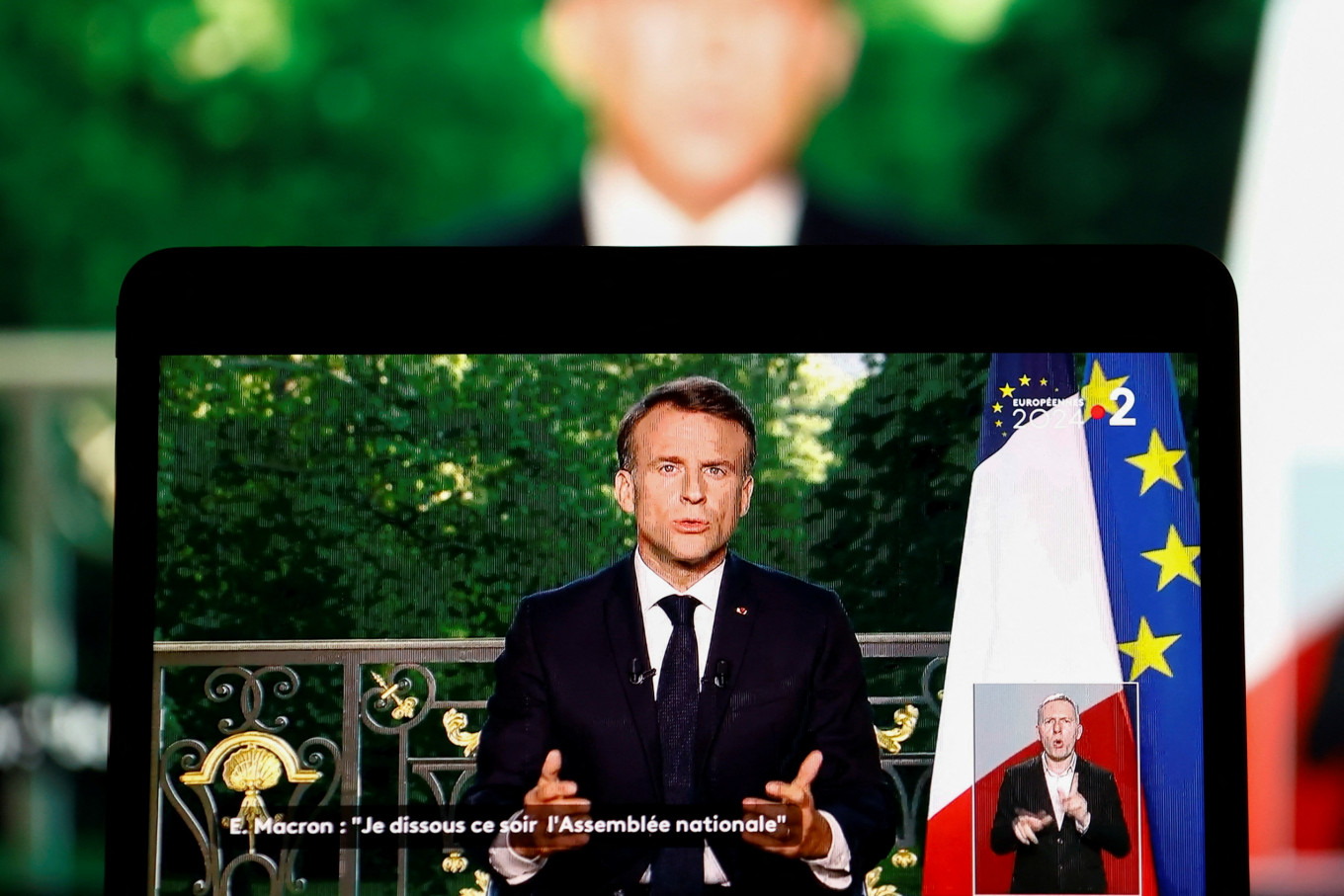

The euro hit a one-month low on Monday, declining 0.44% to $1.0753, as political uncertainty surged following French President Emmanuel Macron’s call for a snap legislative election. This move comes in the wake of significant gains by far-right eurosceptic nationalists in the European Parliament elections, prompting Macron to seek a stronger mandate.

This political upheaval in France has unsettled investors, contributing to the euro’s more than 2.5% slide against the dollar this year. The uncertainty in Europe contrasts sharply with the economic outlook in the United States, where the dollar remains strong. Recent U.S. job data showed an increase of 272,000 nonfarm payrolls in May, surpassing expectations and reducing the likelihood of near-term rate cuts by the Federal Reserve.

