China is witnessing a significant surge in protests, with an 18% increase in dissent cases reported in the second quarter of 2024 compared to the same period last year. This rise in public discontent is largely driven by economic challenges, including a deepening real estate crisis and a sluggish economy, which have shaken the confidence of citizens and strained the government’s ability to maintain social stability.

Economic Challenges Fueling Public Discontent

The uptick in protests reflects broader economic difficulties that have plagued China in recent years. After four decades of rapid economic growth and rising living standards, the country is now grappling with a slowdown that has left many citizens disillusioned. The primary drivers of this discontent are labor-related grievances, which account for 44% of the protests, and homeowner dissatisfaction, which makes up 21%, according to data from the China Dissent Monitor, a project by the US-based advocacy group Freedom House.

The economic challenges facing China are multifaceted. The real estate sector, once a cornerstone of China’s economic growth, is now in crisis. Major real estate companies like Country Garden Holdings Co. and China Evergrande Group have been at the center of numerous protests, with homeowners and investors expressing outrage over delayed projects, falling property values, and unmet promises. The data shows a 10% rise in protests related to real estate over the past year, underscoring the severity of the crisis.

Real Estate Crisis: A Major Catalyst

China’s real estate sector has long been a key driver of its economic growth, contributing significantly to GDP and serving as a critical investment vehicle for the middle class. However, the sector’s rapid expansion has also led to significant imbalances, with soaring property prices and over-leveraged developers creating a bubble that is now beginning to burst. The crisis has been exacerbated by the government’s efforts to curb speculative investment and reduce financial risk, which have led to tighter credit conditions and reduced liquidity in the market.

The collapse of major developers like Evergrande has sent shockwaves through the economy, affecting not only homeowners and investors but also the broader financial system. Evergrande, once China’s largest property developer, defaulted on its debt obligations in 2021, sparking widespread protests and legal actions from homebuyers and contractors who were left in limbo as projects stalled. Country Garden, another major player in the real estate sector, has also faced financial difficulties, leading to further protests and heightened concerns about the stability of the real estate market.

Labor Unrest: A Growing Concern

In addition to the real estate crisis, labor-related grievances have become a significant source of unrest. As China’s economy slows, companies across various sectors have been forced to cut costs, often at the expense of workers. This has led to wage cuts, layoffs, and deteriorating working conditions, fueling anger among the workforce. The manufacturing sector, which has long been the backbone of China’s economic growth, has been particularly hard hit, with many factories closing or relocating due to rising labor costs, trade tensions, and slowing demand.

The situation has been further complicated by the government’s crackdown on the private sector, particularly in tech and education, which has led to widespread job losses and reduced opportunities for young people entering the job market. The pandemic-related lockdowns, which have been among the most stringent in the world, have also taken a toll on the economy, disrupting supply chains, reducing consumer spending, and exacerbating social inequalities.

Political Implications and the Communist Party’s Response

The rising tide of protests poses a significant challenge to the ruling Communist Party, which has long relied on economic growth and rising living standards to maintain its legitimacy. For decades, the implicit social contract between the Party and the people has been one of prosperity in exchange for political stability and limited freedoms. However, as economic growth stalls and the benefits of development become more unevenly distributed, this contract is being tested.

Kevin Slaten, who leads the China Dissent Monitor project, noted that the increasing economic difficulties could undermine the Party’s long-standing trade-off between authoritarian rule and economic prosperity. “As the ramifications of slowing economic growth impact more citizens, it may undermine this trade-off,” he said in a statement to Bloomberg.

Despite these challenges, the Communist Party remains firmly in control. The government’s response to the protests has been swift and decisive, with a combination of repression and propaganda aimed at quelling dissent and maintaining social order. Physical protests are often small, isolated, and quickly suppressed by the authorities, who have ramped up internet controls and surveillance under President Xi Jinping. This has made it difficult for protesters to organize and coordinate, limiting the scale and impact of the demonstrations.

However, the increasing frequency of protests suggests that the government’s strategy may be reaching its limits. While the Party has been able to contain most demonstrations, the underlying economic issues remain unresolved, and public discontent continues to grow. The government’s reluctance to implement more aggressive economic stimulus measures, due in part to concerns about rising debt and financial instability, has only added to the frustration.

