China’s trade with Africa continues to flourish, demonstrating resilience and growth despite global economic challenges. In the first seven months of 2024, trade between China and Africa rose by 5.5% year-on-year, reaching 1.19 trillion yuan (approximately 166.6 billion U.S. dollars), according to the General Administration of Customs (GAC). This steady growth underscores the deepening economic ties between the two regions, which have continued to expand across various sectors.

Historical Context and Recent Developments

China has been Africa’s largest trading partner for 15 consecutive years, a testament to the long-standing relationship between the two regions. This partnership is built on a foundation of mutual economic interests, with China providing a vast market for African commodities and, in return, Africa serving as a crucial supplier of raw materials and an emerging market for Chinese manufactured goods.

In 2023, China-Africa trade reached a record high of 282.1 billion U.S. dollars, a 1.5% increase from the previous year. This growth, though modest, reflects the strong resilience of the trade relationship amidst global economic uncertainties, including the COVID-19 pandemic, supply chain disruptions, and geopolitical tensions.

The trade between the two regions is not just limited to traditional commodities. In recent years, there has been a significant diversification of trade, with China importing more agricultural products from Africa and exporting advanced technological goods to the continent. For instance, in 2023, China’s imports of African nuts, vegetables, flowers, and fruits surged by 130%, 32%, 14%, and 7%, respectively. This trend highlights Africa’s growing role as a supplier of high-quality agricultural products to the Chinese market.

On the other hand, China’s exports to Africa have increasingly included high-tech products. The export of new energy vehicles, lithium batteries, and photovoltaic products to Africa saw remarkable growth, with increases of 291%, 109%, and 57% year-on-year, respectively. These exports are not only meeting the rising demand for sustainable and advanced technologies in Africa but also contributing to the continent’s efforts in achieving energy transition and sustainable development.

China-Africa Trade Index: A Measure of Growing Economic Ties

To better track and understand the dynamics of this evolving trade relationship, the GAC released the China-Africa Trade Index for the first time in 2023. The index uses data from the year 2000 as a benchmark, with 100 points representing the baseline. By 2022, the index had reached a record high of 990.55 points, indicating nearly a tenfold increase in trade activity over two decades. This sharp rise reflects the rapid and positive development of China-Africa trade, which has been characterized by both an increase in trade volume and a diversification of traded goods.

The index’s growth is not just a numerical achievement; it symbolizes the strengthening of economic ties and the mutual benefits derived from this partnership. For Africa, the trade relationship with China has been instrumental in its industrialization process, helping to diversify its economy beyond raw materials and into manufacturing and technology. For China, Africa represents a vital source of natural resources and a growing market for its goods, ranging from consumer products to industrial machinery.

Strategic Importance of China-Africa Trade

China’s strategic interest in Africa is multifaceted, encompassing not only trade but also investment, infrastructure development, and diplomatic relations. The Belt and Road Initiative (BRI), which aims to enhance global trade routes through infrastructure development, has been a significant driver of China’s engagement with Africa. Many African countries have signed onto the BRI, leading to an influx of Chinese investment in infrastructure projects across the continent, including roads, railways, ports, and energy facilities.

This infrastructure development has had a profound impact on Africa’s economic landscape, facilitating trade, improving connectivity, and boosting economic growth. In return, these projects have provided Chinese companies with lucrative contracts and opportunities to expand their global footprint.

