1. What is the future value of a lump sum investment?

The future value (FV) of a lump sum investment refers to the amount of money an investment will grow to after earning interest over a specified period of time. This assumes the principal is invested once and left to accumulate interest without additional contributions.

Future value helps investors estimate how much their current investment will be worth in the future based on a given interest rate and time period.

Push boundaries, reach goals, achieve more. Whether it’s ACCA, HESI A2, ATI TEAS 7, HESI EXIT, NCLEX-RN, NCLEX-PN, or Financial Literacy, we’ve got the course to match your ambition. Start with Serrari Ed now.

2. How do I calculate the future value of a single investment?

To calculate the future value of a lump sum, use the following formula:

Future Value = Present Value * (1 + r)^n

Where:

- Present Value is the initial amount invested.

- r is the interest rate per period (expressed as a decimal).

- n is the number of compounding periods.

Example:

If you invest $1,000 at an interest rate of 5% annually for 10 years:

Future Value = 1000 * (1 + 0.05)^10

Future Value = 1000 * 1.62889

Future Value ≈ $1,628.89

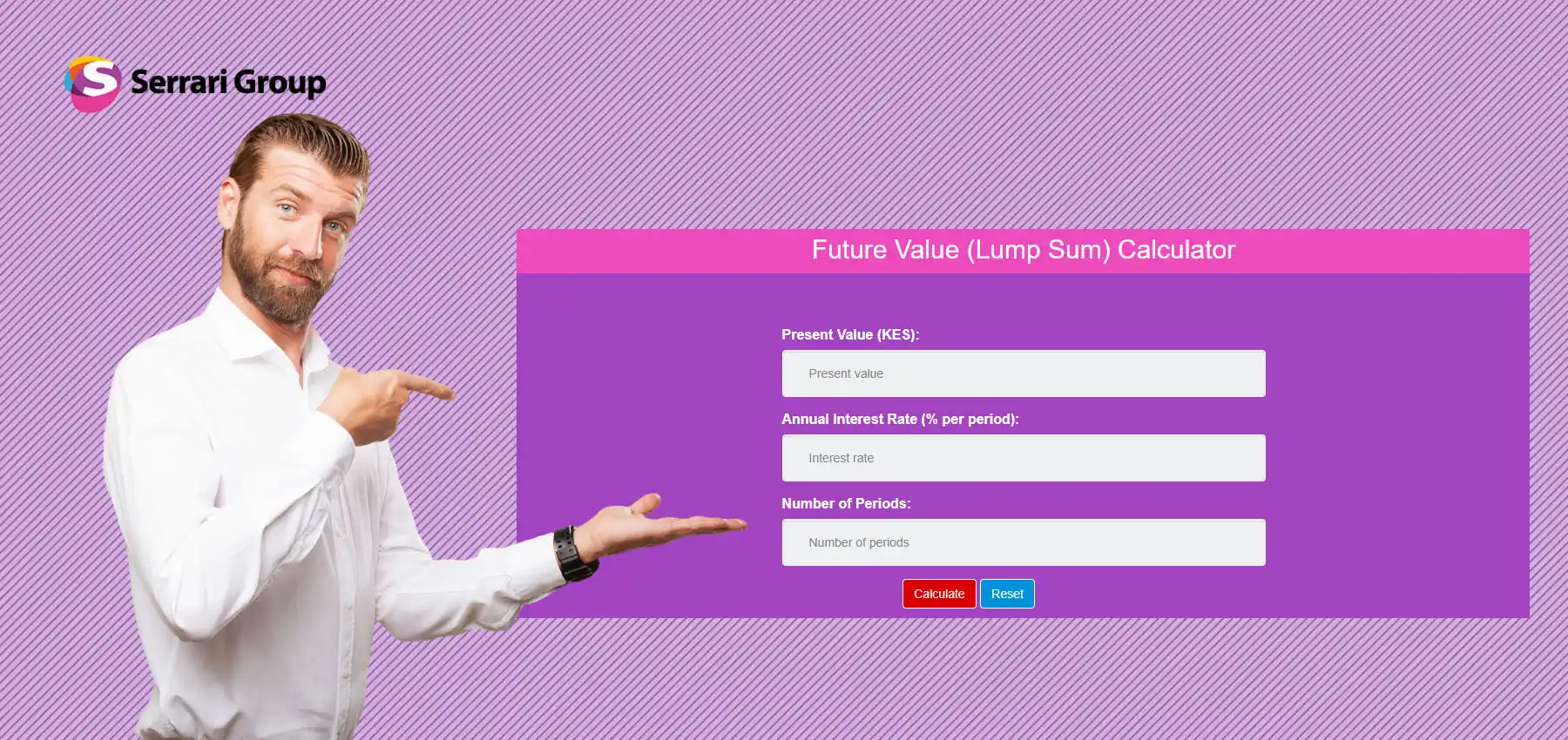

You can easily calculate this using a future value calculator lump sum tool online. Reputable sites like Investopedia and Calculator.net offer such calculators. For a comprehensive future lump sum calculator, visit Serrari Group.