Impact on China’s Long-Term Strategic Goals

The rise in protests also has implications for China’s long-term strategic goals. Liqian Ren, director of Modern Alpha at WisdomTree Inc., a New York-based asset management firm, pointed out that more protests mean central government policies may not be effectively carried out. “Its strategic long-term goals can’t be achieved when short-term needs are now more on people’s minds,” she said.

China’s leadership has set ambitious goals for the country’s future, including becoming a global leader in technology, achieving high-income status, and asserting itself as a dominant power on the world stage. However, these goals require sustained economic growth and social stability, both of which are now under threat due to the ongoing economic challenges.

The real estate crisis, in particular, poses a significant risk to China’s long-term development plans. The sector is not only a major contributor to GDP but also a key source of local government revenue, through land sales and property taxes. If the crisis continues to deepen, it could lead to a broader economic downturn, undermining the government’s ability to finance infrastructure projects, social programs, and other initiatives critical to its strategic goals.

Global Implications of China’s Economic Troubles

China’s economic woes are not just a domestic issue; they have significant global implications as well. As the world’s second-largest economy, China plays a crucial role in global trade, investment, and finance. A slowdown in China could have ripple effects across the global economy, particularly for countries that are heavily dependent on Chinese demand for their exports.

The real estate crisis, for example, has already had a negative impact on global commodity markets, as China’s construction sector is a major consumer of raw materials like steel, copper, and cement. A prolonged downturn in the sector could lead to lower prices for these commodities, affecting producers around the world. Additionally, China’s economic troubles could lead to increased financial instability, as Chinese companies and financial institutions are major players in global markets.

The rise in protests and social unrest in China could also have geopolitical implications. As the Chinese government becomes more focused on domestic issues, it may become less willing or able to engage in international diplomacy or pursue its ambitious foreign policy goals. This could lead to a period of increased tension and uncertainty in global affairs, particularly in regions where China has significant interests, such as East Asia, Africa, and Latin America.

Conclusion

The 18% surge in protests across China is a clear indication of the deepening economic challenges facing the country. As the real estate crisis continues to unfold and economic growth slows, public discontent is likely to grow, posing a significant challenge to the ruling Communist Party. While the government has so far been able to contain most protests, the underlying issues remain unresolved, and the risk of broader social unrest looms large.

For China, the path forward will require careful balancing of short-term economic needs with long-term strategic goals. The government’s ability to manage these challenges will determine not only the future of the Chinese economy but also the stability of the Communist Party’s rule. As the world watches closely, the coming months will be critical in shaping the trajectory of China’s economic and political landscape.