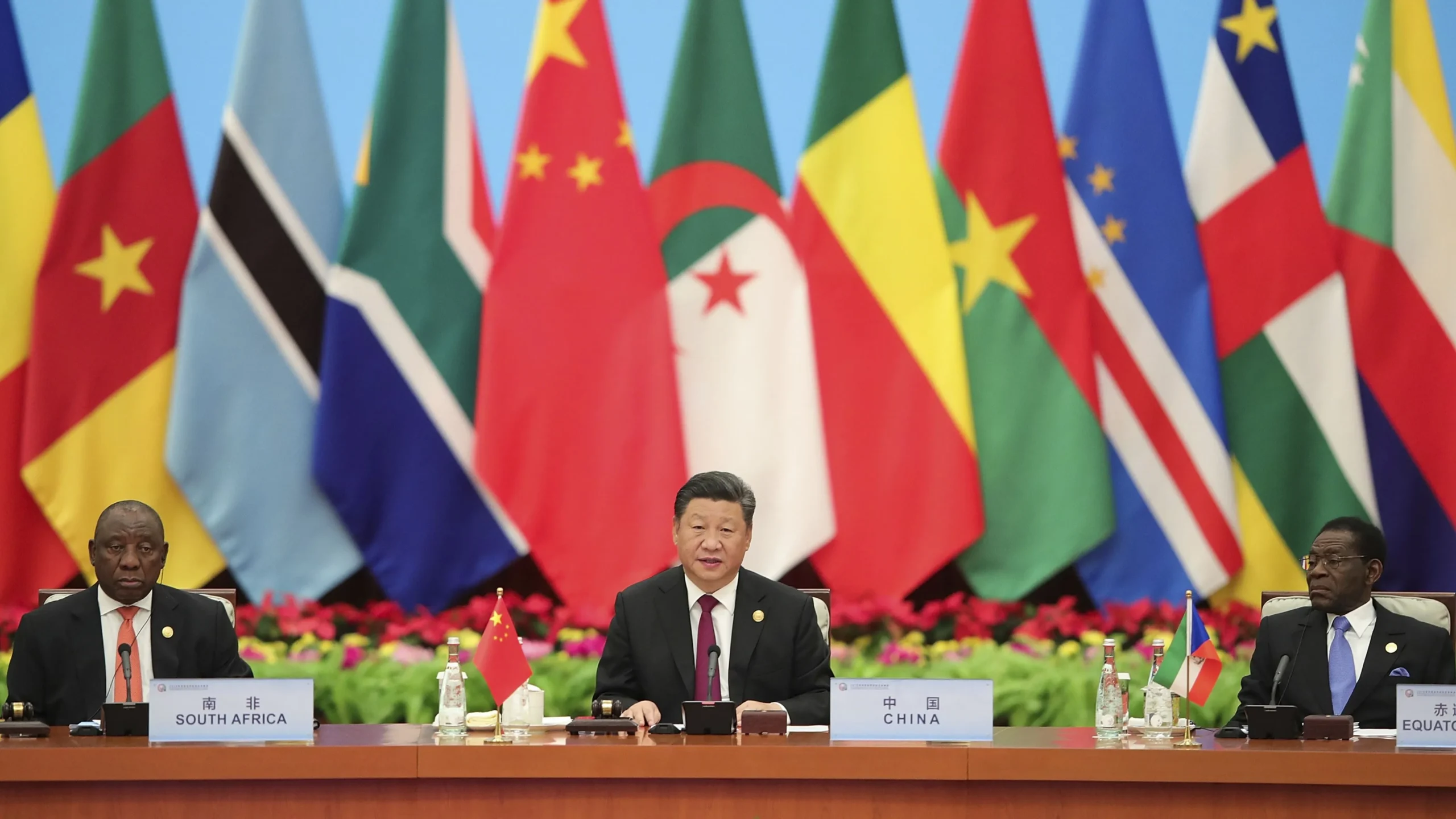

The 2024 Summit of the Forum on China-Africa Cooperation (FOCAC), scheduled to be held in Beijing from September 4 to 6, is expected to further enhance economic and trade cooperation between the two regions. The summit will likely see the signing of new agreements and the announcement of additional investment and development initiatives, further solidifying the partnership.

Sectoral Growth and Economic Diversification

One of the most significant aspects of the China-Africa trade relationship is the growing trade in intermediate goods. In the first seven months of 2024, trade in intermediate goods between China and Africa grew by 6.4% year-on-year, accounting for 68% of the total value of bilateral trade. This is a clear indication that Africa is increasingly integrating into global supply chains, with China playing a pivotal role in this process.

The trade in intermediate goods is crucial for Africa’s industrialization and economic diversification. By importing machinery, components, and raw materials from China, African countries can develop their manufacturing sectors, adding value to their raw materials before exporting them to global markets. This shift from being exporters of raw materials to manufacturers of finished products is key to sustainable economic growth and development in Africa.

Moreover, China’s investment in African industries has also been instrumental in this transformation. Chinese companies have established manufacturing plants, industrial parks, and special economic zones across the continent, creating jobs and transferring technology to local economies. These investments have not only boosted industrial output but have also contributed to skills development and capacity building in African countries.

Challenges and Opportunities in China-Africa Trade

Despite the positive trajectory of China-Africa trade, there are challenges that need to be addressed to ensure the sustainability and mutual benefits of this relationship. One of the primary concerns is the trade imbalance, with China exporting far more to Africa than it imports. This trade deficit is a source of concern for many African countries, which are seeking to boost their exports to China to balance the trade relationship.

