1. What is a future value annuity due calculator used for?

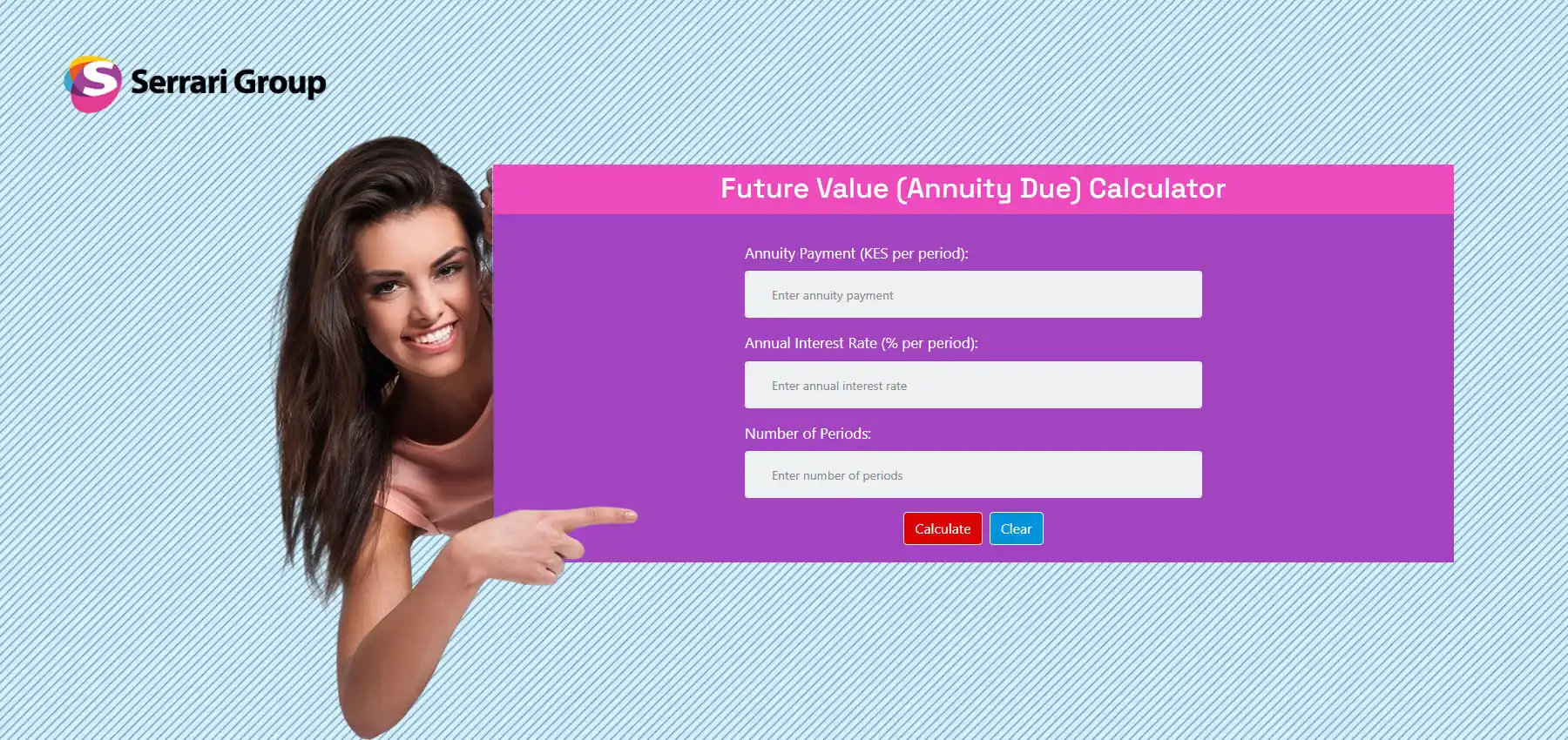

A Future Value (Annuity Due) Calculator helps determine how much a series of equal payments made at the beginning of each period will be worth at a future date, assuming a fixed interest rate and compounding frequency. It’s an essential tool for projecting the value of annuity due calculator scenarios.

It’s typically used for scenarios like:

- Retirement planning (e.g., monthly deposits starting now)

- Saving goals (e.g., saving for a house or education)

- Lease or rental income projections

- Any investment where payments are made at the start of each interval

This is different from a regular (ordinary) annuity where payments are made at the end of each period. You can find reliable fv annuity due calculator tools on financial education sites like Investopedia or general financial calculator sites like Calculator.net. For a comprehensive suite of financial tools, including a future value annuity due calculator, visit Serrari Group.

Push boundaries, reach goals, achieve more. Whether it’s ACCA, HESI A2, ATI TEAS 7, HESI EXIT, NCLEX-RN, NCLEX-PN, or Financial Literacy, we’ve got the course to match your ambition. Start with Serrari Ed now.

2. How does an annuity due differ from an ordinary annuity in future value calculations?

The key difference lies in timing of the payments:

- Annuity Due: Payments are made at the beginning of each period.

- Ordinary Annuity: Payments are made at the end of each period.

Because payments in an annuity due are invested one period earlier, each has one extra compounding period, which leads to a higher annuity due future value than an ordinary annuity.

