The U.S. Federal Reserve held interest rates steady during its latest meeting, signaling a cautious approach to monetary policy despite some promising signs in the economy. Fed Chair Jerome Powell’s comments after the decision made it clear that the central bank sees no immediate need to lower rates further. Instead, officials plan to remain patient and wait for more concrete data on inflation and employment before considering any rate cuts.

With inflation still above the central bank’s target and the job market showing continued strength, Powell emphasized that the Fed would need to see a sustained decrease in inflation or an uptick in job risks before taking any further steps. This announcement places the Fed in a holding pattern, reflecting a balancing act between maintaining price stability and supporting a healthy labor market.

Fed’s Strategy for Economic Stability

The Federal Reserve’s decision to keep the benchmark interest rate in the 4.25%-4.50% range came at the conclusion of its two-day meeting, the first under President Joe Biden’s administration in 2025. This marks a significant moment for the central bank as it navigates the economic challenges stemming from the COVID-19 pandemic, rising inflation, and changing fiscal policies in Washington.

In the meeting’s aftermath, Powell underscored that the Fed’s policy stance remains “well-calibrated.” Despite inflation’s persistent elevated levels, the economy continues to show signs of growth. Economic activity has been expanding at a solid pace, and the unemployment rate has remained at historically low levels. Job market conditions are stable, and there has been a general sense of economic resilience despite global uncertainties.

“We do not need to be in a hurry to adjust our policy stance,” Powell said during a press conference. He added that the Fed’s current policy is “well-positioned” to address both inflationary pressures and job market conditions. However, Powell was careful to stress that the Fed would continue to monitor incoming data to ensure that inflation is trending toward the 2% target.

Inflation Still a Concern

Although inflation has eased from its pandemic highs, it remains a major concern for the Federal Reserve. The latest inflation data shows that consumer prices are still running about 0.5 percentage points above the central bank’s 2% target. This elevated level of inflation means that the Fed cannot afford to be complacent, as sustained inflation could erode purchasing power and undermine economic stability.

In its official statement, the Fed acknowledged that inflation remains elevated, particularly in key sectors like housing, food, and energy. While inflation readings have improved slightly in recent months, the Fed is cautious about declaring victory prematurely. The central bank is mindful that easing monetary policy too quickly could hinder progress in reducing inflation and potentially lead to economic overheating.

At the same time, Powell and other officials have expressed confidence that inflation will gradually move toward the target as supply chain disruptions ease and demand pressures subside. However, until inflation moves more decisively toward 2%, the Fed will maintain a wait-and-see approach, avoiding any premature rate cuts.

The Job Market: A Bright Spot in the Economy

One of the key factors in the Fed’s decision to hold rates steady is the ongoing strength of the U.S. labor market. Unemployment remains at historic lows, and the job market continues to show resilience despite higher interest rates. In recent months, payroll growth has slowed slightly from its pandemic-era highs, but it still exceeds pre-pandemic levels, indicating a healthy and expanding job market.

“We’ve seen broad stability in the unemployment rate for six months now, which indicates that the labor market is holding up well,” Powell said. “That’s a positive sign, and we don’t want to jeopardize that by taking actions that could unnecessarily raise the risks of higher unemployment.”

The Fed has emphasized that its primary goal is to keep the job market strong while achieving price stability. This dual mandate has been a key element of U.S. economic policy for decades. Powell reiterated that the Fed will continue to prioritize job growth while being vigilant about inflation.

Despite the strong job market, there are signs that certain sectors are feeling the pressure of rising interest rates, particularly housing and some segments of consumer spending. Higher borrowing costs have made homeownership less affordable, and credit card debt is beginning to rise as consumers take on more debt to offset inflationary pressures. These challenges highlight the complex nature of the Fed’s task in balancing inflation control with economic growth.

Global and Domestic Factors at Play

As the Fed weighs its next steps, global factors continue to shape the economic landscape. The ongoing effects of the pandemic are still felt worldwide, with supply chain disruptions and geopolitical tensions affecting trade and investment flows. Rising energy prices, particularly oil, have added to inflationary pressures, complicating the Fed’s task in managing the U.S. economy.

