- Ordinary Annuity:

FV=PMT×[r((1+r)n−1)] - Annuity Due:

FV=PMT×[r((1+r)n−1)]×(1+r)

When using any online calculator, it’s crucial to choose the correct annuity type or it will give you an inaccurate future value. This distinction is vital for accurate financial planning, whether you’re looking at a future value ordinary annuity calculator or a future value annuity due calculator.

8. Is there an online tool to estimate future value of periodic investments?

Yes, many online tools are available to estimate the future value of periodic investments, especially when they follow the structure of an ordinary annuity. These tools are helpful for:

- Retirement contributions

- Savings plans

- Recurring investments (e.g., mutual fund SIPs)

- Loan repayment modeling

To find one, search using terms like:

- “Future value calculator for regular investments”

- “Recurring investment FV calculator”

- “Ordinary annuity future value tool”

Ensure the tool clearly indicates that payments are made at the end of each period — this is what defines it as an ordinary annuity calculator. You might also find a future value of an ordinary annuity table useful for quick reference, though calculators provide precise figures.

9. How accurate are future value calculators for ordinary annuities?

Future value calculators for ordinary annuities are highly accurate as long as the following conditions are met:

- Correct inputs: Payment amount, interest rate, and number of periods are entered precisely

- Assumptions are consistent: Compounding frequency matches payment frequency

- Interest rate remains constant throughout the term (no fluctuations)

- Payments are made regularly and consistently at the end of each period

These calculators use the exact mathematical formula:

FV=PMT×[r((1+r)n−1)]

However, accuracy may be affected if:

- The interest rate changes over time

- Payments vary in amount or timing

- Fees or taxes are not accounted for (some tools don’t include these)

For personal planning, these calculators offer a very reliable estimate under ideal conditions. Understanding the fv of an ordinary annuity relies on these consistent inputs.

10. Can I use a future value annuity calculator for retirement or savings planning?

Absolutely. A future value annuity calculator is one of the most effective tools for:

- Estimating retirement savings from regular monthly or annual contributions

- Planning education funds for children

- Projecting savings goals over a specific timeline

- Assessing investment outcomes based on regular deposits

To use it for retirement or savings planning:

- Decide on a regular contribution amount (PMT)

- Use a reasonable interest rate (r) based on expected return

- Set the investment period (n) in months or years

- Run the calculation to see the total amount at the end of the period

Since retirement and long-term saving typically involve consistent contributions over time, the ordinary annuity model is ideal — it assumes payments are made at the end of each period, matching how most people contribute to retirement or savings plans. This makes the future value of an ordinary annuity a crucial concept for long-term financial goals.

Ready to take your career to the next level? Join our dynamic courses: ACCA, HESI A2, ATI TEAS 7 , HESI EXIT , NCLEX – RN and NCLEX – PN, Financial Literacy!🌟 Dive into a world of opportunities and empower yourself for success. Explore more at Serrari Ed and start your exciting journey today! ✨