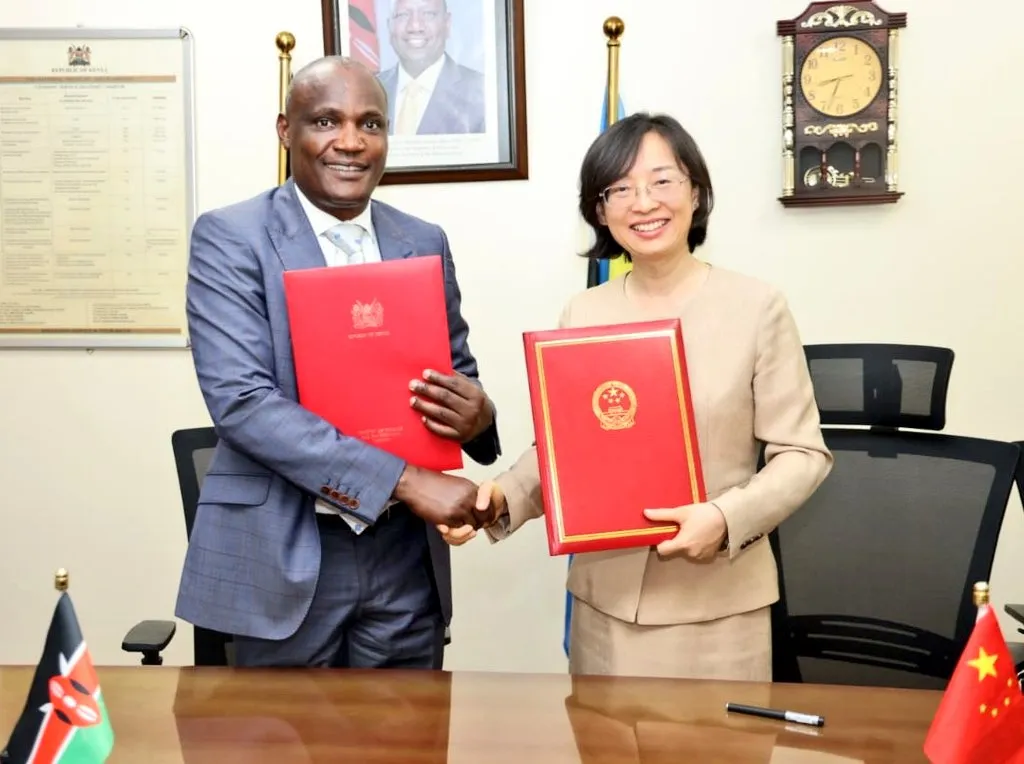

Kenya Secures Ksh 1.8B Grant from China to Upgrade Hospitals

In a major boost to its healthcare infrastructure, Kenya has secured a generous grant of Ksh 1.8 billion (approximately RMB 100 million) from the Chinese government. The grant, aimed at upgrading several key hospitals across the country, underscores the strong bilateral ties between Kenya and China and represents a significant step forward in the nation’s […]