To address this issue, China has taken steps to open its market further to African products. Initiatives such as the China International Import Expo (CIIE) have provided African exporters with a platform to showcase their goods to Chinese buyers. Additionally, China has granted tariff-free access to a range of African products, encouraging more imports from the continent.

Another challenge is the need for Africa to diversify its exports to China. Currently, African exports to China are heavily concentrated in a few commodities, such as oil, minerals, and agricultural products. To achieve a more balanced trade relationship, African countries need to expand their range of exports by developing new industries and value-added products.

Furthermore, the issue of debt sustainability is a concern in the China-Africa relationship. While Chinese loans have financed critical infrastructure projects in Africa, there is growing scrutiny over the terms of these loans and the risk of debt distress in some African countries. Both China and African governments are increasingly aware of this issue and are seeking ways to ensure that Chinese investment in Africa is sustainable and does not lead to unsustainable debt levels.

Future Prospects of China-Africa Trade

The future of China-Africa trade looks promising, with both regions committed to deepening their economic ties. The upcoming FOCAC summit in Beijing is expected to be a key milestone in this relationship, with new initiatives and agreements set to be announced. These could include further investment in African infrastructure, increased trade in new sectors such as digital technology and green energy, and enhanced cooperation in areas such as agriculture and education.

China’s focus on Africa as a key partner in its global strategy is likely to continue, driven by the continent’s vast resources, growing markets, and strategic location. For Africa, China represents a critical partner in its development journey, providing not only trade and investment but also technical expertise and capacity building.

As both regions navigate the complexities of the global economy, the China-Africa trade relationship is likely to evolve, with new opportunities and challenges emerging. However, with strong political will, mutual respect, and a focus on sustainable development, this partnership has the potential to deliver significant benefits for both China and Africa in the years to come.

Photo source: Google

By: Montel Kamau

Serrari Financial Analyst

30th August, 2024

Article, Financial and News Disclaimer

The Value of a Financial Advisor

While this article offers valuable insights, it is essential to recognize that personal finance can be highly complex and unique to each individual. A financial advisor provides professional expertise and personalized guidance to help you make well-informed decisions tailored to your specific circumstances and goals.

Beyond offering knowledge, a financial advisor serves as a trusted partner to help you stay disciplined, avoid common pitfalls, and remain focused on your long-term objectives. Their perspective and experience can complement your own efforts, enhancing your financial well-being and ensuring a more confident approach to managing your finances.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Readers are encouraged to consult a licensed financial advisor to obtain guidance specific to their financial situation.

Article and News Disclaimer

The information provided on www.serrarigroup.com is for general informational purposes only. While we strive to keep the information up to date and accurate, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability with respect to the website or the information, products, services, or related graphics contained on the website for any purpose. Any reliance you place on such information is therefore strictly at your own risk.

www.serrarigroup.com is not responsible for any errors or omissions, or for the results obtained from the use of this information. All information on the website is provided on an as-is basis, with no guarantee of completeness, accuracy, timeliness, or of the results obtained from the use of this information, and without warranty of any kind, express or implied, including but not limited to warranties of performance, merchantability, and fitness for a particular purpose.

In no event will www.serrarigroup.com be liable to you or anyone else for any decision made or action taken in reliance on the information provided on the website or for any consequential, special, or similar damages, even if advised of the possibility of such damages.

The articles, news, and information presented on www.serrarigroup.com reflect the opinions of the respective authors and contributors and do not necessarily represent the views of the website or its management. Any views or opinions expressed are solely those of the individual authors and do not represent the website's views or opinions as a whole.

The content on www.serrarigroup.com may include links to external websites, which are provided for convenience and informational purposes only. We have no control over the nature, content, and availability of those sites. The inclusion of any links does not necessarily imply a recommendation or endorsement of the views expressed within them.

Every effort is made to keep the website up and running smoothly. However, www.serrarigroup.com takes no responsibility for, and will not be liable for, the website being temporarily unavailable due to technical issues beyond our control.

Please note that laws, regulations, and information can change rapidly, and we advise you to conduct further research and seek professional advice when necessary.

By using www.serrarigroup.com, you agree to this disclaimer and its terms. If you do not agree with this disclaimer, please do not use the website.

www.serrarigroup.com, reserves the right to update, modify, or remove any part of this disclaimer without prior notice. It is your responsibility to review this disclaimer periodically for changes.

Serrari Group 2025