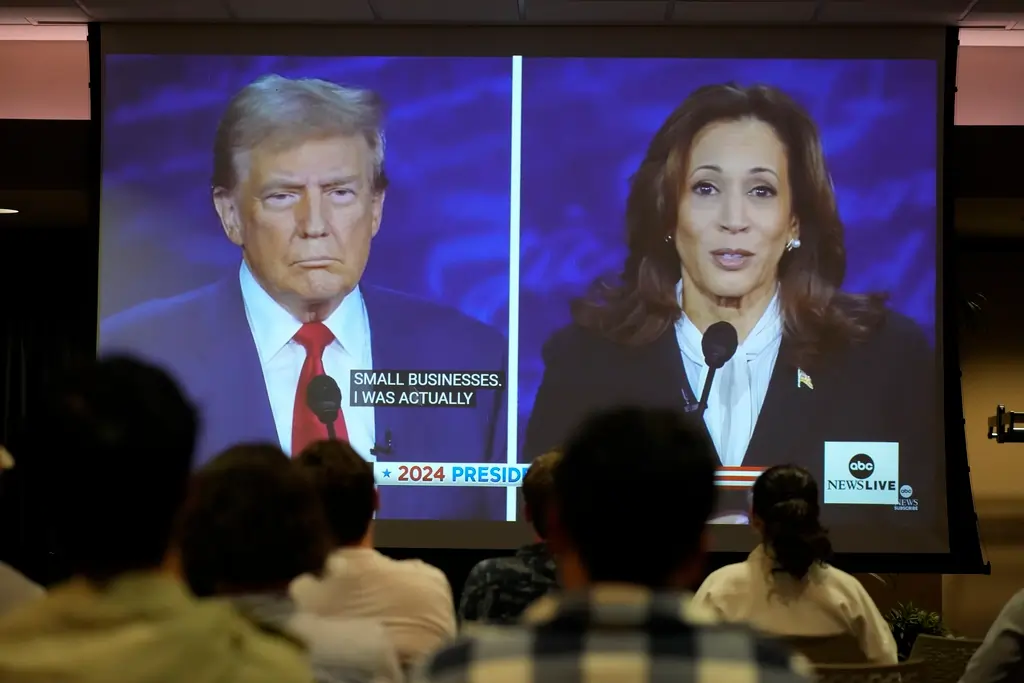

Investors React to Fiery Presidential Debate Between Trump and Harris

The highly anticipated first presidential debate between Republican nominee, former President Donald Trump, and Democratic nominee, Vice President Kamala Harris, took place in Philadelphia, Pennsylvania, on September 10, 2024. The debate, hosted by ABC News, was not only a crucial moment for the candidates but also a pivotal event for investors, as financial markets have […]