3. What formula is used in the future value lump sum calculator?

The standard future value of a lump sum formula used in the calculator is:

FV = PV * (1 + r)^n

Where:

- FV is the future value

- PV is the present value (initial investment)

- r is the interest rate per period

- n is the number of periods

Some future value lump sum calculator tools may offer variations where:

- r is adjusted for compounding frequency (e.g., monthly or quarterly),

- and n reflects total number of compounding intervals (e.g., years * 12 for monthly).

4. How does interest rate affect the future value of a lump sum?

The interest rate has a direct and exponential effect on the future value of a lump sum. The higher the rate, the faster your investment grows. Because the future value formula involves exponentiation, even small increases in the rate can significantly boost long-term outcomes.

For example:

- At 5% interest, $1,000 becomes ≈ $1,628.89 in 10 years.

- At 7% interest, $1,000 becomes ≈ $1,967.15 in 10 years.

This compounding effect becomes more pronounced over longer durations.

5. Can the future value calculator account for compound interest?

Yes, most future value calculator lump sum tools are designed to account for compound interest, which is when interest is calculated on both the initial principal and the accumulated interest from previous periods.

When compounding is involved, the future value of a lump sum formula is:

FV = PV * (1 + r/n)^(n * t)

Where:

- PV is the present value

- r is the annual interest rate

- n is the number of compounding periods per year (e.g., 12 for monthly)

- t is the number of years

Example:

$1,000 invested at 6% annually compounded monthly for 5 years:

FV = 1000 * (1 + 0.06 / 12)^(12 * 5)

FV = 1000 * (1.005)^60 ≈ $1,348.85

Fuel your success with knowledge that matters. Enroll in career-defining programs: ACCA, HESI A2, ATI TEAS 7, HESI EXIT, NCLEX-RN, NCLEX-PN, and Financial Literacy. Join Serrari Ed now and take control of your future.

6. How do I calculate the future value of a lump sum investment over 10 years?

To calculate the future value (FV) of a lump sum investment over 10 years, use the basic compound interest formula:

FV = P * (1 + r)^t

Where:

- FV = future value

- P = present value or initial investment

- r = annual interest rate (as a decimal)

- t = number of years (in this case, 10)

Example:

If you invest $5,000 at an annual interest rate of 6% compounded yearly for 10 years:

FV = 5000 * (1 + 0.06)^10

FV = 5000 * (1.790847)

FV = $8,954.24

7. What interest rate do I need to double my money in a fixed number of years using a lump sum?

To find the required interest rate to double your money, you can use a future lump sum calculator or rearrange the compound interest formula to solve for r:

r = (FV / P)^(1/t) – 1

If you’re doubling your money, FV = 2P, so:

r = (2)^(1/t) – 1

Example:

To double your money in 12 years:

r = (2)^(1/12) – 1

r ≈ 0.05946 or 5.95% annually

8. Can I use the future value formula for non-annual compounding with a lump sum?

Yes. If the compounding is more frequent than once a year (e.g., quarterly or monthly), use the modified future value of a lump sum formula:

FV = P * (1 + r/n)^(n * t)

Where:

- n = number of compounding periods per year

- All other symbols as before

Example:

For a $2,000 investment at 8% interest compounded quarterly for 5 years:

n = 4

FV = 2000 * (1 + 0.08/4)^(4 * 5)

FV = 2000 * (1.02)^20

FV = 2000 * 1.485947

FV = $2,971.89

9. How does inflation affect the future value of a lump sum?

Inflation reduces the real (purchasing power) value of money over time. To account for inflation, calculate the real future value of a lump sum:

Real FV = FV / (1 + i)^t

Where:

- i = inflation rate

- t = number of years

Example:

Nominal FV = $10,000, inflation = 3%, time = 5 years

Real FV = 10000 / (1 + 0.03)^5

Real FV = 10000 / 1.159274

Real FV = $8,624.27

So your $10,000 would have the buying power of approximately $8,624 in today’s dollars.

10. Is future value the same as maturity value for a lump sum investment?

Yes, in most contexts, future value and maturity value are used interchangeably when referring to a lump sum investment. Both represent the amount you will receive at the end of the investment period, assuming interest has compounded over time. The term “maturity value” is commonly used in fixed deposits or bonds, while “future value” is used in general financial planning. The calculation remains the same:

FV = P * (1 + r)^t (for annual compounding)

In summary, both terms indicate the value of your investment at a future date.

Ready to take your career to the next level? Join our dynamic courses: ACCA, HESI A2, ATI TEAS 7 , HESI EXIT , NCLEX – RN and NCLEX – PN, Financial Literacy!🌟 Dive into a world of opportunities and empower yourself for success. Explore more at Serrari Ed and start your exciting journey today! ✨