Mathematically, the annuity due formula future value is related to the ordinary annuity formula:

Future Value of Ordinary Annuity:

FV = P * [((1 + r)^n – 1) / r]

Future Value of Annuity Due:

FV = P * [((1 + r)^n – 1) / r] * (1 + r)

Where:

P = periodic payment

r = interest rate per period

n = total number of payments

3. What formula is used to calculate future value for an annuity due?

The Future Value (FV) for an annuity due is calculated using the annuity due formula future value:

FV = P * [((1 + r)^n – 1) / r] * (1 + r)

Where:

P = Payment amount per period

r = Interest rate per period (e.g., annual rate / number of periods per year)

n = Total number of periods (years * periods per year)

The extra (1 + r) at the end adjusts for the fact that each payment is made at the beginning of the period, giving it one extra period to grow. This is the core of the fv annuity due formula.

4. How do I calculate the future value of monthly payments made at the beginning of each period?

To calculate this using the fv annuity due formula, first convert the annual interest rate and time into monthly terms:

Step-by-step:

Convert annual interest rate to monthly rate:

r = annual rate / 12

Convert number of years to months:

n = years * 12

Use the formula:

FV = P * [((1 + r)^n – 1) / r] * (1 + r)

Example:

P = $200 per month

Interest rate = 6% annually = 0.06

Time = 5 years

Then:

r = 0.06 / 12 = 0.005

n = 5 * 12 = 60

FV = 200 * [((1 + 0.005)^60 – 1) / 0.005] * (1 + 0.005)

FV approx 200 * [((1.005)^60 – 1) / 0.005] * 1.005

FV approx 200 * [0.34885 / 0.005] * 1.005

FV approx 200 * 69.77 * 1.005

FV approx 14,010.77

So, after 5 years, you’ll have approximately $14,010.77. This is how a future value annuity due calculator determines the outcome.

5. Can I use the annuity due calculator for retirement savings planning?

Yes. The Future Value (Annuity Due) Calculator is especially effective for retirement planning, because most retirement savings plans (like 401(k) or pension contributions) involve regular, fixed contributions made at the beginning of each period (e.g., start of the month).

Using this calculator allows you to:

- Project how much your savings will grow by retirement

- Compare how different interest rates or durations affect your goals

- Evaluate the impact of increasing your contributions

It’s ideal for goal setting, investment comparisons, and retirement milestones, helping you visualize your annuity due future value.

Fuel your success with knowledge that matters. Enroll in career-defining programs: ACCA, HESI A2, ATI TEAS 7, HESI EXIT, NCLEX-RN, NCLEX-PN, and Financial Literacy. Join Serrari Ed now and take control of your future.

6. How do I calculate the future value of an annuity due with monthly contributions?

To calculate the future value of an annuity due with monthly contributions, use this fv annuity due formula:

FV = P * [((1 + r)^n – 1) / r] * (1 + r)

Where:

FV = Future Value

P = Monthly payment amount

r = Monthly interest rate (annual interest rate / 12)

n = Total number of payments (number of years * 12)

The key distinction for an annuity due is the extra multiplication by (1 + r), which accounts for payments being made at the beginning of each period.

7. What is the impact of interest rate changes on the future value of an annuity due?

An increase in the interest rate raises the annuity due future value because more interest is earned on each payment. Since payments are made at the beginning of the period, each dollar has more time to grow.

Example:

$100 contributed monthly for 10 years at 6% annual interest (0.5% monthly) results in a future value higher than if the rate were 4%.

You can use an fv annuity due calculator and test with different ‘r’ values to see the impact.

8. How many years will it take to reach a certain future value with regular annuity due contributions?

You can solve for n using logarithms, which is a more advanced application of the value of annuity due calculator:

n = log[(FV * r) / (P * (1 + r)) + 1] / log(1 + r)

Where:

FV = Desired future value

P = Payment per period

r = Interest rate per period

n = Number of periods (months, quarters, etc.)

Then convert to years if needed.

9. Can the future value of an annuity due be higher than that of an ordinary annuity?

Yes. The future value of an annuity due is always higher than that of an ordinary annuity, assuming the same payment, rate, and duration.

That’s because in an annuity due, each payment is made one period earlier, giving each payment one additional period to earn interest.

Comparison:

FV (Ordinary Annuity) = P * [((1 + r)^n – 1) / r]

FV (Annuity Due) = FV (Ordinary) * (1 + r)

You might also find a future value annuity due table useful for quick comparisons, though a calculator provides precise figures.

10. What’s the difference between using a calculator for annuity due vs. ordinary annuity?

An annuity due future value calculator accounts for payments made at the beginning of each period, adding an extra (1 + r) multiplier in the final step. An ordinary annuity calculator assumes payments are made at the end of each period.

Make sure to use the correct calculator for your scenario. Using the wrong type may lead to inaccurate projections. While this document focuses on future value, it’s also important to note the distinction when you calculate present value of annuity due versus ordinary annuities.

Ready to take your career to the next level? Join our dynamic courses: ACCA, HESI A2, ATI TEAS 7 , HESI EXIT , NCLEX – RN and NCLEX – PN, Financial Literacy!🌟 Dive into a world of opportunities and empower yourself for success. Explore more at Serrari Ed and start your exciting journey today! ✨