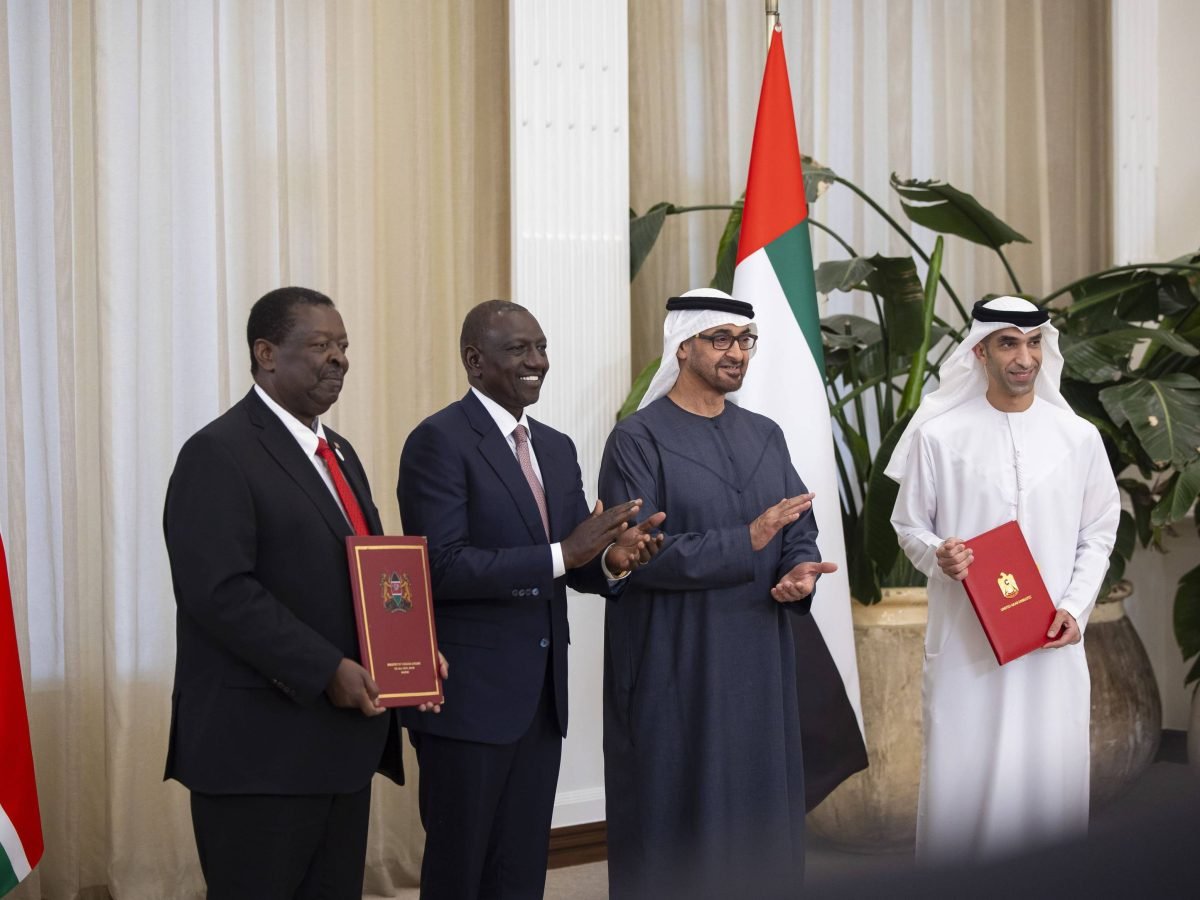

Kenya Investment Authority Partners with KEPSA to Boost Economic Growth

The Kenya Investment Authority (KenInvest) and the Kenya Private Sector Alliance (KEPSA) have announced a groundbreaking partnership aimed at enhancing Kenya’s economic growth through strategic public-private collaboration. The partnership is expected to streamline investment processes, advocate for business-friendly policies, and position Kenya as a premier destination for sustainable investments. This collaboration comes at a time […]