At home, the Biden administration’s fiscal policies will also play a role in the Fed’s decision-making. In particular, the administration’s proposed spending plans and potential changes to tax policy could influence inflationary pressures. If the government increases its spending without addressing supply-side constraints, it could exacerbate inflation, prompting the Fed to act more aggressively to curb price increases.

Meanwhile, President Biden faces political pressure from various quarters. Republicans have called for more fiscal discipline and have criticized some of the administration’s spending initiatives. This could lead to further political gridlock, which might influence economic growth and inflation trends. The Fed’s stance will be influenced by how these issues unfold in the coming months.

Looking Ahead: What’s Next for Monetary Policy?

The Federal Reserve’s decision to hold rates steady does not mean that rate cuts are completely off the table. While Powell emphasized the importance of waiting for more data, there is a general expectation that the Fed may begin to cut rates later in 2025. The timing of these cuts will depend on how inflation and the job market evolve.

Most economists anticipate that the Fed will not cut rates aggressively in the near term, but there is speculation that the central bank could take small, measured steps to lower rates in the second half of the year. A potential reduction of a quarter-point could help provide some economic stimulus without risking a resurgence in inflation.

Markets are currently pricing in that the Fed will wait until June 2025 before making any further rate cuts, reflecting the central bank’s cautious stance. Investors will be closely watching the next few months of inflation data, as well as any signs of economic weakness, to gauge the likelihood of a rate cut.

In the longer term, the Fed’s strategy will likely involve a gradual return to more normalized interest rates as inflation moves closer to the 2% target. However, given the uncertainty in the global economy and the evolving fiscal landscape, the central bank will need to remain flexible and responsive to emerging data.

Conclusion: A Cautious Path Forward

The Federal Reserve’s decision to keep interest rates unchanged reflects the complexities of the current economic environment. While inflation remains elevated, the job market is stable, and economic growth continues at a solid pace. Powell and his colleagues at the Fed have struck a careful balance, opting for a wait-and-see approach rather than rushing into further rate cuts.

As 2025 progresses, the Fed will continue to monitor inflation, labor market conditions, and other economic factors to guide its decisions. The central bank’s priority is to achieve a soft landing for the U.S. economy—maintaining low unemployment while bringing inflation closer to the target without triggering a recession.

For now, the Fed’s approach to monetary policy seems well-positioned to navigate the uncertainties ahead. However, the evolving economic landscape, both at home and abroad, will likely necessitate ongoing adjustments and careful attention from policymakers.

Ready to take your career to the next level? Join our dynamic courses: ACCA, HESI A2, ATI TEAS 7 , HESI EXIT , NCLEX – RN and NCLEX – PN, Financial Literacy!🌟 Dive into a world of opportunities and empower yourself for success. Explore more at Serrari Ed and start your exciting journey today! ✨