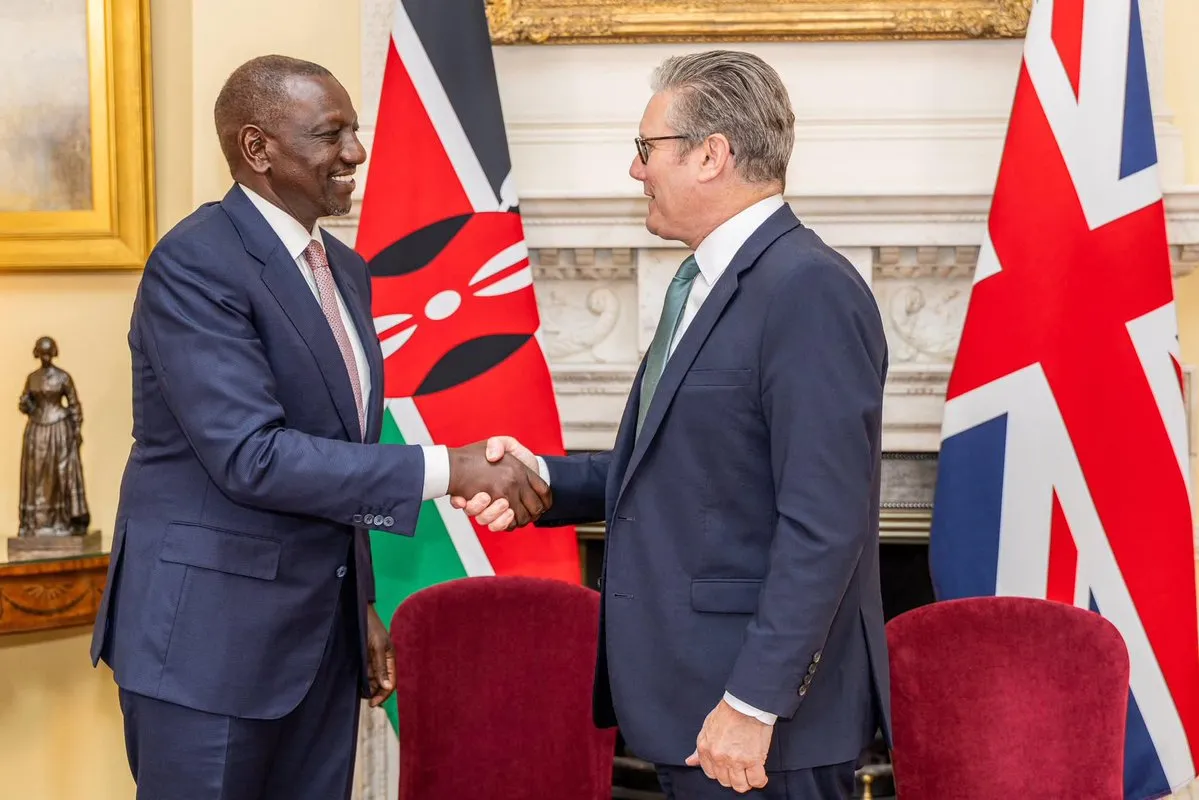

photo source: Google

By: Montel Kamau

Serrari Financial Analyst

29th August, 2024

Article, Financial and News Disclaimer

The Value of a Financial Advisor

While this article offers valuable insights, it is essential to recognize that personal finance can be highly complex and unique to each individual. A financial advisor provides professional expertise and personalized guidance to help you make well-informed decisions tailored to your specific circumstances and goals.

Beyond offering knowledge, a financial advisor serves as a trusted partner to help you stay disciplined, avoid common pitfalls, and remain focused on your long-term objectives. Their perspective and experience can complement your own efforts, enhancing your financial well-being and ensuring a more confident approach to managing your finances.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Readers are encouraged to consult a licensed financial advisor to obtain guidance specific to their financial situation.

Article and News Disclaimer

The information provided on www.serrarigroup.com is for general informational purposes only. While we strive to keep the information up to date and accurate, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability with respect to the website or the information, products, services, or related graphics contained on the website for any purpose. Any reliance you place on such information is therefore strictly at your own risk.

www.serrarigroup.com is not responsible for any errors or omissions, or for the results obtained from the use of this information. All information on the website is provided on an as-is basis, with no guarantee of completeness, accuracy, timeliness, or of the results obtained from the use of this information, and without warranty of any kind, express or implied, including but not limited to warranties of performance, merchantability, and fitness for a particular purpose.

In no event will www.serrarigroup.com be liable to you or anyone else for any decision made or action taken in reliance on the information provided on the website or for any consequential, special, or similar damages, even if advised of the possibility of such damages.

The articles, news, and information presented on www.serrarigroup.com reflect the opinions of the respective authors and contributors and do not necessarily represent the views of the website or its management. Any views or opinions expressed are solely those of the individual authors and do not represent the website's views or opinions as a whole.

The content on www.serrarigroup.com may include links to external websites, which are provided for convenience and informational purposes only. We have no control over the nature, content, and availability of those sites. The inclusion of any links does not necessarily imply a recommendation or endorsement of the views expressed within them.

Every effort is made to keep the website up and running smoothly. However, www.serrarigroup.com takes no responsibility for, and will not be liable for, the website being temporarily unavailable due to technical issues beyond our control.

Please note that laws, regulations, and information can change rapidly, and we advise you to conduct further research and seek professional advice when necessary.

By using www.serrarigroup.com, you agree to this disclaimer and its terms. If you do not agree with this disclaimer, please do not use the website.

www.serrarigroup.com, reserves the right to update, modify, or remove any part of this disclaimer without prior notice. It is your responsibility to review this disclaimer periodically for changes.

Serrari Group 2025