Charu Chanana, head of currency strategy at Saxo, highlighted the dual pressures on the euro: “The euro has faced a double blow from robust U.S. jobs data and political instability in France, adding to the currency’s downside risks after the European Central Bank’s rate cut last week.”

The ECB’s recent rate reduction aimed at combating inflation, which remains above target, offered little guidance on future monetary policy, leaving markets uneasy. Meanwhile, the dollar index, which measures the U.S. currency against six major rivals, rose 0.18% to 105.25, approaching a one-month high. Market expectations for the Fed’s rate cuts this year have been recalibrated, with the probability of a September rate cut dropping from around 70% to 50%.

The euro’s decline was also reflected against other major currencies, hitting its lowest since August 2022 against the British pound and easing 0.2% against the Japanese yen. The yen, trading at 157.13 per dollar, remains close to a 34-year low, with the Bank of Japan expected to maintain its ultra-low interest rates in its upcoming policy meeting.

Sterling remained relatively stable, trading around $1.27145 after touching a one-week low earlier. Market focus now shifts to upcoming U.S. inflation data and the Federal Reserve’s meeting, where statements from Fed Chair Jerome Powell will be closely watched for any changes in economic projections.

Moh Siong Sim, a currency strategist at the Bank of Singapore, emphasized the cautious market sentiment: “Investors are waiting for the inflation report and the Fed meeting for clearer direction. The key will be the dot plot, indicating the projected rate cuts.”

As these developments unfold, the global financial landscape remains sensitive to political events in Europe and economic indicators from the United States, with the euro’s trajectory hanging in the balance.

photo source: Google

By: Montel Kamau

Serrari Financial Analyst

11th June, 2024

Article, Financial and News Disclaimer

The Value of a Financial Advisor

While this article offers valuable insights, it is essential to recognize that personal finance can be highly complex and unique to each individual. A financial advisor provides professional expertise and personalized guidance to help you make well-informed decisions tailored to your specific circumstances and goals.

Beyond offering knowledge, a financial advisor serves as a trusted partner to help you stay disciplined, avoid common pitfalls, and remain focused on your long-term objectives. Their perspective and experience can complement your own efforts, enhancing your financial well-being and ensuring a more confident approach to managing your finances.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Readers are encouraged to consult a licensed financial advisor to obtain guidance specific to their financial situation.

Article and News Disclaimer

The information provided on www.serrarigroup.com is for general informational purposes only. While we strive to keep the information up to date and accurate, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability with respect to the website or the information, products, services, or related graphics contained on the website for any purpose. Any reliance you place on such information is therefore strictly at your own risk.

www.serrarigroup.com is not responsible for any errors or omissions, or for the results obtained from the use of this information. All information on the website is provided on an as-is basis, with no guarantee of completeness, accuracy, timeliness, or of the results obtained from the use of this information, and without warranty of any kind, express or implied, including but not limited to warranties of performance, merchantability, and fitness for a particular purpose.

In no event will www.serrarigroup.com be liable to you or anyone else for any decision made or action taken in reliance on the information provided on the website or for any consequential, special, or similar damages, even if advised of the possibility of such damages.

The articles, news, and information presented on www.serrarigroup.com reflect the opinions of the respective authors and contributors and do not necessarily represent the views of the website or its management. Any views or opinions expressed are solely those of the individual authors and do not represent the website's views or opinions as a whole.

The content on www.serrarigroup.com may include links to external websites, which are provided for convenience and informational purposes only. We have no control over the nature, content, and availability of those sites. The inclusion of any links does not necessarily imply a recommendation or endorsement of the views expressed within them.

Every effort is made to keep the website up and running smoothly. However, www.serrarigroup.com takes no responsibility for, and will not be liable for, the website being temporarily unavailable due to technical issues beyond our control.

Please note that laws, regulations, and information can change rapidly, and we advise you to conduct further research and seek professional advice when necessary.

By using www.serrarigroup.com, you agree to this disclaimer and its terms. If you do not agree with this disclaimer, please do not use the website.

www.serrarigroup.com, reserves the right to update, modify, or remove any part of this disclaimer without prior notice. It is your responsibility to review this disclaimer periodically for changes.

Serrari Group 2025