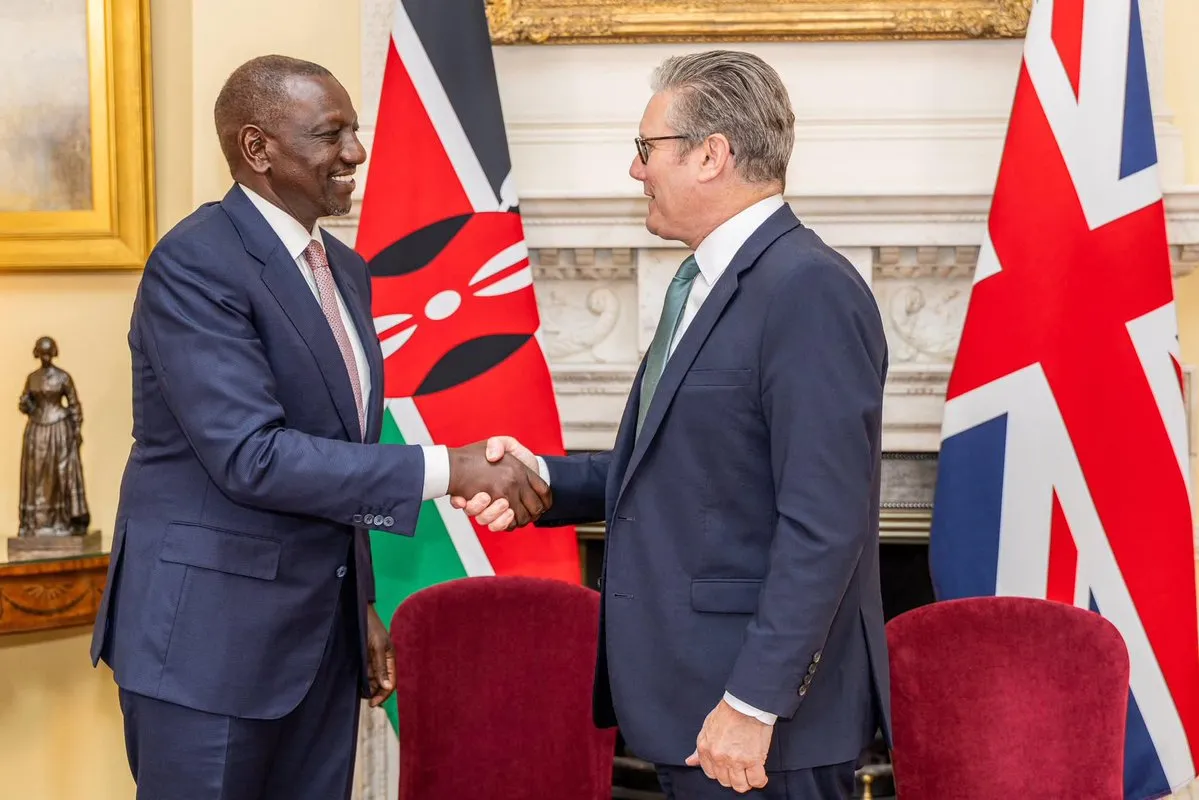

photo source: Google

By: Montel Kamau

Serrari Financial Analyst

30th January, 2025

Article, Financial and News Disclaimer

The Value of a Financial Advisor

While this article offers valuable insights, it is essential to recognize that personal finance can be highly complex and unique to each individual. A financial advisor provides professional expertise and personalized guidance to help you make well-informed decisions tailored to your specific circumstances and goals.

Beyond offering knowledge, a financial advisor serves as a trusted partner to help you stay disciplined, avoid common pitfalls, and remain focused on your long-term objectives. Their perspective and experience can complement your own efforts, enhancing your financial well-being and ensuring a more confident approach to managing your finances.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Readers are encouraged to consult a licensed financial advisor to obtain guidance specific to their financial situation.

Article and News Disclaimer

The information provided on www.serrarigroup.com is for general informational purposes only. While we strive to keep the information up to date and accurate, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability with respect to the website or the information, products, services, or related graphics contained on the website for any purpose. Any reliance you place on such information is therefore strictly at your own risk.

www.serrarigroup.com is not responsible for any errors or omissions, or for the results obtained from the use of this information. All information on the website is provided on an as-is basis, with no guarantee of completeness, accuracy, timeliness, or of the results obtained from the use of this information, and without warranty of any kind, express or implied, including but not limited to warranties of performance, merchantability, and fitness for a particular purpose.

In no event will www.serrarigroup.com be liable to you or anyone else for any decision made or action taken in reliance on the information provided on the website or for any consequential, special, or similar damages, even if advised of the possibility of such damages.

The articles, news, and information presented on www.serrarigroup.com reflect the opinions of the respective authors and contributors and do not necessarily represent the views of the website or its management. Any views or opinions expressed are solely those of the individual authors and do not represent the website's views or opinions as a whole.

The content on www.serrarigroup.com may include links to external websites, which are provided for convenience and informational purposes only. We have no control over the nature, content, and availability of those sites. The inclusion of any links does not necessarily imply a recommendation or endorsement of the views expressed within them.

Every effort is made to keep the website up and running smoothly. However, www.serrarigroup.com takes no responsibility for, and will not be liable for, the website being temporarily unavailable due to technical issues beyond our control.

Please note that laws, regulations, and information can change rapidly, and we advise you to conduct further research and seek professional advice when necessary.

By using www.serrarigroup.com, you agree to this disclaimer and its terms. If you do not agree with this disclaimer, please do not use the website.

www.serrarigroup.com, reserves the right to update, modify, or remove any part of this disclaimer without prior notice. It is your responsibility to review this disclaimer periodically for changes.

Serrari Group 2025